Author: Citizen42

TL;DR

To me as a Delegate and VGC member for past 6 months Velora’s north star feels simple and concise: make cross-chain DeFi feel like one click.

The intents engine finds the best route, Super Hooks bundle multi-step flows (bridge → swap → deposit) into a single action and tight liquidity integrations keep costs down.

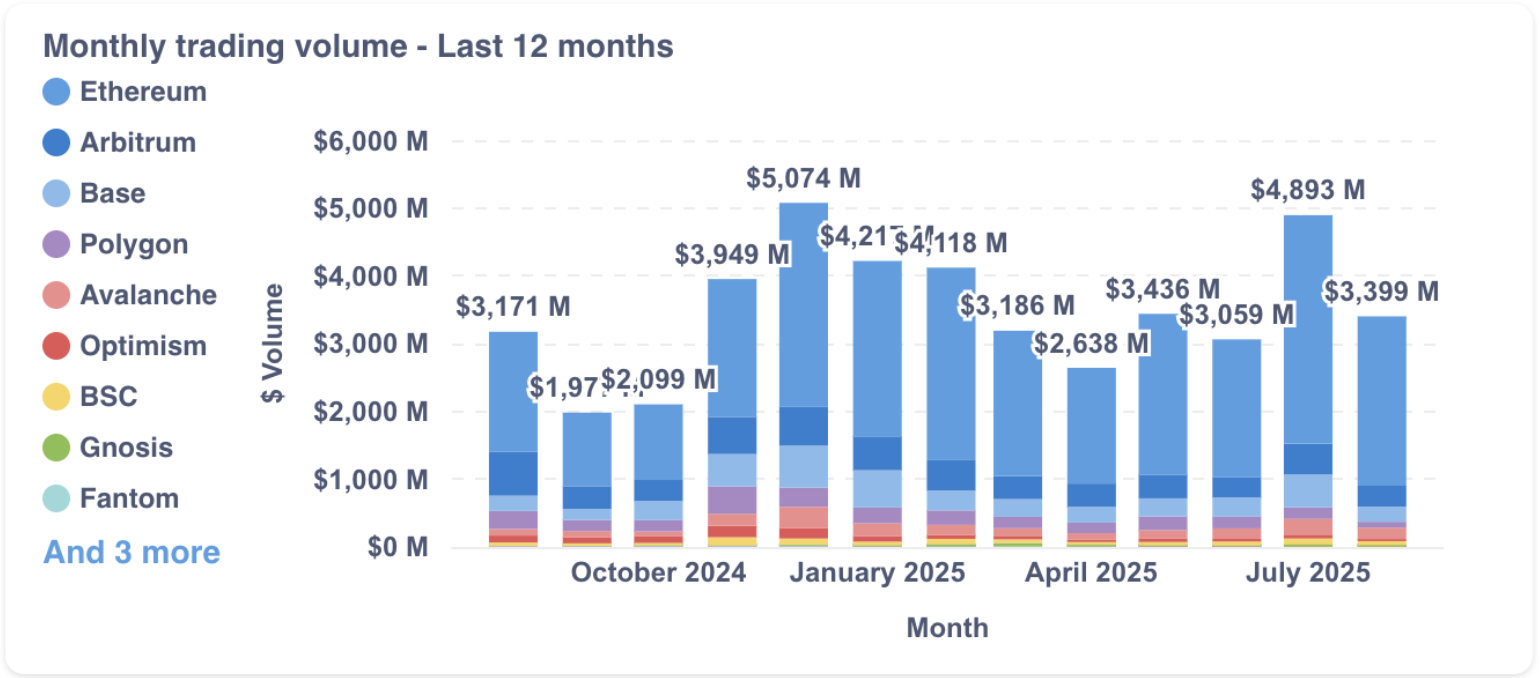

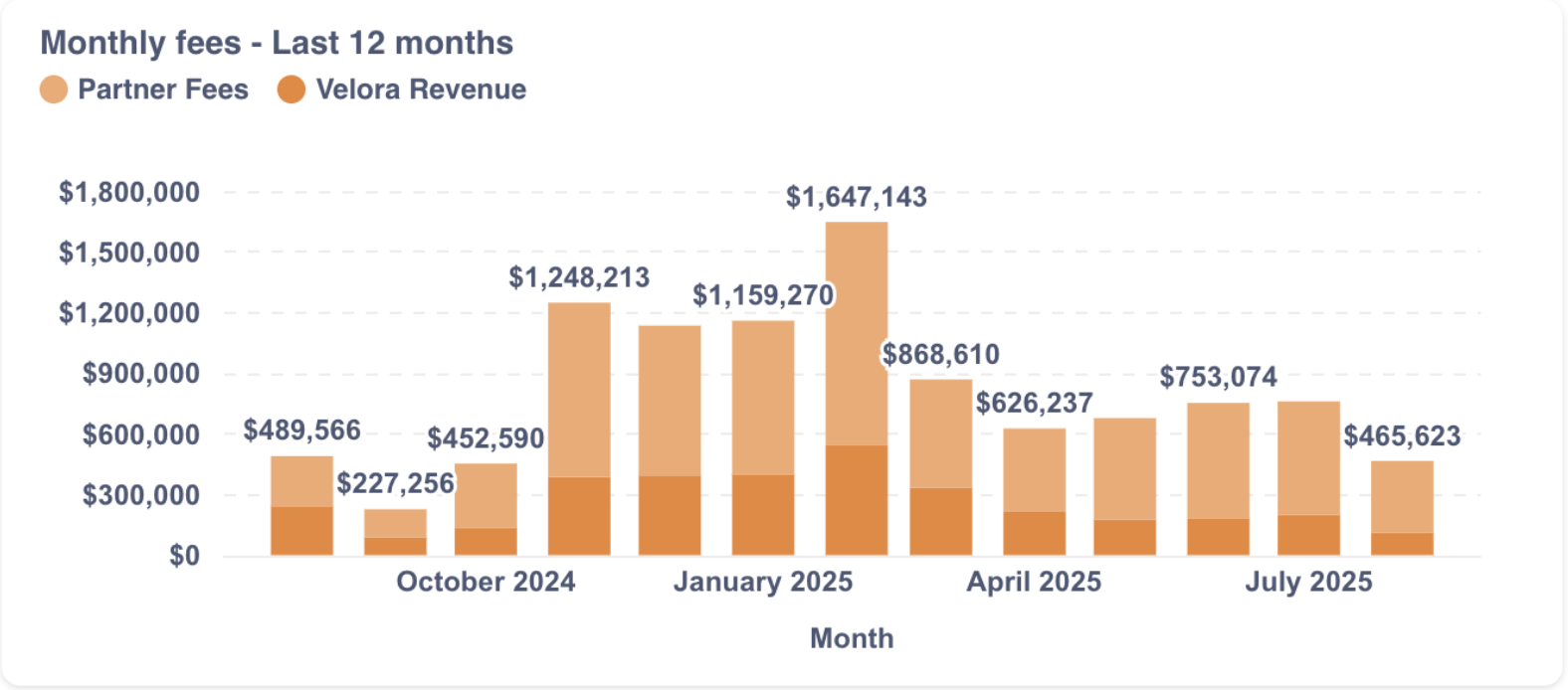

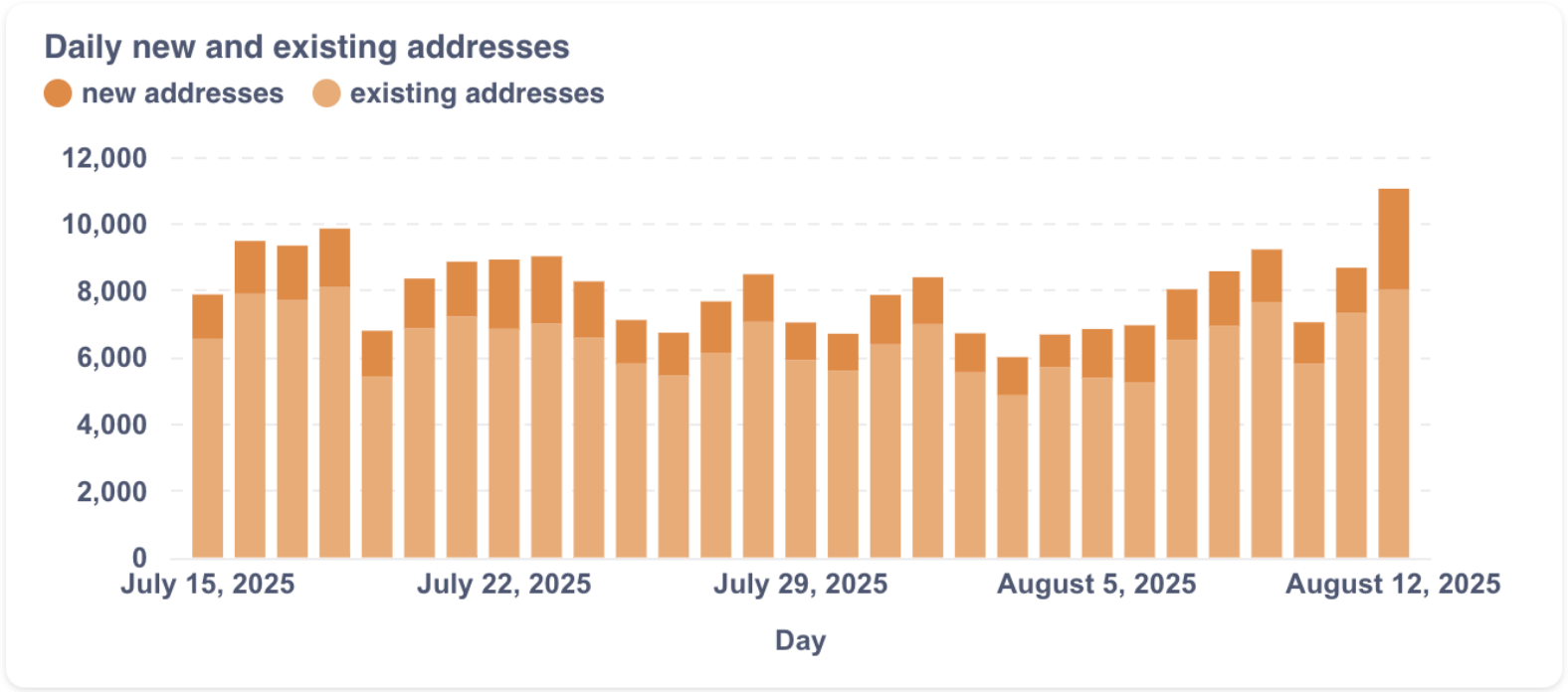

Below, three charts show volume, user activity, and fees vs. revenue - a data-backed story that Velora solves fragmented UX, bridging friction and scattered liquidity.

What Velora does!

Simply put, you tell Velora what you want (not how to do it).

Solvers compete to deliver the best price and path across chains and venues. If your action needs multiple steps, Super Hooks ( check Morpho integration for examples ) pack them into one atomic intent - so the UX feels like a single tap while the engine handles bridging, approvals, swaps, and deposits behind the scenes.

