In order to understand what this entire article is about, first we need to unravel what exactly MEV is and the problems it caused on the network before Jito's solution entered the picture.

The story of MEV begins on Ethereum as "Mining Extractable Value" where an astute observer noticed a pattern: miners could extract additional value by strategically ordering transactions within the blocks they produced, where those practices can be exploited for huge opportunities. The term "Miner Extractable Value" eventually evolved into "Maximal Extractable Value," reflecting its relevance beyond mining to all forms of block production across different consensus mechanisms. On Solana, MEV are differ than others, one of the differences is the Solana architecture, which doesn't utilize traditional mempools like Ethereum. Instead, Solana employs transactions, where they are forwarded to the current block leader through Solana's Turbine propagation protocol and processed continuously. This continuous block production with very low latency are likely reduces the certain type of MEV, as third-party or attackers have less time to observe due to long public pending queue transaction.

With time constantly spinning, MEV became significant problem on Solana, just with different symptoms. Instead of open mempool sniping like on Ethereum, with Solana’s extremely low fees, MEV searchers would spam the network with transactions to try to be the first to capture an opportunity, led to network congestion and caused headaches for network stability. Here are some common MEV transaction types that exist on Solana:

-

NFT Minting: This MEV occurs when participants attempt to acquire rare or valuable NFTs during public minting events.

-

Liquidation: The borrowers could get liquidated for failing to maintain the collateralization ratio in their loan agreements. So, MEV searchers monitor and seize rewards by liquidating undercollateralized loan positions.

-

Arbitrage: Simultaneously taking advantages by buying and selling of crypto assets to profit from price differences for the same asset on different markets or platforms.

-

Sandwich Attack: An arbitrage strategy in DeFi where an attacker front-runs a victim's trade to inflate the price, lets the victim buy at the higher price, then back-runs by selling for profit.

MEV attack can impact like everything from transaction costs to validator economics, from market efficiency to decentralized network. Rather than viewing MEV as an opportunity for profit or a problem that must be eliminated, Jito see it as a fundamental economic of blockchain that must be understood and managed, in ways that benefit the entire Solana ecosystem.

