Berachain is a high-performance EVM-compatible blockchain built on Proof-of-Liquidity consensus

Berachain是一个开发中的与 EVM 兼容的区块链,利用其独特的“流动性证明”共识,允许用户使用 Berachain 验证器质押第 1 层、蓝筹 DeFi 和稳定币资产。它源于Bong Bears NFT社区的一个想法,它是使用 Cosmos-SDK 构建的。

该链围绕由 $BERA、$BGT 和 $HONEY 组成的三通证结构运行。目前还没有官方文档或公共测试网,但涌向 Berachain 的新用户和协议数量正在迅速增长。

最近cosmos系公链不少,比如gnoland、Celestia、canto、sei……

代币模型: | $BERA - Gas token| $HONEY - 稳定币| $BGT - 治理代币

Berachain 具有由 $BERA、$BGT 和 $HONEY 组成的三通证结构。供应和其他代币经济学细节尚未公布,随着主网的临近,将变得更加清晰。

质押者获得 $BERA 奖励,用于支付网络上的汽油费。它以 10% 的年通货膨胀率铸造,所有用于 gas 的 $BERA 都被烧毁。持有 $BERA 的人也将获得 $BGT 代币。质押 $BERA 是获得 $BGT 的唯一途径。

$BGT 是不可转让的 ERC-721,持有者对费用、符合共识的代币等参数进行投票。它就像质押的 $BERA 的收据,因此您在解除质押时“兑换”了 $BGT。$BGT 持有者从 DEX swaps、$HONEY 利率、perps 的资金利率、清算费用等中赚取费用,所有这些费用都以 $HONEY 支付。

$HONEY 是与美元挂钩的稳定币,可与 Berachain 质押的资产一起铸造。它被冠以生态系统的“基础层”,充当所有 DEX 交易的中介,是原生生态系统的稳定交换媒介,并用于支付永久资产的资金费率。它是 Berachain 资本效率的支柱。

$HONEY 挂钩通过多种方法在算法上进行维护,包括受控利率、控制滑点和某些货币对费用的 $HONEY AMO、不断需要支付资金费率等费用,并且是超额抵押的。

@CrocSwap 原生DEX

@SynapseProtocol 跨链桥

berachain 上早期项目

@redactedcartel 会在berachain上推出分叉项目 Hidden Hand

@GumBallProtocol defi+nft聚合中心

@dammfinance 创新的借贷协议

@BongBearsNFT NFT市场

@abacus_wtf NFT领域的CRV/CVX

以上内容来自📜📌

1/ What do you get when you combine a decentralized stablecoin, a native dex and perps platform, and bears smoking bongs? A capital-efficient, cosmos EVM chain with the deepest liquidity pools making it a purpose-built layer-one chain for Defi. A thread on @berachain;

2/ Turns out "berachain isn't real" was psyops all along and devs have been doing smth. I know what you're thinking: "Not another meme coin copy pasta EVM chain! After reading this thread, you'll learn why Berachain is unlike any L1 that we've seen so far.

3/ The thread will be separated into the following parts:

| The problem solves

| Proof of liquidity

| The chain's tri - token system

| Dex & Perps Let's get started

4/ ----- | The problem solves -----

There's an L1 liquidity epidemic right now. Rotatooors bridge funds to a new L1 chain for 1-2 weeks, farm shitcoins then exit when the fun is over. The chain's userbase dries up and the projects built on the chain end up dead. Boba

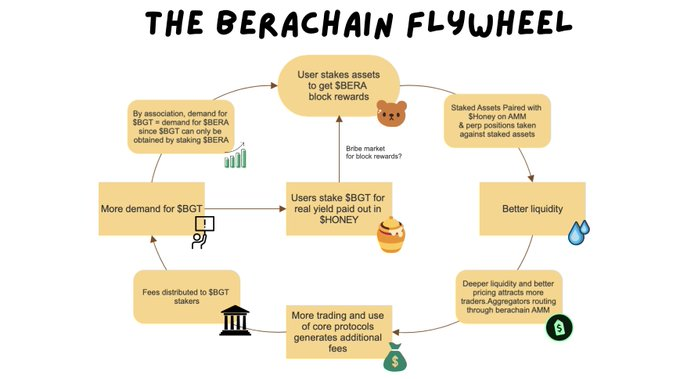

5/ Berachain fixes this. The whole chain was designed from the ground up to align incentives and make capital more productive so there is less of a reason for users to leave the chain. The magic ingredient to all this is proof of liquidity - dPOS with a twist.

6/ -------| Proof of liquidity -------

Unlike standard dPOS consensus, there's the option to stake multiple assets (BERA, ETH, BTC, Stablecoins etc. to a validator. All the while, those staked assets are being used to provide liquidity on the chain's native virtualized AMM.

