The rise of blockchain has brought revolutionary changes with Bitcoin, Ethereum, and NFTs dazzling the world, making wealth seem within reach. However, blockchain is not a utopia. Beneath the surface of this seemingly free and transparent field lie countless traps, often disguised as “100x coins,” waiting to ensnare newcomers dreaming of overnight riches.

One of the deadliest traps is the infamous Rug Pull scam. According to CertiK, every two new tokens launched on Ethereum contain one scam.

CertiK’s security team analyzed token data between November 2023 and August 2024, revealing that 49.53% of the 93,930 new tokens promoted on Telegram were scams, with stolen funds totaling a staggering $800 million!

Today, I’ll break down the Rug Pull scam to its core. After reading this guide, you’ll not only recognize scammers' tactics but also learn how to safeguard your assets, allowing blockchain to be a tool for transformation rather than a wealth-draining pitfall.

1. What Is a Rug Pull?

The term “Rug Pull” literally means “pulling the rug.” Imagine standing on a rug, and someone yanks it out from under you, causing you to fall flat. Here’s how it works in the crypto world:

-

Scammers launch a new token, branding it as the “next Bitcoin” or “1000x opportunity.”

-

They lure investors to buy in, creating a false image of a booming project.

-

Once enough funds accumulate in the liquidity pool, the scammers exploit hidden backdoor codes to withdraw the funds and vanish.

Investors? Left stunned, with empty wallets. This isn’t a rare incident—it’s a persistent plague in the blockchain world, even becoming a “business model.” Why is it so rampant? The reasons are simple:

-

Anyone can create a token: Launching a token on the blockchain is easier than ordering a cup of bubble tea. Scammers need only copy a few lines of code to create a “new project.”

-

Lack of regulation: Decentralized exchanges (DEXs) don’t have any review mechanisms for new tokens, allowing scammers to list their tokens at will.

-

Breeding ground for greed: Many people are driven by the fantasy of “getting rich quick” and rush into new tokens, playing right into scammers’ hands.

Let’s delve into a real-life case highlighted by CertiK to understand how a Rug Pull unfolds step by step.

2. Case Study: TOMMI Token Scam

This case serves as a “Rug Pull playbook,” with each step revealing chilling precision.

Step 1: Token Creation and Building Trust

The scammer, using the address 0x4bAF, created the TOMMI token and added 1.5 ETH along with 100 million TOMMI tokens to a liquidity pool. To appear “legit,” they burned all LP tokens and transferred the contract ownership to the zero address, making it seem like the liquidity pool was “immutable.”

Step 2: Creating Hype and Attracting Investors

Next, the scammer used several fake accounts to buy and sell TOMMI tokens, creating high trading activity. The liquidity pool appeared active, attracting bots and naive investors who rushed in, thinking it was a promising “100x coin.”

Step 3: Rug Pull – Running Away Overnight

Once enough ETH accumulated in the liquidity pool, the scammer exploited a backdoor in the contract to withdraw 3.95 ETH. They then quickly transferred the funds through intermediary addresses before funneling them to the final storage address, 0x2836. The entire scam concluded within a few hours, leaving investors empty-handed.

3. Key Points of Investor Vulnerability

Burning LP tokens + Transferring contract ownership = The perfect bait

Why?

Because burning LP tokens and transferring contract ownership are two carefully crafted “smokescreens” designed to deceive both investors and on-chain trading bots into believing the funds are safe. Let’s break down how these tricks work.

3.1 Burning LP Tokens: The “Safety Promise” Illusion

Burning LP tokens means that liquidity providers (scammers, in this case) destroy the tokens they receive after adding ETH and tokens to the liquidity pool. LP tokens act as “keys” to the pool, allowing redemption of deposited funds. Burning them seems like a way of saying, “We’ve thrown away the keys; the funds are now untouchable!”

Investors, seeing this, assume the project is secure and pour in their money. But in reality, this is a façade. The scammer has already embedded a backdoor in the contract, enabling them to secretly drain the funds despite the burned LP tokens.

It’s like a magician claiming to throw the key to a safe into the ocean while secretly opening the safe through a hidden door. Burning LP tokens lowers investor vigilance, creating a false sense of security.

3.2 Transferring Contract Ownership: Fooling Trading Bots

While burning LP tokens deceives investors, transferring contract ownership targets on-chain trading bots. These bots scan new token contracts for potential Rug Pull risks. If they detect that the contract owner retains control, they might flag the token as risky or refuse to trade.

To bypass this, scammers transfer contract ownership to a “zero address” (0x000...000), signaling to bots: “The project owner no longer controls the contract; it’s safe to trade!”

Once the bots are fooled and start buying, they attract more investors. But transferring ownership is just a cover; the scammers retain control through pre-written backdoors. It’s like a landlord pretending to donate their property to a public trust while secretly keeping a spare key to loot the house.

Here is the openTrading function from the contract, which is used to create a new liquidity pool.

