--- the incomplete story of web3, and its user retention problem ---

(note: if you are an up-to-date industry insider, you can skip directly to the fourth section: The Leakiness Problem)

For very online people, Twitter was a mainstay for the last decade, despite its one-hundred faults and despite the downhill trajectory of the quality of social interactions on the platform. During the very-online pandemic years of 2020-21, web3 arrived on the scene with its enticing airdrops and its utopian promises of user-owned web.

DeFi had had a sufficiently successful start in 2020 in creating decentralized exchanges and financial derivatives markets. Billions of dollars were flowing in the protocol tokens and millions of crypto-newcomers were yield-farming with these new lending protocols. It was the good times. After Finance, the builders and investors turned their attention towards social-media. User experience on existing major social media platforms was now already a dumpster fire most of the time. It was the obvious next sector to disrupt, with blockchain.

We Are Gonna Make It?

There was reason to hope web3 will bring a new dawn to the social web. Open social graphs, decentralized identities, user-owned content, no platform lock-in. Everyone started talking about “protocols, not platforms”. Even I designed the user-experience mechanism for a web3 social protocol in 2021. Tokenization was the name of the game. Those Web2 evil giant corporations be damned, we were starting fresh in the new tokenized world. Hundreds of protocol iterations were designed by ambitious founders and coded by newly-minted solidity developers. “Token first, Product later” was the playbook. Zero-interest-rates era had no shortage of investors, small and large, plowing into web3 companies as soon as they launched their tokens. As their product, these companies had just another chrome extension or another discord bot or another listing-directory websites with the web3 signature feature of “Connect Wallet”. Their logos and website designs were full of rainbow color-schemes and utopian vibes.

In the community-space(read: discord server with a dozen meme & trading channels), they were building community before product. Instead of early adopters and paying users, there was a swarm of micro-investors, token-traders and airdrop farmers, going from one “community” to another posing as early adopters. I was scouring through many of these “communities” trying to find products with real-world use-cases and those elusive “paying users“. But they were nowhere to be found. But the bubble kept on going in 2021. The memes kept on going. “WE ARE ALL GONNA MAKE IT” or WAGMI, said everyone in the web3 bubble of 2021. Only in mid-2022, zero-interest-rate money taps got closed off and VCs started questioning the head-in-the-sky web3 fundraising pitches. NFT prices and trading-volumes fell over 90 percent and hundreds of web3 tokens went to almost-zero.

Then Came Reckoning

2022 was a hard year for tech companies in general but for web3 companies, it was close to an extinction event. VCs were not dishing out more money for every generic website/app that could “Connect Wallet”. Consumers were struggling with high inflation and selling their NFTs and tokens for whatever price they could get. Lingering earnest memes of 2021 didn’t feel optimistic anymore but rather delusional. Airdrops became uncommon and tiny.

When the dust cleared, what remained was only a handful of web3 products with 10,000+ real active users. As far as I know (after being in the depths of web3 for the last three years), not even one web3 native company had a million daily-active-users at the end of 2022. After all the talk of focusing on user-experience and growth, mainstream adoption of web3 was far from reality. But now the token ponzi schemes had run out of steam. Meme hysteria dried off and social-influencers were either distancing themselves from their token promotions or getting sued by their fans who lost money by blindly investing in those tokens. 2022 made web3 founders think hard why their products had few, if any, paying users and why their “early-adopters” didn’t stick to their “communities” after the first month of signing up. Then came ChatGPT, diverting the excess VC money into a new startup bubble: Generative AI. Web3 was left to hang dry.

This is not a Eulogy

Because web3 didn’t die in 2022, but it was forced to start evolving towards utility.

