Ethereum has faced an avalanche of FUD on crypto Twitter over the past weeks. As BTC hovers near ATHs, ETH is about half what it was at the peak of last cycle. This is despite approval for an ETF and other regulatory tailwinds that should be fueling growth. Common bear arguments include value capture being cannibalized by L2s and slow execution of Ethereum improvement proposals.

People are wondering: where does ETH derive its value? And a primary question is whether ETH is money. Money is defined as “a liquid asset generally accepted to facilitate transactions of value.” I’m going to break down the various users of Ethereum and how well ETH functions as money for them – now, and going forward. I argue ETH is exchanged as “money” for transactions within the Ethereum ecosystem, but is closer to a speculative investment.

ETH users by category

Let’s examine each group that owns or interacts with ETH and consider the “money-ness” of ETH:

-

Retail

-

DApps & L2s

-

Market Makers

-

Borrow/lend Protocols

-

Long Term Investors

-

Future: AI Agents (will tackle this at the end)

Retail Users

Retail users are everyday people using blockchains. These could be people using dApps on Ethereum’s L1 or L2s, people speculating on various crypto assets related to the Ethereum ecosystem (including governance tokens or NFTs).

Ethereum is the biggest ecosystem within crypto and most Ethereum applications & L2s use ETH for core actions & gas fees. It’s increasingly common for protocols to have their own native token that’s used for governance and sometimes other core actions. USDC and other dollar denominated stables on Ethereum are also being accepted as forms of payment more and more, but Ethereum validators need to be paid in ETH so it’s hard to separate an Ethereum application from ETH as payment entirely.

For users of Ethereum applications, ETH is widely accepted and used as a medium of exchange. That said, many or most of these retail users only keep enough ETH in their hot wallets to be used for the applications they expect to interact with. And then they may also separately have a long-term position as a speculator, which I’ll touch on later. These users know that ETH is a speculative asset that is volatile and is not a replacement to holding dollars, even if it’s forced to be used as a currency in the ecosystem.

As time goes on and we reach the early/late majority of crypto, many retail users may not want to hold any ETH or other speculative crypto assets at all. This will necessitate abstracting the use of Ethereum and other crypto assets – for instance allowing users to instantaneously onramp and offramp from USD or instantly swap from stables to complete a transaction with ETH.

DApps & L2s

As mentioned above, many protocols require ETH for core actions on their network and collect fees in ETH. While in earlier bull markets like 2020, many teams chose to hold treasuries in ETH, now it’s become much less popular to do so. E.g. ENS DAO had close to 100% of its treasury in ETH, but from late 2021 to early 2023, the value of ETH declined from ~$4,600 to ~$1,500, wiping out ⅔ of the treasury’s spending power in dollars. As such, in Feb 2023, the DAO passed a proposal to sell 10k ETH and diversify the treasury. Many other projects have done similar, or simply chosen to hold the entire treasury in dollars.

The dollar rules the effective cost of talent & other expenses – holding a treasury in dollars enables teams to better plan around expenses. ETH can still be “money” in the sense it may be the core way many of these protocols receive funds, but it is not how they choose to hold a balance of funds. Similar to a US business that does business with Argentina, accepting pesos, but then converting that money into dollars to hold it.

Market Makers

Market makers provide liquidity across centralized exchanges (CEXs) and decentralized exchanges. This ensures there is always a buy and sell side for assets, reducing price slippage for other traders. ETH is the second largest cryptocurrency and is a primary trading pair for market makers. While ETH’s volatility offers arbitrage opportunities for market makers, they also have to carefully hedge positions to avoid significant losses. Increasingly, market makers are using stablecoins (e.g. USDC or USDT) alongside ETH to maintain liquidity & settle trades without exposing themselves to the price fluctuations of ETH. ETH is treated more as a trading instrument than a stable medium of exchange.

Borrow / Lend Protocols

In borrow/lend protocols, borrowers are borrowing various crypto assets by depositing other assets as collateral (e.g. borrowing USDC by depositing ETH as collateral). USDC/ETH is one of the most common pairs in borrow lend/protocols like AAVE. There are a few primary reasons for this – borrowers want access to dollars without paying capital gains taxes on their appreciated ETH, borrowers want to maintain ETH exposure while spending, and borrowers can’t pay for most things with ETH.