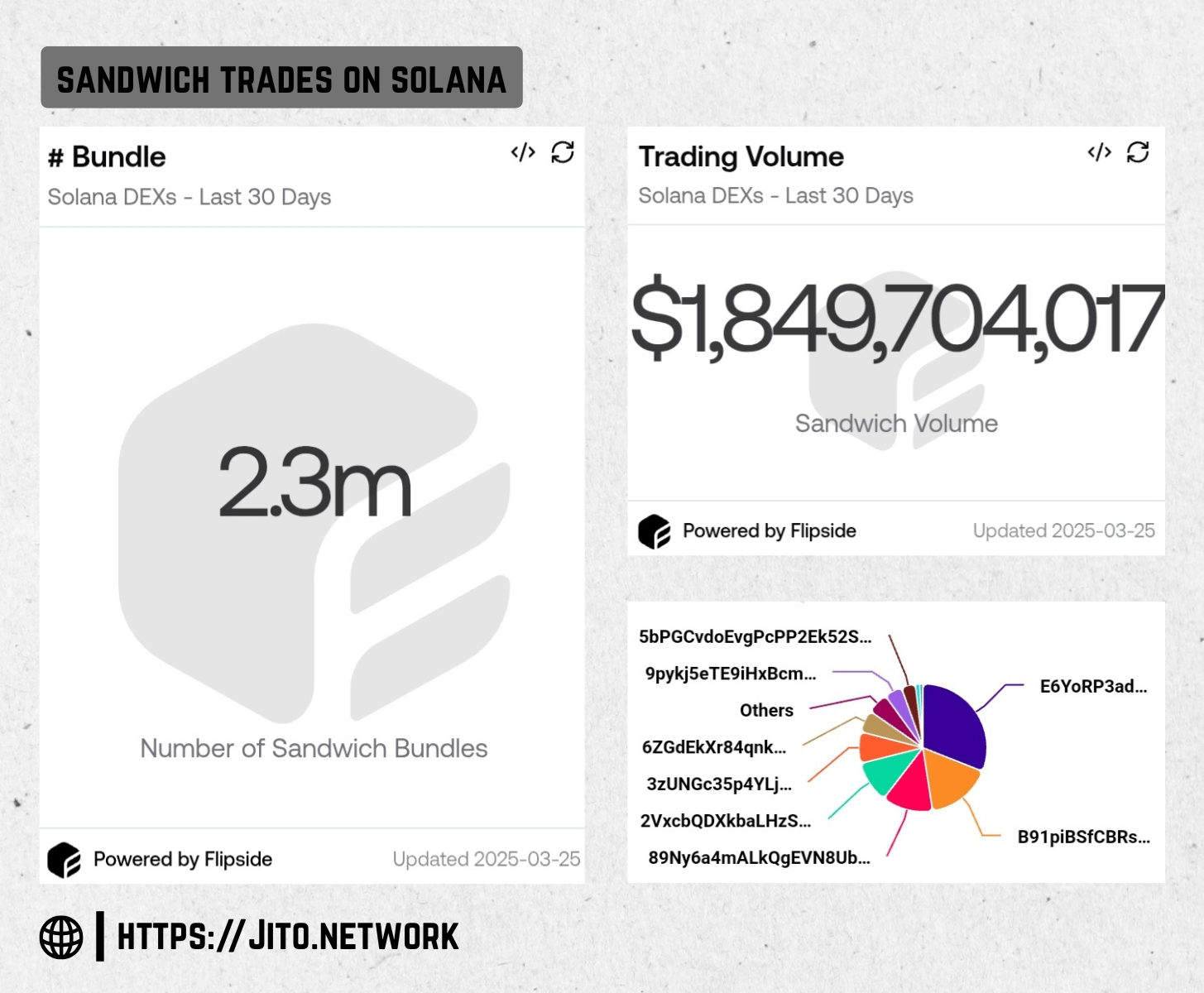

As activity on the Solana network surged, MEV profits also increased. According to Flipside, $1.8 billion in sandwich trade volume has been captured on Solana over the past 30 days, with one bot alone accounting for 31% of all sandwich volume, conducted through more than 3.9 million bundles.

MEV attack can impact like everything from transaction costs to validator economics, from market volatility to network decentralization. Rather than viewing MEV as an opportunity for third-party profit or a threat that must be eliminated, Jito views it as a fundamental part of blockchain economics, like something that must be understood and managed to benefit the entire Solana ecosystem. Simply put:

-

MEV on Solana is not going away,

-

Not all MEVs are bad, and

-

MEV is big business!

In this article, I'll break down the Jito approach to solve MEV problem with a mission to democratize and ethically optimize value extraction across Solana blockchain networks.

What Is Jito?

