Author: DAOplomats

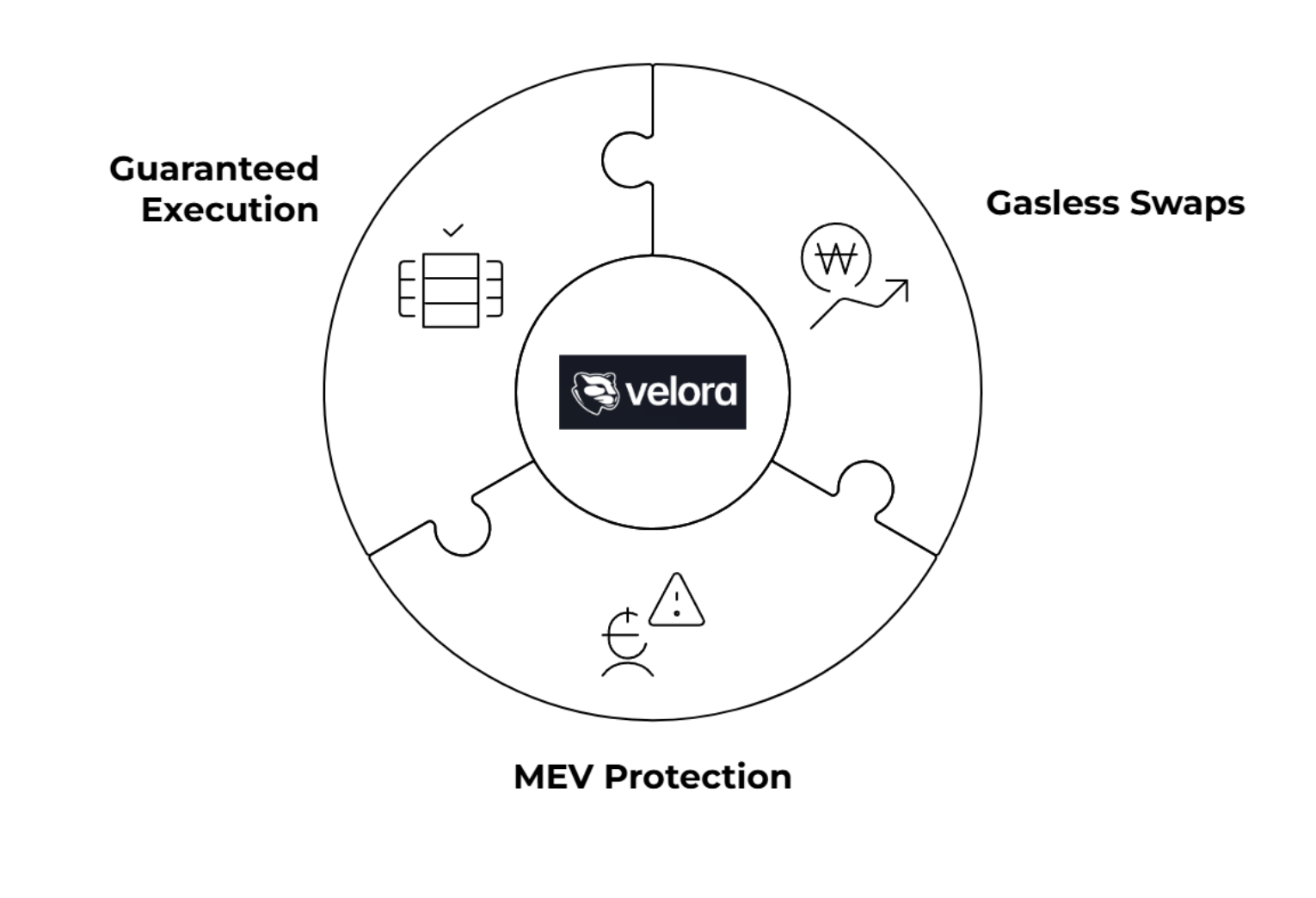

Velora, the strategic evolution of the battle-tested DEX aggregator ParaSwap, represents a fundamental shift in how users interact with DeFi. By moving beyond simple price optimization to a more intent-centric architecture, Velora addresses the critical modern challenges of liquidity fragmentation and Maximal Extractable Value (MEV). Velora’s core innovation, the Delta engine, leverages a competitive network of professional agents to execute goals, abstracting away the technical hurdles of transaction routing, gas payments, and cross-chain execution. This model delivers a radically simpler and more secure user experience, defined by gasless swaps, robust MEV protection, and guaranteed execution without the risk of failed transaction costs.

