I've come across numerous blogs, reports, and articles discussing crvUSD, but they were all too complex for many in my network to comprehend. All of the existing resources towards crvUSD catered to a specific group of individuals who had a deep understanding of the concept already.

However, this blog on crvUSD will provide simpler explanations and diagrams, making it easier for everyone to grasp the concept.

Table of Contents

-

crvUSD: What is it?

- What problem is Curve Finance trying to solve with crvUSD?

-

crvUSD vs. UST

-

Comparing Stablecoin Mechanisms- Curve Finance, MakerDAO & Compound

-

How to decide what kind of stablecoin to invest in?

-

crvUSD Design

-

LLAMMA

-

PegKeeper Mechanism

-

How it works?

-

How does crvUSD maintain its peg?

-

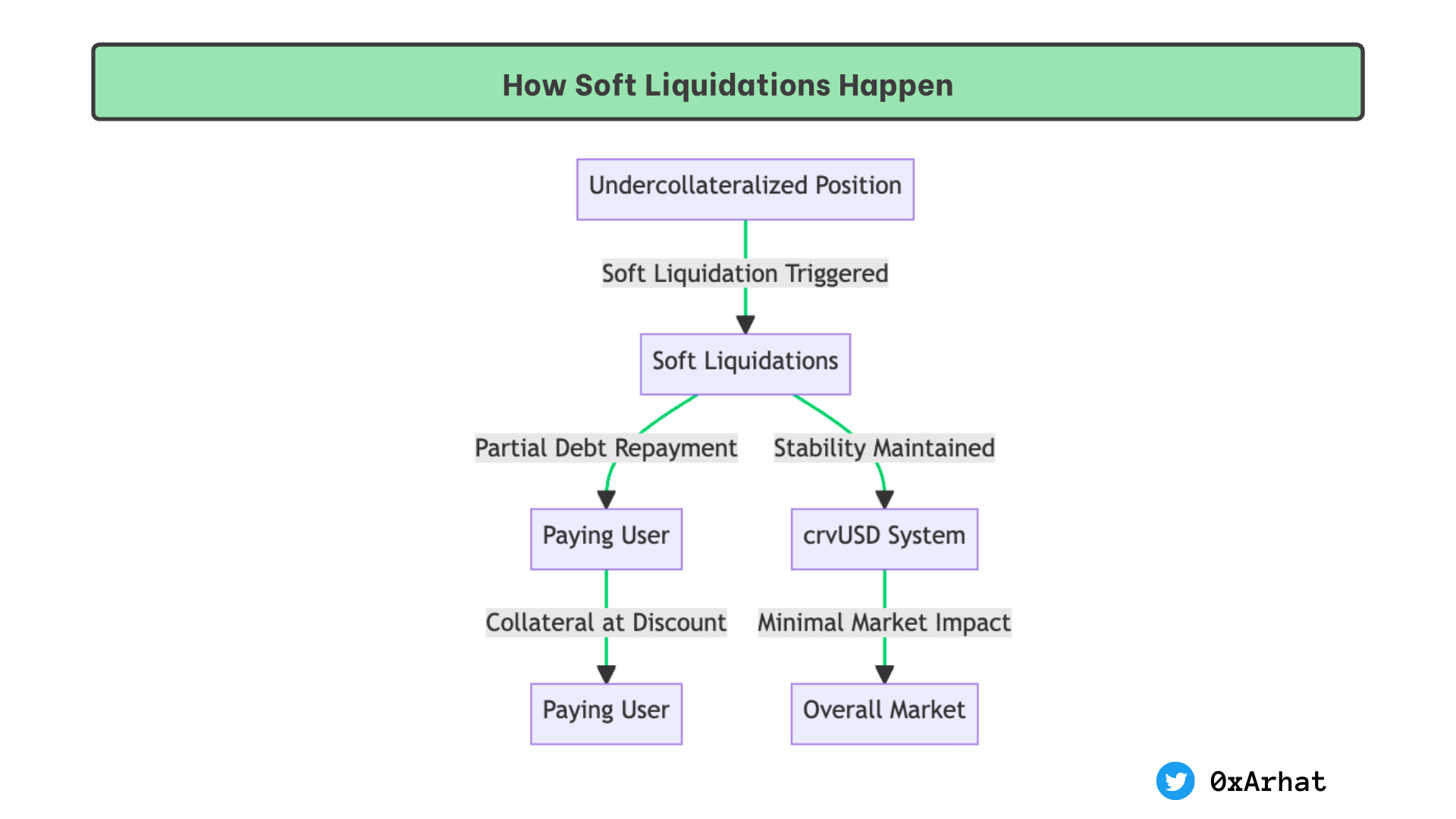

How do soft liquidations happen?

