Overview

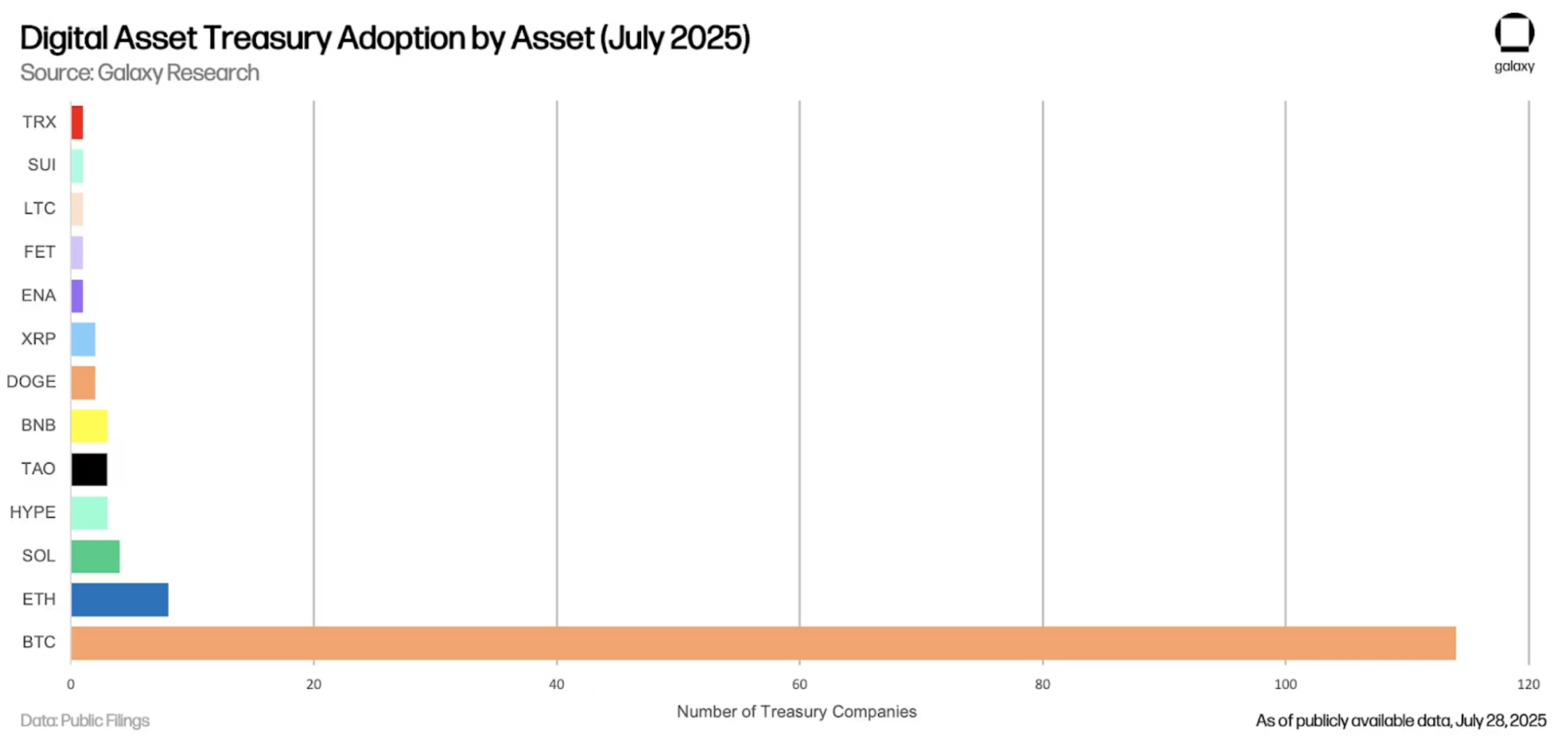

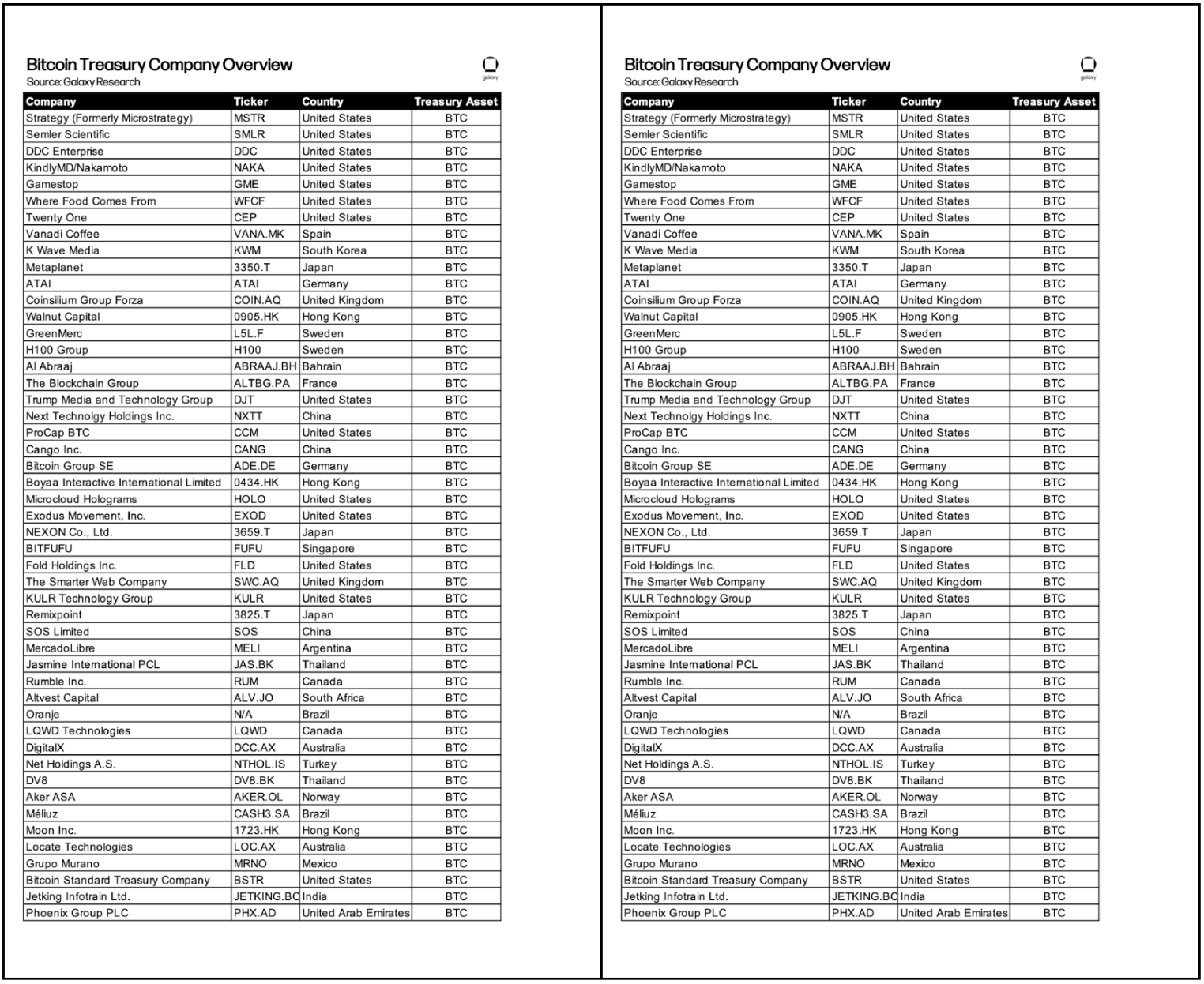

A Digital Asset Treasury (DAT) is a strategy where public companies hold cryptocurrencies like Bitcoin and Ethereum on their balance sheets as reserve assets or long-term investments. This approach was pioneered by MicroStrategy in 2020 and has since become a global trend, allowing firms direct exposure to digital assets through their brokerage accounts. By mid-2025, over 150 publicly listed companies worldwide had adopted DAT strategies, collectively holding about 791,000 BTC—nearly four percent of the total BTC circulating supply—and more than 1.3 million ETH, roughly one percent of the supply. Recently, new strategies involving longer-tail assets such as SOL, BNB, IP, and SUI have begun to emerge.

