GLOBAL BLOCKCHAIN & WEB3 GAIN MOMENTUM: 298 NEW PROJECTS WORLDWIDE

Blockchain & Web3 Outlook 24/25 reveals 3.5% growth in new initiatives developed by traditional companies and strong adoption (41% active companies) among Fortune Global 500 corporations in Web3

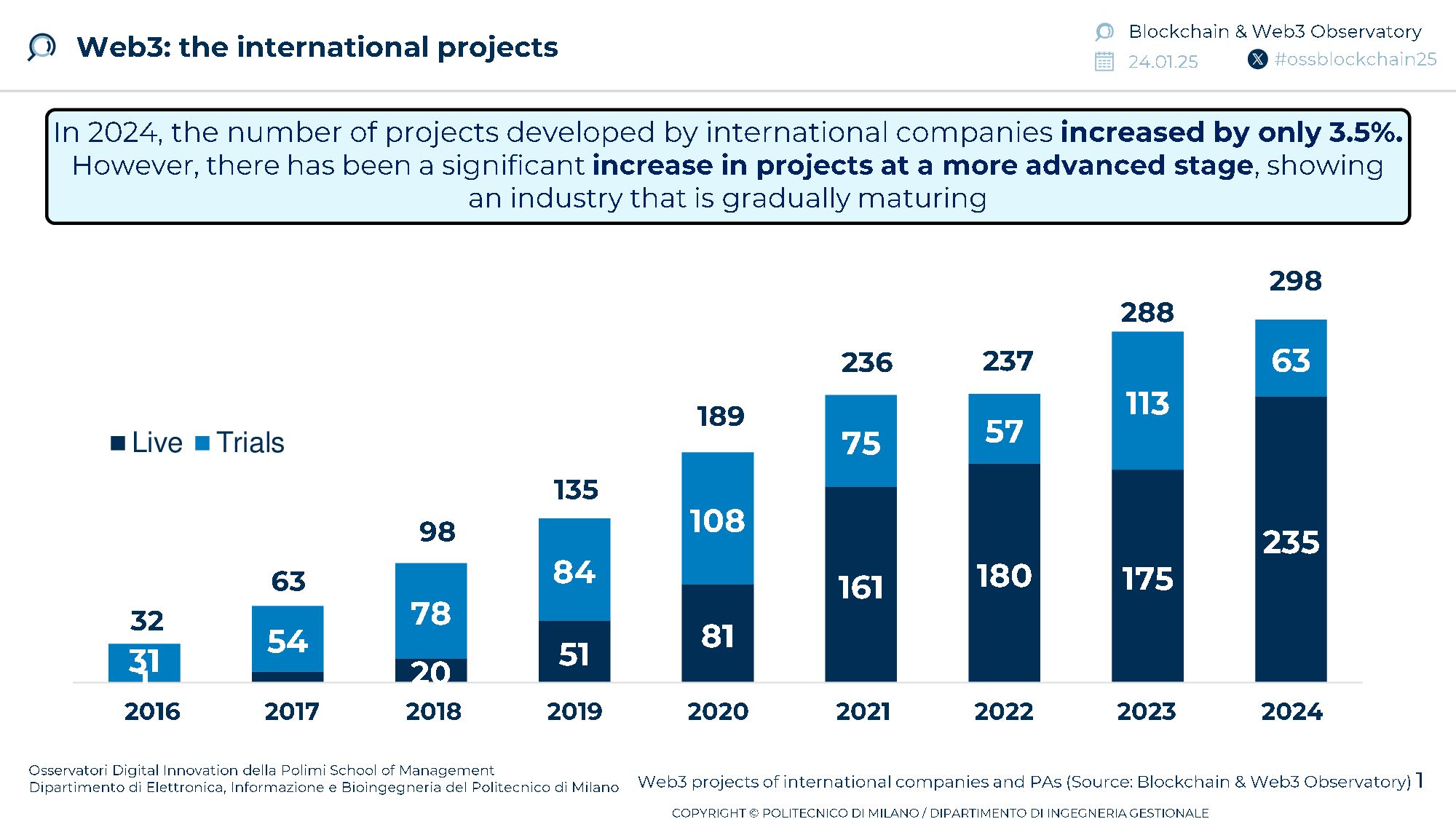

Despite an apparent lull in 2024 in corporate blockchain adoption, especially when compared to the renewed spike in cryptocurrency values and media buzz, the blockchain and Web3 landscape has been quietly unfolding behind the scenes. According to new findings from the Blockchain & Web3 Observatory of Politecnico di Milano, established enterprises continued to build infrastructure and experiment with new business models. As a result, 298 new blockchain and Web3 projects developed by traditional companies were launched globally in 2024, up 3.5% from the previous year.

The research, which focuses on the worldwide adoption of blockchain by companies, highlights a shift toward more mature implementations. While experimentation dipped by 43%, operational projects rose significantly, suggesting that organizations are moving beyond proofs-of-concept to full-scale rollouts. Notably, 204 of the world’s Fortune Global 500 companies have undertaken at least one blockchain initiative (totally they developed 482 projects), with 51 new projects launched in 2024 alone.

