This article was first published in Chinese in March 2021. See here for more details.

In one year, Bitcoin’s price has surged from below $10,000 to $60,000, and now it's hovering below $60,000, with signs of breaking through $60,000 again.

But if you take Bitcoin’s price seriously, you’ve been fooled. Bitcoin’s price, like that of other cryptocurrencies, is the result of manipulation.

Are you worried I might be too bold or presumptuous by saying this? Don’t worry. Let’s first look at how the big bull market of 2013 was “successfully” manipulated.

Firstly, you’ll see a historic image that’s etched into Bitcoin’s history.

1/5 The Strange Trading Screenshot

The following image is from the BitcoinWisdom website, timestamped January 7, 2014, at 1:37 AM Eastern Time. The screenshot shows real-time trading data from a cryptocurrency exchange called Mt. Gox.

At first glance, the image doesn’t seem much different from typical trading data. However, I mentioned earlier that this screenshot is part of Bitcoin’s historical development. Technical experts used this image to confirm that Mt. Gox manipulated Bitcoin’s price.

The screenshot is from January 7, 2014, at 1:02 AM. According to Mt. Gox’s announcement, their “trading API” was offline at that time, meaning no transactions should have occurred. An API, or Application Programming Interface, allows different software applications to communicate. Without the trading API, all trading should have stopped.

At approximately 1:02 AM EST on January 7, 2014, the Gox trading API went offline for everyone in the world...

However, something magical happened. Mt. Gox’s trading platform remained quiet for seven minutes after 1:02 AM but then resumed trading. If you look closely, there are four transactions listed in the image’s middle-right section. The next image is zoomed in to show these transactions clearly, marked by a red box.

There are four records. The three columns represent time, transaction price, and the amount of Bitcoin purchased, respectively.

01:37:54 bought 15.9373 BTC at $1035

01:23:19 bought 17.4971 BTC at $1030

01:16:32 bought 18.9182 BTC at $1030

01:09:03 bought 11.2174 BTC at $1030

User paleh0rse noted in a post that every 6 to 20 minutes, there would be transactions involving 10 to 19 Bitcoins over the next 90 minutes. Paleh0rse also pointed out that the transaction prices were green, indicating active buying.

However, as mentioned earlier, Mt. Gox’s API was offline at the time, making it impossible for external parties to trade. If there were any trades, they could only occur on Mt. Gox’s servers. So, who was this mysterious buyer?

Paleh0rse whimsically named this mysterious buyer “Willy,” inspired by the 1993 American film “Free Willy.” The film is touching and successful, with a budget of $20 million and a box office of $150 million, over seven times its budget.

“Free Willy” tells the story of a boy and an orca named Willy. In the film, the boy rescues Willy and releases him back into the ocean. Paleh0rse named this mysterious buyer “Willy” in hopes that he would be like the orca that comes back to save everyone. On January 7, 2013, Bitcoin’s price dropped to $880.

This bot now has a name. Henceforth, we shall call him "Willy" -- the whale that we once set free has returned to free us all from the annoying whale dumpers and bears. :)

Mt. Gox, the world’s largest cryptocurrency exchange at the time, frequently experienced issues like outages, trading delays, and withdrawal suspensions. People coined the term “goxed” from Mt. Gox’s name to describe the frustrating trading experience.

So, was Willy a heroic “vigilante” or a greedy “bandit”?

2/5 Who is Willy?

One person might know Willy’s true identity: Mark Karpeles, the CEO of Mt. Gox.

The photo above shows Karpeles bowing in apology on February 28, 2014. On that day, Mt. Gox filed for bankruptcy protection with the Tokyo District Court, just a month after Paleh0rse discovered Willy.

Mt. Gox claimed insolvency, with liabilities of 6.5 billion yen (about $65 million at the time) and assets of only 3.84 billion yen. They blamed “a weakness in our system,” which resulted in hackers stealing 850,000 Bitcoins.

Investors didn’t believe Karpeles’ explanation. Nor would he reveal Willy’s true identity.

Mt. Gox had 127,000 creditors, only about 1,000 of whom were in Japan. Upon hearing the news of Mt. Gox’s bankruptcy, many people traveled to Japan from around the world.

A user from London, Kolin Burges, told The New York Times that he was prepared for the worst but found it hard to believe Mt. Gox had lost the Bitcoins. (I was prepared for the worst, but it’s hard to believe they might have lost their coins.)

