Limited Entrie: 100 spot

Cryptocurrencies have revolutionized the way we perceive and conduct transactions, and Venom Blockchain is at the forefront of this transformative movement. At the heart of the Venom ecosystem lies its native currency, VENOM, which functions similarly to how ETH operates on the Ethereum blockchain. In this blog, we will explore the tokenomics of Venom and its various use cases that contribute to the network’s functionality and vitality.

VENOM’s Utility

The VENOM token serves as the primary means of transaction settlement and participation within the Venom network. It has practical applications, including paying for transaction fees, maintaining the network through validators, securing the network through Proof-of-Stake (PoS) mechanisms, and supporting validators through DePools staking. These functions ensure the seamless operation and growth of the Venom ecosystem.

Token Standards: TIP-3 and TIP-4

Similar to how ERC-20 is the standard for fungible tokens on Ethereum, the Venom network utilizes the TIP-3 token standard. TIP-3 aligns with the distributed system architecture of the Venom network, providing cost-efficient fee models and enabling essential functionalities such as token transfers, balance inquiries, total supply retrieval, and token minting/burning.

In addition to fungible tokens, Venom also supports non-fungible tokens (NFTs) through the TIP-4 standard. TIP-4 is specifically designed for the Venom network, offering an optimal framework for creating, exchanging, and trading NFTs. This flexibility caters to a wide range of applications, from unique digital assets to collectibles and beyond.

Wrapped Venom (WVENOM): Simplifying DeFi Interactions

For regular users of decentralized finance (DeFi) protocols, direct ownership of the VENOM token might not be apparent. Instead, protocols handle the process of wrapping VENOM tokens behind the scenes. This wrapping results in a fungible TIP-3 token called Wrapped Venom (WVENOM). DeFi protocols support TIP-3 tokens for ease of implementation and compatibility, mirroring the practices in most blockchains.

While WVENOM represents the VENOM token within DeFi protocols, it is essential to note that it maintains a 1:1 ratio with VENOM. Users always have the option to convert their WVENOM back to the actual VENOM tokens, ensuring the liquidity and accessibility of the native currency.

The Future of Venom’s Tokenomics

The VENOM token stands as the primary currency within the Venom blockchain, acting as a utility token that performs crucial functions within the ecosystem. Its core functions include incentivizing validators, protecting against Sibyl attacks, enabling delegated staking, and introducing governance mechanisms.

Validators receive rewards in VENOM tokens for maintaining the network’s integrity, incentivizing them to act honestly and consistently. To prevent Sibyl attacks, participants must stake their tokens to become validators, with the number of validators they can create limited by the tokens they hold. Delegated staking allows participants to delegate their tokens to validators, ensuring network decentralization and preventing the concentration of power. The VENOM token will also play a pivotal role in governance, allowing participants to propose and vote for network proposals, decentralizing decision-making and empowering the community.

The VENOM token is subdivided into the smallest transferable units called NanoVENOM, ensuring precision and flexibility in transactions. However, it is important to note that the VENOM token does not represent ownership in the traditional sense. It does not entitle holders to shares, participation, or entitlements to profits, dividends, or investment returns. Instead, VENOM’s value lies in its utility and the possibilities it unlocks within the Venom ecosystem.

Venom’s tokenomics model is dynamic and adaptable, geared towards the network’s long-term sustainability. Currently, Venom follows an inflationary model with no fixed maximum supply. However, the Venom Foundation is actively exploring the transition to a deflationary model. One potential approach involves burning a portion of transaction fees, reducing the overall token supply. This transition necessitates careful planning and consideration to maintain network stability and ensure a thriving ecosystem for all participants.

Token Release and Inflation Rate

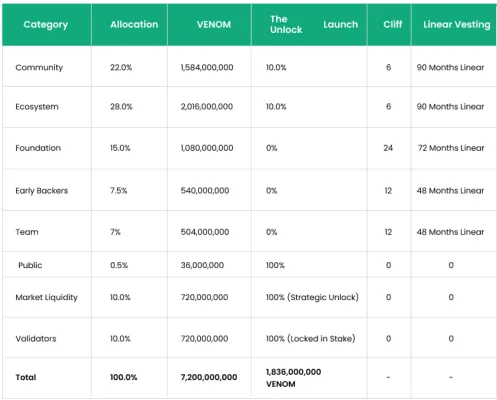

During the mainnet launch, the initial supply of VENOM tokens is set at 7,200,000,OOOVENOM. Out of this supply, 15.596 (1.116B) is immediately available, while 84.56 (6.084B) is locked. The locked tokens include a stake of the initial validators, constituting 10% (720 million) of the initial supply.

The projected annual inflation rate for VENOM is -1% (-72,000,000 VENOM). This model aims to balance the token supply’s growth and prevent excessive inflation, ensuring a stable and sustainable network.

Features that make building on Venom easier

Account Abstraction: Unlike traditional blockchains, Venom adopts an account abstraction approach, transforming every account into a smart contract. This design pattern allows for enhanced authentication beyond external ownership, empowering users to define custom permission levels, batch transactions, implement account recovery mechanisms, and set transaction limits. Account abstraction enhances security, customization, and usability, simplifying the user experience.

Cross-Chain Communications: Venom introduces a native cross-chain communication protocol, enabling seamless interaction between different workchains without relying on third-party bridges or intermediaries. This protocol facilitates interoperability between public and private networks, fostering shared liquidity, privacy, and compliance across various use cases. It opens up possibilities for DeFi applications, private payments, and regulatory-compliant transactions, expanding the potential of blockchain technology.

Invisible Gas Fees: Venom streamlines the payment of transaction fees by allowing users to pay in any on-chain currency accepted by the dApp they are interacting with. This eliminates the need for a separate native token to pay gas fees, enhancing user experience and facilitating seamless accounting with traditional systems. Stablecoins or Central Bank Digital Currencies (CBDCs) on the Venom blockchain can charge fees in their respective currencies, ensuring a frictionless transaction process.

The Venom Blockchain’s tokenomics model, centered around VENOM token, is designed to power a secure, scalable, and versatile ecosystem. With its practical utility, support for fungible and non-fungible tokens, interoperability, and innovative features like account abstraction and invisible gas fees, Venom is ushering in a new era of blockchain applications. As the network evolves, the Venom Foundation continues to evaluate and refine tokenomics to ensure a thriving environment for all participants.

To learn more about Venom, check out the following links:

Website: https://venom.foundation/

Testnet: https://venom.network/

Whitepaper: https://venom.foundation/Venom_Whitepaper.pdf

Documentation: https://docs.venom.foundation/

Twitter: https://twitter.com/venomfoundation!

Let’s BUIDL great things together!