-

-

Automatic Stabilizer and Monetary Policy Mechanisms.

-

-

Risks & Benefits to crvUSD

crvUSD: What is it?

Curve Finance’s crvUSD is probably one of the most anticipated stablecoin launches. Ever since the Terra-LUNA debacle, the skepticism around stablecoins still lingers.

Curve Finance’s CrvUSD is a crypto-backed over collateralized stablecoin that is soft-pegged to the US dollar, similar to MakerDAO’s DAI.

Users can mint crvUSD by depositing collateral in a collateralized debt position (CDP), a smart contract that locks up the collateral and issues the stablecoin. Users can also burn crvUSD to get back their collateral, minus some fees.

CrvUSD uses a novel algorithm called the Lending-Liquidating AMM Algorithm (LLAMMA), designed to manage the collateralization risks of the stablecoin.

The problem that Curve Finance is trying to solve with crvUSD is the lack of a stable and decentralized alternative to fiat currencies in the DeFi space.

-

Centralized stablecoins, such as USDT, USDC, or BUSD, are backed by fiat reserves that are held by centralized entities. These entities can censor transactions, freeze accounts, or (can) manipulate the supply of stablecoins. They also face regulatory uncertainty and compliance issues in different jurisdictions.

-

Decentralized stablecoins like DAI or FRAX are backed by crypto assets deposited into smart contracts. These assets are subject to market fluctuations and volatility, which can affect the stability and security of the stablecoins. They also require liquidations, which are events where the collateral backing a stablecoin becomes insufficient to support its value, and thus has to be sold off quickly to avoid under-collateralization. Liquidations can be costly and disruptive for users, as they may lose their collateral or incur high fees.

-

Algorithmic stablecoins are not backed by any collateral but rely on algorithms that adjust the supply and demand of the stablecoins using incentives and penalties. These algorithms are complex and experimental and may only sometimes work as intended. They also face governance attacks, market manipulation, or coordination failures.

CrvUSD aims to solve these problems by offering a decentralized, over-collateralized stablecoin that is soft-pegged to the US dollar and built on Curve Finance.

CrvUSD uses a novel algorithm called LLAMMA. LLAMMA combines the functions of lending, borrowing, and liquidating in an AMM system and adjusts the amount of collateral backing each stablecoin in real time based on market conditions. This avoids the need for liquidations, which are costly and disruptive events where the collateral backing a stablecoin becomes insufficient to support its value.

CrvUSD benefits from the existing liquidity and user base of Curve Finance. Curve has a specialized AMM that uses low-degree polynomial curves to determine the prices and availability of the tokens, which allows for low fees and slippage, as well as high capital efficiency and liquidity. CrvUSD can leverage Curve Finance’s pools, fees, rewards, and governance system to enhance its utility and adoption.

CrvUSD also complements Curve Finance’s native token, CRV, which is used for governance and rewards on Curve Finance. CRV holders can lock their tokens into veCRV, which gives them voting rights, a share of trading fees, and boosted liquidity mining rewards on Curve Finance. CrvUSD will also generate fees and reward values for CRV holders and increase CRV's demand and v.

crvUSD is not an algorithmic stablecoin similar to Terra’s UST.

CrvUSD and UST have some key differences in their design and mechanism.

-

CrvUSD is over-collateralized with crypto assets, meaning users must deposit more value in crypto than they can mint in crvUSD.

UST was under-collateralized with Luna, Terra’s native token, meaning users only had to burn $1 worth of Luna to mint 1 UST. -

CrvUSD uses a novel algorithm called LLAMMA, which continuously liquidates and sells the deposited collateral to maintain a healthy collateral ratio and avoid under-collateralization.