As crypto gets more widespread, it’s possible that most offcahin vendors start to accept ETH as payment, eliminating the need to borrow dollars for most use cases. For the borrowers now and going forward, ETH is still being treated predominantly as an investment asset. Similar to someone holding a public company stock and borrowing against it.

Long-term Investors

Some folks are explicitly buying ETH to hold it and sell it later. These are people who want upside to Ethereum growing and treat it as an investment asset similar to public market securities. ETH is not “money” for these investors, at least with these holdings. These same investors may also overlap with retail users (e.g. transferring ETH from cold wallets to do shorter term speculation on alt-coins or NFTs, or using ETH in a hot wallet to interact with applications). But the vast majority of these assets for this group are treated as an investment asset, not money.

Conclusion: ETH is exchanged as “money” for transactions, but is closer to a speculative investment

Let’s zoom out. ETH can be used as a medium of exchange to execute a transaction (e.g. retail users interacting with ETH-based DApps). But by and large, ETH is not treated as money, and the reason for that is simple: ETH might go up a lot, and is volatile. The upside of ETH makes it difficult to be treated as a currency. Speculators don’t want to spend their ETH, and non-speculators don’t want to hold it. Outside of being used for the purposes of a transaction, those who don’t want ETH beta would prefer to hold dollars.

However we see similar things with fiat currencies in emerging economies in the web2 world. Most US businesses wouldn’t want to hold Argentinian pesos, for instance. Rather US businesses may collect money from other countries in their respective currencies, but then quickly convert those currencies to dollars. That doesn’t mean Argentinian pesos aren’t money, and within the Argentinian economy, pesos are exchanged more than dollars. However most people would prefer another type of money (US dollars or something that traces close to the US dollar from another leading nation state), and that’s okay. Even the Argentinian people & businesses may prefer to hold money in dollars rather than pesos to avoid exposure. There’s no reason to think the crypto economy should be any different.

As crypto continues to reach mainstream adopters, ETH will continue to be used as a medium of exchange within the Ethereum ecosystem, but most stakeholders may prefer to hold US-dollar denominated stables. Similar may be true for other crypto ecosystems as well, where the native token is used as a form of currency locally, but predominantly for transactions themselves versus a base currency people hold as “cash.” The more volatile crypto is (e.g. when looking at behavior after crashes of Terra, 3AC, and FTX), the more on-chain actors choose to hold stablecoins.

Post-Script: What digital medium of exchange will dominate the next era?

One way to answer this question is “who will be using blockchains the most and what will they care about?” After all, it’s American industry & businesses that make the dollar prevail - the dollar is valuable because American businesses are valuable. For now, most blockchain usage is from humans, particularly web3 natives and people in developing markets. But as autonomous AIs (“AI agents”) continue to improve, they are likely to use digital currency as their primary means to transact (essay on that here). AI agents don’t have a social security number to open a bank account or a credit card, and digital money comes with far fewer restrictions.

If we assume AI agents work, over the next 5-10 years, AI agents are likely to become the majority of onchain activity, in the same way quantitative trading has become the majority of trading activity. So really, the way to answer the question about what will be the prevailing digital “money” requires answering “what type of money will AI agents want to use?”

AI agents will use whatever cryptocurrency is the combination of fastest, cheapest, and most convenient. That will likely start as USDC or USDT but continue to swap as soon as a better technology comes out (agents are perfectly logical and have near 0 switching cost). The game theory dictates that agents would constantly be switching to different technologies & tokens (perhaps even swapping back and forth between stablecoins and governance tokens with sufficient liquidity). Agents are smart — they may hold value in stablecoins or Bitcoin, and then instantly swap to the best blockchain’s token purely for transaction execution, swapping back to the “value hold” currency afterwards. This is already how most people treat ETH & SOL today, as discussed above. This is an unstable future with no equilibrium.

