Demand and Supply Tokenomics

In the builder space, the definition of tokenomics can be remarkably broad and multifaceted. In our opinion, it is quite an overused term without a clear definition of what it is.

For some, the “tokenomics” simply refers to the attributes that describe a token, such as emissions schedule, allocations structure, and predicts the future market price.

Others, however, take a more holistic view, considering tokenomics as an umbrella term that encompasses the token utility, mechanism design, rules/policies, and market forces influencing a token's price.

A commonly accepted understanding, though, frames tokenomics as the interplay of forces that can be distinguished as a demand and supply sides that define a token's value. Essentially:

Tokenomics = Token * Economics = Token * (Demand + Supply) = Token Demand + Token Supply[1]

Interestingly, the industry’s status quo predominantly focuses on the supply due to its predictable and controlling nature under the founding team's control. This control offers a tangible, manageable aspect of tokenomics that can be strategically planned and executed. Sometimes, it is referred to as ‘token metrics’.

However, the supply-centric approach is fundamentally flawed. By neglecting the demand side, these strategies miss half of the equation. Since no amount of supply manipulation can transform a useless token into a valuable one, true tokenomics requires a balanced consideration of both supply and demand to ensure a token’s viability[2].

Our research group believes this lack of focus on the demand-side of tokenomics is partly due to the absence of a standardized “language” that could articulate token demand. Namely, a comprehensive framework that accurately categorizes the sources of value for tokens and the mechanisms through which this value is captured. Although several attempts have been made in literature to classify tokens, none have completely addressed this matter[3].