-

Airdrop criteria now include multiple, nuanced market-segmenting factors and rewards are modest and more proportional to the estimated customer lifetime value. (see: RabbitHole’s pivot to Quest Protocol)

-

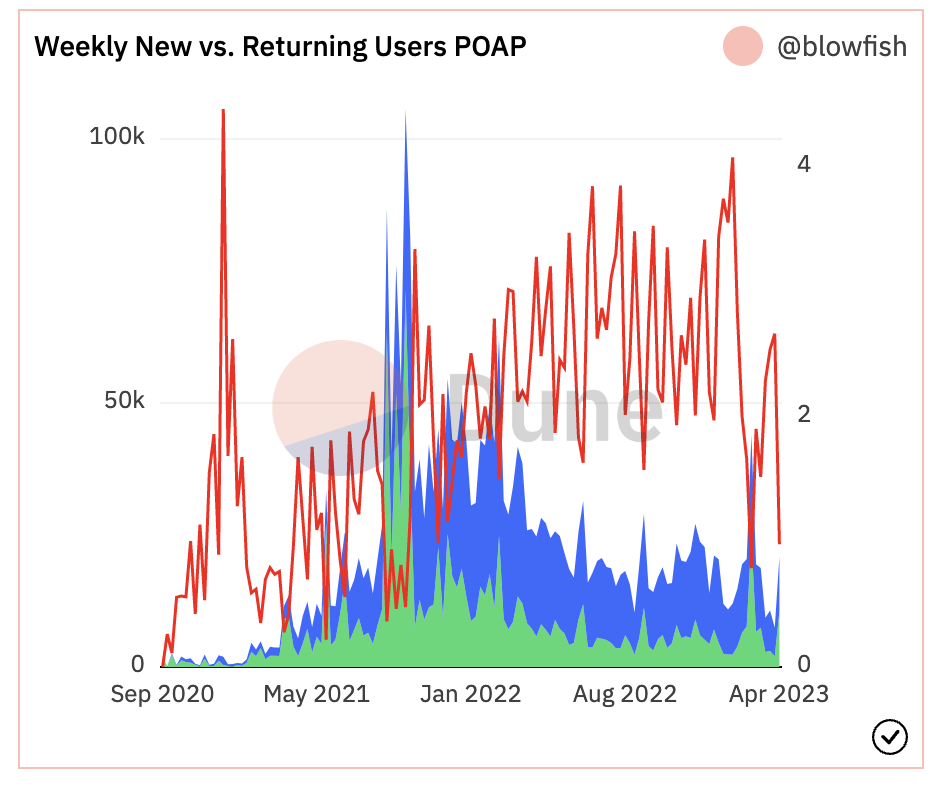

A few new blockchain-based web primitives came out of the bubble. Three promising ones are: 1) token-gated access (built by Collab.Land), 2) crypto-badges(built by POAP), and 3) multi-party crypto accounts (built by SnapShot). These are genuinely useful applications of NFTs for community-management and have reached hundreds of thousands of users who are repeatedly using them.

-

DAO (group chat with a shared bank-account on the blockchain) as a concept got battle-tested and was found wanting. Many interesting use-cases were explored but success was found mostly as an alternative seed-funding mechanism of traditional Venture Capital process(see: SeedClub, Friends With Benefits, VitaDAO, and Gitcoin).