-

This powerful architecture serves as the foundation for a thriving ecosystem.

-

Velora's true strength is amplified through its deep, symbiotic integrations with other pillars of DeFi; from leading lending protocols and hardware wallets to innovative yield platforms.

-

These partnerships are not just features; they are the channels through which Velora extends its unique capabilities, transforming complex, multi-step financial strategies into single, seamless user intents.

The Delta Engine: From Imperative to Intent

The transition from ParaSwap to Velora was a direct response to an increasingly multi-chain world where users were burdened with managing complex workflows. That's where Velora's engine introduced a fundamental shift in how trades are executed:

-

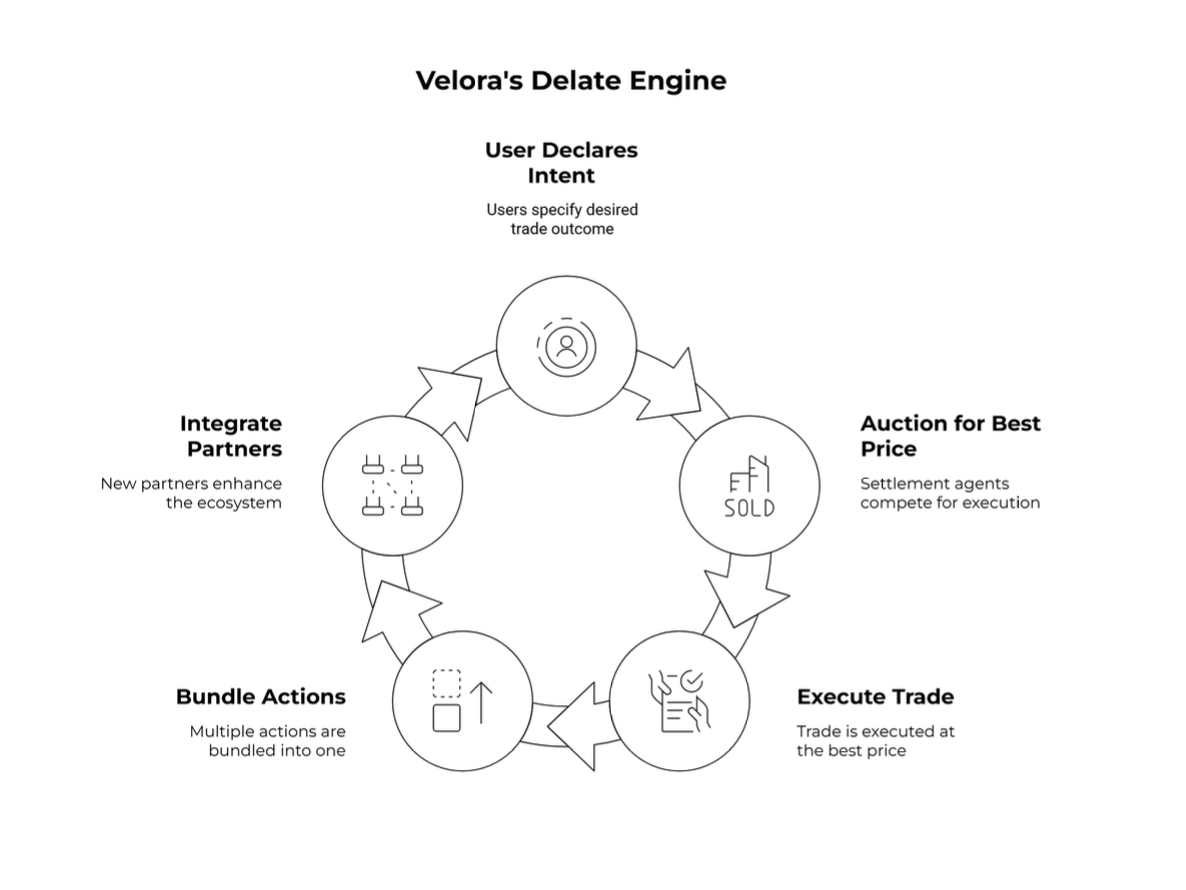

A Paradigm Shift from 'How' to 'What': Unlike traditional aggregators that require users to specify the exact path for a trade, Velora’s intent-based system lets users simply declare their desired outcome (the "what"). This abstracts away the underlying complexity of routing and execution.

