Nowadays, People are talking about customer experience and making crypto accessible to billions which definitely is something missing and different Dapps and protocols are working to alleviate these pain points.

But, one should go a step beyond that and ask oneself what's the end destination. Once a user enters a crypto labyrinth through one of those seamless UX portals then what’s that curious mind searching for?

They are chasing for yields definitely but what is at the core which unlocks a box of new ideas for them and make their mind racing and heart excited for having found a new way of financial markets unlike anything ever seen before their life. (Remember that time when you first explored Defi).

The appeal lies in the fact that anyone, anywhere in the world, can explore these crypto money markets without state boundaries, participating as non-state and non-sovereign individuals in this new decentralized finance ecosystem. Additionally, the transparency and control over their finances, along with the opportunity to vote on proposals through decentralized applications (Dapps), are significant draws. Acquiring governance tokens gives them the power to influence decisions, making their vote feel impactful and meaningful for the first time.

As Bankless Co-founder has iterated again & again about bringing users down the funnel to becoming active on-chain participants. By, owning an ETF which is a US-issued fund instrument with definite state restrictions on who can participate, will not leave a good and a lasting impression while seeking exposure to crypto markets because of the highly volatile nature. That’s where Blackrock and other funds are working towards launching more & more tokenized products which can be easily accessible on-chain.

For me, one of the coolest things which got me hooked was these stablecoin protocols. Stablecoins are like mini central banks with decentralized monetary policies, managing supply and demand through community incentives. Even if someone has never traded forex, stablecoins are sure short way to get one excited about arbitraging stablecoin prices when they deviate from the peg. For someone from a developing country, minting and holding a dollar backed by their chosen asset is empowering.

It’s clear to a lot of us that defi legos are the real deal with some unique experience. Degen is increasingly becoming a new way of life in crypto and infact it has become a kind of badge of honor for some. It’s also a term that encapsulates the spirit of crypto community in some sense by their willingness to challenge the status quo. That’s the reason you see unproven projects reaching billions in TVL within a short span of time. I believe that this is a future of product experience. World is and has always been built with a degen spirit

The case of Olympus DAO

In my mind, Olympus DAO has been the pinnacle of Defi degen experience!

Good for some and bad for others !

People left with mixed feelings and emotionally bursting experiences. There were definitely some ponzi components but people had a nice experience with the product and the early ones made big bucks by not just relying on Olympus token price alone and instead taking calculated risks by calculating the probability of price decrease over coming days and the inflation happening constantly.

Autonomint’s new Defi primitive

We are bringing a new Defi primitive to the space called decentralized credit default swaps (dCDS) where this degen spirit has been respected and explored further. We have created an omni-chain stablecoin which we call as ‘Colored Dollar’ and as per our simulations earlier, we estimated pure stablecoin yields nearing to 200% for users participating in dCDS product with some definite risks of course. These risks wash away as more people borrow/mint stablecoins or even if the existing users stay and extend their borrowing. Here is a snapshot, where APYs for a particular deposit in testnet in dCDS reached as high as 297%

**What if there was no stablecoin invented back in 2014?

**

Now before I discuss our stablecoin protocol and the dCDS concept, I would like you to imagine for a moment that no stablecoin exist in the world currently and then we uncover what is the cost of achieving a stable store of value in this imaginary crypto world.

Stablecoin was ultimately started as a necessity to hedge across crypto/token volatility when you have fulfilled your desires of profit or lost your enthusiasm towards a particular token and ultimately would like to explore other opportunities. But, in the meantime you would like an illusion of stability in some on-chain asset without needing to convert to cash and pay those extraordinary entry & exit fees everytime.

A hedging mechanism like this is also seeked by arbitrage traders when some opportunity is presented for discrepancies in prices between different exchanges ( DEXes or CEXes). So, this basic need of traders who otherwise would have to sell an asset in one exchange and convert to cash and transfer to another exchange which can take more than 24 hours due to bank procedures in between.

