Author: Velora Growth Committee (VGC)

Swapping tokens across chains and protocols can be deceptively complex. Between slippage, gas optimization, bridging, and routing, it’s easy to get buried in low-level details.

Velora has a lightweight, developer-friendly API for token swaps, offering two core modes:

-

Delta, an intent-based system designed for price optimization through a sealed-bid auction layer, and

-

Market, designed for speed and simplicity.

Both share the same elegant integration flow: you get a quote, build a payload, sign, and submit.

Whether you’re building a wallet, DeFi tool, or aggregator, this post shares how Velora’s API can support seamless token swaps, without custom contracts or manual routing logic.

Overview: What Velora Delta Unlocks

Velora Delta is an intent-based swap protocol built on top of the Portikus Network, now live on Ethereum and Base. Rather than routing swaps immediately through a DEX, Delta submits trades to a sealed-bid auction. Specialized agents compete to fulfill the trade, and the best-priced offer wins. This design opens up new possibilities for token swaps: gasless submission, MEV resistance, and dynamic price discovery through a single integration.

Users don’t need to hold ETH or any native gas token. Velora handles execution on their behalf, making Delta particularly well-suited for mobile-first experiences or onboarding flows. Because orders are signed and submitted off-chain, they’re protected from mempool exposure, reducing the risk of sandwiching and frontrunning. The competitive auction mechanism adds another advantage: it encourages agents to continuously improve pricing, often resulting in better outcomes for end users.

Integrating Delta through the API follows a five-step process designed to feel familiar to developers and integrators.

Step 1: Fetch a Quote

As an integrator, the first step is to request a quote from the /quote endpoint using mode=delta.

For example, initiating a swap from 100 DAI to PSP on Ethereum returns a Delta object that includes the quoted price, expected output, and route metadata.

Step 2: Build the Order

Next, use the /delta/orders/build endpoint to construct a structured payload for the trade. This payload defines the intent and can include optional parameters for monetization, such as a flat fee or surplus-sharing configuration.

Step 3: Sign the Order

Sign the order using EIP-712, a standard for typed, off-chain signatures that ensures both security and gas efficiency. Signing can occur on the client side via wallet, or server-side depending on your architecture.

Step 4: Submit the Order

Once signed, submit the payload to the /orders endpoint. Velora will automatically trigger the auction, where agents bid to fulfill the trade. The best-priced fill is confirmed on-chain.

Step 5: Track the Order Status

You can monitor execution by polling the order ID. If the status is EXECUTED, the swap is complete. If marked as PENDING or OPEN, the order is still in the auction queue and awaiting fulfillment.

Market Mode: Direct Execution, Structured Simplicity

While Delta introduces an intent-based auction layer for price optimization, Market mode is built for immediacy. It enables trades to settle instantly, directly onchain, by using the most efficient available DEX route at execution time.

When a Market quote is requested, Velora scans connected liquidity sources and returns a transaction payload that’s ready to sign and send. This approach is ideal for highly liquid token pairs, smaller trade sizes, or time-sensitive user interactions—cases where speed and predictability are critical. The integration flow remains consistent and minimal: quote, build, sign, and submit.

You can explore all active and upcoming DEX integrations through DexLib, Velora’s open-source library that tracks supported and pending connectors.

Velora supports two quote formats for Market mode: version 6.2 and version 5.

Version 6.2 is the latest and recommended option. It introduces a route object with expanded metadata, including how liquidity is split, which pools are used, per-hop gas estimates, and support for multicalls or bridging.

Version 5 remains available for simpler implementations and backward compatibility. It returns a priceRoute object that includes essential swap data like token addresses, expected output, gas cost, and slippage.

Once a quote is received, regardless of version, it can be passed to the /transactions/{network} endpoint along with trade-specific parameters like amount, slippage, user address, and any partner fee configuration. Velora responds with a transaction payload that’s ready to be signed and broadcasted.

There’s no auction, no pending state, and no off-chain intent, just direct, fast settlement onchain using the route that was quoted. Market mode is the most streamlined path to execution within the Velora stack.

To see how this flow looks in practice (whether you’re working with version 5 or the more structured version 6.2) you can explore detailed examples and request formats in the Velora Market API reference.

The documentation includes example quote requests, transaction building instructions, and full parameter breakdowns for both versions.

When to Use Market Mode

Market mode is ideal for simple swaps: cases where speed and user responsiveness matter more than price optimization. It’s also helpful in fallback scenarios: for example, if a Delta quote can’t be generated (due to unsupported tokens or low activity), you can set mode=all to let Velora try Delta first and gracefully switch to Market.

Monetization and Extension

Like Delta, Market supports partner fees. You can pass a partnerAddress and partnerFeeBps (up to 2%) to earn a share of the swap volume. If you’re building a wallet, a frontend dApp, or any UX layer over swaps, this is a simple way to turn traffic into passive revenue.

Market mode also works with bridging, smart contract recipients, and multicall scenarios, especially when using v6.2 quotes. This makes it flexible enough to support custom logic while remaining straightforward for standard use cases.