The Value Capturing Mechanism Framework

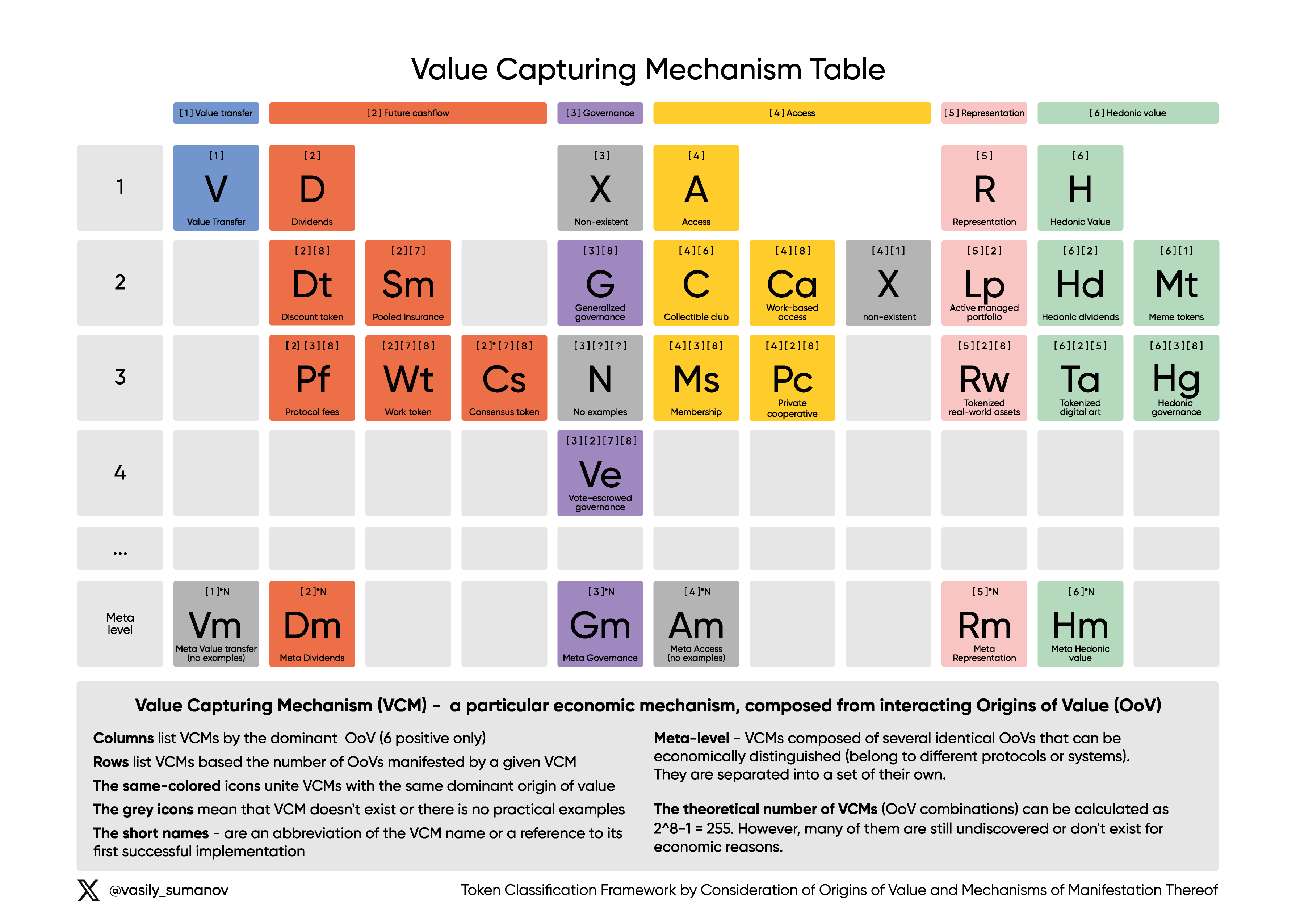

Building on Vasily Sumanov's research paper, "Token Classification Framework by Consideration of Origins of Value and Mechanisms of Manifestation Thereof" [4], we propose the Value Capturing Mechanism framework as a standard of token utility classification and analysis. This framework, taken inspiration from the chemical periodic table, organizes the economic design space considering origins of value (OoVs) and value capturing mechanisms (VCMs) through which activate them.

The three-tiered classification encompasses:

-

Origins of Value (OoVs) is an elementary economic pattern reflecting the value that arises from coordinating agents within the network, for example, by engaging in Ethereum block production. The existence of Origins of Value themselves is conditioned on the existence of some kind of coordination value in a particular system.

-

Value-Capturing Mechanisms (VCMs) is a particular economic mechanism composed of interacting origins of value. The VCM design space is filled with sets of possibly multiple Origins of Value whose value can be extracted via a specific behavioral pattern.

-

Value Capturing Implementation Patterns (VCIPs) are code implementations of Value Capturing Mechanisms in a particular protocol or network. The particularities of technical implementation appear only at this hierarchical classification level.

We opine that this structure of decreasing abstractness has the additional benefit of allowing a clearer view of the similarity between tokens with respect to their ways of generating value, even if implementation details differ greatly[3].

We haven not, however, yet approached how these implementations are quantified. In our view, the value of digital assets should be described in terms of a formal optimization problem; this is natural in the framework of rational economic agents. Hence, we propose a token value function (U) as the following qualititative function:

Q - General utility / or positive function for the holder (can be reffered to utility gains)

L - General costs & risks / or negative function for the holder (diminishes the overall token utility)

X - The share of token supply held from the circulating token supply

T - Time period during which holder uses the token utility function

P = Token price

S = Blockchain state, that also can be considered as distribution of token stakes across other holders taking into account their token using activity

While a negative U value means the token is not worth holding and, consequently, not held if all economic actors act optimally, a positive U means the token is held readily and appreciated. It becomes possible to assume the possible price and token distribution at any point in time as formal solutions to the following optimisation problem:

Although this problem seems simple in form, the target function is very much indeterminate and is, as a rule, neither convex nor simple; for this reason, optimization is purely formal and is assumed to be carried out by the market itself.

Depending on the VCMs in respect to the token in question, Q and L functions differ accordingly to origins of value involved in the VCM. Appropriate valuation models need to address the specificities - a subject matter which will be subject of research and development by our team.

For further exploration of the framework, we recommend checking the original paper here.

Authored by Arc and Tiago from Valueverse.

-

Arc’s public Token Engineering profile: https://tokenengineering.net/user/64a9f242c6db16f2650445a4/

-

Arc’s public X profile: https://x.com/krowtaergeht

-

Tiago’s public Token Engineering profile: tokenengineering.net/user/6345c5d5c2f873bbd100c00c

-

Tiago’s public X profile: https://x.com/xTiagoSantana

-

Valueverse X profile: https://x.com/valueverselab

About Valueverse Research

Valueverse is a research lab focused on economic research in web3, with particular emphasis on mechanism design and economic foundations of token utility.

The lab develops and maintains a classification framework for token analysis and design that considers the origins of value and the value-capturing mechanisms that manifest them.

Bibliography

-

ETHDenver (Director). (2023, March 20). Demand-Side Tokenomics by Nate @EatSleepCrypto [Video recording]. https://www.youtube.com/watch?v=I_4QbbZJjsA

-

Mattytokenomics. (n.d.). Tokenomics for Builders: The Practitioner’s Guide to Token Design. Notion. Retrieved July 24, 2024, from https://www.notion.so

-

Sumanov, V., & Desmarais, J.-L. (n.d.). [DRAFT] The value capturing classification Paper.docx. Google Docs. Retrieved July 24, 2024, from https://docs.google.com/document/d/1I1T_ftDnt7E_y5C9mlqTomxd6WhYUh1r/edit?usp=sharing&ouid=116362223184273470428&rtpof=true&sd=true

-

TE Academy (Director). (2024, May 14). Track 8/1: TE Value Capturing Fundamentals - Introduction to demand-side token engineering [Video recording]. https://www.youtube.com/watch?v=YYv92_ReN9M