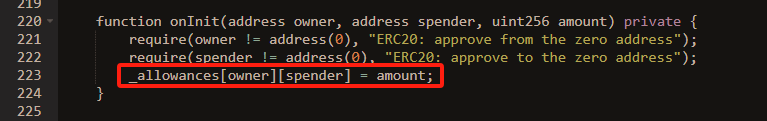

Please take note of the highlighted section in the image above:

onInit(uniswapV2Pair, _chefAddress, type(uint)

This is the backdoor function. Below is the code for this backdoor function.

The highlighted section in the image shows the function _allowances[owner][spender] = amount, which essentially allows the liquidity pool to approve the transfer of a certain amount of tokens to the scammer's address. Here, owner refers to the liquidity pool uniswapV2Pair, and spender refers to the scammer’s address, _chefAddress.

What makes this even more deceptive is that _chefAddress is defined in the constructor function, meaning it’s set during the creation of the token contract.

You can review all the contract details [here]. However, if you’re not familiar with smart contracts, it would be almost impossible to detect this backdoor. Fortunately, you now have the power to uncover it, thanks to ChatGPT.

4. AI’s Role in Detecting Rug Pulls

I retrieved the full contract code for TOMMI and asked ChatGPT to analyze it for potential backdoors. ChatGPT didn’t disappoint—it not only identified the backdoor described above but also flagged additional issues.

The highlighted section in the image shows the backdoor discovered by CertiK’s security team, which ChatGPT also identified. The circled part indicates the following:

Blacklist (bot) mechanism*: The contract owner can freeze the trading activity of any address at any time.*

This blacklist (bot) mechanism was independently uncovered by ChatGPT, which also provided a clear security warning.

If you are an investor or user planning to hold or interact with this contract, you should be aware that the development team retains the ability to freeze addresses or move large amounts of tokens (especially liquidity-related tokens) at will. In other words, this contract is not a fully decentralized and immutable “pure” ERC20—it functions more like a meme token with significant room for manipulation, requiring extreme caution.

This demonstrates that even without deep knowledge of smart contracts, you can use AI to detect Rug Pull scams—thanks to OpenAI. You can review my detailed conversation with ChatGPT [here].

However, don’t assume that AI alone will make you invincible. While AI can identify scams, scammers are equally aware of its capabilities. As the saying goes, “When the righteous rise, so do the wicked.” To completely avoid Rug Pull traps, AI alone is not enough.

5. How to Completely Avoid Rug Pull Traps

Remember two key principles:

-

The crypto market is not the stock market. Speculation is a deadly gamble.

-

If you don’t plan to hold a token long-term, don’t hold it for even a second.

Let’s explore why.

Principle 1: Speculation in Crypto Is a Game of Survival

Unlike stocks, which are tied to real businesses and financial data, tokens are often backed by little more than a flashy whitepaper. The decentralized nature of blockchain also allows scammers to operate anonymously, making it nearly impossible to track them down once they’ve made their escape.

Trying to make quick money through speculation in such an environment is like picking gold in a minefield—your chances of stepping on a bomb far outweigh your odds of striking it rich.

Principle 2: Don’t Hold What You Don’t Understand

Token prices can be highly volatile, often manipulated by those behind the scenes. CertiK’s data shows that 89.84% of Rug Pull tokens last less than 72 hours, with 55.07% collapsing within 3 hours! You won’t have time to react.

If a project has true long-term value, there’s no rush to buy at launch. Time will reveal genuine projects, while scams quickly fade. Patience is your best defense.

Conclusion: Rug Pulls as a Reflection

Rug Pulls reveal the greed, blind trust, and ignorance in the crypto space. The key to avoiding them lies not only in technical vigilance but also in recognizing the essence of investing: any “get-rich-quick” opportunity likely hides a deadly trap.

Blockchain’s true potential is to change the world, not fuel speculation. Resist temptation, stay rational, and you’ll not only safeguard your wealth but also help build a healthier crypto ecosystem.

The future is here. Will you be a pioneer or a victim? The choice is yours.

For airdrop updates, follow the new official WeChat account (the old one got banned):

Zero-Cost Airdrop Recommendations:

-

Grass (Token Released): https://t.co/PnwBigWSMM

-

Silencio (Distribution Completed): https://t.co/4WxV3EAWGk

Beginner's Guide Recommendations:

-

Buy 0.001 BTC: https://t.co/UeaC0pQm5m

-

Store Bitcoin in a Cold Wallet: https://t.co/sbT1E9AB14

-

Sell 300 USDT: https://t.co/ICb4wHMWq1

-

Perpetual Contracts: https://t.co/67J5atbVeo

Airdrop-Friendly DeFi Services:

-

ARP1: Liquidity Mining + Re-staking: https://t.co/XJs0w3edXN

-

ARP2: Extreme Rebalancing: https://t.co/9E8Q9XWLQh

About Airdrop Reference

Airdrop Reference is an innovative blockchain education and promotion platform aimed at spreading basic blockchain knowledge and helping ordinary users understand and participate in the development of blockchain technology. The mission of this project is to lower the entry barriers to blockchain, promote high-quality blockchain projects, and allow more people to enjoy the benefits of the Web3.0 era.

Discord | 𝕏 | Zhihu Column | Mirror | Wechat 2.0 | Daii’s 𝕏