UST used a seigniorage model, which adjusts the supply of Luna and UST to maintain the peg. -

CrvUSD is built on Ethereum, the most popular and widely used blockchain for DeFi applications.

UST was built on Terra, a blockchain specializing in stablecoins and payment solutions. -

CrvUSD benefits from the existing liquidity and user base of Curve Finance. UST benefited from integrating various Terra applications, such as Anchor Protocol, Mirror Protocol, and Chai.

Now that we have an idea of what crvUSD as a stablecoin is, I’ll be analyzing crvUSD as a Stablecoin mechanism as compared to MakerDAO & Compound.

But MakerDAO & Compound aren’t stablecoins. Why are you comparing crvUSD with them?

Although not stablecoins themselves, MakerDAO and Compound serve as stablecoin mechanisms. These platforms enable users to mint and borrow stablecoins by providing collateral.

For instance, MakerDAO lets users mint DAI, a decentralized stablecoin pegged to the US dollar, by depositing ETH or other assets as collateral. Similarly, Compound allows users to borrow USDC and other stablecoins by depositing ETH or other assets as collateral.

CrvUSD is also a stablecoin mechanism, but it differs from MakerDAO and Compound. It is a native collateralized-debt-position (CDP) stablecoin based on Curve Finance’s Lending-Liquidating AMM Algorithm (LLAMMA).

It allows users to mint crvUSD, a decentralized stablecoin pegged to the US dollar, by depositing ETH or other assets as collateral. It also enables users to liquidate undercollateralized positions by swapping collateral for crvUSD.

Existing stablecoin mechanisms, such as MakerDAO and Compound, allow users to access stablecoins by depositing crypto assets as collateral.

However, they use fixed parameters for the interest rate and the liquidation ratio that are often conservative and inefficient.

For example, MakerDAO uses a stability fee and a collateralization ratio determined by the Maker DAO governance. In contrast, Compound uses a market-based interest rate and a collateral factor determined by supply and demand.

MakerDAO uses a stability fee and a collateralization ratio determined by the Maker DAO governance. The stability fee is a fixed interest rate that borrowers must pay on their borrowed DAI, while the collateralization ratio determines how much collateral a user must deposit to borrow DAI. These fixed parameters can be conservative and may not adjust quickly enough to market conditions.

Compound uses a market-based interest rate and a collateral factor determined by supply and demand. The interest rate is based on the supply and demand of each asset in the Compound protocol, while the collateral factor determines how much of each asset can be used as collateral. However, these parameters are still fixed and may need to adjust more quickly to market conditions.

So, how would you, as a retail investor, decide which stablecoin is better for you to invest in?

Which metric do you think is the most important for a stablecoin mechanism?

I don’t think there is a definitive answer, but here’s what I’m thinking:

-

If you are a borrower who wants to leverage your collateral and maximize your return on investment, you may care more about the capital efficiency and the liquidation risk of the stablecoin mechanism.

-

If you are a lender who wants to earn interest by supplying collateral or stablecoins to the pool, you may care more about the interest rate and the security of the stablecoin mechanism.

-

If you are a trader who wants to swap between different stablecoins or other assets, you may care more about the scalability and the interoperability of the stablecoin mechanism.

-

If you are a governance token holder who wants to have a say in the direction and development of the stablecoin mechanism, you may care more about the governance model and the incentives of the stablecoin mechanism.

Let's dive into crvUSD’s design and discover how this stablecoin mechanism works.

The design of crvUSD, as described by Michael Egorov in his Curve stablecoin design paper, is based on several key concepts:

-

Lending-Liquidating AMM Algorithm (LLAMMA),

-

PegKeeper, and

-

Automatic Stabilizer and Monetary Policy Mechanisms.

So, What is LLAMA?

crvUSD follows the Lending Liquidating AMM Algorithm much different from what we saw with Terra's UST, which followed a Seigniorage algorithm.

LLAMMA is a novel algorithm to manage the collateralization risks of the stablecoin. LLAMMA stands for Lending-Liquidating AMM, which combines lending, borrowing, and liquidating functions in an automated market maker (AMM) system.

The main idea behind LLAMMA is to adjust the pool leverage of the collateral backing each stablecoin in real time based on market conditions.

