TL;DR

-

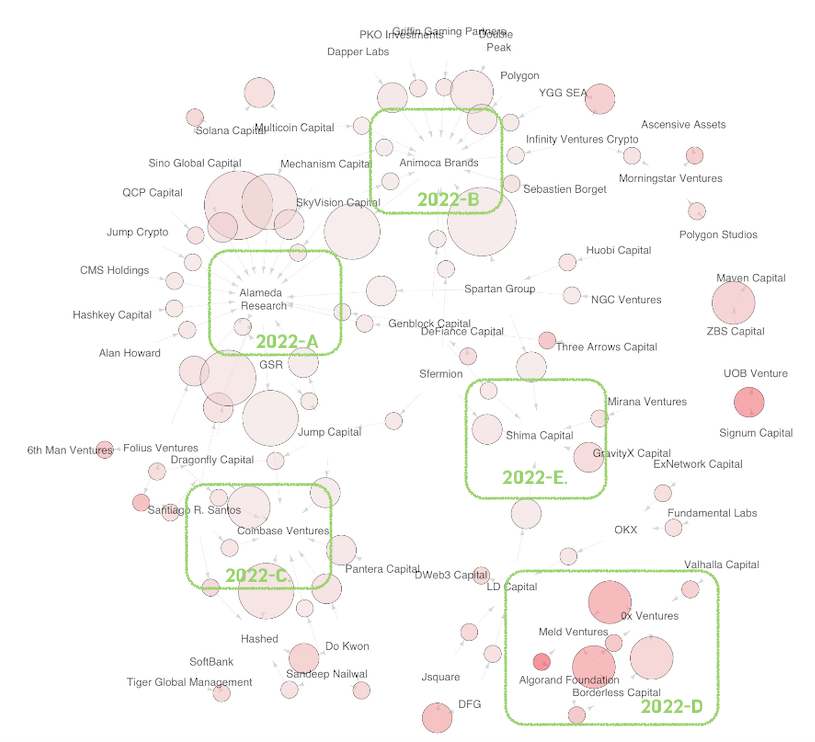

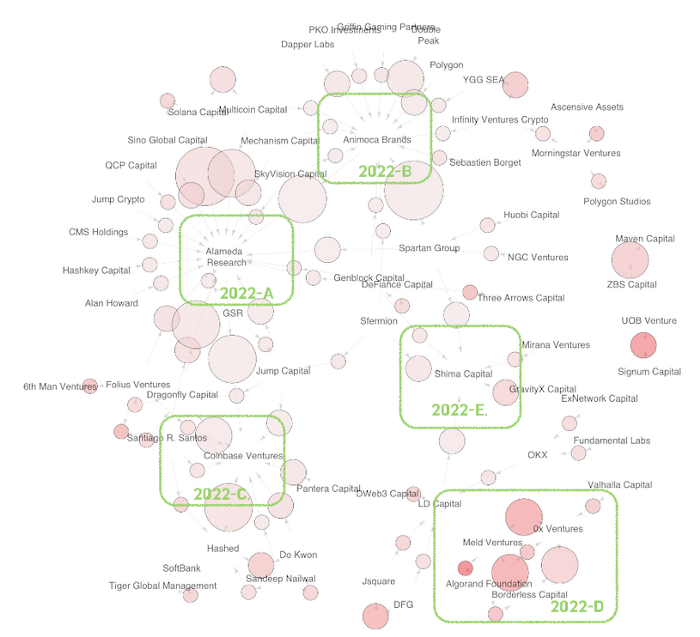

By visualizing the network between 2022 Crypto VCs, 5 noteworthy groups were identified centered around Alameda Research, Animoca Brands, Coinbase Ventures, Shima Capital, and Algorand, each with their own characteristics.

-

In 2022 Group A moved the largest amount of funds, centered around Alameda Research.

