Author: Pink Brains & Ignas | DeFi

“The old ParaSwap can’t come to the phone right now. Why? Cause it’s Velora.”

The ParaSwap’s rebranding to Velora has brought with it more than just a new look. The shift to the VLR token marks a significant step in the platform’s evolution, unified token staking, multi-chain strategy, and how the project positions itself in the wider DeFi space.

The rollout ties into Velora’s broader ambitions, community incentives, and renewed focus on partnerships and onboarding.

In this article, let’s unpack the rebrand, the PSP-to-VLR migration, and what this shift means for users, governance, and Velora’s next growth cycle.

Why Velora Rebranded, and What Changed

Velora’s rebrand reflects a broader product evolution, which has grown beyond its origins as a simple DEX Aggregator.

ParaSwap once ranked among the most-used DEX Aggregators, finding efficient trade routes across exchanges. Over time, it added rapid routing, gas refunds, and other features. But as DeFi evolved, multi-chain complexity, MEV risks, and fragmented UX became obstacles.

That’s why Velora introduced Delta v2.5, a fundamental upgrade. Now, users send “intents” (e.g., swap token A on chain X for token B on chain Y) and Velora’s network handles bridging, order filling, and execution via its agent system, neutralizing MEV, reducing slippage, and streamlining cross-chain trading.

-

With Cross-Chain Swaps, users can swap tokens between networks in a single transaction.

-

With Super Hooks, users can string together complex actions (swap → deposit → repay) in one seamless flow.

-

With Intent-Based Orders, users submit their requests, and Velora privately auctions them off for optimal fulfillment. No mempool exposure. All gasless transactions.

-

With built-in MEV protection, users are shielded from front-running, sandwich attacks, and other exploitative practices common in DeFi.

This changes how users interact, where fees go, and how incentives work. A new token model was needed to match this reality with simpler, more practical mechanics.

PSP – The ParaSwap Legacy

The PSP token powered ParaSwap’s governance and rewards. Holders could stake PSP in sePSP2 pools, often paired with ETH, to earn rewards and vote in DAO decisions. It also directed incentives toward certain trading pairs, boosting activity among stakers.

At its peak, PSP staking drove strong engagement. But over time, the model showed its limits. Utility was split between governance and liquidity, with little connection between the two. Most activity remained on Ethereum even as Velora expanded cross-chain, and the reward structure became too complex for newcomers.

A clean-slate tokenomics was needed. One that matched Velora’s vision of composability without complexity.

The Birth of VLR

VLR redesigns Velora’s tokenomics into one unified structure.

-

Native on Base: VLR was initially launched on Base, one of the fastest-growing Ethereum L2s that offers reduced gas costs and a massive user base. This will integrate Velora’s VLR token into the broader Superchain ecosystem with high liquidity potential.

-

Staking with VLR: VLR replaces PSP at a 1:1 ratio, becoming the new token for staking and governance participation. Velora has made clear that staking rewards will be tied to liquidity contributed, although the full mechanism remains to be detailed.

-

Multi-chain Expansion: Velora’s DAO has approved deploying VLR on BNB Chain. The goal is for VLR to serve as a cross-chain governance and liquidity token, connecting every network where Velora operates.

-

Migration Process: In the migration phase, PSP holders can migrate to VLR at a 1:1 ratio using a gasless, one-click interface.

Onboarding VLR – The First Activation Campaign

To kick off the transition, Velora ran The Hunt for VLR, a four-week campaign for stakers with at least $50 PSP and ETH in sePSP2. Weekly trading challenges awarded points, with bonuses for certain chains and partner token pairs. Badge tiers (Gold, Silver, Bronze) acted as multipliers for VLR rewards during migration.

The results were strong. From the Velora DAO’s Campaign Update and Roadmap Validation:

-

While the average Velora trader volume grew by 17%, sePSP2 stakers experienced a weekly growth of 36%

-

Highlighted ecosystem tokens saw a 500% increase in their share of transaction volume.

-

PSP stakers accounted for 0.84% of total protocol volume, up 16% from before.