Proof in pictures

See Velora Analytics for in-depth view - https://dashboard.paraswap.io/public/dashboard/bb8b5007-ecc3-44e9-bdbe-b4b7a5273eb4

Trading Volume overview:

Revenue & Fees:

Active & New Addresses

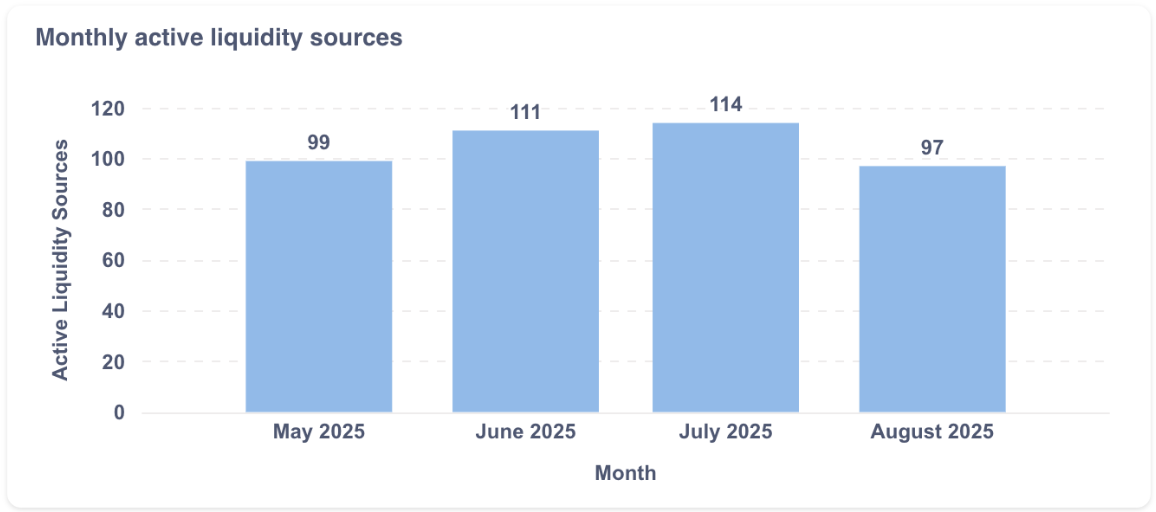

Active Liquidity Sources

What should we extract out of this !

True execution moat 🐆 with 100+ active liquidity sources means more paths per intent → better prices and higher fill rates.

No flaws - reliable demand with billions in recent volume and steady weekly rhythm suggests integrators and power users treat Velora as default routing.

Healthy capture for stakers and ecosystem participants: Fees and Velora revenue scale with flow, indicating the engine captures value without degrading end-user quotes and staker enjoy pure ETH revenue!

Why this matters one may ask!

Fewer steps, fewer errors: No more “bridge here, swap there, re-approve” - one instruction, one confirmation.

Better prices by default: Competing solvers and broad venue coverage keep effective costs low.

Cross-chain without the headache: Intents and programable layer logic remove the context switching that normally kills conversions.

Therefore Velora isn’t just moving volume, it’s turning that flow into protocol fees that cycle back to the community. With automated distributions in place, stakers share in ETH-denominated fee revenue, so participation isn’t just governance, it’s yield aligned with real usage.

If the charts above resonate, explore staking to earn pure ETH from protocol activity, try an intent yourself, or plug Velora into your app.

One click in, value out !

All screenshots come from Velora’s dashboards taken the same day as publication. Numbers in captions are the headline figures visible in each panel.