A Velora Integration in the Wild

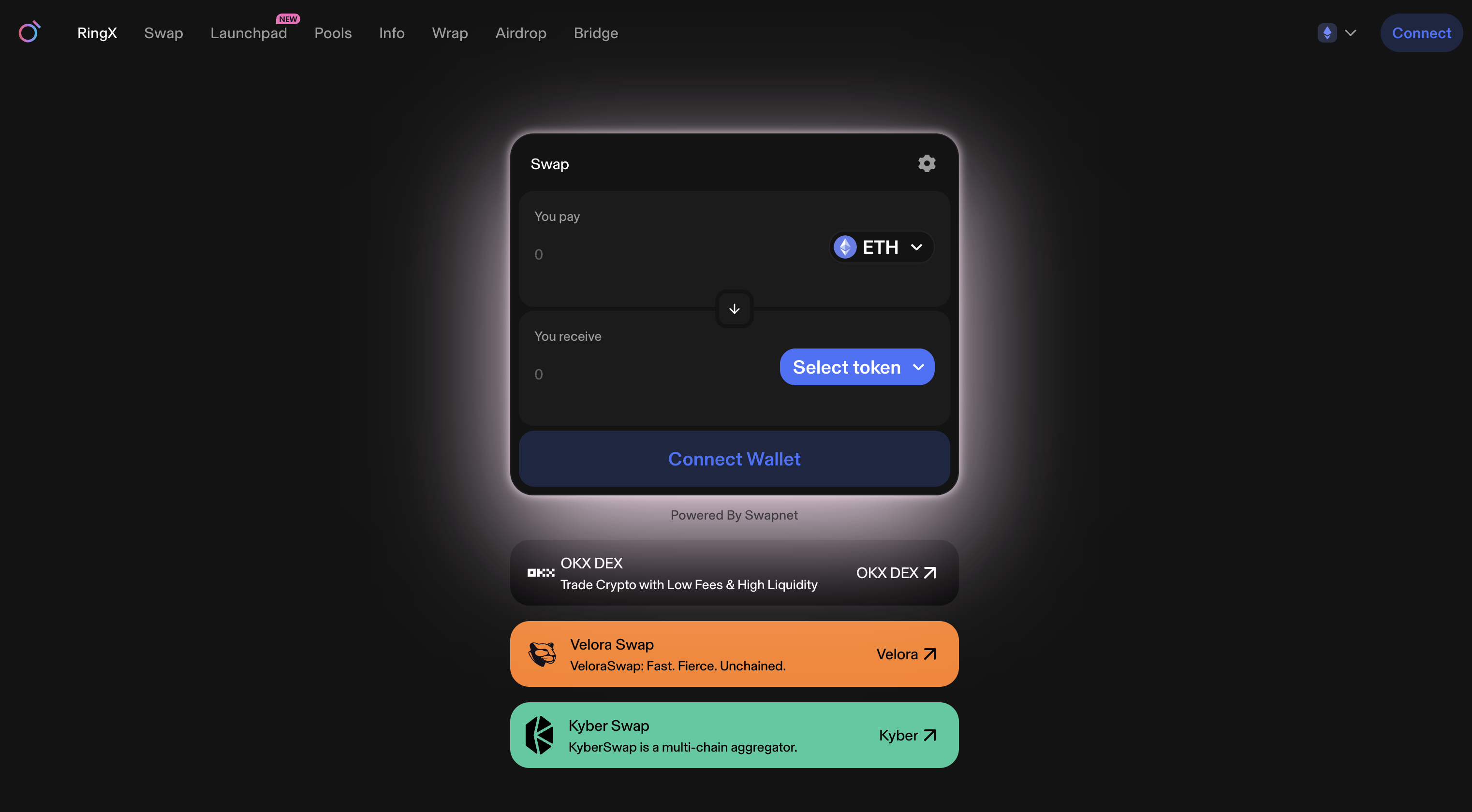

What can an integration with Velora look like in practice? Velora recently partnered with Ring Protocol to integrate its trading widget, expanding the Velora intent-based engine’s reach to more users. For Ring, integrating the trading widget directly into their UI enables users to easily get access to the best routes.

Wrapping Up

Velora offers two distinct paths to token swaps: Market mode for speed, and Delta mode for optimization and flexibility.

Market mode is designed for immediacy. It enables direct onchain execution through the most efficient DEX routes available, with no auction layer, no intent signing, and no pending status to track. It’s ideal for high-liquidity pairs, smaller trades, and time-sensitive interactions where simplicity and speed take priority.

Delta, on the other hand, is the more advanced and capable option. With its intent-based architecture, it unlocks competitive price discovery, gasless submission, MEV resistance, and cross-chain swaps, making it a strong choice for mobile-first flows, onboarding experiences, and power-user functionality. Because orders are signed off-chain, Delta also avoids mempool exposure, adding an additional layer of execution security.

If you need deeper control, structured metadata, and bridging capabilities, use version 6.2 of the API. For simpler use cases, version 5 remains fully supported.

Delta is the best fit when you’re building for long-term flexibility and user-centric execution. Market is the fastest path when time matters most. Whichever approach you choose, Velora gives you a clean, powerful way to integrate token swaps into your product with minimal friction.

Start with a quote, build a payload, sign, and submit. That’s all it takes.