"There is timing in everything. Timing in strategy cannot be mastered without a great deal of practice." - Miyamoto Musashi

In Japanese, kuzushi means to unbalance. It is “not just an unbalancing, but the process of putting an opponent [in] a position, where stability, and hence the ability to regain uncompromised balance for attacking, is destroyed.”

Nothing happens without kuzushi. I learned this in Judo but it is especially true in founding a startup.

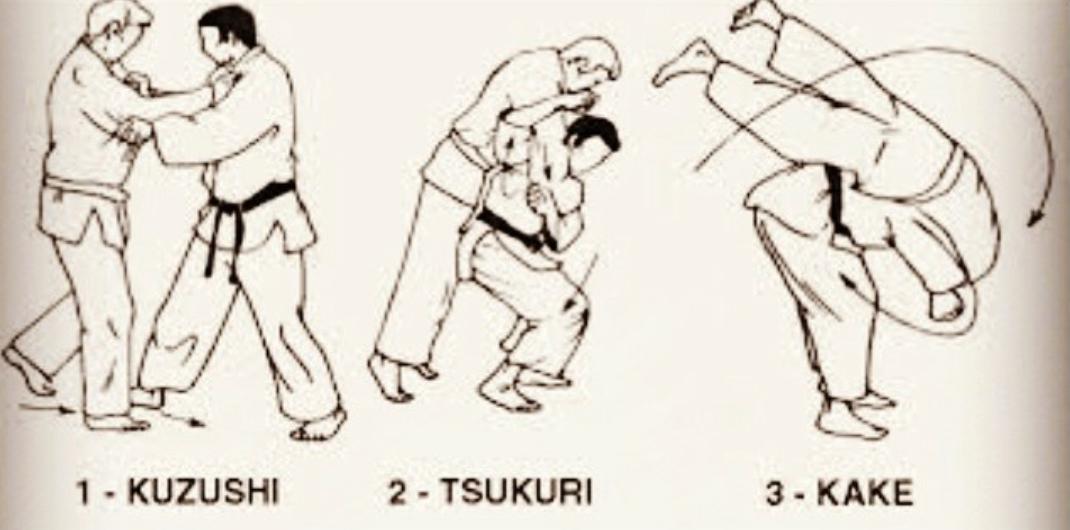

The goal in Judo is to throw an opponent on their back. There are 3 phases to a throw:

- Kuzushi: unbalancing

- Tsukuri: entering

- Kake: execution

When I started training Judo I had no concept for kuzushi. All my throw attempts started with tsukuri and ended with me flat on the ground and my opponent standing above me. My results changed when sensei revealed the all-important concept of kuzushi or as he put it, preparing my uke (opponent) for their fate.

Kuzushi happens in one of three ways: directly unbalance the opponent, feinting to lure an opponent off balance, or an opponent unbalances themselves in their own attack.

Since learning about kuzushi I see it everywhere now. In startups, kuzushi is the “why now” moment. No idea is good enough to overcome a market where the timing (i.e. balance) is wrong. As Andy Rachleff puts it, "When a great team meets a lousy market, market wins.” We can trace every startup to a why now moment critical to their success:

- Tesla: the invention of lithium ion batteries

- Uber: market adoption of smart phones and regulation requiring GPS in every phone

- Bitcoin: cryptography, blockchain technology, and the decay of institutional trust

None of these ideas were new. They were the best teams executing on their idea at a time when the market was one miracle away from unbalancing.

Like kuzushi, the “why now” moment is a slim window of time. Once people realize the opportunity, the timing is too late and balance is reestablished, incumbents and startups move to capitalize on the shift. What was non consensus yesterday is normal today.

Like Judokas, great founders posses the coup d'œil to see their market’s why now moment and move quickly to establish and seize kuzushi before it’s gone. Most founders fail at this. Founders will enter with an idea and end up flat on the ground with their markets standing above them. Everyone remembers tsukuri (entering) and kake (execution) but few address kuzushi which ultimately decides whether there is an opportunity to be seized at all.

In startups and in Judo we neglect kuzushi because we misperceive our strengths as being greater than physics. To my surprise, stepping and lifting exactly how sensei showed me didn’t budge my opponent in the slightest. We naturally grow out of this neglect in Judo after being thrown enough times.

But startups are more elusive teachers. Instead of focusing on finding kuzushi, founders will spend years of their life building before they find a real opportunity. This is the result of prioritizing a personal desire to build over a market’s desire to buy.

Finding kuzushi in startups requires understanding a market well enough to spot the opportunities, if they exist. Only then does it make sense to go all in on building and selling. Founders can escape this Sisyphean curse and optimize the possibility of finding kuzushi by creating tight feedback loops that compound their understanding of a market.

As a founder, I explore ideas the way I do randori (sparring) in Judo: jumping in with the humility to learn in service of finding kuzushi. I get in front of customers, rapidly experiment with prototypes, and iterate based on feedback. During this process, it’s important to not lock myself to a specific plan or let a setback demoralize me. I focus on remaining close enough to strike but far enough to see and adapt.

Thanks to Aaron Resnick and Grace Alofe for reviewing drafts of this. Thanks to all my teachers at Oishi Judo Club.