-

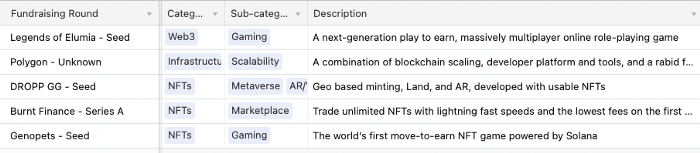

In 2021, APAC-based VCs created a single group centered on AU21 Capital, and in 2022 VCs based in the US, Hong Kong, and Singapore created multiple groups that were intricately entwined. This means cases of sharing information and deals between VCs are increasing, yet the bonds between VCs are particularly stronger when they are in the same country or geographically closer.

-

Thus, the tendency of VC groups to form based on geographical location will influence the nationality of projects that receive investment, potentially creating the risk of geographical imbalance as the market develops.

Introduction

Which VC exhibits the best social network in the current crypto market?

Since analyzing past fundraising records, it is evident that most VCs enter an investment round with each other. By doing this, the receiving project is able to leverage the network and information of various fundraising VCs while efficiently raising investment.

Thus it became apparent that even among VCs, there are social networks used to share deals and various forms of information. By leveraging this network VCs can efficiently complete their due diligence and exchange investment opinions.

This article is based on the hypothesis that there will be especial relationships between particular VCs in which information is shared, and as these relationships grow different groups with specific characteristics will appear. Hence we can infer that there are VCs who play a pivotal role in each group and this article aims to highlight these core players.

Methodology Used for Analysis

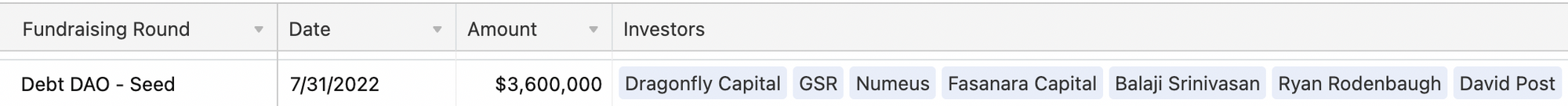

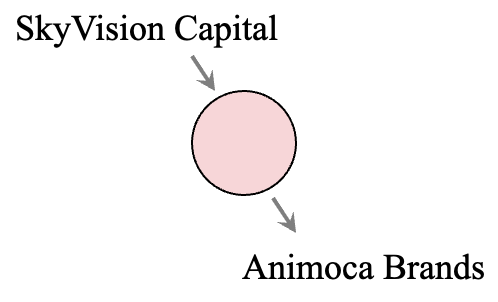

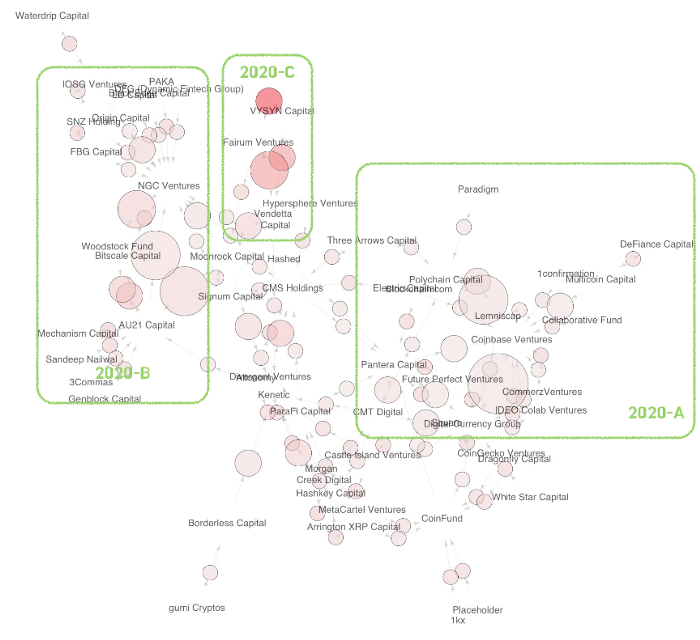

In the following analysis, Fundraising data by Messari and Apriori algorithm from Agrawal and Srikant’s 1994 research paper were used to uncover the existing network between VCs.