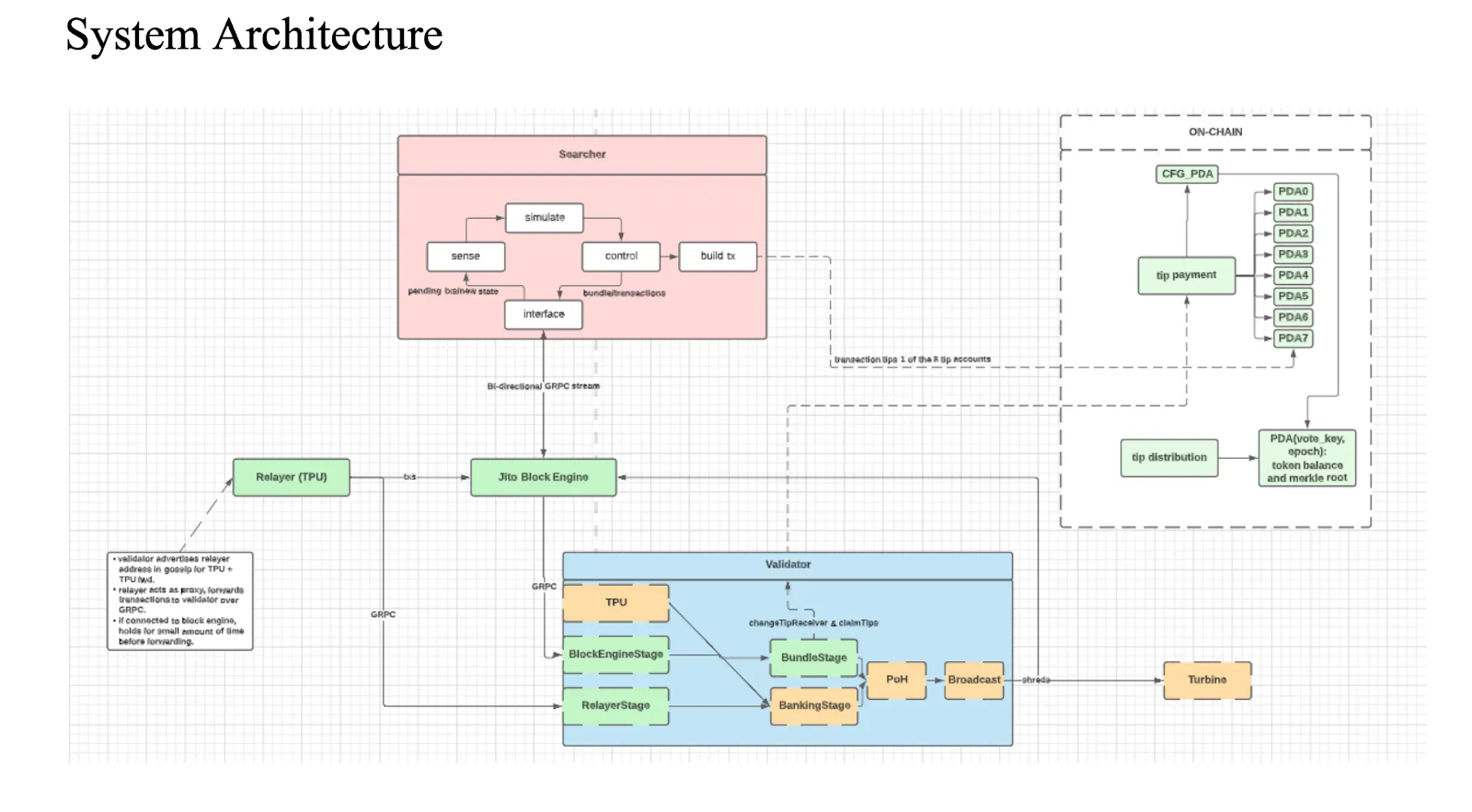

Jito is a modified-protocol Solana client built on Solana validator with additional off-chain components (Relayer and Block Engine) and on-chain programs (Tip Payment and Tip Distribution) that enables more efficient, profitable, and equitable MEV value capture, while redistributing those earnings to validators, and stakers.

As I said earlier, Jito redistributes value that can be extracted from MEV to the Solana ecosystem. To implement this, one of the important components needed is Jito Tips, which is responsible for storing and handling MEV tips. This component ensures searchers (specialized programs that identify MEV opportunities on-chain) are incentivized to submit profitable MEV bundles (grouped transactions that execute atomically), while the Jito ecosystem like stakers and validators are fairly compensated for their contributions. I'm gonna focused on Jito Tips, examining their current composition across various platforms, their evolution over time, and how market conditions influence their usage.