Indeed, Kolin was right to be skeptical. On March 7, 2013, a week after filing for bankruptcy, Mt. Gox announced on their website that they had found nearly 200,000 Bitcoins in an old wallet. Thus, the number of Bitcoins allegedly stolen by hackers decreased from 850,000 to 650,000.

For Mt. Gox, hackers and “temporary workers” were scapegoats readily available to take the blame. But this time, the hackers didn’t want to take the fall anymore. They might have even thought some of the Bitcoins in the “pot” belonged to them.

On March 9, 2014, hackers took real action. They hacked Karpeles’ Reddit account and published a lengthy post exposing Mt. Gox’s misdeeds.

Lastly, the hackers added a phrase that I’ve loosely translated as “enough is enough”:

It's time that MTGOX got the bitcoin community's wrath instead of [the] Bitcoin Community getting Goxed.

Key files from Mt. Gox’s 750M internal documents were uploaded to Karpeles’ personal website. Here’s the download link, but don’t run any executable files—it might be malware.

Among these internal files, a file named “trades_summary” caught users’ attention. This file detailed the available balances of various currencies at Mt. Gox, including Bitcoins.

The hacker added a note next to the 950,000 BTC balance: “That fat fuck is been lying!!”

People found that the files contained internal trading records from Mt. Gox, covering the period from April 2011 to November 30, 2013, including November 27, when Bitcoin’s price first exceeded $1,000.

This was a once-in-a-lifetime opportunity, with a bull market and data. Bitcoin’s world never lacks data analysis experts. This confluence of factors explains why I dared to use the title “Don’t Take Bitcoin’s ‘Price’ Seriously.”

Of course, Willy’s true identity soon emerged.

3/5 Willy is a Group of People

Willy wasn’t a person but a group of people, specifically 49 accounts.

This conclusion comes from the most widely circulated analysis report on these trading records: “The Willy Report: Proof of Massive Fraudulent Trading Activity at Mt. Gox, and How It Has Affected the Price of Bitcoin.”

These 49 accounts were identified as belonging to Willy because they had two fields with identical values, both marked as “??” instead of specific values. These fields were “User_Country” and “User_State,” which should normally contain country and region codes (e.g., US for the United States, CA for California).

More importantly, these accounts exhibited consistent behavior: they only bought, never sold, and always purchased 10 to 20 Bitcoins every 5 to 10 minutes, without interruption, until the end of January 2014.

Basically, a random number between 10 and 20 bitcoin would be bought every 5-10 minutes, non-stop, for at least a month on end until the end of January.

It was this non-stop activity that led paleh0rse to discover Willy’s presence. Paleh0rse never expected Willy to be 49 accounts. However, this made sense, as these 49 accounts worked seamlessly together.

These 49 accounts acted like a “Bitcoin sweeping team,” but unlike a real estate group buying mode, they adopted a solo approach. Starting at 1:41 PM on September 27, 2013, each account aimed to buy Bitcoins with $2.5 million (or less), one after another. Although the records only go until November 30, 2013, subsequent sweeping activities were meticulously documented by vigilant users like paleh0rse.

This Willy “sweeping team” bought a total of 270,000 Bitcoins. However, before

Willy, there was an even more powerful entity named Markus.

4/5 Markus’ Buying Spree

Markus was another trading bot at Mt. Gox, active from February 14, 2013, to September 27, 2013. In just 33 days over 225 days, Markus bought 300,000 Bitcoins, more than Willy’s total.

Markus was discovered due to the following trading records.

Looking at the red box, the top four lines represent two transactions (each transaction includes two records: a buy and a sell), which seem normal. However, from the fifth line onwards, the “Money” value remains unchanged at “15.13163,” regardless of the amount of Bitcoins purchased. This value isn’t magical; it comes from the second transaction, the third and fourth records.

If you look closely at the “User_Id,” you’ll notice that the buyer’s ID is always the same—698630. This is Markus’ true identity.

The left side of the image shows the price in yen, with the site’s exchange rate at 1 USD = 93 yen. Green represents buying Bitcoins, and purple represents selling Bitcoins for USD. The size of the colored areas indicates the transaction amount.

Any arbitrary transaction amount will result in different prices, and the image above shows Markus trading at various prices daily, as if he were a god. Markus was indeed “divine” as he could buy Bitcoins without spending a cent.

As for the transaction amount, it was simply copied from the previous transaction, just like you saw earlier, where all transaction amounts were “15.13163.”