This means that the supply and demand of the stablecoin and the collateral are always in sync, and liquidations are less needed.

Liquidations are events where the collateral backing a stablecoin becomes insufficient to support its value and thus has to be sold off quickly to avoid under-collateralization. Liquidations can be costly and disruptive for users, as they may lose their collateral or incur high fees.

However, LLAMMA does not eliminate liquidations entirely. It only reduces their frequency and severity by burning some stablecoins from the pool reserve when the collateral value drops and minting some stablecoins to the pool reserve when the collateral value rises. This way, the pool leverage is constantly adjusted to maintain a healthy pool collateralization ratio.

However, suppose the collateral value drops too fast or too much. In that case, LLAMMA may still need to partially liquidate some users’ positions by selling some of their collateral to buy back stablecoins and repay their loans until their collateral ratios reach the minimum threshold again. Users can also avoid liquidation by repaying some of their stablecoins loans or adding more collateral.

At the same time, LLAMMA uses a price oracle to monitor the market value of the collateral and crvUSD. when the value of the collateral drops, LLAMMA converts some of the collateral into crvUSD to maintain stability and prevent liquidation. Conversely, when the value of the collateral rises, LLAMMA converts some of the crvUSD back into collateral to maintain stability. This process is automated and continuous, with LLAMMA adjusting the ratio of collateral to crvUSD based on market conditions in order to maintain stability.

By doing so, LLAMMA ensures that the collateral ratio of crvUSD stays above a certain threshold, which is determined by a risk parameter that governance can adjust.

The collateral ratio is the ratio between the total value of the collateral and the total value of crvUSD.

-- A higher collateral ratio means that crvUSD is more secure and stable but also more expensive to mint.

-- A lower collateral ratio means that crvUSD is cheaper to mint but also more risky and volatile.

LLAMMA is designed to provide a scalable and efficient solution for creating a decentralized stablecoin that can be used in various DeFi applications. By replacing liquidations with a continuous process of selling and buying collateral, LLAMMA aims to reduce the volatility and complexity of managing a stablecoin system.

CrvUSD improves upon existing stablecoin mechanisms by using a dynamic interest rate and liquidation ratio that adjust to market conditions.

Dynamic interest rate* incentivizes users to deposit or withdraw their funds based on market demand, which helps maintain stability and avoid liquidations as much as possible. The mechanism works by adjusting the interest rate for borrowing crvUSD (the stablecoin) based on the supply and demand of crvUSD and the collateral.*

LLAMMA also uses it to respond to market conditions and adjust quickly based on real-time data. This helps ensure that users are always incentivized appropriately based on market demand, which helps maintain stability and avoid liquidations as much as possible.

The LLAMMA converts between collateral (such as sfrxETH) and crvUSD in a continuous liquidation/de-liquidation process, but it does not directly adjust the dynamic interest rate or liquidation ratio.

LLAMMA also introduces the feature of PRICE BANDS

In LLAMMA, price bands are used to determine the appropriate allocation of collateral between crvUSD and volatile crypto assets.

When a user deposits collateral and borrows a stablecoin, the LLAMMA smart contract calculates the bands where to locate the collateral. The bands are determined based on the current market conditions and can adjust in real-time as market conditions change.

Suppose the LLAMMA system has three bands for borrowing crvUSD against ETH collateral:

-

Band 1: 150% to 170% Collateralization Ratio (CR) - Low risk

-

Band 2: 130% to 150% CR - Medium risk

-

Band 3: 110% to 130% CR - High risk

If a user borrows crvUSD with ETH as collateral, they must first choose the collateralization ratio within one of these bands. This ratio determines the debt they can take and the amount of crvUSD they can borrow against their ETH collateral.

When the price of ETH changes, it converts into crvUSD if it falls below a certain band. For example, if ETH falls below the lower limit of Band 1 (150%), some of the ETH will be automatically converted into crvUSD until the required collateralization ratio is maintained. This process continues until all of the ETH has been converted into crvUSD or until the price bounces back up above a certain threshold.

By using price bands in this way, LLAMMA can ensure that there is always enough crvUSD available to cover any potential losses due to market volatility while allowing for more efficient use of collateral.

