The recent a16z post highlighting the top 5 metrics that define the crypto market resonates deeply with the vision and innovation EQLZR is bringing to the ecosystem. Among these metrics, transaction fees stand out as a critical indicator of blockchain demand, economic activity, and user engagement. At EQLZR, we see this metric not just as a reflection of current market dynamics but as a gateway to unlocking the next wave of DeFi growth through GasFi - our market-neutral gas derivatives platform designed for multi-chain scalability and risk management.

The Market Context: Transaction Fees as a Leading Indicator

According to a16z, transaction fees are a vital metric because they directly reflect how much users are willing to pay for blockspace, signaling real demand and network utility. This aligns with data showing that users paid approximately $6.9 billion in fees across the top 10 Layer 1 and Layer 2 blockchains in 2024 alone(CoinGecko Research, 2025). The growth in fees is driven by factors including:

-

The post-2024 Bitcoin halving increasing reliance on fees as miner subsidies reduce, followed by additional demand from ordinals and upcoming Post-Quantum BIPs(BIP-360 and Hourglass, 2025).

-

Ethereum’s Pectra upgrade doubling fees due to improved fee market dynamics and Layer 2 rollups(EQLZR Research Post on Pectra Fee Analytics, 2025).

-

Explosive stablecoin transaction volume on chains like Solana and Tron(Sudden changes in Tron (TRON Resource Model by CryptoQuant, 2025).

-

Rapid Layer 2 expansion with Base and Arbitrum scaling dApps and transactions(Base L2 Fee Analytics by Messari, 2025).

-

Niche growing use cases such as gaming and NFTs on BNB Chain and TON.

This fee growth, however, comes with significant challenges: high volatility and unpredictability of gas fees cause user churn (up to 30% drop in dApp users during fee spikes), operational unpredictability for dApps, and declining trust in scaling solutions. These pain points create a clear market opportunity for solutions that stabilize and optimize gas fee exposure.

EQLZR’s GasFi: A Market-Neutral Solution to Gas Fee Volatility

EQLZR is uniquely positioned to capitalize on these trends by pioneering GasFi - a sophisticated, market-neutral trading framework for blockchain gas derivatives that allows participants to hedge, speculate, and manage risk associated with gas fee volatility across multiple chains.