Also, people living in high-inflation countries just needed a way to preserve their wealth nothing more nothing less. They needed a simple store of value that doesn’t inflate away like their national currencies and destroy all their savings. Thus, born a dire need for a product like stablecoin.

But ultimately, in all of the above cases it’s basically a need for a very cheap hedging mechanism to preserve one’s wealth before they venture again into crypto wild west and wear their degen hat.

So, now continuing with our thought experiment of no stablecoins existing and then exploring the creation of illusion of stability on-chain.

One approach could have been is giving the right to the user to buy/sell a particular token at a $1 price. So, essentially if you would like to sell a volatile crypto/token on-chain, then with above approach, you can buy 1000s of minutes worth of put options giving you the right but not the obligation to sell a particular token at $1 at the end of every minute ( I have taken minute here but for arbitrage traders it might be seconds although blockchain tx speeds weren’t feasible enough at that time to require to facilitate that along with the gas fees cost being used).

Around 2019 time, Convexity also released a paper on utilizing option Tokens for buying protective puts on DAI de-pegging from 1 USDC. The counterparty to this trade would be the one who sells these options contracts for some premiums. Usually, these options or derivative contracts use a stable medium as a mode of settlement but since we are assuming that no stablecoins exist, so probably a volatile token has to be utilized as a mode of settlement. Alternatively, cash in a bank account can be used as collateral.

If you currently go to Deribit now

1. The premium for a put option on ETH ATM (At the Money) for 1-week expiry is ranging around $100

2. ETH has an implied volatility ranging around 55% to 58%.

3. Options have some of these financial measures of sensitivity called greeks which measure the change in option prices with different factors. One of those Greeks is ‘Vega’ which measures the change in option price for every 1% change in implied volatility. Currently, above ETH option with 1-week expiry has a vega of 1.5. So, for every 1% change in implied volatility (IV) of ETH the option price increases by 1.5

Now, it is fair to assume that a stablecoin put option would have far less implied volatility probably ranging at 0.5% - 1%

So, doing some back of the napkin calculations here

1 week = 10080 minutes

Since, a 1% change in IV leads to a $1.5 change in ETH option price per week (10080 minutes)

So, assuming a stablecoin with 55 times less IV to have 55 times less change in option price. The change in option price comes to about $0.02 ( We are disregarding some factors here but broadly this will be range)

Per minute put option pricing of stablecoin = $0.02/ 10080 minutes = $0.0000019 per minute

The cost of holding the stablecoin for the entire year (525960 minutes) comes to about $1.04

So, essentially the cost of holding a $1 stable store of value on-chain is $1 for an entire year. That’s like a 100% fees (APR) on a stablecoin. What above illustrates that you cannot mint money out of thin air (Dokwon laughing…)

Ultimately the costs of minting will be realized fully. However, one of the big difference here is no requirement of collateral while buying option contracts as options can easily be rolled over to the next minute.

Currently, the cost of borrowing stablecoins in decentralized CDP designs is ranging between 1% - 9% along with a high amount of collateral backing requirement. Here also you are buying a kind of put option that gives you the right to redeem the stablecoin always at $1. If the stablecoin price is trading at $0.99 then you can buy stablecoin from the market and redeem it for $1 with the protocol. But how come the costs are very less here or who is bearing the missing costs ?

Here, the risks are distributed across different parties by redistribution of volatility costs across parties. Some of the costs distributed across participants are

-

In collateralized CDP designs, Arbitrageurs incur transaction fees and slippage costs when exploiting price discrepancies. They bear market risks and the potential for losses if the price moves against them.

-

The protocol incurs operating costs, including maintenance, development, and governance.

-

The protocol manages the systemic risk of under-collateralization, which can lead to insolvency and accordingly they have to incentivise a system of keeper networks or Market Maker Keeper bots who can act accordingly.

-

This incentivisation is done by taking 8% - 12% of collateral as liquidation gains which are then split between keeper and protocol. They also have to pay with token incentives. But, ultimately the costs are being borne by the stablecoin borrower/minter as his/her collateral can get liquidated.