The lower band and upper band ranges are critical components for maintaining the stability of a stablecoin, such as crvUSD. These two bands represent a range within which the stablecoin's price should ideally stay.

-

Lower Band: If the price of the stablecoin falls below the lower band, LLAMMA will convert some of that collateral into more crvUSD to maintain stability.

-

Upper Band: If the price of the stablecoin rises above the upper band, LLAMMA will convert some of those stablecoins back into more collateral.

In this diagram: LB represents the lower band, while UB represents the upper band.

-

If the price drifts towards LB, the PegKeeper increases the liquidation ratio (LiqRatio↑) and decreases the borrow rate (BorrowRate↓). This aims to reduce the stablecoin supply and bring the price back to the target value.

-

If the price drifts towards UB, the PegKeeper decreases the liquidation ratio (LiqRatio↓) and increases the borrow rate (BorrowRate↑). This aims to increase the stablecoin supply and reduce the price, bringing it back to its target value.

The bands serve as a reference for the PegKeeper mechanism to adjust key parameters and maintain stability in the stablecoin's price.

For Example,

Let's say a user deposits 100 ETH as collateral and borrows 10,000 crvUSD. The LLAMMA smart contract calculates the bands where to locate the collateral based on market conditions.

Suppose the LLAMMA system has 3 bands for borrowing crvUSD against ETH collateral:

Band 1: ETH price between $1900 and $2100

Band 2: ETH price between $1700 and $1900

Band 3: ETH price below $1700

If the price of ETH is currently $2000, then all of the user's collateral will be in Band 1. If the price of ETH drops to $1800, then some of the collateral will be converted into crvUSD to maintain the required collateralization ratio.

Specifically, enough ETH will be converted into crvUSD to cover any potential losses if the price were to drop further.

If the price of ETH drops further to $1500, then more of the collateral will be converted into crvUSD. This process continues until all the collateral has been converted into crvUSD or until the price bounces back up above a certain threshold.

By using bands this way, LLAMMA can ensure that there is always enough crvUSD available to cover any potential losses due to market volatility while allowing for more efficient use of collateral.

These bands are used to maintain a healthy collateralization ratio and avoid under-collateralization without relying on traditional liquidations.

However, suppose the price of the collateral drops too quickly and falls outside of the designated band. In that case, this can trigger a soft liquidation or an external liquidation if coverage is too close to dangerous limits.

This helps ensure that there is always enough collateral backing each stablecoin to maintain stability and avoid under-collateralization.

Capital efficiency measures how many stablecoins a user can mint with a given amount of collateral. A higher capital efficiency means that the user can borrow more stablecoins with less collateral, which increases their leverage and return on investment.

Liquidation risk is the probability that a user’s position will be liquidated due to a drop in the collateral value or a rise in the interest rate. A lower liquidation risk means the user can avoid losing collateral and paying a liquidation penalty.

So, How does crvUSD maintain its peg?

Due to market volatility, the price of crvUSD may deviate from its target value, and while crvUSD does maintain its peg, it does so through a combination of different mechanisms.

The primary mechanism for maintaining the peg is the PegKeeper algorithm, which adjusts the interest rate and liquidation ratio based on the supply and demand of crvUSD to keep its value stable relative to the USD. This helps to balance the supply and demand of crvUSD and ensure that its value is backed by sufficient collateral.

Collateralization is also an essential mechanism for maintaining the peg. Users who want to mint crvUSD must first deposit collateral (such as ETH) into a smart contract as security. The amount of collateral required depends on the current liquidation ratio, which the PegKeeper algorithm sets. This ensures there is always enough collateral backing crvUSD to maintain its value.

Finally, soft liquidation is used as a last-resort mechanism to maintain the peg. If a user's position becomes undercollateralized (i.e., their collateral value drops below a certain threshold), their position will be partially liquidated in a way that minimizes losses for both the user and the system. This helps to prevent sudden drops in collateral value from destabilizing the system and causing crvUSD to lose its peg.

-

When collateral falls below a certain threshold, the soft liquidation mechanism starts.

-

Instead of forcibly liquidating the collateral, other users are incentivized to repay the debt at a discount.

-

The user partially repays the debt and receives a portion of the collateral at a discounted rate.

-

The process helps maintain stability and reduce the harsh impact of forced liquidations on the market.

