New study reveals shocking trends in data breaches for publicly traded companies. Learn the most common threats and how your investments could be at risk.

You can also find this article on my Medium page.

“Mapping of Data Breaches in Companies Listed on the NYSE and NASDAQ: Insights and Implications” by Gabriel Arquelau Pimenta Rodrigues et al. (2024) is a comprehensive study published in Results in Engineering. The paper explores the pervasive issue of data breaches among publicly traded companies, emphasizing the significance of such events in the digital age. As cybersecurity concerns mount, understanding the dynamics of data breaches provides crucial insights for corporations, stakeholders, and policymakers alike.

What is a data breach? A data breach is when unauthorized parties access sensitive or confidential information, such as personal or corporate data.*

Summary of the Research Article

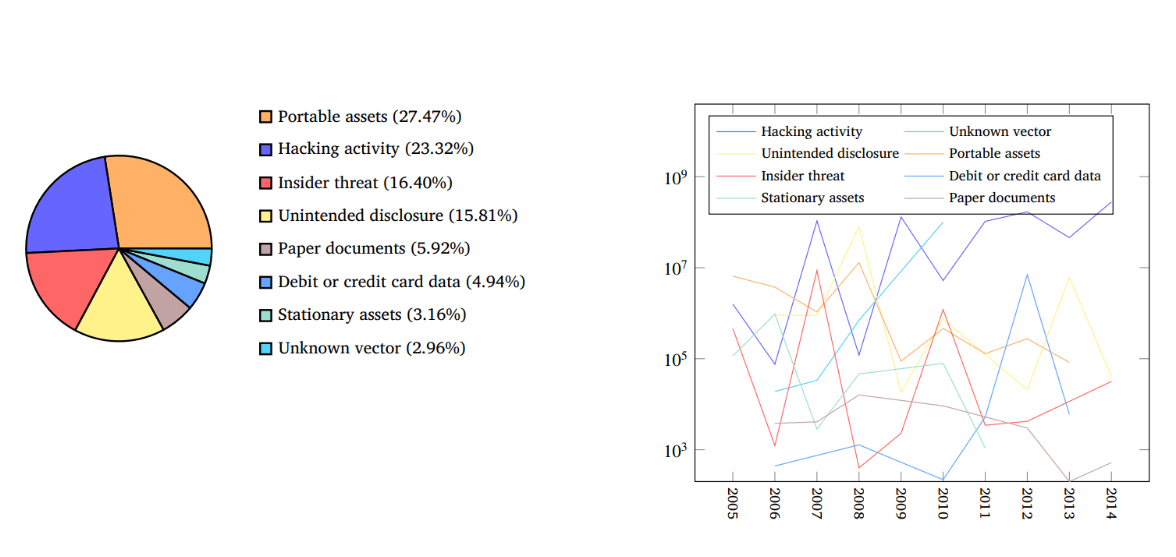

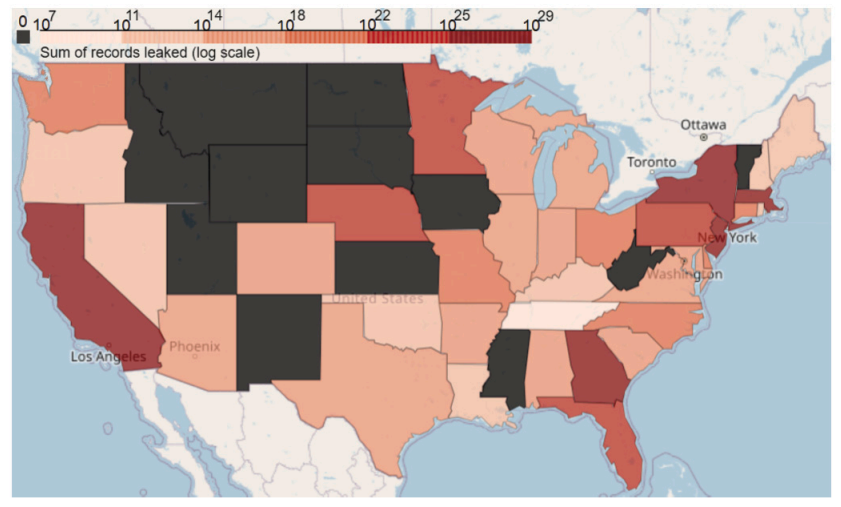

The research article addresses the frequency, types, and consequences of data breaches on companies listed on the NYSE and NASDAQ from 2005 to 2015. Utilizing a dataset initially sourced from the Privacy Rights Clearinghouse, the authors analyzed 506 reported incidents. The study identifies hacking and unauthorized internal disclosures as the predominant breach types through detailed statistical and visual analyses, presenting comprehensive insights into these breaches' geographical distribution and sector-specific impacts.

The methodology incorporates exploratory data analysis, highlighting the severity and frequency of incidents over time and across various sectors. The paper effectively maps the landscape of data breaches, revealing a significant increase in the number of breaches and the volume of exposed records over the study period.

Critical Analysis

The research by Rodrigues et al. stands out for its rigorous analytical approach and extensive data coverage. One of the paper's strengths is its detailed quantitative analysis, which provides a clear picture of the trends and patterns in data breaches across a significant timeframe. The inclusion of various data breach types and their specific impacts across different states and sectors adds depth to the analysis.

However, the study is not without limitations. The reliance on publicly reported data breaches may skew the results, as not all breaches are disclosed, potentially underrepresenting the true scope and impact of data breaches. Furthermore, the study's focus on publicly traded companies may not entirely capture the data breach landscape, excluding significant incidents in private sectors or smaller enterprises.

Highlight: The Most Surprising Aspect

Perhaps the study's most intriguing aspect is identifying unauthorized internal disclosures as a significant type of breach, second only to hacking. This finding challenges the common perception that external threats are the predominant risk, highlighting the critical need for internal controls and employee training in cybersecurity measures.

Implications and Potential

The implications of this research are profound, offering valuable insights for enhancing data security strategies within publicly traded companies. Companies can better allocate resources toward effective prevention and mitigation strategies by understanding the primary vectors and impacts of data breaches. Additionally, the study underscores the potential for regulatory improvements and the need for stringent compliance measures to protect sensitive data.

Conclusion

Rodrigues et al.'s study provides a crucial contribution to cybersecurity, offering a detailed examination of data breaches within major stock exchanges. While the study's limitations suggest caution in generalizing its findings across all industries, its insights are invaluable for corporations, regulators, and cybersecurity professionals aiming to fortify defenses against data breaches. The thorough analysis enhances understanding of past incidents and aids in preparing for future cybersecurity challenges.

Explore Next

Discover how blockchain is transforming industries on the Blockchain Insights Hub. Follow me on Twitter for real-time updates on the intersection of blockchain and cybersecurity. Subscribe now to get my exclusive report on the top blockchain security threats of 2024. Dive deeper into my blockchain insights on Medium.