-

Costs incurred while dishing out economic incentives/ rewards for users and liquidity providers to help maintain participation and system stability. Programs like liquidity mining and staking rewards distribute protocol tokens, which can be sold or held for additional income. It’s not purely a free market as participants hold governance tokens and they can take decisions through governance tokens voting in advance as per the risks foreseen or encountered.

-

Also, since users can now earn staking yields on their collateral so the opportunity cost is somewhat covered with those yields with the potential to keep the upside.

-

This lower cost is also achieved partially with overcollateralized backing of a stablecoin with a promise of redemption always and in order to execute on that promise and acquire people's trust, the protocol needs a high liquidity collateral which can be easily liquidated as well.

So, that’s how with the power of decentralization, a low cost stablecoin protocol is created by spreading the risks among different decentralized parties. In centralized or government backed mechanisms, obeyance with social construct and laws helps reduce the risk to very low levels but that gives extraordinary power to an entity to control the future of money which was responsible for destabilizing the social construct in the first place.

Imagine, going to a bank and instead of borrowing money against collateral, you would ask them to write you 525960 worth of put option contracts of some stock with the strike price being the current price (ATM). Then the bank would have to create a securities account and write those option contracts with the collateral backing being the cash deposited by depositors. The cash deposits are liability for the bank and a cost of enabling this transaction. But the person buying option contracts won’t need to deposit any collateral and these options can rollover every minute.

As of now, we have discussed the cost of achieving stability in crypto markets.

Now, we explore the cost of building a decentralized network where non-state and non-sovereign actors can come together to form a mini economy central bank a.k.a. stablecoin protocol

Autonomint’s Omni-chain ‘Colored Dollar’ $USDa

In this blog, I propose how to create a synthetic stablecoin that can leverage the power of existing crypto trust networks created by different projects and utilize them as a secondary protection mechanism or backing before we utilize our governance & utility token to manage the volatility.

As I have discussed earlier, the cost of stablecoin minting & borrowing on-chain is spread across different decentralized actors and that’s how projects create the illusion of stability for stablecoins. It allows users to mint the stablecoin at a low cost as would have been possible otherwise. But the biggest cost currently for users is the over-collateralization of stablecoin and the costs incurred of losing collateral during heightened volatility and that too at a high price which are then split as gains among keepers and protocol.

Here is Maker about to dump $600 mln in ETH which could have lead to further cascading liquidations and high losses for users.

This is an excess cost for the users because let’s be real when someone takes a stablecoin loan then they don’t just intend to hold it and instead would like to utilize the same to explore yields in either other protocols or use it for paying their operating expenses in daily life while they await their salaries or dividends from existing asset, or cash flows from his small scale business.

Infact one of the core reasons, existing decentralised stablecoin or lending protocols are not able to scale or utilized by businesses to borrow working capital against their crypto assets is the possibility of getting liquidated prematurely and requiring to overcollateralize further to keep a buffer in-case something happens.

The total liquidatable amount sitting at within 20% range is $84.7 mln out of $1.5 bn total Liquiditable amount. This highlights the high buffer of $1.415 Bn which stablecoin borrowers need to keep to not get liquidated prematurely.

Most of the businesses deploy the borrowed working capital and receive cash flows quarterly or after a 6-month period from downstram supply chain. The others receiving monthly cash flows need to account for salaries and other variable expenses to be paid by month/quarter end. So, if we look deeply then the biggest cost for user and stability of stablecoin is the opportunity cost in terms of over-collateralization and that arises from high volatility of the asset and if protocols reduce collateralization ratio then that’s just inviting potential instability for stablecoin and more frequent liquidation losses.

How about we try to tackle this volatility of assets?

Autonomint protocol has created an omnichain stablecoin $USDa that is minted based on a collateralized architecture similar to CDP design. Users can mint upto 100% in synthetic value in stablecoin across multiple chains and bridge them across to capture incentives across chains. Every borrowing position is attached with a combination of a put option and call option on collateral deposited by the user. The counterparty to this derivative trade are dCDS users who act as option sellers. We are able to create an in-house delta-neutral architecture through this mechanism where the delta price variation of collateral are being handled inhouse. The protocol is designed in a way that we can also integrate with external hedging mechanism like initiating a Short Perp position across exchanges.