This soft liquidation process ensures a more gentle approach to dealing with under-collateralized positions in the crvUSD stablecoin system and minimizes the risk of severe market disruptions.

Collateralization involves locking crypto assets in an LLAMMA pool to mint crvUSD. The collateral assets guarantee the value of crvUSD and act as a buffer against price volatility. The collateral ratio is the ratio between the collateral's value and the crvUSD debt's value. A higher collateral ratio means that the crvUSD is more secure and stable, while a lower collateral ratio implies that the crvUSD is more risky and volatile.

Interest rate adjustment changes the interest rate that users have to pay on their crvUSD debt based on the supply and demand of crvUSD. The interest rate affects the incentive for users to mint or burn crvUSD. A higher interest rate means that users must pay more for borrowing crvUSD, which discourages minting and encourages burning. A lower interest rate means that users must pay less for borrowing crvUSD, which encourages minting and discourages burning.

Soft liquidation converts collateral into stablecoins using a special-purpose AMM when the collateral ratio falls below a certain threshold. Soft liquidation reduces the crvUSD debt and increases the collateral ratio, which restores the stability and security of crvUSD. Soft liquidation also avoids abrupt and forceful liquidation events that could cause market shocks or losses for users.

What is the PegKeeper Mechanism?

The PegKeeper is a concept used in the design of LLAMMA to help maintain the peg between the stablecoin and its target price. When the price of the stablecoin deviates from its target price, the PegKeeper can take action to bring it back in line.

It is a single smart contract responsible for minting and burning crvUSD tokens in response to changes in demand.

and how does it help maintain the peg between the stablecoin and its target price?

When the price of crvUSD rises above $1, the PegKeeper mints new crvUSD tokens and deposits them into a Curve pool between the stablecoin and a redeemable reference coin or LP token. Specifically, when the price of the stablecoin rises above its target price (i.e., when ps > 1), an asymmetric deposit forms a peg-keeping reserve into a stableswap Curve pool between the stablecoin and a redeemable reference coin or LP token. Once ps > 1, the PegKeeper contract is allowed to mint uncollateralized stablecoin and deposit it to the stableswap pool single-sided in such a way that the final price after this is still no less than 1.

Conversely, when the price of crvUSD falls below $1, the PegKeeper withdraws existing crvUSD tokens from the Curve pool and burns them. Conversely, when the price of the stablecoin falls below its target price (i.e., when ps < 1), the PegKeeper is allowed to withdraw (asymmetrically) and burn the stablecoin. This helps reduce supply and increase demand for the stablecoin, which can help bring its price back up toward its target.

ELI5

Imagine you have a piggy bank where you keep your money. You want to make sure that you always have the same amount of money in your piggy bank, but sometimes you accidentally spend some of it, or someone gives you extra money.

The PegKeeper is like a helper who watches your piggy bank and makes sure that you always have the right amount of money in it.

If you accidentally spend too much money and don't have enough left in your piggy bank, the PegKeeper will give you some extra money to put back in.

And if someone gives you too much money and your piggy bank has more than it should, the PegKeeper will take some of the extra money out.

The goal is to make sure that your piggy bank always has the right amount of money in it, just like how LLAMMA stablecoins aim to keep their price close to their target value with the help of the PegKeeper!

In PegKeeper’s design, Automatic Stabilizer and Monetary Policy mechanisms also play crucial roles in maintaining the stablecoin's value and ensuring its long-term stability.

Let’s explore each in detail.

Automatic Stabilizer

This mechanism is the interaction between the LLAMMA and PegKeeper.

The Automatic Stabilizer's primary goal is to maintain the crvUSD's intended peg value, and it does so with the help of LLAMMA's asymmetrical conversions between collateral and crvUSD.

As the collateral price rises, more deposits are converted to collateral, and when it falls, the deposits are converted back to crvUSD.adjustment mechanism ensures that the stablecoin's value remains stable without requiring any manual intervention.

This automatic adjustment mechanism ensures that the crvUSD’s value remains stable without requiring any manual intervention.

Monetary Policy

The Monetary Policy mechanism helps manage crvUSD's supply, issuance, and other aspects to ensure long-term stability and value.