-

Competitive, Agent-Based Execution: A user’s intent—for example, "swap my ETH on Ethereum for the maximum possible amount of USDC on Base"—is submitted to an auction where professional settlement agents compete to offer the best execution price. This model inherently shields users from MEV attacks, offloads gas fees, and removes the risk of paying for failed transactions.

-

Advanced Composability with "Super Hooks": The architecture unlocks powerful financial primitives like "Super Hooks," which allow for the bundling of multiple actions (e.g., swap, bridge, deposit) into a single, atomic transaction. This capability positions Velora as a "meta-layer" or operating system for DeFi, capable of orchestrating complex workflows across its integrated partners.

Ecosystem Symbiosis: A Network of Value

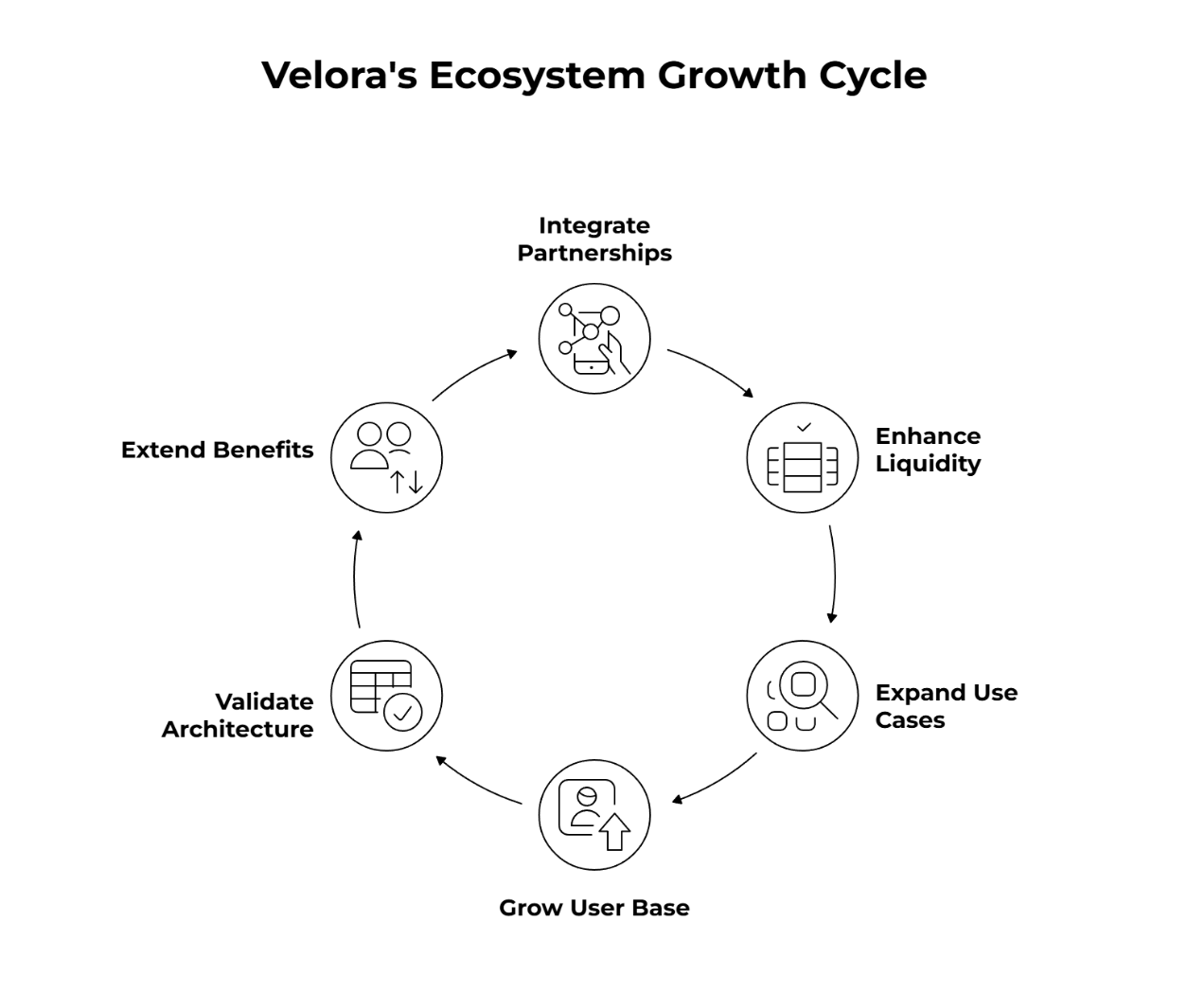

Velora’s intent-based engine becomes exponentially more powerful through its integrations, which provide the liquidity, use cases, and user bases necessary for growth. Each partnership validates Velora's architecture and extends its core benefits to a wider audience.

