Redefining Real-World Assets Through RWAfi

The original Bitcoin whitepaper was centered around a simple idea – a peer-to-peer, electronic cash system. This seminal document also laid the foundation for broader ideas such as smart contracts, decentralized autonomous organizations (DAOs), and what was then referred to as "Smart Property." The vision was to enable ownership and management of various assets—like cars, company shares, or software rights—on a decentralized blockchain network.

The next adoption in crypto will be smart property, now called real-world assets (RWAs). RWAs represent digital tokens tied to tangible or synthetic assets, such as real estate, private credit, or data like the Consumer Price Index (CPI). This aims to bridge the gap between the traditional, off-chain, and on-chain world through a framework known as “RWAfi.” RWAs remain underutilized within the decentralized space. Plume is tackling this challenge with its RWAfi model, designed to unlock the immense potential of real-world value for crypto-native users. By combining the stability and credibility of RWAs with the modularity and flexibility of decentralized finance (DeFi), Plume is reimagining how assets are tokenized, traded, and utilized. This approach not only enhances accessibility but also forges a seamless connection between the physical and digital worlds.

According to Plume’s co-founder and Chief Business Officer, “Traditional RWA solutions often prioritize institutional needs, leaving retail crypto users underserved. RWAfi bridges this divide by making tokenized assets modular, flexible, and accessible to the crypto-native community, integrating them into the vibrant DeFi ecosystem.” This vision sets Plume apart from other platforms focusing solely on institutional onboarding, such as tokenizing real estate or private equity for sophisticated investors.

However, institutions are not overlooked in Plume's strategy. The platform has forged partnerships with several well-known entities to scale adoption and enhance credibility. For example, Plume’s partnerships with regulated broker-dealers ensure compliance in major jurisdictions, including the United States. By embedding compliance at every level—from AML and KYC to global securities, Plume ensures it can scale both retail and institutional adoption seamlessly. This institutional alignment allows Plume to provide secure, regulated channels for tokenizing and managing real-world assets like private credit, real estate, and other traditionally illiquid asset classes.

Lessons learned from Stablecoins

Stablecoins have achieved widespread product-market fit in crypto because they are what RWAs today are not — they are just crypto. The stablecoin didn’t just take the US Dollar and slap them onto the blockchain, they were designed for a crypto audience and use case. Stablecoins leveraged crypto’s native features including liquidity, composability, global access, and 24/7 accessibility.

Balancing Institutional and Retail Needs

While institutional adoption is crucial for the growth of the RWA sector, Plume’s RWAfi framework is geared toward empowering retail investors. It allows crypto users to engage actively with RWAs, leveraging DeFi primitives like lending, liquid staking, and yield generation to unlock the full potential of their tokenized assets. Plume’s modular toolkit simplifies the tokenization process, eliminating many operational and regulatory complexities that have historically deterred wider adoption.

One of Plume’s defining strategies is its focus on assets that resonate with crypto-native users. By tokenizing assets offering stable yields, speculative potential, or cultural significance, Plume aligns its ecosystem with the habits and interests of its target audience.

The platform offers three distinct categories of tokenized assets to cater to a wide range of users:

-

Stable Income Assets: These assets, including tokenized private credit and solar energy projects, provide predictable yields ranging from 7% to 15% annually.

-

Speculative Assets: Designed for users seeking higher-risk, higher-reward opportunities, these assets include tokenized market data and event-driven investments, such as on-chain speculation on sports or economic outcomes.

-

Cultural Collectibles: By tokenizing culturally significant assets like rare sneakers, Plume combines financial opportunity with social and cultural relevance, attracting younger, digitally native investors.

Liquidity and Beyond

Plume’s ecosystem extends beyond tokenization with over $275M worth of transactions on their testnet, focusing heavily on liquidity and utility. Plume enables these assets to act as collateral, staking tokens, or yield-generating instruments, unlocking their full potential.

For example, tokenized RWAs like real estate or private credit can serve as collateral for stablecoin loans, providing a more stable and less volatile option for lenders. Similarly, Plume introduces liquid staking for RWAs, allowing users to stake assets while receiving tokenized equivalents for use in other DeFi protocols. These open up opportunities for compounding yields and enhance the liquidity of traditionally illiquid assets.

The platform also supports perpetual trading, enabling users to speculate on tokenized RWAs via decentralized exchanges. This creates a unique fusion of traditional finance stability and DeFi’s speculative appeal, broadening the range of use cases and attracting diverse user profiles.

Plume’s commitment to security and trust is evident in its strategic partnerships and technological advancements. It is currently developing an AI-driven Proof of Concept for RWA analysis, which uses data insights to enhance decision-making and liquidity. Additionally, zero-knowledge proof (ZKP) enables the implementation of Proof of Reserves (ZK PoR), ensuring assets are fully backed without compromising sensitive information. Furthermore, the platform’s integration with Arbitrum, Celestia, and LayerZero enhances cross-chain interoperability and data efficiency across their ecosystem.