For example, when crvUSD's price is greater than the 1:1 peg (e.g., due to increased demand), the PegKeeper mints uncollateralized stablecoin and deposits it into the stableswap pool, maintaining the price at no less than 1.

In contrast, when the crvUSD price is below the peg, the PegKeeper withdraws asymmetrically from the stableswap pool and burns the stablecoin to appreciate its price. This dynamic Monetary Policy helps maintain the crvUSD peg while managing its supply in a responsive and efficient manner.

This diagram showcases how the PegKeeper interacts with the Stableswap Pool when the crvUSD price goes above or below the intended peg.

When the crvUSD price is greater than 1, the PegKeeper mints uncollateralized stablecoin and deposits it into the Stableswap Pool, which prevents the price from going below 1.

Conversely, when the crvUSD price is below 1, the PegKeeper withdraws asymmetrically from the Stableswap Pool and burns the stablecoin, appreciating its price and moving it closer to the intended peg.

Together, Automatic Stabilizer & Monetary Policy work like this:

In this diagram:

-

If the crvUSD price (ps) is greater than 1, the PegKeeper mints uncollateralized stablecoin and deposits it into the stableswap pool. This helps maintain the price no less than 1.

-

If the crvUSD price (ps) is less than 1, the PegKeeper withdraws asymmetrically and burns the stablecoin. This helps appreciate the price.

-

A "slow" mechanism is also used for stabilization through the varying borrow rate (r), which changes as the crvUSD price (ps) changes, ensuring that the rate remains within a stable range.

So this is how crvUSD maintains its peg

crvUSD also carries higher risk due to its reliance on liquidity pools and the PegKeeper mechanism for maintaining price stability.

crvUSD is tied to the US dollar through liquidity pools and the PegKeeper mechanism, but this approach is riskier than other stablecoins that use traditional collateralization methods.

One of the main risks associated with crvUSD is liquidity risk. Since crvUSD relies on liquidity pools to maintain its peg, any disruptions in these pools can lead to price instability.

For example, if there is a sudden increase in demand for crvUSD and the liquidity pool cannot keep up with this demand, the price of crvUSD may rise above its peg. Conversely, if there is a sudden decrease in demand for crvUSD and the liquidity pool has excess supply, the price of crvUSD may fall below its peg.

Another risk associated with crvUSD is smart contract risk. Since crvUSD is implemented as a smart contract on the Ethereum blockchain, any vulnerabilities or bugs in this smart contract could potentially be exploited by attackers. This could lead to loss of funds or other security issues.

Regarding LLAMMA, one of the main risks associated with this algorithm is market risk. Since LLAMMA relies on converting collateral into stablecoins based on market conditions, any sudden changes in market conditions can lead to significant losses for users who have deposited collateral into the system.

Additionally, there is also some risk associated with external liquidations. If a user's collateral falls below a certain threshold and LLAMMA cannot convert it into stablecoins quickly enough to maintain stability, an external liquidation may occur. This could result in significant losses for the user whose collateral was liquidated.

Overall, while both crvUSD and LLAMMA have been designed to minimize risks as much as possible, there are still some inherent risks associated with using these systems that users should be aware of before depositing funds into them.

Although, crvUSD can offer several benefits:

-

Providing more liquidity and stability to the Curve ecosystem, as crvUSD can be used as a base currency for swapping and lending other stablecoins.

-

Reducing the reliance on centralized stablecoins, such as USDC and USDT, which are currently exposed to regulatory and security risks.

-

Increasing the utility and value of CRV, the native token of Curve Finance, as CRV holders can participate in the governance and risk management of crvUSD.

-

Creating new opportunities for arbitrage and yield farming, as users can exploit price differences and interest rates between crvUSD and other stablecoins.

As CrvUSD is still in its early stages of development and testing, and Curve Finance plans to launch it on the mainnet soon, let’s hope all goes well.

Thank you for reading through, and subscribe below for regular post updates.

I’d also appreciate it if you shared this with your friends, who would enjoy reading this.

You can contact me here: Twitter and LinkedIn.

If you find this deep dive analysis useful, please consider donating to 0x34ddd9223D9DDb6B56F640824Af6FCC31e1deBF4 and/or by minting an NFT for this & other blog posts by me.

My previous research: