Written by Jacob Zhao | Follow on Twitter: @0xjacobzhao

The crypto market has shown significant volatility recently, and conservative, steady yields are once again in demand. Drawing from my own investment insights over the past few years, as well as focused research into the stablecoin space conducted at the end of last year, I’d like to revisit the age-old but evergreen topic of Stablecoin Yields.

Currently, the main categories of stablecoins in the crypto market can be grouped as follows:

-

Conditionally Compliant but Market-Dominant: USDTWith the widest range of use cases—including exchange trading pairs, payroll for crypto-native companies, and real-world trade and payments—USDT maintains dominance. Users place trust in its “too big to fail” status and Tether’s perceived ability to backstop the asset.

-

Regulatory-Compliant Fiat-Pegged StablecoinsUSDC stands out as the most widely supported across chains and applications, essentially acting as on-chain USD. Others, such as PayPal USD and BlackRock’s USD, are compliant but have more limited use cases.

-

Overcollateralized StablecoinsMakerDAO’s DAI (and its upcoming evolution into USDS via the Sky Protocol) leads this category. Liquity’s LUSD also carves a niche with its zero-interest loans and low 110% collateral ratio, offering a subtle innovation.

-

Synthetic Asset-Based StablecoinsThis cycle’s standout is Ethena’s USDe, which has achieved breakout success. Its yield model—driven by funding rate arbitrage—is one of the key strategies that this guide will explore in detail.

-

RWA-Backed Stablecoins (U.S. Treasuries as Collateral)Usual’s USD0 and Ondo’s USDY represent this cycle’s leading cases. Notably, Usual’s USD0++ brings innovation by providing liquidity for U.S. Treasuries, much like Lido does for ETH staking.

-

Algorithmic Stablecoins: After the collapse of Terra’s UST, this category has been largely discredited. With no real value backing, Luna’s violent price swings triggered a death spiral of sell-offs and eventual collapse. FRAX, which blends algorithmic mechanisms with overcollateralization, still sees some use, but most other algorithmic stablecoins no longer have any market relevance.

-

Non-USD StablecoinsEuro-based stablecoins (e.g., Circle’s EURC, Tether’s EURT) and other fiat alternatives (such as BRZ, ZCHF, and the Hong Kong Dollar-pegged HKDR) currently have minimal influence in the USD-dominated stablecoin landscape. The only viable future for non-USD stablecoins lies in regulated payment use cases, rather than within the crypto-native ecosystem.