-

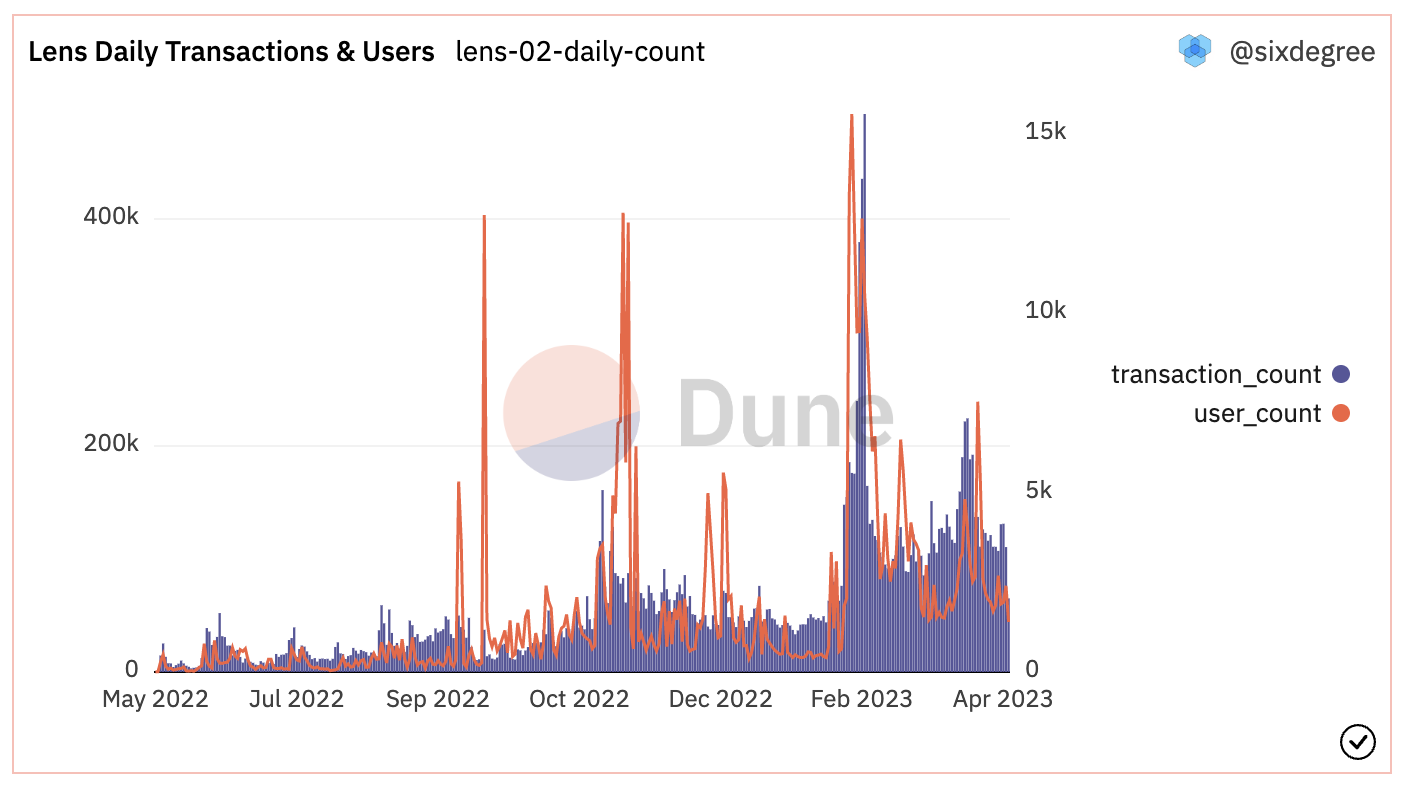

Web3 social protocols are still full of NFT-traders posing as users but a couple of them have gotten initial traction (see: Lens Protocol’s 100K+ profile NFTs being traded on OpenSea, Mirror has 100K+ users on its publishing platform).

-

Reputation systems and decentralized identity was finally taken seriously by some web3 builders in 2022 and 2023 (see: Disco, Polygon ID, Soulbound), after realizing web3 is not like DeFi, money alone doesn’t build sustainable communities.

-

NFT marketplaces got less greedy as competition (see: OpenSea vs Blur) got intense and their profit margins(via fees) got eroded away.

-

Wallets started to adapt to consumer-market reality: gas fees were swept behind the protocol curtains(not borne by users anymore) and more sustainable self-custody mechanisms started to be implemented(see: Argent wallet with social recovery mechanism).

-

Putting the app operations actually on-chain (not just promising to do it later) is now becoming an expected norm in web3.

-

Off-chain web2 data is now being leveraged for bootstrapping web3 reputation.

The Leakiness Problem

Why is Web3 still not mainstream then? because it is too leaky. Let me list real examples to make my point. I am listing down the more known names below but keep in mind each of these categories has dozens of copycat projects that are racing to get their own piece of the pie.

Stumblers

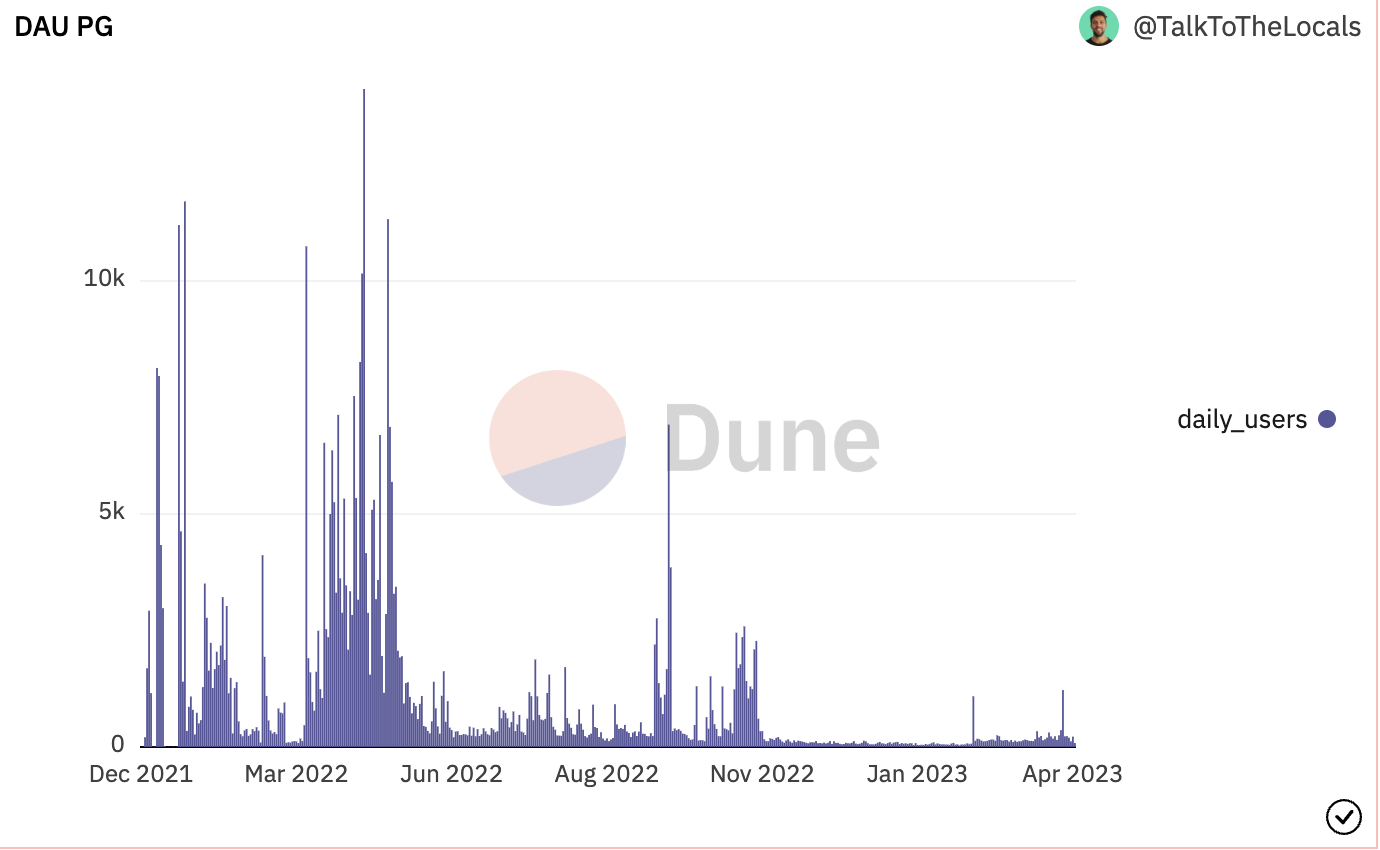

These projects didn’t lack early-adopters, they just were too leaky to retain those users. A majority of users who tried their products ended up never using the protocol again after their first month of signup. For some of the popular protocols, the churn has been upto 90%. With incentives and memes, major web3 projects managed to attract a swarm of “early adopters” to get started but their products and communities were not sticky enough for most of those users to stay and become repeat users. This phenomenon resulted in a swarm of web3 speculators and airdrop farmers posing as “early-adopters” going from protocol to protocol to harvest incentives and move on. Just like you would imagine a locust swarm.

-

On-chain data aggregators + verifiable-credentials curators

-

Play-to-earn games / virtual real-estate

-

Axie Infinity

-

Decentraland

-

Zed Run

-

-

Open social graph protocols

-

Lens Protocol

-

Mask Network

-

-

Crypto-certification protocols --(pivot)-→ targeted incentive-marketing protocols

Real Success Stories

Despite the swarm phenomena seen in web3 for last couple of years, some web3 projects have managed to attract sticky users (bees) and repel speculators(locusts). Four major success stories in web3 adoption have been these protocols who have either completely disabled or highly sidelined token-trading.

-

POAP -- the original crypto-badge protocol which has been copied dozens of times by other protocols.

Over half of active users for POAP have been returning users(see chart above). -

ENS -- the blockchain address naming protocol that’s meant for one-time registration purchase for long-duration.

-

Mirror -- the onchain publishing protocol with crypto-native features like NFT collections and automated revenue-splits.

-

Collab.Land -- the OG token gating community tool first implemented on discord servers of “crypto-communities”