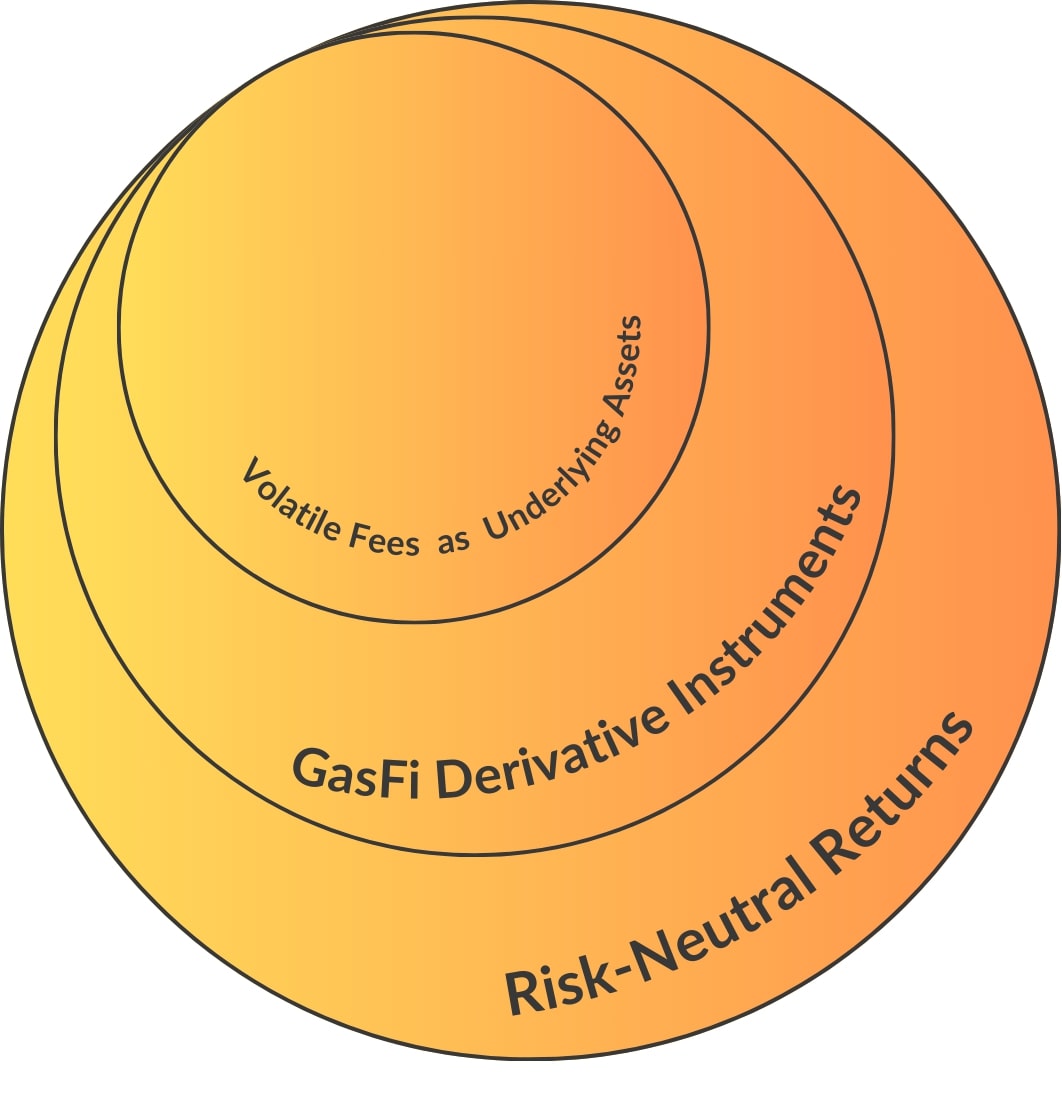

Figure: Visual representation of the GasFi, the new DeFi primitive for fee markets

Key innovations include:

-

Gradient Positions: Unlike simplistic binary bets on fee direction, Gradient Positions enable nuanced exposure to the probabilistic distribution of future gas costs, allowing traders to express complex views on fee volatility and distribution curves.

-

Cross-Chain Coverage: GasFi supports derivatives on base fees, priority fees, bridging fees, bonding fees, intent fees, swap fees, and more, spanning Ethereum, Bitcoin, Solana, Tron, BNB Chain, and various Layer 2s.

-

Diverse Derivative Instruments: Forwards, futures, options, perpetuals, swaps, and synthetic blockspace contracts empower users ranging from dApps, wallets, paymasters, miners, validators, to institutional investors to manage gas fee risk effectively.

-

AI-Driven Risk-Neutral Trading: EQLZR’s multi-agent AI framework leverages adaptive reinforcement learning and natural language processing to optimize trading strategies and risk management in dynamic fee markets.

Why GasFi is the Next Major Trend in DeFi

1. Addresses a Massive, Untapped Market

With nearly $7 billion in annual fees paid and a crypto userbase growing at a 99% CAGR, the demand for tools that can hedge and monetize gas fee volatility is enormous and largely unmet. GasFi creates a new asset class — gas derivatives — unlocking value for all ecosystem participants.

2. Enables Feeless UX and Mass Adoption

By stabilizing fee costs and enabling dApps to sponsor gas fees via paymaster contracts, GasFi reduces the friction that causes user drop-off and builds trust in decentralized applications. This directly supports the user growth trends a16z highlights, such as the 23% rise in monthly mobile wallet users and 51% increase in DEX-to-CEX volume.

3. Supports Institutional and Validator Revenue Stability

GasFi offers miners and validators tools to hedge against low fee revenue exposure, protecting network security and incentivizing participation. Institutional investors gain access to novel yield-generating derivatives uncorrelated with traditional crypto assets, enhancing portfolio diversification.

4. Future-Proofs DeFi for Multi-Chain and Layer 2 Expansion

As Layer 2s scale and new chains emerge, fee volatility will persist due to scaling limits and network demand spikes. GasFi’s cross-chain, multi-asset derivatives platform is designed to adapt to this evolving landscape, providing continuous risk management solutions.

Gradient Positions: The Innovation Powering GasFi

Gradient Positions are EQLZR’s breakthrough mechanism that transcends binary fee predictions by allowing users to take positions along the entire distribution of future gas fees. This enables:

-

Sophisticated hedging strategies that protect dApps and users from extreme fee spikes.

-

Market-neutral trading strategies that generate yield regardless of fee direction.

-

Customizable risk profiles tailored to individual preferences and roles within the ecosystem.

EQLZR’s Roadmap and Ecosystem Momentum

EQLZR is actively advancing its platform with milestones including:

-

Whitepaper v2 and v3 publications detailing options, perpetuals, and credit derivatives.

-

v1.x and v2.x app rollouts with forwards, futures, and options trading.

-

Partnerships with wallets, dApps, and paymasters to integrate GasFi’s risk management tools.

Conclusion: EQLZR is Poised to Define the Next Wave of DeFi

The a16z metrics confirm that transaction fees are not just a cost but a vital market signal reflecting blockchain adoption and economic activity. EQLZR’s GasFi platform transforms this challenge into an opportunity by creating the first comprehensive, market-neutral derivatives ecosystem for gas fees — across chains and layers.

By enabling risk management, fee stabilization, and new yield opportunities, EQLZR is building the infrastructure that will power scalable, sustainable, and user-friendly DeFi in the years ahead. For early investors and users, this represents a compelling chance to participate in the foundational technology that will shape the future of Web3 finance.

Links: Website | Telegram Group | Telegram Announcement Channel | X