Compositions of Jito Tips

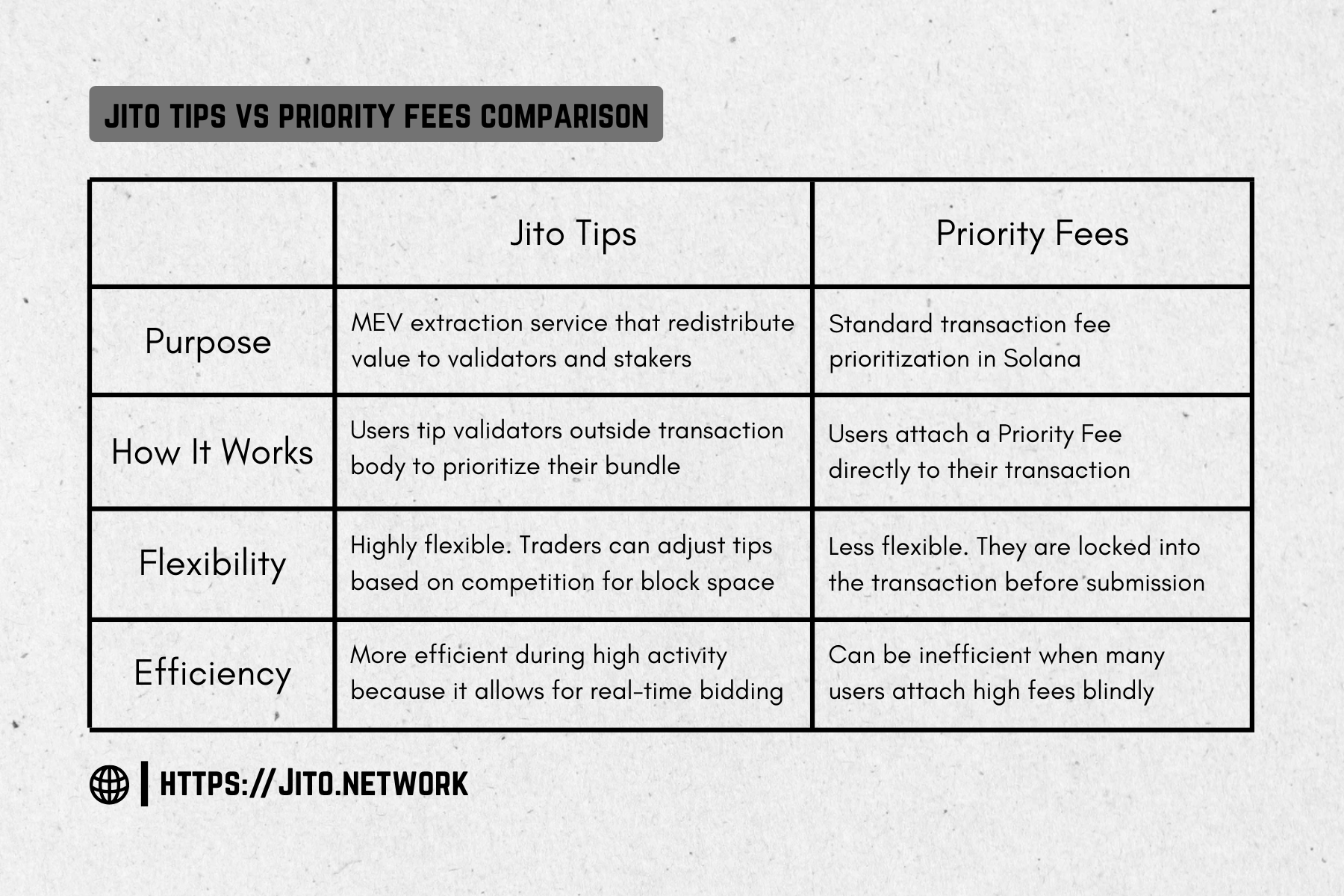

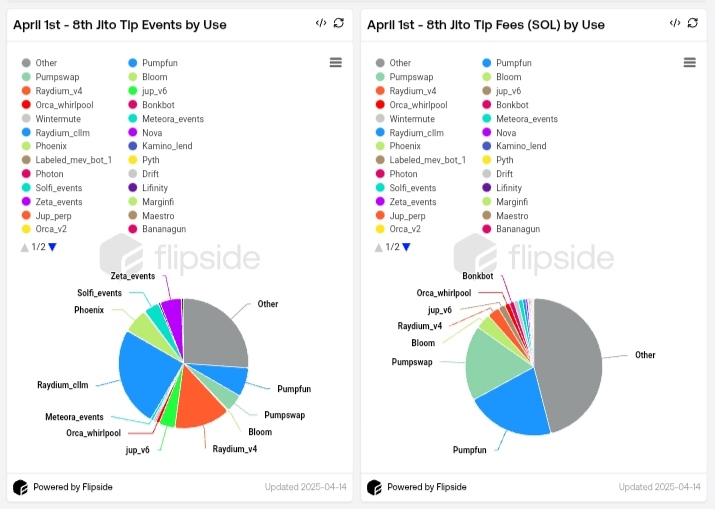

In Solana, we already know about "priority fees," which are mechanisms that allow users to pay extra to have their transactions processed faster. However, Jito Tips work differently. Jito Tips are designed specifically for MEV (Maximal Extractable Value) extraction, allowing searchers to pay an extra tip for transaction priority, while Priority Fees are Solana's native mechanism where users simply set higher fees for faster processing. I have summarized insights from several trusted sources, such as the Pine Analytics dashboard on Flipside, which discusses the composition of Jito Tips based on Solana-based protocols, according both statistics "Jito Tip Events" and "Jito Tip Fees" recorded so far in 2025.

-

Jito Tip Events: Statistics of tip transactions that interacted with Solana-based protocols.

-

Jito Tip Fees: Statistics of the total SOL tipped to Jito across various Solana-based protocols.

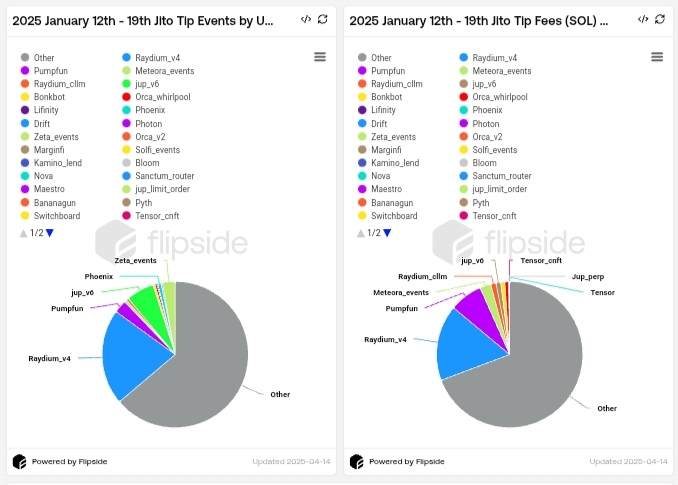

January 12th - 19th, 2025

Raydium accounted for the largest share of tip events and also made a significant contribution to tip fees. Meteora and Pumpfun also contributed a huge amount of fees. Interestingly, protocols such as Tensor and Jupiter appeared in the fee chart despite not being very prominent in the number of events, indicating that each of their transactions provided a larger tip on average.