Institutions are increasingly interested in DATs because they offer a regulated and liquid way to gain exposure to cryptocurrencies. Many pension funds, endowments, and sovereign wealth funds are limited in their ability to purchase tokens directly; however, they can invest in publicly traded stocks. DATs act as a compliant proxy, allowing large capital allocators to participate in crypto upside within their existing mandates. Unlike passive products like ETFs, treasury companies can actively raise capital and invest it into digital assets, often trading at a premium to the net asset value of their holdings. This enables them to operate a sort of compounding strategy: issuing stock at a premium, purchasing more crypto, and thereby increasing the net asset value per share. For assets like Ethereum or Solana, treasuries can also generate staking or DeFi yields, providing an additional income stream that further distinguishes them from traditional passive vehicles. Several high-profile examples demonstrate how this model functions in practice.

-

MicroStrategy remains the leading Bitcoin treasury holder, with an incredible 628,791 BTC valued at over $74 billion, and it continues to grow through equity and debt issuance.

-

Metaplanet has been likened to “Japan’s MicroStrategy” due to its aggressive accumulation of Bitcoin, primarily funded through at-the-market offerings.

-

BitMine Immersion Technologies emerged in 2025 as the largest ETH treasury, accumulating over 833,000 ETH in just over a month of operation.

-

SharpLink Gaming, which initially ran a sports betting data platform, shifted to build an ETH treasury that now exceeds 740,000 ETH.

-

Other companies, like Verb Technology, have diversified into alternative treasuries, with Verb rebranding as “TON Strategy Co.” after raising over $500 million to acquire Toncoin.

How DAT Companies Operate: Valuation and Funding Mechanics

The valuation of a Digital Asset Treasury (DAT) company can be understood as the product of three factors: the amount of crypto per share held, the market price of that crypto, and a multiple to net asset value (mNAV) that reflects market sentiment, management quality, and growth prospects. In practice, most DAT stocks trade at a premium (mNAV > 1), with larger, established firms like MicroStrategy valued around 1.5× NAV, while more aggressive players such as Metaplanet have reached multiples above 2.5× as investors bet on their ability to scale quickly. Ethereum-focused treasuries often command even higher premiums, reflecting the added yield potential from staking.

To build and expand their holdings, DATs rely on two main financing tools: at-the-market (ATM) offerings and private investments in public equity (PIPEs). ATMs enable companies to issue shares gradually at current market prices, raising capital in a manner that minimizes disruption. When trading at a premium, this approach can generate an accretive cycle of new equity, increasing the amount of crypto per share. This approach has been key to MicroStrategy’s and Metaplanet’s growth strategies. PIPEs, on the other hand, involve block sales of stock to institutional investors, typically at a discount, and are used by newer or smaller DATs to raise cash quickly. While PIPEs offer speed and certainty, they also pose risks of dilution and market overhang if the market weakens.

These mechanisms demonstrate how DATs differ from static vehicles, such as ETFs. Their active participation in equity markets to build assets creates a feedback loop: strong demand and high premiums enable more crypto accumulation, while downturns can quickly reverse this cycle. This reflexivity offers substantial upside in bull markets but also brings additional volatility and capital management risks during market stress.

The growth of DATs carries certain risks. Their valuations depend heavily on trading at a premium to the value of their underlying holdings; if investor sentiment shifts, these premiums can disappear, causing stocks to trade below their net asset value. To expand their cash reserves, companies often issue new shares through at-the-market programs or private placements, which, if overused, can lead to significant dilution. As equity proxies for crypto, DATs are also very volatile, often amplifying the price swings of the underlying assets. Finally, there are reputational risks: some struggling companies have used DAT pivots as short-term publicity stunts, which can damage investor trust and attract regulatory scrutiny.

Despite these challenges, the momentum behind DATs continues to grow. The market cap of crypto treasury companies nearly doubled in the first half of 2025, reaching about $160 billion. Investment banks report increasing demand for new vehicles, including those focused on alternative tokens beyond Bitcoin and Ethereum. The success of firms such as MicroStrategy and BitMine shows that when executed well, a DAT strategy can attract significant capital and give investors greater exposure to digital assets. DATs are likely to expand into more regions, diversify into additional tokens, and become a more integrated part of corporate finance. While the model remains sensitive to market cycles, it remains one of the most important links between institutional capital and the crypto ecosystem.