You may have noticed two purple circles in the image, representing Markus selling Bitcoins. In my previous article, “Leaked Data Tells You Why Bitcoin Should Avoid Leverage Trading,” I analyzed the largest purple circle. It represents transactions between 8 AM and 10 AM on June 2, 2013, where Markus created a V-shaped price movement by selling and then buying Bitcoins. I used this example to warn people to avoid leverage trading with Bitcoin, as its price is easily manipulated, leading to potential liquidation.

The Willy Report summarizes Markus’ buying behavior, confirming that he net-bought nearly 300,000 Bitcoins.

Start: 14-2-2013 3:37

End: 27-9-2013 6:16

User_ID: 698630

User: b2853e3c-3ec0-4fa5-8231-d21e2fd13330

BTC bought: 335203.83080579044

USD spent: $??.??

JPY spent: 0.0

EUR spent: €2110.46

BTC sold: 37575.39028677996

USD received: $4,018,376.87

JPY received: ¥2,744,463.91

EUR received: 0.0

Net BTC bought: 297628.4405190105

Net USD spent: $??.?? - $4,018,376.87

On September 27, 2013, after completing his mission of buying 300,000 Bitcoins, Markus passed the torch to Willy, who started seven hours later and continued until January 2014, with recorded data available until November 30, 2013.

The image above shows the Bitcoin price trend on Mt. Gox during Markus and Willy’s activities. The red box represents Markus’ activity period, and the green box represents Willy’s.

Your first question should be: Why didn’t Bitcoin’s price rise significantly during Markus’ activity period, despite him buying 300,000 Bitcoins, more than Willy?

Next, you might wonder: Was there really a relationship between Markus and Willy’s buying spree and the bull market? Other exchanges also saw Bitcoin prices surpassing $1,000. Was this also due to Markus and Willy?

These are questions the Willy Report can’t answer, but fortunately, we have experts to help.

5/5 Expert Analysis

The answer is yes. The 2013 Bitcoin bull market was not only man-made but specifically created by Markus and Willy. This conclusion comes from four foreign experts.

On May 30, 2017, more than three years after the incident, economists Neil Gandala and Tali Obermana from Tel Aviv University, and computer scientists JT Hamrick and Tyler Moore from The University of Tulsa, published the paper “Price Manipulation in the Bitcoin Ecosystem.”

Their conclusion was that the suspicious trading activity of Markus and Willy was associated with a daily 4% rise in Bitcoin’s price, leading to a massive spike from around $150 to over $1,000 in late 2013.

The suspicious trading activity of two actors were associated with a daily 4% rise in the price, which in the case of the second actor combined to result in a massive spike in the USD-BTC exchange rate from around $150 to over $1,000 in late 2013.

First, let’s explain why Bitcoin’s price didn’t rise significantly during Markus’ activity period before September 27.

The issue lies in the intensity of purchases. Willy bought Bitcoins on 50 of the 65 days, while Markus bought them on 33 days over 225 days. Therefore, Willy’s buying spree had a more substantial impact on Bitcoin’s price.

Willy traded on 50 of the 65 days before the data cutoff. In total, Willy acquired 268,132 bitcoin, nominally for around $112 million. While Willy acquired slightly fewer bitcoins than Markus, the Markus activity occurred on 33 days spread over a 225-day period. Thus, the Willy activity was much more intense.

Next, was there a relationship between Markus and Willy’s buying spree and Bitcoin’s price?

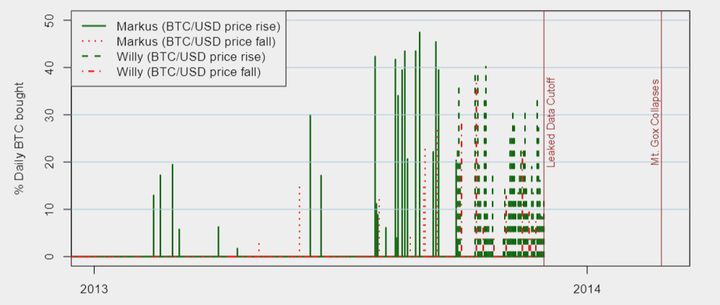

Yes. The following graph clearly shows this.

Understanding the graph might be slightly challenging. The presence of lines indicates buying activity on that day. The height of the lines represents the proportion of the day’s total transactions. The key is the color: green indicates a price increase, while red indicates a price decrease. It’s evident that green far exceeds red for both solid and dashed lines.