April 1st - 8th, 2025

Raydium remained consistent in both events and fees. Meanwhile, Pumpfun surged to the top by generating a large amount of SOL tip fees, although the number of events was not as high as Raydium. Pumpswap also contributed significantly to the total SOL tipped, even though the number of events was relatively low, meaning that Pumpswap event carried a large tip on average. Many unclassified (other) MEV activities, as well as several protocols such as Orca, Phoenix, Zeta Markets, Meteora, and Jupiter, contributed to both tip fees and events.

Has They Evolve?

Based on both diagram above on Jito tips compositions, Jito Tips shows the interpretation of the composition of Jito Tips that is constantly changing, from where Raydium originally dominated in January, to being more diversified with the surge of activity from Pumpfun and Pumpswap in April showing that the MEV dynamics in Solana are becoming more competitive. Here are the reason:

1. Tip Volume Follows PvP Activity

The surge in volume on Pumpfun and Pumpswap, which shifted the dominance away from Raydium, indicates a structural shift. The massive trading volume of memecoins launched from Pumpfun is being traded and routed to Pumpswap, prompting MEV searchers adapt quickly, redirecting their strategies and tipping behaviors to new areas of opportunity.

2. Tip Composition Becomes More Diverse

The increasing diversity of protocols contributing to Jito Tips, such as Orca, Phoenix, Zeta Markets, and Jupiter, indicates a broader adoption of tipping strategies beyond just DEXs. This shows that Jito Tips are now also being applied to on-chain orderbook, default frontends, market making, and hedging strategies.

Volatility Has Little Impact on Jito Tips

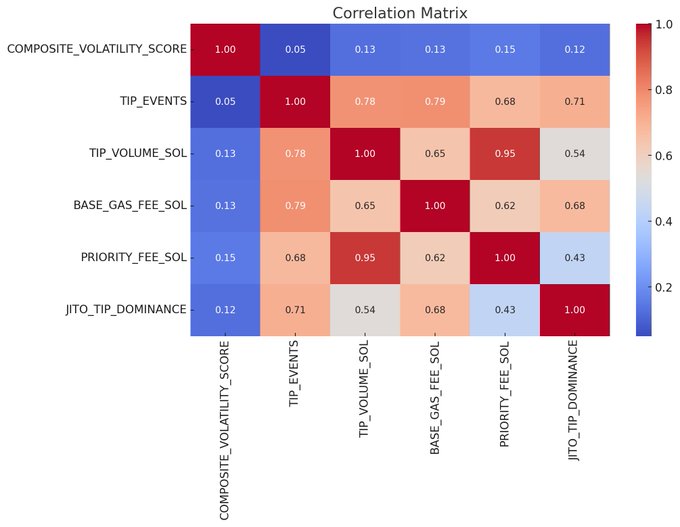

To advance reader understanding, the following is the Correlation Matrix by PineAnalytics:

From the correlation matrix above, it is clear that market volatility, represented by the Composite Volatility Score, has little direct influence on Jito Tips metrics. The correlation between volatility and key metrics such as Tip Events, Tip Volume in SOL, Base Gas Fee, and Priority Fee are all very low, around 0.05 to 0.15. This shows that Jito Tips is driven more by PvP transaction rather than by market fluctuations.

Do Retail and Professional Traders Often Use Tips?

In general, they are the primary users of tipping mechanisms like Jito Tips. They leverage tips strategically to:

-

Increase the chances their transactions are included faster.

-

Optimize their position in block ordering, especially for arbitrage, liquidations, or sniping.

-

Secure competitive advantages in high-frequency PvP environments.

To support this claim, I’ve summarized several Solana-based protocols whose user bases are the main contributors to Jito Tips. Interestingly, many of these users may not even realize they are using Jito Tips.