The Future of RWAfi and Plume

Plume is not just a blockchain for tokenizing assets; it reintroduces how real-world value can integrate with decentralized ecosystems. By focusing on modularity, accessibility, and user engagement by positioning itself as an RWA native chain.

Its emphasis on crypto-native interests, combined with robust compliance frameworks and innovative liquidity solutions, and potential to transform asset management. As the RWA market continues to expand—projected to exceed $16 trillion by 2030, Plume’s RWAfi framework offers a compelling model for the future, bringing real-world assets to life in ways previously unimaginable.

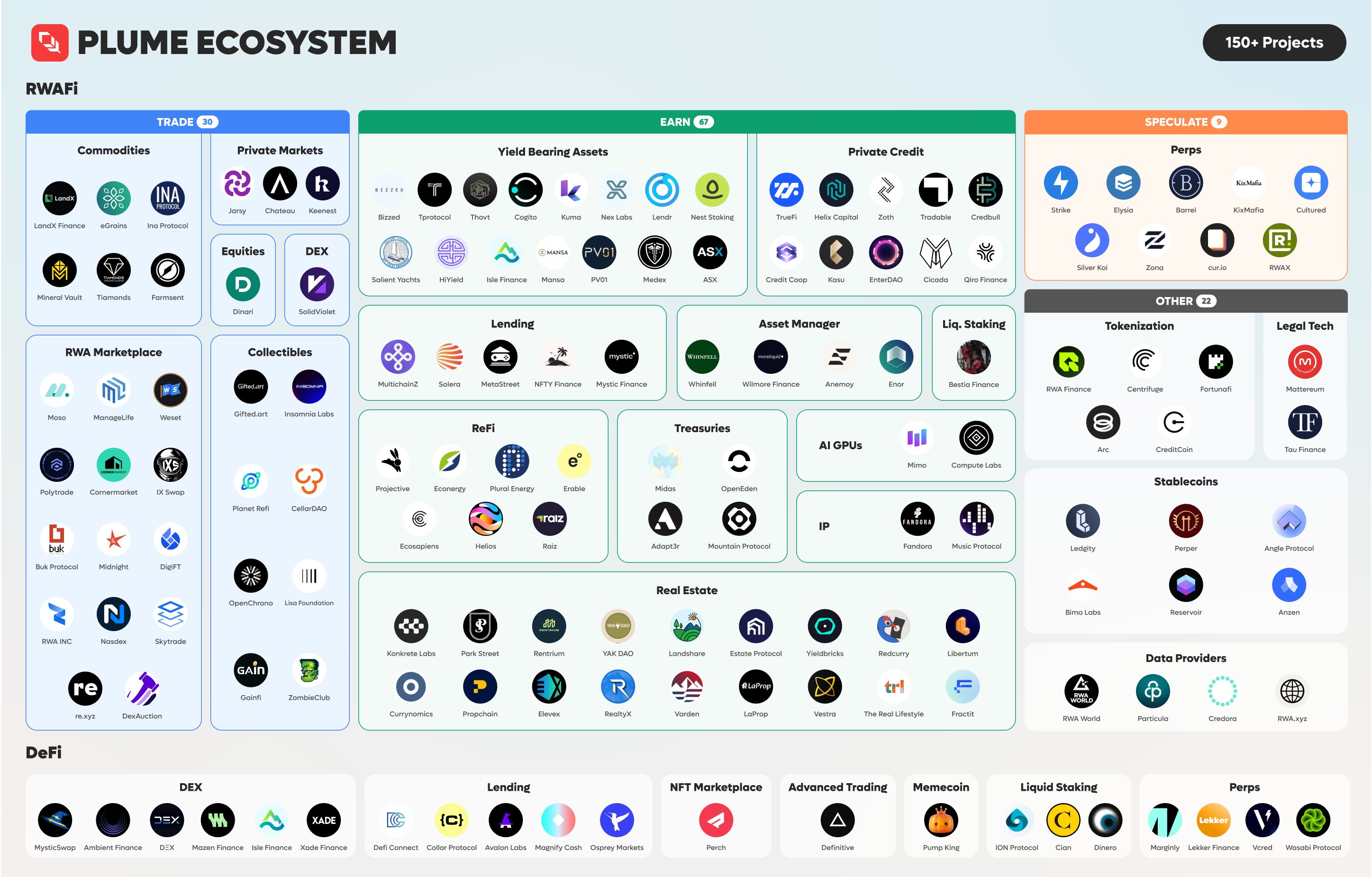

By aligning the stability of RWAs with the dynamism of DeFi, currently with over 150+ apps and protocols building on Plume. Plume is setting a new standard, unlocking opportunities for both seasoned investors and everyday users alike. This is not just the tokenization of assets; it is the tokenization of possibilities.