-

PSP trading volume by stakers rose over 725%.

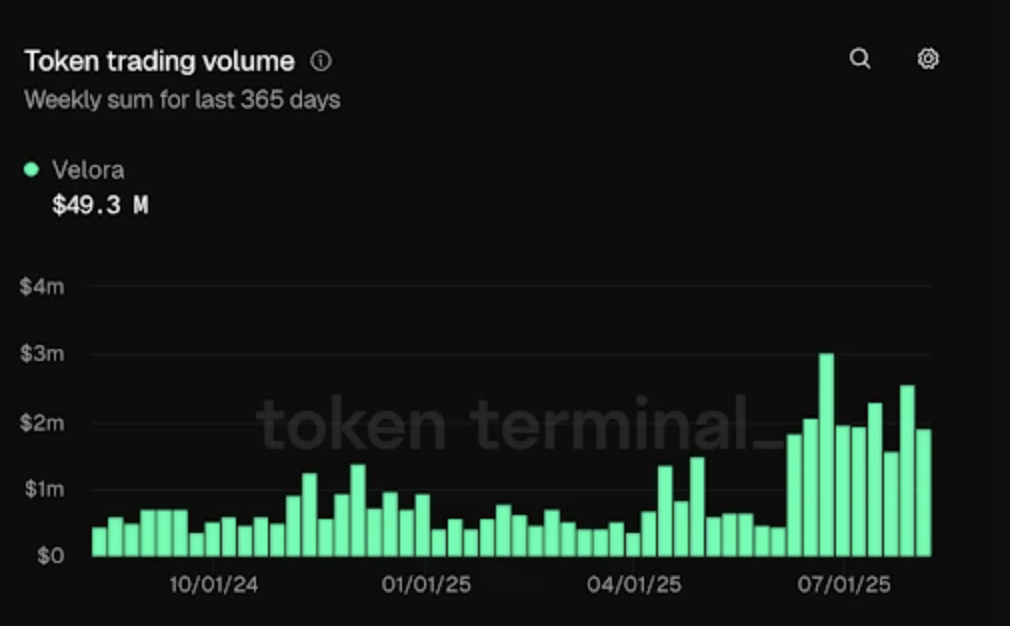

Below is the weekly PSP trading volume chart from Token Terminal. In early June, trading activity clearly picked up, jumping from around $454,000 to over $3 million at its peak. That’s more than a 6x increase. The spike reflects the current users’ interest in moving and swapping positions ahead of the VLR rollout.

The campaign succeeded in activating stakers. The next step is expanding reach to new stakers, and onchain-native users by leveraging InfoFi and other Web3-first media, which already resonate with DeFi users and early adopters who can help amplify the message organically.

Incentives will stay the same, with the 5% migration allocation spread evenly over three months to encourage ongoing participation instead of a one-time surge.

Project Miró: Launching VLR on BNB Chain

As part of Project Miró, Velora will deploy VLR on BNB Chain, the second-largest EVM network with over $6.1 billion in DeFi TVL. The move targets a highly active ecosystem where liquidity and user engagement already run deep.

The launch will include ~$600,000 in Protocol-Owned Liquidity on PancakeSwap to ensure smooth trading from day one. Bridging will use Across Protocol, already integrated into Velora’s stack, and the rollout will be handled by Laita Labs at no additional cost to the DAO.

Looking Ahead

The new Velora token, VLR, connects Velora’s traders, governance participants, and liquidity providers into one system for the protocol’s next phase.

The migration replaces a fragmented, single-chain model with a unified, multi-chain design for governance, staking, and participation. It aligns incentives, simplifies UX, and supports long-term cross-chain growth.

As DeFi hits new highs in TVL and trading volume, and new chains launch, demand for cross-chain, gasless, and intent-based swaps is rising.

The coming months will be key: steady migration, active staking, and liquidity growth on Base and BNB Chain will determine how well VLR becomes the backbone of Velora’s expanding ecosystem.

All eyes will be on Velora.