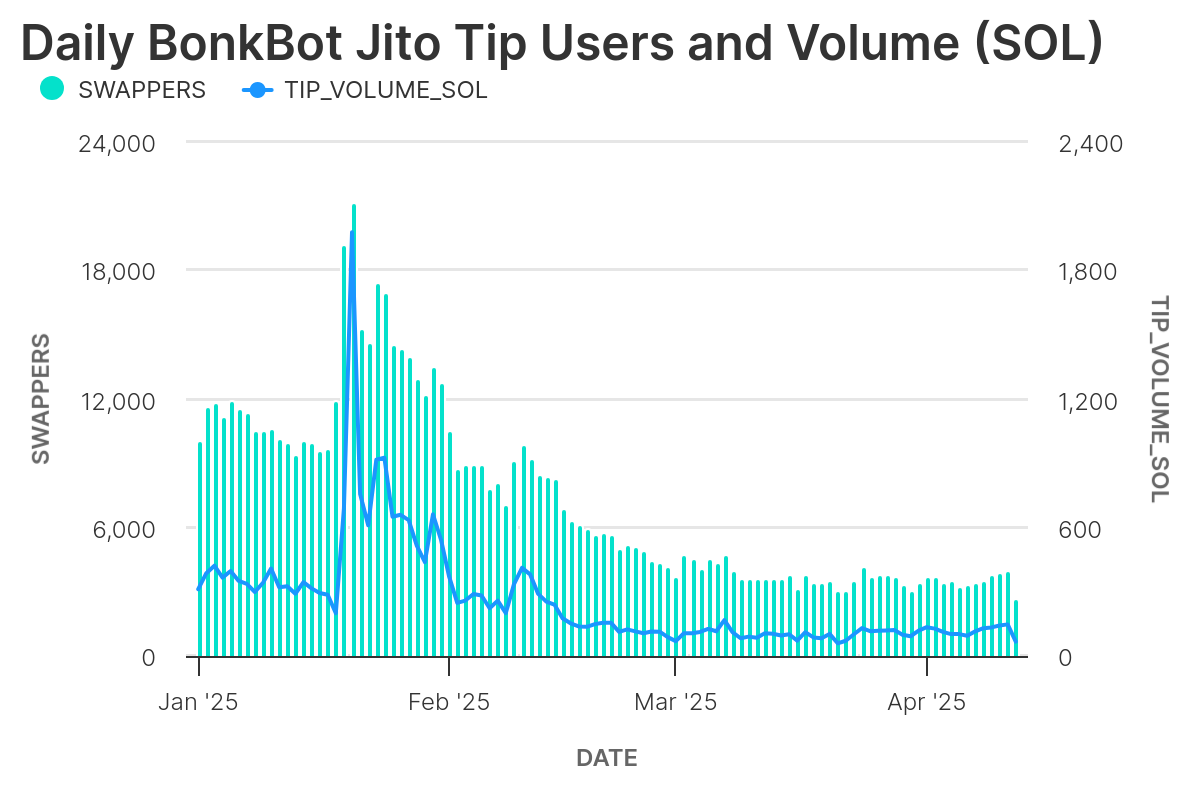

1. Bonkbot Telegram Bot

Retail users interact using Telegram bots like Bonkbot to trade memecoins, where they leverage Bonkbot to avoid sandwich attacks. Based on the chart above from Flipside, there are around 2,000–5,000 swappers per day, contributing approximately 60–200 SOL per day in tips.