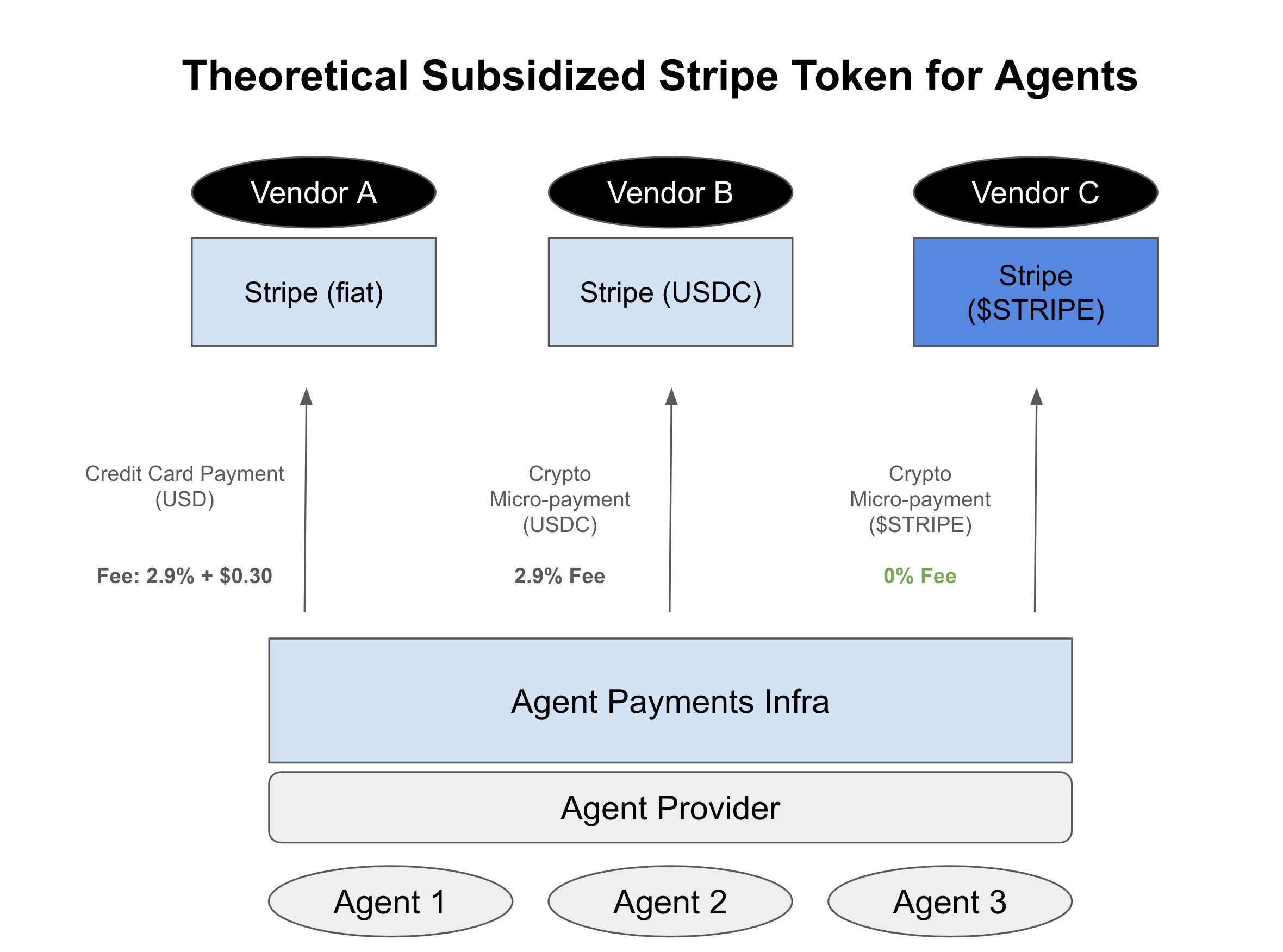

The only way to ensure a stable equilibrium for the currency these agents use, outside of a durable technological edge of a single chain, is a significant subsidy on a certain currency that makes it uneconomical to use anything else. I.e. it’s much cheaper to use a particular token vs. any stablecoin. However, who can financially support such a subsidy?

I’d propose that it’s possible we see a single dominant, subsidized currency launched by a critical piece of infrastructure around flow of funds (think Stripe, Visa, or the AI agent comparable). That’s because the payment software eats transaction fees on every purchase, and could simply reduce transaction fees to zero or near-zero for a native token (imagine Stripe charging 3% for sending USDC, but 0% for sending STRIPE -- a native token, every agent would use STRIPE). It’s possible that there’s no durable, critical piece of infrastructure like this -- perhaps software & payment networks get competed to zero. But if Stripe, Visa, or a new upstart can build a sufficient moat, that will be the best basis for a consistent, dominant cryptocurrency in the digital age.