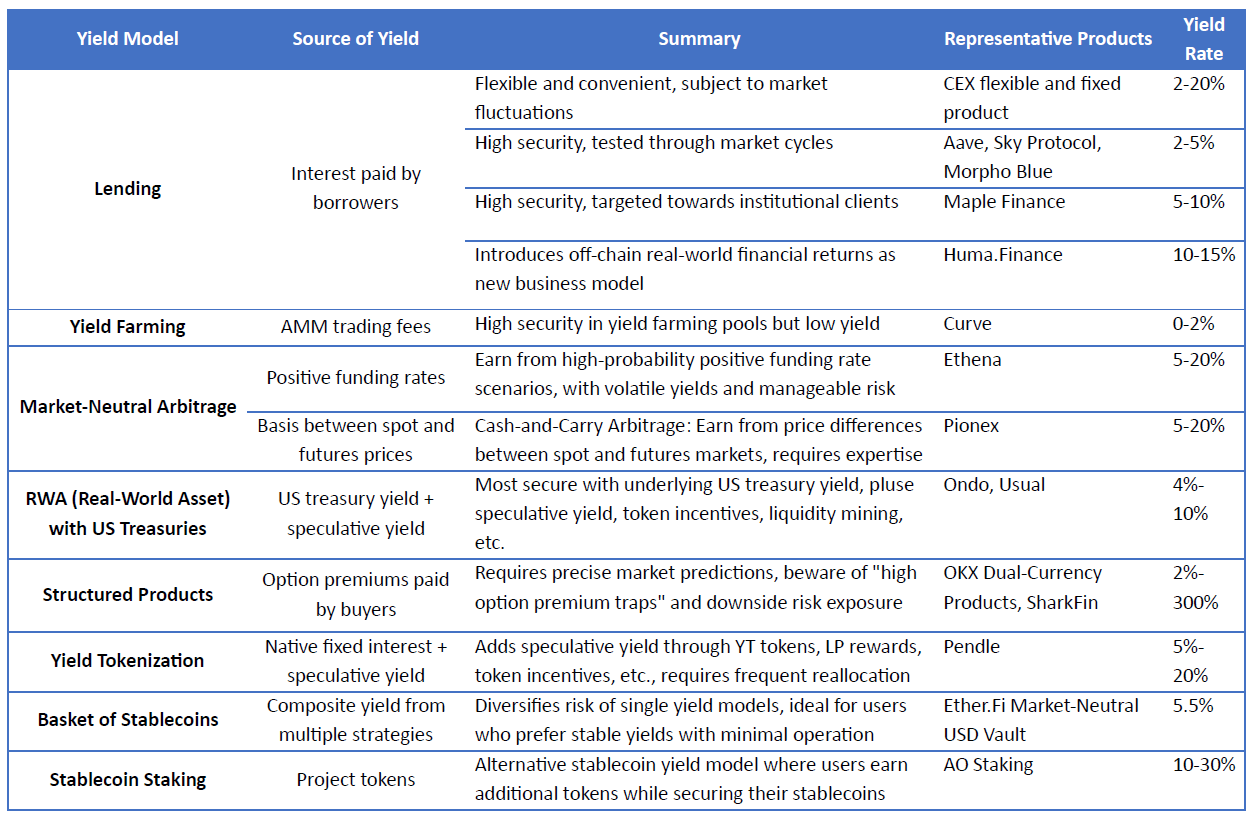

Currently, the main categories of stablecoin yield strategies can be grouped as follows. This article will further analyze each of these yield models in detail:

1. Stablecoin Lending & Borrowing

Lending is the most traditional form of financial yield. The core source of returns lies in the interest paid by borrowers. Key considerations include platform or protocol security, borrower default risk, and yield stability. The current stablecoin lending market includes:

-

CeFi Platforms: Primarily flexible savings products offered by major exchanges such as Binance, Coinbase, OKX, and Bybit.

-

Top DeFi Protocols: Aave, Sky Protocol (MakerDAO’s rebranded evolution), and Morpho Blue are the main players.

Platforms that have weathered market cycles—whether CeFi or DeFi—generally offer stronger security. During bull markets, high demand for borrowing often pushes flexible stablecoin lending yields above 20%. In contrast, during quieter periods, rates typically drop to around 2%–4%. As such, flexible interest rates are also a direct indicator of market activity.

Fixed interest lending, which sacrifices liquidity, usually offers higher yields than flexible products in stable conditions. However, it often misses out on the sharp spikes in returns during highly active market phases.

Additionally, there have been some notable micro-innovations in the stablecoin lending space:

-

Fixed-Rate Lending Protocols: Pendle, which started with fixed-rate lending and evolved through yield tokenization. Other early fixed-rate projects like Notional Finance and Element Finance haven’t broken out but offer interesting design insights.

-

Introducing Rate Tranching and Subordination Mechanism in protocol

-

Leveraged Lending Protocols: Offering borrowers access to leveraged positions.

-

Institutional DeFi Lending: Protocols like Maple Finance’s Syrup derive yields from institutional borrowers.

-

RWA-Based Lending: Bringing real-world lending yields on-chain, such as Huma Finance’s supply chain finance product.

In summary, lending remains the most straightforward and capital-heavy stablecoin yield strategy—and will likely continue to be the dominant one.

2. Yield Farming Returns

This strategy is best represented by Curve, where yields come from AMM trading fees distributed to liquidity providers (LPs) and token incentives. As the “Holy Grail” for stablecoin DEX platforms, Curve has become a benchmark—being listed in a Curve pool is often seen as a sign of industry adoption for a new stablecoin.

Farming on Curve is its exceptional security however low yield—typically ranging from 0% to 2%. For non-institutional capital or smaller amounts, especially over shorter timeframes, the returns often aren’t enough to offset gas fees, making the strategy unattractive for most retail users.

Stablecoin pools on Uniswap face similar issues. While Uniswap’s non-stablecoin pairs carry the risk of impermanent loss, even smaller DEXs offering higher APYs for stablecoin pairs pose rug pull risks, which go against the cautious and capital-preserving nature of stablecoin yield strategies.

Today, DeFi stablecoin pools are still dominated by lending protocols, not AMMs. Curve’s classic 3Pool (DAI, USDT, USDC), while iconic, currently ranks only in the top 20 by TVL, reflecting a broader shift in capital away from AMM-based farming.

3. Market-Neutral Arbitrage Yields

Market-neutral arbitrage strategies have been widely adopted by professional trading firms. By simultaneously holding long and short positions, these strategies aim to reduce net market exposure to near zero. In crypto, the primary market-neutral arbitrage approaches include:

Funding Rate Arbitrage

Perpetual futures contracts have no expiry date. Their prices are kept in line with spot prices through a funding rate mechanism, where periodic payments are exchanged between long and short positions to balance price discrepancies.

-

When the perpetual price is above the spot price (premium), longs pay shorts — the funding rate is positive.

-

When the perpetual price is below the spot price (discount), shorts pay longs — the funding rate is negative.

Historically, positive funding rates occur more frequently than negative ones. Therefore, a common strategy is to buy spot and short the perpetual, earning the funding payments from longs.

Cash-and-Carry Arbitrage

This involves exploiting the price difference between the spot and futures markets, locking in a profit through hedged positions. The key concept is the basis, the difference between the futures price at expiry and the spot price. Traders typically apply this strategy in markets with: Contango (futures > spot) and Backwardation (futures < spot). Cash-and-carry is most suitable for large capital investors who can tolerate position lock-ups and expect basis convergence. It’s commonly used by traders with a traditional finance background.

Cross-Exchange Arbitrage (“Arb Bots”)

This was one of the earliest arbitrage strategies in crypto—capitalizing on price discrepancies for the same asset across different exchanges by building neutral positions. However, spreads between major exchange pairs have now tightened significantly.

This strategy now typically requires: Automated trading scripts, High market volatility and Smaller-cap tokens. Due to the high operational complexity, this strategy is no longer retail-friendly. Tools like Hummingbot may still offer access for technically savvy users.

Other forms like triangular arbitrage, cross-chain arbitrage, and cross-pool arbitrage do exist, but will not be discussed in this guide.

The Rise of On-Chain Funding Rate Arbitrage — Ethena

Historically, market-neutral arbitrage has been reserved for professionals due to its complexity. However, Ethena has brought funding rate arbitrage on-chain, making it accessible to retail users for the first time.

How it works:

-

Users deposit stETH into the Ethena protocol to mint an equivalent amount of USDe.

-

At the same time, Ethena opens hedged short positions on centralized exchanges.

-

These shorts earn positive funding payments from longs in the majority (historically >80%) of market conditions.

-

In rare periods of negative funding rates, Ethena uses reserve capital to cover the losses.

-

Revenue model: ~65% from funding rate arbitrage; ~35% from ETH staking, DeFi lending, and CeFi yield sources

-

Assets are custodied by OES (Off-Exchange Settlement) providers with monthly audited reports, reducing exchange risk exposure.

Risks of Ethena

Aside from typical risks like smart contract vulnerabilities, custody failure, or USDe depegging, the core risk lies in extended periods of negative funding rates depleting protocol reserves.

However, historical data suggests this is a low-probability scenario. If it does occur, it would imply that the widely-used funding rate arbitrage strategy is failing market-wide. Unlike Terra’s death spiral, Ethena is unlikely to collapse under its own mechanism. The more probable outcome is a gradual tapering of token-subsidized yields as they normalize to sustainable arbitrage returns.

Notably, Ethena has prioritized transparency—users can track real-time funding rates, historical returns, open positions across exchanges, and monthly audits directly on its dashboard. This puts it ahead of most other arbitrage-based products in terms of visibility and risk disclosure.

Outside of Ethena, Pionex offers stablecoin products based on Cash-and-Carry Arbitrage, but these are more limited in scope. It’s worth noting that, aside from Ethena, there are still very few market-neutral arbitrage products accessible to retail users with low barriers to entry.

4. US Treasury-Backed RWA Yields

The Fed's interest rate hikes during 2022–2023 pushed USD rates above 5%. Even as we enter a gradual rate-cutting cycle, 4%+ dollar yields remain a rare combination of safety and return in traditional finance. In crypto, RWA (Real World Assets) is a high-barrier, compliance-heavy, and operations-intensive sector—but U.S. Treasuries, due to their standardization and deep liquidity, stand out as one of the few RWA use cases with truly sound business logic.

Leading Projects

-

Ondo Finance has emerged as a leader in the space:

-

USDY targets non-U.S. retail users.

-

OUSG is designed for qualified U.S. institutional investors.

-

Both currently yield around 4.25%, supported by underlying U.S. Treasuries.

-

Ondo leads in multi-chain deployment and ecosystem integration, though lags slightly behind Franklin Templeton’s FOBXX and BlackRock’s BUIDL in terms of regulatory and institutional trustworthiness.

-

-

Usual Protocol, a rising star this cycle:

-

Its USD0 stablecoin is backed by a basket of U.S. Treasuries.

-

It introduces USD0++, a liquid staking-like token that unlocks capital from 4-year locked Treasuries—similar to how Lido enables liquidity on staked ETH.

-

USD0++ can be deployed in yield farming and lending pools to earn additional returns.

-

Yield Breakdown and Risks

Most Treasury-backed RWA projects offer stable yields around 4%, reflecting their underlying assets. However, higher yields in Usual’s pools are largely driven by: USUAL token subsidies, “Pills” (points) incentive programs and Speculative yield farming rewards. These incentives are not sustainable long term, and should be viewed as temporary bootstrapping tools rather than reliable yield sources. Despite that, Usual remains one of the most complete DeFi-native RWA projects. While it faces downward pressure on yields, it's unlikely to face a blow-up scenario.

USD0++ Depeg Incident (Early 2025):

In early 2025, a redemption mechanism change led to a temporary depeg and sell-off of USD0++. The core issue stemmed from a mismatch between market expectations and the bond-like redemption mechanics, plus Governance missteps during the rollout. While this incident revealed operational weaknesses, the liquidity design of USD0++ remains a valuable industry innovation—offering a blueprint for future RWA protocols looking to bring capital efficiency to otherwise locked, off-chain assets.

5. Structured Products in Options

Structured products and dual-currency strategies popular on most centralized exchanges today originate from the Sell Put or Sell Call strategies in options trading, where the seller of the option profits from the premium paid by the option buyer. U-anchored stablecoins mainly rely on Sell Put strategies, where the yield comes from the premium paid by the buyer of the option—either in USDT or by purchasing BTC or ETH at a lower target price.

Practical Application of Sell Put Strategy

In practice, Sell Put is more suited to sideways market conditions. The Sell Put target price is typically the lower bound of the trading range, while the Sell Call target price is the upper bound. In a bullish market, the yield from selling options is limited, and buying a Buy Call would be more suitable. In a bearish market, Sell Put can become a losing strategy, where the price keeps falling, leading to losses as the options are sold at a loss.

For beginners selling options, there is a common pitfall of chasing high premium yields in the short term while ignoring the risk exposure from a sharp drop in asset prices. Setting the target price too low can also lead to low premium yield, which might not be sufficiently attractive. Based on my experience in options trading, the Sell Put strategy works best in a downward market with panic sentiment, where lower target prices are set to capture high premium yields. However, during a bull market, the yield from lending stablecoins on exchanges would typically be more attractive.

Shark Fin Principal Protection Strategy

The Shark Fin strategy, popular on exchanges like OKX, uses a combination of Bear Call Spread (Sell Call + Buy Call at a higher strike to limit the upside) and Bull Put Spread (Sell Put + Buy Put at a lower strike to limit the downside). This results in an overall range-bound options strategy, where premiums are earned within the defined price range. Outside of the range, the positions hedge each other with no additional yield.

For users focused on capital protection and not aiming for the highest premium or asset-based yield, the Shark Fin strategy offers a suitable U-anchored investment option.

Maturity of On-Chain Options

The maturity of on-chain options remains underdeveloped. In the previous cycle, Ribbon Finance was a leading options vault protocol, while other on-chain options trading platforms like Opyn and Lyra Finance allowed for manual trading of options strategies. However, these platforms are no longer as dominant in this crypto cycle.

6. Yield Tokenization

A representative project in this cycle is the Pendle Protocol, which started in 2020 with fixed-rate lending and evolved by 2024 into yield tokenization. Pendle splits yield-generating assets into different components, allowing users to lock in fixed returns, speculate on future yields, or hedge yield risks.

Standardized Yield Tokens (SY)

SY (Standardized Yield Tokens) are split into:

-

PT (Principal Token): Represents the principal of the underlying asset, which can be redeemed at a 1:1 ratio for the underlying asset at maturity.

-

YT (Yield Token): Represents the future yield of the asset, which decays over time and becomes worthless at maturity.

Pendle's Trading Strategies

-

Fixed Yield: Hold PT until maturity to receive a fixed return. Suitable for risk-averse users.

-

Yield Speculation: Buy YT to bet on rising future yields. Suitable for risk-tolerant users.

-

Risk Hedging: Sell YT to lock in current yield and avoid market downturns.

-

Liquidity Provision: Users can deposit both PT and YT into liquidity pools to earn trading fees and Pendle token incentives.

Pendle's main stablecoin pool offers attractive returns, combining: Native asset yield, Speculative yield from YT, LP (liquidity provider) rewards, Pendle token rewards, Points-based incentives. While this yields significant returns, one drawback is that Pendle’s high-yield pools typically have medium-to-short durations, unlike staking, liquidity mining, or lending pools, which can offer long-term rewards with a one-time action. Pendle’s pools require frequent on-chain actions to switch between yield pools.

7. Basket of Stablecoin Yield Products

Ether.Fi, as the leading protocol in Liquid Restaking, has maintained its dominant position in the DeFi industry by actively embracing change and transforming its products. After the Restaking sector entered a saturation and downward trend, Ether.Fi diversified by launching several yield products in BTC, ETH, and stablecoins.

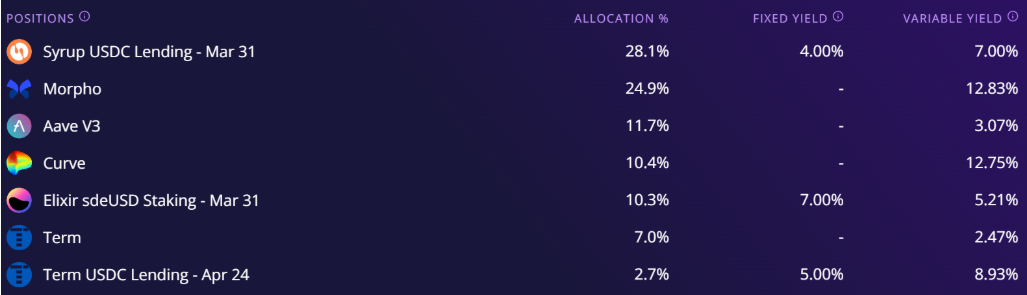

Stablecoin Market-Neutral USD Pool

In its Stablecoin Market-Neutral USD Pool, Ether.Fi offers a variety of yield products for users in the form of actively managed funds. These products include:

-

Lending-based yields (via Syrup, Morpho, Aave)

-

Liquidity mining (via Curve)

-

Funding rate arbitrage (via Ethena)

-

Yield tokenization (via Pendle)

For users seeking stable, on-chain yield but lacking sufficient capital or unwilling to engage in frequent operations, this pool provides a high-yield, risk-diversified approach to earning passive income.

8. Stablecoin Staking Yield

Stablecoin assets do not inherently have staking properties like ETH or other POS (Proof of Stake) chains. However, the Arweave team launched the AO network, which allows for on-chain staking of stETH and DAI under a Fair Launch token issuance model. Among these, DAI staking offers the highest AO yield efficiency.

This type of stablecoin staking model can be classified as an alternative stablecoin yield strategy. It allows users to earn additional AO token rewards while ensuring the safety of their DAI assets—essentially leveraging small investments for potentially larger returns. The core risk of this model lies in the development of the AO network and the uncertainty in token prices.

Conclusion

In summary, we have outlined the main stablecoin yield models currently prevalent in the crypto market in the table above. Stablecoin assets represent a market that professionals in the crypto industry are most familiar with, yet often overlook. Understanding the sources of stablecoin yield and making informed allocations allows one to build a strong financial foundation, enabling more confident navigation through the uncertainty and risks inherent in the crypto market.