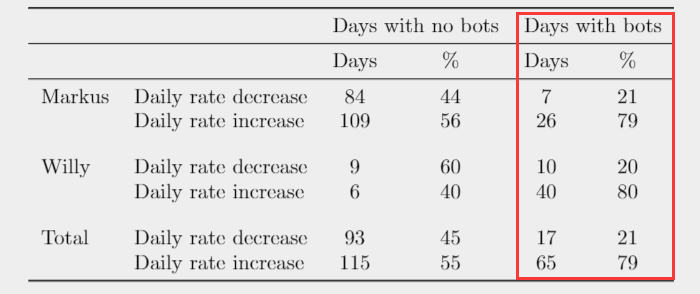

The table above specifically shows that on days when Markus and Willy bought, the price increased 79% of the time. On days they didn’t buy, the price increase ratio was only 55%, close to half. This comparison proves that their buying caused Bitcoin’s price to rise.

Now, your most pressing question: Mt. Gox was just one exchange. Other exchanges also saw Bitcoin prices exceed $1,000. Was this also influenced by Markus and Willy?

Yes. The explanation is a bit complex but not too difficult. You need to focus and read carefully. You can review it multiple times if necessary.

Mt. Gox, Bitstamp, Bitfinex, and BTC-e were the main Bitcoin exchanges at the time, accounting for 80% of trading volume.

To see the impact of Markus and Willy on these three exchanges more clearly, the timeline was divided into four phases from December 1, 2012, to November 30, 2013, each phase lasting three months. This division aids in comparison.

The percentages represent the proportion of active days for Markus or Willy during each phase. These values help us see that Markus was mainly active in the third phase (Period 3), while Willy was active in the fourth phase (Period 4). The first and second phases are mainly for comparison.

The table above shows that during the third phase, Markus bought Bitcoins on 17 days, all of which saw price increases (left red box). In the fourth phase, Willy’s 50 days of buying saw price increases reaching double digits (right red box). In stark contrast, Bitcoin’s price dropped on days Markus and Willy didn’t buy (negative values in the column next to the red box).

Price is highly correlated with trading volume. Markus and Willy’s presence significantly impacted the trading volumes of the four exchanges.

The table above shows that during the 17 days Markus bought Bitcoins, the average and median trading volumes of the four main exchanges were significantly higher than on the 75 days with no buying activity. This phenomenon was even more pronounced in the fourth phase, where the average trading volume during Willy’s 50 buying days was nearly twice that of non-buying days (1.95 = 90,611/46,263), and the median was nearly three times (2.8 = 82,779/29,476).

Thus, the truth about Markus and Willy creating the 2013 bull market finally came to light. Of course, everything comes at a price. The cost of the 2013 artificial bull market was three years of stagnation, with Bitcoin’s price not returning to $1,000 until January 2017.

But your final question remains: It’s already 2021; can a story from eight years ago still be relevant?

Maybe Coinbit can answer that question.

Conclusion

Coinbit is South Korea’s third-largest cryptocurrency exchange. On August 26, 2020, Coinbit was investigated by the police for 99% of its transactions being fake. Coinbit profited over $84 million from these fake trades. However, this time the investigation was not due to hackers but an insider whistleblower.

Following the whistleblower’s tip, the police conducted a covert investigation and found that from August 2019 to May 2020, 99% of Coinbit’s cryptocurrency transactions lacked deposit and withdrawal records. This mirrors Mt. Gox’s Willy and Markus, who also didn’t need deposits and withdrawals as they were bots.

Do you think only South Korean exchanges do this? No, most exchanges do it.

The accurate statement is: the suspicious trading volume of most exchanges exceeds 90% (Suspicious volume of >90% is detected for most investigated exchanges.), as seen in the red box in the image below.

This 90% figure comes from the paper “Wash Trading at Cryptocurrency Exchanges,” published on February 19, 2021. The authors, Guénolé Le Pennec, Ingo Fiedler, and Lennart Ante from Germany and Canada, concluded by monitoring the exchanges’ network traffic and user funds:

-

For most exchanges, the suspicious trading volume exceeds 90%;

-

The highest wash trading volume reached 50 times;

-

Wash trading is not limited to Bitcoin; Ethereum and Ripple also exhibit wash trading.

However, the world is not entirely dark; there is still some light. Some exchanges remain self-disciplined. But the cryptocurrency market is a global market. One bad apple can spoil the bunch. In this sense, Bitcoin’s price still has a long way to go before it can be taken seriously.