Fragmentation from Competition

Too many chains led to a fragmented DeFi space, still being patched with interoperability multi-chain solutions, years later. Now, the movie repeats itself in web3. Many social wallets are now claiming to be the one-and-only wallet you need in web3. Lens, CyberConnect, Mask Network, Galxe, just to name a few.

This race will take a while to even come close to being settled. Big web2 social platforms were hoarding the user-data and their proprietary social-graph to earn targeted-advertising bucks. The new web3 social protocol wallets are trying to create moats by being the “most-integrated with” protocol in the expansive composable web3 ecosystem to earn a cut of transaction-fees from all the apps. User-data hoarding is passe, app-integration hoarding is chic now.

NFT and Beyond

In 2023, after hard learned lessons, it’s time for web3 protocols to try new approaches to tackle user-churn and give users stronger reasons to stay. Let me put down a few retention-boosting approaches that are interesting and possible to emerge in this and next year of web3 trajectory:

-

Non-financial reputation-systems using non-transferable tokens

-

Cluster-level onboarding of social users from web2 platforms

-

Embedded wallets within existing popular mobile apps (like Tinder & Uber)

-

Competition among web3 protocols to fund new app-developers to boost their integration-moats and increase user-retention at protocol level.

-

Indexing of on-chain data in easy-to-read formats, beyond current chain explorers. Using natural language to query on-chain data using LLMs.

-

Diversified IRL usecases like gym, club, travel and event memberships based on onchain data.

-

Private credentials in the wallet via zero-knowledge proof.

The future of web3 is uncertain yet full of exciting possibilities. As a contributor to the industry, I want to start seeing sticky use-cases for products that are not just “web3 for X“ but true utility unlocks that were unviable in web2 era. To move forward, this space needs more humility to accept what has worked in web2 business models and innovate towards product-market-fit approaches that give mainstream web2 normies not just reasons to come, but yet stronger reasons to stay in web3. Onward.