The Web3 sector’s advancement varies worldwide. In the United States, venture capital funding and corporate partnerships continue to support blockchain initiatives, and many consider Trump’s pro-crypto stance a potential boost for future projects. Across Asia, financial tokenization sees steady adoption in fintech hubs like Singapore and Hong Kong, where multiple token-based platforms are under development. In South America, stablecoins attract interest for their ability to mitigate currency risks and facilitate cross-border transactions. Meanwhile, Europe is centering its efforts on regulatory frameworks such as the Markets in Crypto-Assets Regulation (MiCAR) and the DLT Pilot Regime, aiming to unify standards and oversight within a complex but increasingly structured environment.

The Observatory’s analysis indicates that although 2024 appeared quiet on the blockchain and Web3 fronts, it was in fact a period of consolidation and infrastructure development, reminiscent of the early days of the internet. While cryptocurrencies are the most visible application, the Observatory points out that blockchain technology holds potential in many other areas and is steadily laying the groundwork for broader adoption.

Global trends and sector insights

According to the research, corporate initiatives can be grouped into three key areas for simplicity: Internet of Value, Blockchain for Business, and the Decentralized Web.

Internet of Value maintains momentum

“Internet of Value” projects, encompassing cryptocurrencies, stablecoins, and central bank digital currencies (CBDCs), remained steady at 88 new initiatives in 2024, representing 28% of all projects. While the number of new endeavors held firm, there was a notable improvement in quality: production-ready implementations rose by 53%, and experimental pilots declined by 37.5%.

A key driver of these initiatives has been the growing stablecoin market. By the end of 2024, stablecoin capitalization reached USD 205 billion, a 57% year-on-year increase, with trading volume hitting an all-time high of over USD 37 trillion. Banks have increasingly adopted stablecoins to streamline cross-border settlements, facilitate corporate payments, and enhance interbank processes.

Blockchain for Business on the rise

The majority of 2024’s global blockchain initiatives, 149 in total, fall under the “Blockchain for Business” category, marking a 43% increase over 2023. These projects leverage tokenization and smart contracts to optimize internal processes, reduce supply chain friction, and streamline financial operations. The data shows a surge in fully operational applications, jumping from 55 to 122 year-on-year, while proofs-of-concept nearly halved.

The Observatory’s findings indicate that the tokenization of financial assets is especially strong, with further growth expected in 2025. The continued development of infrastructure and services supports broader business needs, and the financial sector appears particularly prepared to leverage large-scale tokenization.

Decentralized Web sees mixed signals

Decentralized Web initiatives among traditional enterprises, projects in which blockchain serves as an enabling infrastructure for the creation and development of innovative business solutions, such as decentralized applications (DApps) or token projects on public blockchains, dipped significantly, totaling 61 new projects compared to 98 in 2023. The NFT collectibles boom that fueled much of 2022–23 appears to have cooled. In contrast, native Web3 players reported substantial growth, with daily active users in DApps surpassing 19 million worldwide, up from 3 million the previous year. Meanwhile, the Total Value Locked (TVL) in decentralized finance (DeFi) doubled to USD 140 billion in 2024, laying the groundwork for potentially transformative business models, even if they have yet to emerge at scale.

Italy’s blockchain market: cautious growth

In Italy, the blockchain and Web3 market totaled EUR 40 million in 2024, a modest 5% uptick from 2023, indicating measured but cautious progress. The financial and insurance sector continues to dominate, accounting for 49% of all investments, followed by public administration (22%), real estate (9%), logistics (4%), and automotive (4%). Agrifood investments fell sharply, from 10% last year to just 2% in 2024.

Despite relatively low investment levels, Italy is showing increased enthusiasm and expertise in blockchain technology. In 2024, the Observatory registered 227 Italian blockchain startups, up 15% compared to the previous year, and over the last seven years, 231 companies have developed at least one blockchain project in the country (+27 compared to 2023).

Meanwhile, approximately 2.7 million Italians aged 18 to 75 (7% of the internet population) hold crypto-assets. Most of these investors (85%) have portfolios worth under EUR 5,000, with 57% below EUR 1,000. Additionally, 65% state that crypto-assets make up no more than 10% of their total investments, while only 15% allocate more than 30%.

17% of the Italian population is interested in buying crypto-assets in the future, while the share of individuals who have owned crypto-assets at some point but no longer hold them is 11%. Altogether, approximately 13 million Italians either hold, have held, or are interested in holding crypto-assets.

The Observatory’s research warns that Italy risks falling behind other European countries. Companies remain hesitant to invest, and many promising blockchain startups are opting for more supportive environments abroad. The findings call for greater collaboration among regulators, industry leaders, and citizens to create an ecosystem conducive to innovation.

Looking ahead: 2025 and beyond

The Observatory’s research predicts that 2025 will extend the trends observed in 2024, with a gradual increase in investments and the continued maturation of the blockchain infrastructure supporting Web3 services. Identifying use cases that offer tangible value and open up new market opportunities will be crucial to driving growth. Early adopters stand to benefit significantly, while those who delay may find it hard to catch up.

About the Blockchain & Web3 Observatory

The Blockchain & Web3 Observatory is one of the Digital Innovation Observatories of the POLIMI School of Management and is part of the Web3Hub, a center of excellence for blockchain and Web3 technologies established in 2017 at Politecnico di Milano, one of the world’s leading technical universities. By combining research and practical application, Web3Hub fosters a robust network of companies, public institutions, and startups in Italy and abroad, supporting the development of cutting-edge decentralized solutions. For more information, visit www.web3.polimi.it.