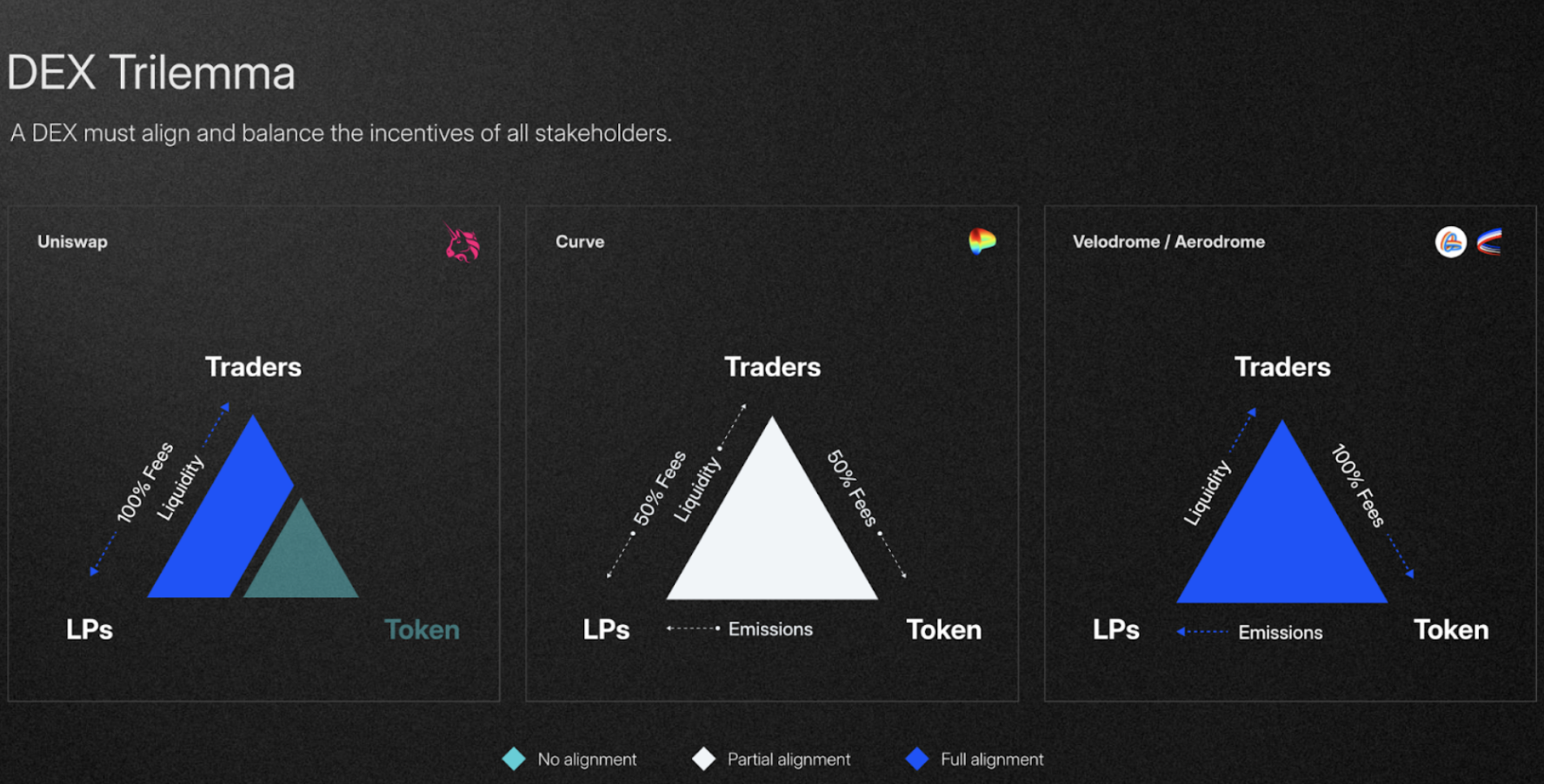

Over the past decade, decentralized finance (DeFi) has drastically changed for the better. Yet, many trading models remain inefficient, failing to align long-term incentives for liquidity providers, traders, and governance participants. Traditional DEXs often present significant challenges for retail users and institutions, primarily due to liquidity inefficiencies, capital misallocation, and a short-term focus that undermines long-term engagement. Liquidity issues arise from fragmented pools, where low liquidity results in slippage and high transaction costs, while impermanent loss deters long-term participation from liquidity providers. Moreover, the rewards in liquidity mining are typically volatile and unsustainable, leading to a lack of stable liquidity. Capital is often inefficiently distributed across pools, with either an over-concentration in low-demand pairs or under-capitalization in high-demand ones. The reliance on short-term incentives discourages long-term liquidity provision, and the disconnection between governance and users further compounds the issue, leaving strategic decisions misaligned with the needs of liquidity providers.

Momentum is stepping in to solve this problem, leveraging the ve(3,3) model to establish itself as the leading liquidity hub for the Move ecosystem. The ve(3,3) model refines this further, ensuring deep, protocol-owned liquidity while rewarding long-term token holders with a share of trading fees.

Momentum’s implementation of ve(3,3) ensures:

-

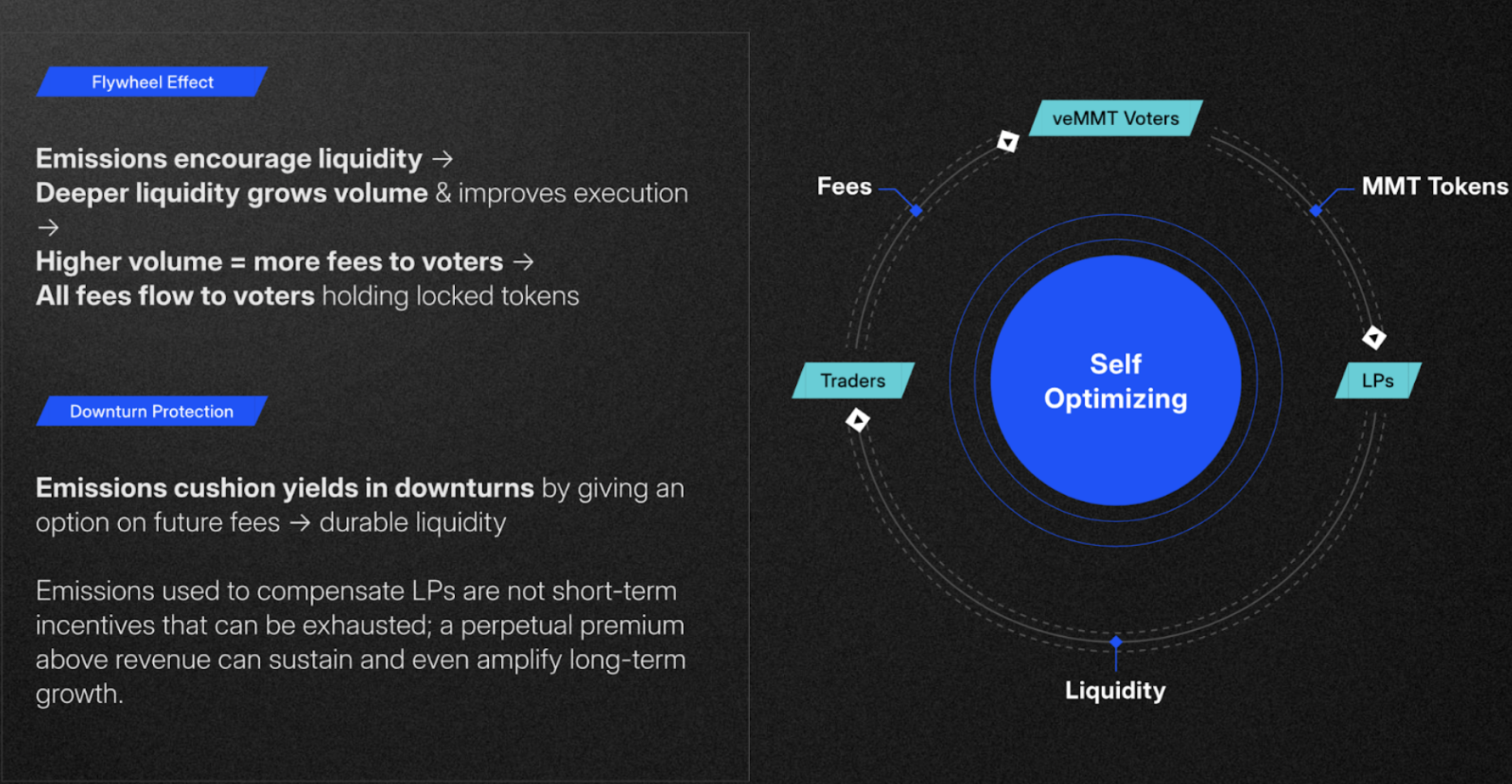

100% of trading fees go to veMMT holders, fostering active governance and participation.

-

Bribe-driven incentives that allow projects to attract liquidity without excessive emissions.

-

Institutional-grade liquidity provisioning powered by deep integrations with key DeFi protocols.

This approach not only enhances liquidity but also aligns incentives across traders, liquidity providers, and governance participants, creating a sustainable, self-reinforcing flywheel.

With institutional demand for efficient liquidity and scalable DeFi solutions increasing, Varys Capital is excited to back Momentum to bring capital efficiency liquidity, deep liquidity, and sustainable incentives for traders, LPs, and protocols alike. Ensuring liquidity is sticky, capital is optimized, and all stakeholders benefit from participation in the Move-VM.

Strategic Advantages & Institutional Integration

Momentum’s strength lies in its deep-rooted partnerships, institutional backing, and rewarding community. As the official ve(3,3) DEX for the Move-VM, the platform benefits from direct liquidity inflows and ecosystem incentives. Additionally, its integration with M-Safe, Sui’s leading multi-sig treasury management solution, allows institutional capital to flow seamlessly into Momentum, ensuring deep and reliable liquidity from day one.

-

$100M liquidity on day one.

-

Seamless M-Safe integration, providing direct institutional access.

-

IDO launchpad for Move-VM projects, creating a steady pipeline of new tokens and trading activity.