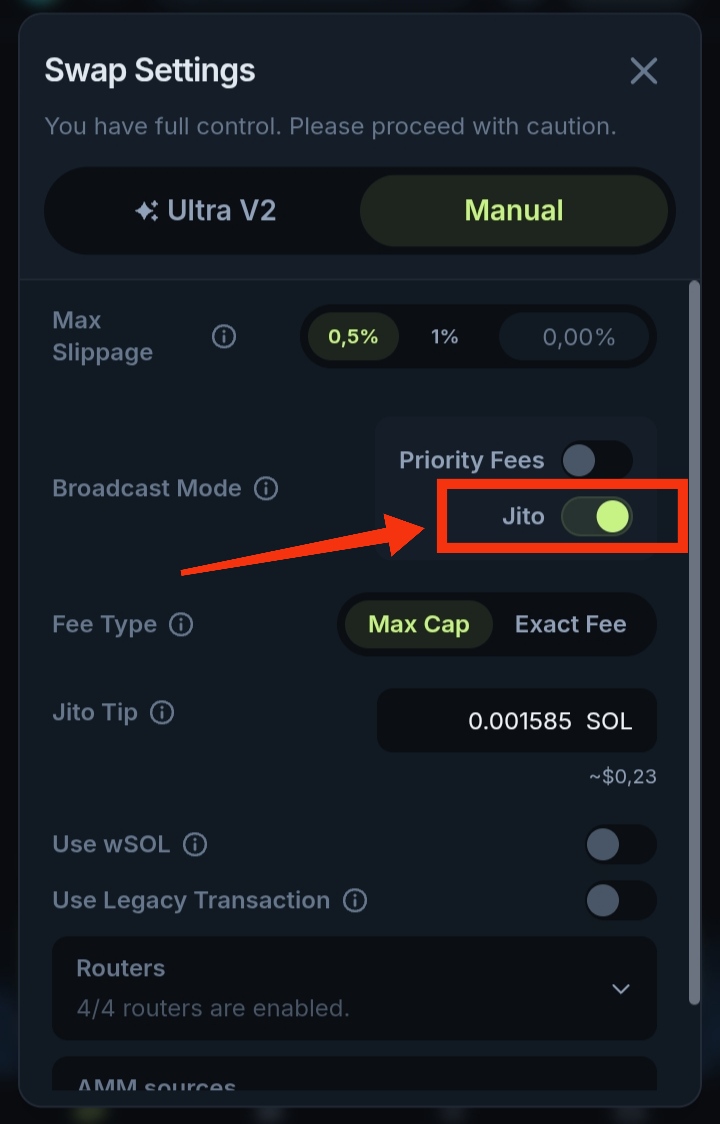

2. Frontend Default Jito Tips

On platforms like Jupiter Exchange and Raydium we are often unaware of the use of Jito Tips. Platforms like Jupiter Exchange integrate Jito Tips by default in the interface, making it easier for users to get benefits such as faster inclusion. They contribute to and maintain the steady use of Jito, although their individual impact is minimal.

3. Orderbook and Perp

Users interacting on on-chain orderbook platforms (e.g., Phoenix) and perpetuals platforms (e.g., Drift) use Jito Tips for optimal execution and active position management. This group contributes significant Jito Tips transactions, around 10% in total.

Largest Jito Tip Transactions

Here are some examples of high-value transactions where significant Jito Tips were used.

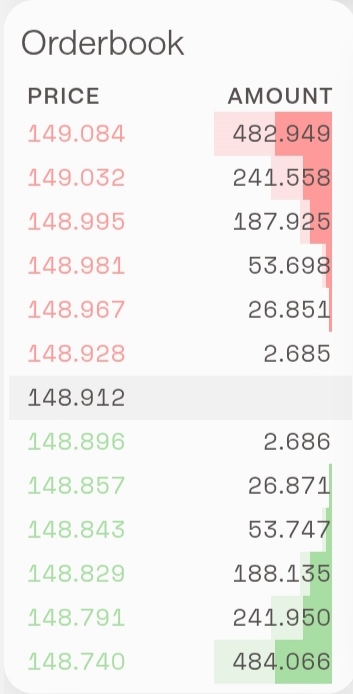

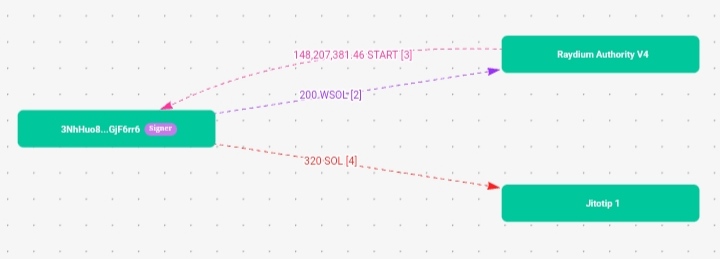

1. Wallet 3NhHuo8...GjFfr6

A clear example of Jito Tip usage can be seen in the activity of wallet 3NhHuo8...GjFfr6. This wallet purchased 148 million START tokens worth 200 WSOL on Raydium. Alongside this transaction, it also sent a 320 SOL tip to the Jitotip 1 address.

2. Wallet qqqSqs9F...K9CBuc

Another case is wallet qqqSqs9F...K9CBuc, which swapped 500 WSOL for 178 million BLUEY tokens on Raydium. Interestingly, this wallet also sent a 505 SOL tip to the Jitotip 1 address.