Lending and Capital Efficiency (Morpho & Aave):

-

The integrations with premier lending protocols Morpho and Aave showcase the power of Super Hooks for advanced capital management.

-

Morpho’s own developer documentation highlights a ParaswapAdapter, designed to execute DEX swaps as part of bundled transactions within its ecosystem.

-

This enables users to perform complex actions like collateral swaps or leveraging a position in a single, one-click transaction, all while benefiting from Velora's gasless, MEV-protected execution.

Cross-Chain by Default (Across Protocol):

-

The partnership with Across Protocol, announced in April 2025, is the backbone of Velora's chain abstraction strategy.

-

This integration powers seamless "any-to-any" asset swaps across more than 17 EVM-compatible chains, transforming a fragmented landscape into a unified trading experience.

-

By building on Across's intent-based architecture, Velora aligns itself with the emerging ERC-7683 standard for interoperability, future-proofing its platform and offering a user experience that rivals centralized exchanges.

Extending Reach to New Users (Ledger & Argent):

-

Velora extends its secure and user-friendly features to massive user bases through wallet integrations. A dedicated Velora app within Ledger Live brings gasless, MEV-protected swaps directly to the industry-leading hardware wallet's millions of security-conscious users. Similarly, the integration with

-

Argent, a popular smart contract wallet, embeds Velora's swap engine (as the successor to ParaSwap) to provide its large mobile-first user base with seamless, best-price execution.

Expanding DeFi Frontiers (Pendle & Usual):

-

Velora's reach extends to specialized DeFi verticals. The integration with Pendle, a premier yield-trading protocol, brings Velora’s superior routing and MEV protection to the complex world of yield token swaps.

-

The partnership with Usual, a new protocol issuing a real-world asset (RWA) backed stablecoin, adds a deep pool of stable liquidity, increasing cross-chain swap options.

On-Chain Trajectory: From Resilience to Explosive Growth

-

Velora's market position is best understood not as a static snapshot, but as a dynamic growth story validated by years of on-chain data.

-

Building on the foundation of ParaSwap, which processed over $138 billion in cumulative volume, the protocol has demonstrated a clear pattern of resilience, strategic innovation, and accelerating momentum.

A History of Growth:

-

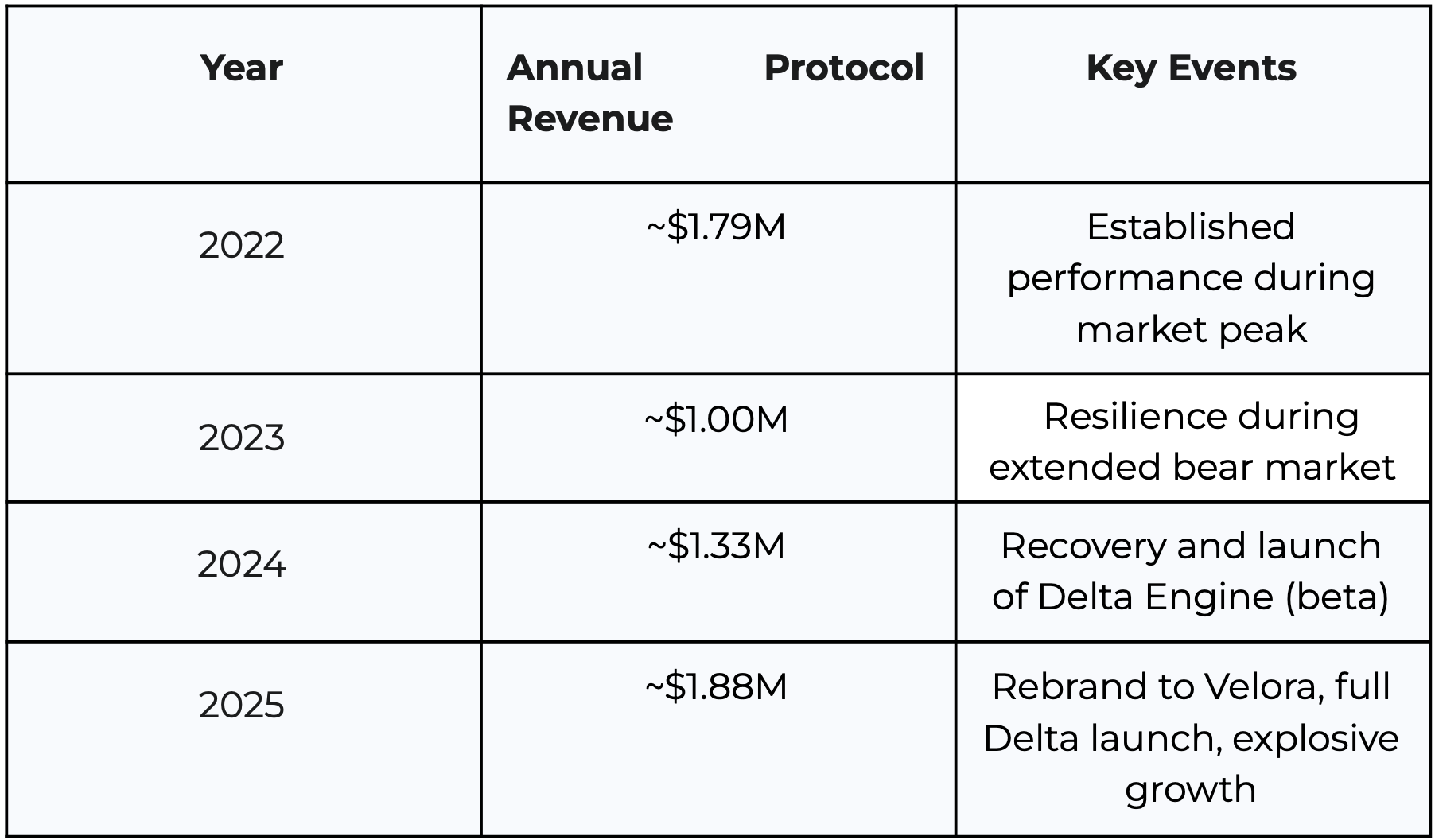

The protocol's journey can be traced through its revenue generation, which reflects both market conditions and strategic execution.

-

After a strong performance in 2022, the protocol navigated the 2023 bear market, a period that saw a contraction across the entire DeFi space. However, late 2024 marked a critical inflection point.

-

The launch of the beta version of the Delta intent engine triggered a dramatic resurgence in revenue, a trend that has accelerated significantly in 2025 following the full rebrand to Velora.

Table 1: Velora Protocol Annual Revenue (2022-2025 YTD)

-

The data is unequivocal: in just over two quarters of 2025, Velora has already surpassed the full-year revenue of any previous year.

-

This explosive growth is a direct result of its technological pivot from the intent-based Delta engine which is a fundamentally more efficient value-capture mechanism.

Future Outlook: Capturing the Next Wave of DeFi

-

Velora's current trajectory is aligned with the projected expansion of the broader DeFi market. Industry forecasts predict the DeFi market will grow at a CAGR of over 40% through 2033, with the total blockchain market expected to exceed $1 trillion by 2026.

-

Velora is uniquely positioned to capture an outsized share of this growth. As the DeFi ecosystem becomes increasingly multi-chain, the problems of fragmented liquidity and MEV—the very issues Velora's intent engine is designed to solve—will become more acute. Given its accelerating revenue and strategic position, a forward-looking projection is warranted.

-

If Velora continues on its current growth path it is on track to potentially triple its current annualized revenue within the next 18-24 months.

Conclusion: Building the Future of Trading

-

Velora is more than just a DEX aggregator; it is a foundational middleware layer for the future of DeFi.

-

Its intent-based architecture, proven by significant on-chain volume and amplified by a powerful ecosystem of integrated partners, provides a clear vision for a more accessible, secure, and efficient decentralized financial system.

-

By focusing on the user's ultimate goal rather than the complex mechanics of execution, Velora is not just participating in the market, it is actively building the user-centric, cross-chain, and intent-driven future of finance.