7/ So to recap...

-

User stakes assets to secure the network eg. ETH (Single sided liquidity provision)

-

ETH LP'd with $honey on virtualized AMM

Outcomes:

-

User stake secures the network

-

More capital efficiency

-

User gets $BERA block rewards

-

ETH is more liquid

8/ The team has confirmed that at the start, the weighting of the block rewards will be directed towards the major L1 tokens. However, over time the chain may be secured by existing or new defi protocols tokens on

9/ This opens up the possibility of using gauges to determine the weighting of block rewards for specific assets. Gauges but on a chain level Add in @redactedcartel's hidden hand for bribes and imagine the smell.

10/ Let me emphasize how BIG OF A DEAL this is for projects building on @berachain. This would mean protocols aren't just building on the chain, they're actually a part of it. Not to mention, the benefits that come with having your token secure the berachain network

11/ Liquidity as a service: Tokens securing the network get their liquidity bootstrapped by being paired with $honey in the berachain native AMM. An additional source of utility and yield for users: Earn $BERA block rewards from tokens that otherwise wouldn't generate much yield

12/ Here's a list of projects that are already rumored to be building on @berachain

@redactedcartel, @templedao, @OlympusDAO, @SynapseProtocol,@GumBallProtocol, @Bond_Protocol, @fiatdao, @abacus_wtf, @guzzolene_wtf, @dammfinance, @ParagonsDAO,@CrocSwap

13/ Some native berachain projects...

@berasinocom,@honeypotfinance,@BeraCreek,@BeraBetsGG,@artio_finance

I also heard a rumor that there's a group sponsoring a berachain hackathon.

14/ ---- The chain's tri-token system----

| $BERA - The Gas Token

| $HONEY - The Stablecoin

| $BGT - The Governance Token

$BERA is pretty self-explanatory but $HONEY and $BGT deserve a short explanation.

15/ $HONEY is the chain's native stablecoin. $HONEY is money as the beras say. Why? | Strong PSM: CDPs, Perp Funding Rates, AMOs | Decentralized: Not largely backed by centralized assets | Liquid: Each asset trades through $honey on berachain AMM

16/ BGT - Bera Governance Token 📜

Any profit that the chain generates is distributed to $BGT stakers in the form of $HONEY.

-

Swaps

-

$Honey loan interest

-

Perp funding rates

Yield generation from an entire L1 chain takes the real yield narrative to a whole new level 👀

17/ But no no no $BGT won't be something you can buy. In fact, it's a nontransferrable NFT reserved for long-term aligned users. The only way to get $BGT is to stake your $BERA. $BGT holders will also have a say in determining new stakable assets and directing $BERA emissions.

18/ Why have a token just for governance you ask? Problems arise when you associate governance with token price. $BGT is a "time in vs. timing" kind of token and is earned only by people contributing to the network. The $HONEY rewards also incentivize participation in governance

19/ ------| Dex & Perps------- Okay, so it's the day of the

@berachain mainnet launch (estimated 3 months - @itsdevbear) and you bridge over using some of the best bridging infrastructure out there -@SynapseProtocol

. What can you do on Day 1?

20/ From the get-go you'll be able to transact on their native dex and perpetual exchange! Just so we're clear, this isn't your ordinary AMM and Perpetuals exchange. They are integrated into the chain itself, not just built on top of it. More on this below.

21/ | The Dex Berachain's native dex will leverage the tech built by @CrocSwap to offer a familiar but much more advanced AMM engine to enhance liquidity, get better pricing, reduce slippage, and lower transaction costs.

22/ Some key points about @CrocSwap 's AMM tech and how it's integrated with @berachain

-

Ambient and concentrated liquidity in the same pool

-

One-sided pools: Staked assets securing the network are paired with $honey

-

Single contract architecture

-

Dynamic pricing control

23/ | Perpetual exchange When users stake an asset to a validator they are then able to mint $HONEY as a loan to trade spot or take leverage positions on the native perpetual exchange. All funding rates are paid $Honey which acts as a secondary peg mechanic.

24/ I want to reiterate the WHY for these core products: They reduce the likelihood of users removing their staked capital because users can do everything they need on the chain while continuously securing the network. The goal is to align incentives at the fundamental level...

25/ so that the network is set up for longevity and sustainability. A Dex and Perp exchange that is composable with staked assets that secure the chain is good for long-term growth, means less mercenary capital, and less of a reason to bridge off.

26/ To conclude this thread I'll leave you with a nice infographic of the Berachain flywheel that will be put into motion when the chain launches. Pretty much everything that was just talked about is summed up in the photo. Will proof of liquidity be the next meta?