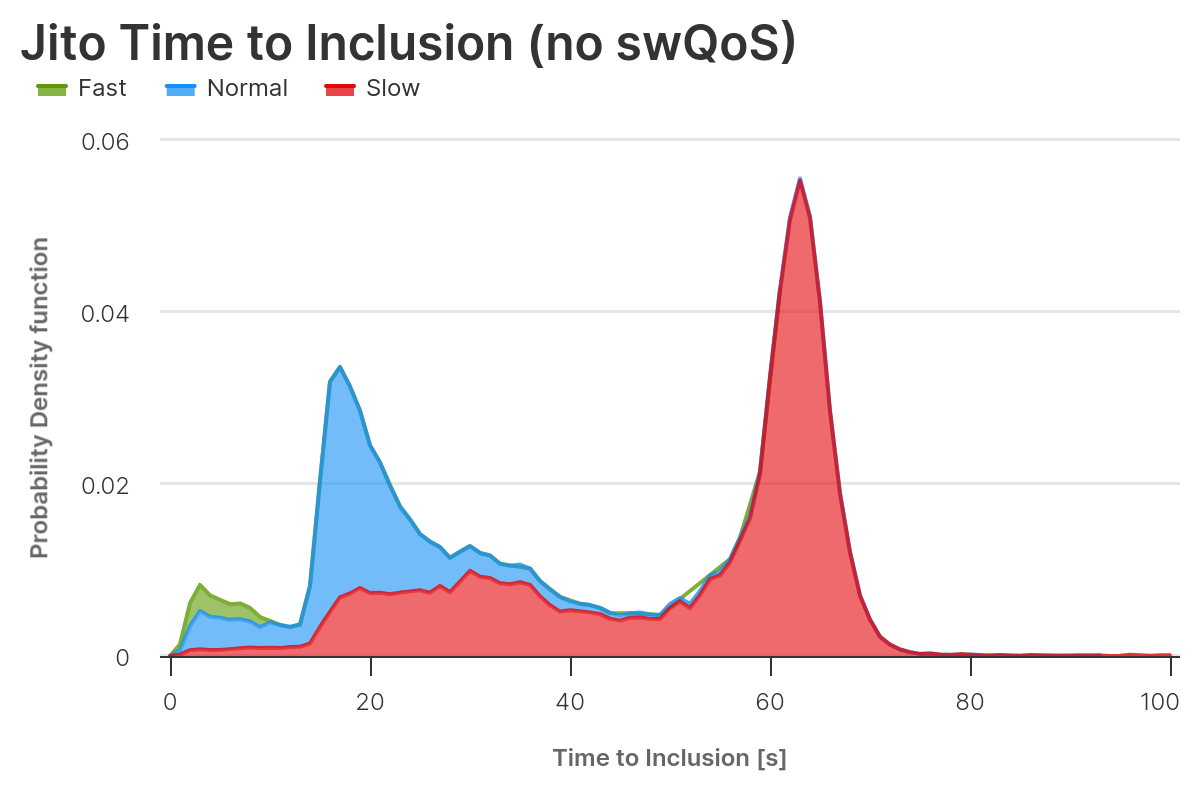

What Are The Areas That End-Users are Focused On (Time or Price?)

According to Chorus data, many Jito users send tips as separate transactions from their main transactions. In this case, the inclusion time for the entire bundle is determined by when the tip came in, not when the main transaction was sent. The majority of Jito users are likely not latency-sensitive traders such as arbitrage or sniping bots, but rather simply want to ensure their transactions are processed with relative priority. In short, many Jito users are aware that the effect of tipping on speed is not linear or direct, so they choose to optimize cost rather than speed. That is why we see the majority of Jito Tips transactions to be in the “slow” category, although still paying tips.

Conclusion

In short, MEV on Solana is growing fast, and Jito is helping make it more fair and efficient for everyone involved. Instead of treating MEV like a problem, Jito turns it into a system where validators, stakers, and even Solana users can benefit. With Jito Tips, it’s easier to redistribute the value from MEV without causing network's problem. Jito is building the tools and systems that can support this growth and make sure MEV works better for the whole Solana ecosystem.

Metrics and images sources in this article:

1. Statistics of sandwich trades on Solana: https://flipsidecrypto.xyz/Ario/sandwich-trades-on-solana-sxAEgG

2. Jito architecture infographic on “What Is Jito”: https://www.eclipse.xyz/articles/how-jito-works--on-solana-deep-dive

3. Metrics for "Compositions of Jito Tips": https://flipsidecrypto.xyz/pine/jito-tip-metrics-UJOW_T

4. Correlation metrics for " Volatility Has Little Impact on Jito Tips": https://x.com/PineAnalytics/status/1911835872808649121

5. Bonkbot metrics for "Bonkbot Telegram Bot": https://flipsidecrypto.xyz/pine/q/cPDPRkSnP8oQ/bonkbot-tip-metrics/visualizations/cbdea88c-3a7c-44bc-80e8-b0c3e6c34aca

6. Screenshot of Jupiter dApp for “Frontend Default Jito Tips”: https://jup.ag/swap

7. Screenshot of Phoenix dApp for "Orderbook and Perp": https://phoenix.trade

8. Solscan link sources for " Largest Jito Tip Transactions":

9. Chorus' data on "What Are The Areas That End-Users are Focused On (Time or Price?): https://chorus.one/reports-research/transaction-latency-on-solana-do-swqos-priority-fees-and-jito-tips-make-your-transactions-land-faster