The Apriori Algorithm, called the Association Rule Analysis, is an algorithm that generates rules indicating which two sets of items occur frequently. Widely known as the Market Basket Analysis in business administration, this methodology produces an algorithm that can draw conclusions such as “Customers who purchase item X are more likely to purchase item Y as well” based on consumer purchasing history. In this algorithm, support is a measure of how ‘frequently’ two items appear together, confidence is a measure of the likelihood that the association rule between the two items is a reliable rule and lastly, lift is the measure of whether the association rule of the two items is coincidental. Analysis results are interpreted mainly through these three indicators. This article intends to visualize networks based on the indicator of support, and thus identify any existing groups and their characteristics.

How to Interpret the Network Diagram

The network between VCs over the past three years (2020, 2021, 2022) has been reinterpreted into three visual diagrams below. In order to understand the three diagrams attached, one must first consider three keys.

-

The size of the circle joining two VCs

The size of the circle is proportional to the level of support. In other words, a large circle signifies that the two mentioned VCs entered investment deals together frequently that year. -

The color of the circle connecting the VCs

The intensity of color in the circle represents the lift value. The darker the color of a circle, the stronger the relationship between the two VCs. -

The number of lines connected to other VCs

Multiple lines signify that the VC has participated in various investment deals with the connected VC.

2022 Network Diagram

2022-A Group: USA

-

Group members: Alameda Research (centered), Solana Capital, Multicoin Capital, Dragonfly Capital, Animoca Brands, Coinbase Ventures

-

With the exception of Animoca Brands, the above VC CEOs are American or headquartered in the US

-

This group is estimated to run the largest investment budget and currently leading the investment market. This group is estimated to have participated in a total of 357 deals between January 1st, 2022 to August 5th (including overlaps).

-

Relationship entwined via Investment

-

Alameda Research, Multicoin Capital → Investment in Solana (link)

-

Coinbase Ventures, Dragonfly Capital → Investment in Animoca Brands (link 1, link 2)

-

-

This group has a relatively higher rate of investment in Web3 Infrastructure and DeFi-related projects compared to other groups.

2022-B Group: Hong Kong & Singapore

-

Group members: Animoca Brands (centered), Spartan Group, Alameda Research, Double Peak, Dapper Labs, Polygon

-

Headquarters of Animoca Brands, Alameda Research, Double Peak are all located in Hong Kong (Spartan Group in Singapore, Dapper Labs in Canada, Polygon in India)

-

This group has shown a tendency to invest in projects mainly related to NFTs and Web3, showing profound interest in NFT, Gaming, Metaverse, and Web3 Tooling.

2022-C Group: Bay Area

-

Group members: Coinbase Ventures (centered), Hashed, Dragonfly Capital, Pantera Capital

-

With the exception of Hashed (based in South Korea), the above mentioned VCs are all based in San Francisco

2022-D Group: Algorand

-

Group members: Meld Ventures, Borderless Capital, 0x Ventures, Algorand Foundation

-

Although the size of this group is relatively small, the lift value between this group seems higher than in other groups. It can be inferred that this group has strong internal cohesion.

-

Borderless Capital created a $500m Algorand Fund (link)

-

Algorand found in Meld Ventures portfolio

-

Algorand-related dApps found in 0xVentures portfolio (such as Algomint, Algopulse, etc)

-

This group can be characterized by their tendency to only invest in projects classified as DeFi.

2022-E Group: Asian-American

-

Group members: Shima Capital (centered), Gravity X Capital, Sfermion, LD Capital, Spartan Group

-

Shima Capital’s headquarters are located in the United States, but five key executives including the CEO are Asian-American.

-

LD Capital is a China-based VC, Spartan Group is a Singapore-based VC

-

This group tends to evenly invest in projects of various natures, including DeFi, NFT, Gaming, Metaverse, Layer 2, Infrastructure and more.

2021 Network Diagram

2021-A: APAC

-

Group members: AU21 Capital (centered), X21 Digital, LD Capital, NGC Ventures, Magnus Capital, ExNetwork Capital, Genblock Capital, Spark Digital Capital

-

VC Founders or headquarters based in APAC

-

AU21 Capital: Asian-American Co-founders (Chinese)

-

X21 Digital: Singapore

-

LD Capital: China

-

NGC Ventures: Singapore

-

ExNetwork Capital: Philippines

-

Spark Digital Capital: Asian-America CEO (Chinese)

-

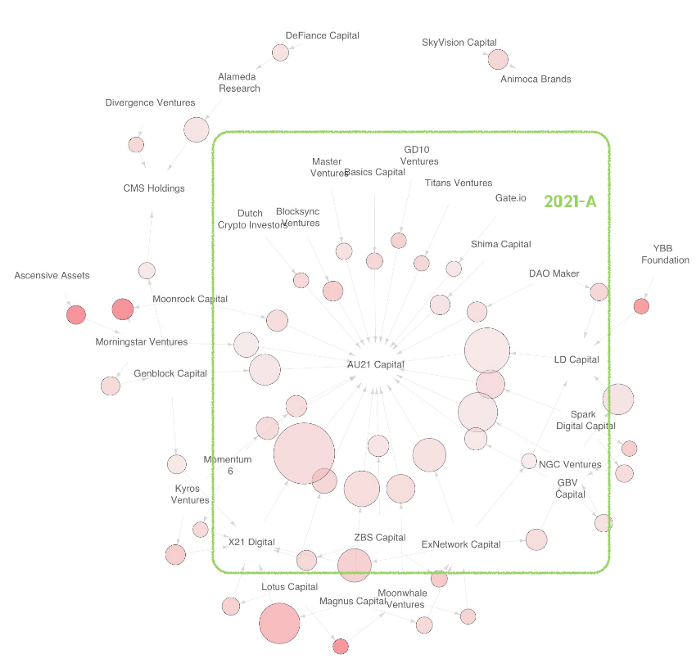

2020 Network Diagram

2020-A: USA

Group members: DCG (US), Coinbase Ventures (US), Polychain Capital (US), Multicoin Capital (US), Lemniscap (HK), CMT Digital (US), Pantera Capital (US), Commerz Ventures (Germany)

2020-B: Europe

Group members: AU21 Capital (US), Moonrock Capital (UK), NGC Ventures (Singapore), Woodstock Fund (UAE), Origin Capital (Ireland), Bitscale Capital (Switzerland), Caballeros Capital (N/A)

2020-C: Etc

Group members: Fairum Ventures, Vendetta Capital, VYSYN Capital

Coming to a Conclusion

Based on fundraising data from the past three years, in this article we examined the characteristics of VC groups. What was interesting was that VCs with geographically closer headquarters often formed a group. Meaning, that the closer the physical distance, the higher the chances were of social distances being much tighter. This is presumably because the probability of sharing similar culture, language, and time of activity is much higher.

As I write this article, a few questions come to mind. How should new VCs or founders receive investment when they are faced with the difficulty of accessing these main VC groups due to their geographical location? Is it fair to say that these projects VC groups invest in together are indeed good projects? Doesn’t the success rate of these projects increase significantly because these VC groups have entered investment together? The question of which is first, the chicken or the egg, remains unanswered here.

In the next article, let us examine whether a VCs’ physical distance is proportional to their social distance even in the projects they invest in. If such a trend can be observed, this means the party receiving investment and the party providing funds are grouped based on the country or on a larger scale, the language area. This means it is highly likely that FAANG of Web3 will be born again in the US.

Copyright 2022. nonce Classic. All Rights Reserved.

Edited by Yumi Hong, Translated by Esther Kim