Momentum’s Token Generation Lab (TGL) further strengthens its position by providing a structured, high-quality launch environment for projects on Move-VM, ensuring consistent ecosystem growth.

Momentum’s Growth Strategy & Market Impact

Varys Capital was the lead investor, with investments from Coinbase Ventures, Aptos, Circle Ventures, Jump, Sui, Gate, Amber Group, Selini Capital, and more.

Momentum is strategically positioned to capture DeFi liquidity within the Move ecosystem, which includes Sui, Aptos, and Movement Labs. Its launch plan is backed by a structured liquidity campaign, including a trading competition and veMMT governance incentives, aimed at bootstrapping liquidity to $500M TVL within eight weeks.

About Momentum

Momentum is launching the first ve(3,3) DEX on the Move Virtual Machine (Move-VM), positioning itself as the market leader for Move-based liquidity. The platform aims to drive adoption by enabling bribe wars and incentivizing the staking of BTC, stablecoins, and Move-VM native tokens. For more information, visit: https://mmt.finance/

About Varys Capital

Varys Capital is a global, multi-strategy digital asset fund and market-maker that invests in and supports early-stage and growth-stage companies building blockchain-enabled businesses. We are a highly differentiated capital partner with a deep understanding of the digital asset ecosystem and a proven track record of success as investors and operators. We provide our portfolio companies with access to capital, expertise, and a network of relationships to help them scale and succeed. Varys Capital was established in 2018 and is headquartered in Abu Dhabi, UAE and Bangkok, Thailand. Twitter | Linkedin For more information, visit: https://varys.capital/