Derivatives have been utilized from past many decades in the TradFi space to hedge against volatility and uncertainty. Even airlines use derivatives to hedge oil prices while simultaneously using oil as utility in their operations.

That's why at Autonomint, we've made derivatives more accessible for stablecoin users. Instead of offering derivatives on stablecoin depegging, which can be costly for users minting stablecoins and unappealing for option sellers, we provide an alternative. We allow users to hedge the volatility of the crypto collateral backing stablecoins by purchasing a combination of put and call options on the collateral.

Now I know, you will say that who is going to cover the cost of premiums of these derivatives?

Well, it will be of-course covered by the users but in return they are able to get 100% synthetic LTV. So, a user is able to mint & borrow either 1.5x or 2x the amount of stablecoin considering their is no buffer required by borrower to prevent himself from getting liquidated. We all know that the most popular use of DeFi protocols is to obtain leverage, often via the borrowing of USD based stablecoins against crypto collateral. In many instances, this leverage is then traded and/or redeposited into DeFi protocols, creating a form of on-chain rehypothecation.

During the great deleveraging of the 2021 sell-off with capital increasingly taking risk-off positioning, the TVL in DeFi protocols saw a dramatic unwind. This was a result of two primary mechanisms:

-

Leverage, and recursive borrowing positions accumulated by the market during the bull being closed out, either by discretion, or via liquidations.

-

The value of crypto collateral falling as tokens locked in DeFi protocols are repriced lower, often as a result of sell-side generated by point 1 above.

TVL on Ethereum declined by $124 Billion (60%) in 2021 with massive deleveraging and closing of multiple recursive positions with massive liquidations across money markets, lending protocols, decentralized exchange liquidity pools, and many more. If a stablecoin protocol like ours existed then users would have been able to protect themselves against some immediate corrections by buying derivatives directly while borrowing stablecoins.

The case for derivatives leading to liquidity fragmentation?

Now, the issue with derivatives is that they lead to liquidity fragmentation across different crypto assets, with different strike prices and different expiries. If we look at top defi derivatives protocols then they currently all have been suffering from that same issue which leads to high premiums and inefficient use of liquidity provided by LPs acting as counterparty to trades or facilitating the trades between option writer/seller & buyer.

The overall adoption of crypto options has been muted relative to perps. Complexity may contribute to the relative lack of adoption, with market participants favoring the simpler pricing dynamics of linear derivatives like Perps thus far. Another impediment is the sheer challenge of bootstrapping liquidity into a new market that is fragmented by so many variables. We don’t want to be dealing with this situation so that’s where we created this new defi primitive called decentralized credit default swaps.

Credit default swaps have been utilized heavily in TradFi and they can provide protection against any asset across any industry by investors paying a derivative premium to these CDS writers. One of the big issues with CDS was centralisation of risks where a single CDS writer is providing protection to 50X the amount of assets for 1X the collateral and when any of these assets have systematic risks then it leads to chaos and that’s what happened in 2008 financial crisis.

However, we have created decentralized credit default swap (dCDS) where instead of covering broad protocol failure risks, we start with providing protection to individual stablecoin borrowers. This protection changes as per the volatility of assets provided as collateral. Currently, it is set at 20% so the borrower collateral is covered for a 20% fall in collateral price.

The biggest advantage here comes in solving for liquidity fragmentation for derivatives. As different users looking to borrow stablecoins participate at different times with different collateral assets and at different prices and opting for different strike prices. So, a dCDS like product allows us to deal with this liquidity fragmentation by matching these different positions having different variables with multiple dCDS users leading to an efficient use of liquidity. There is no complexity of choosing strike prices and creating separate contracts per different option expiries.

So, if a borrower comes with stETH/ETH collateral at current price of $3000 looking to borrow stablecoins at 100% synthetic LTV and seeking a 1 month protection (expiry) then these user premiums are matched with current set of dCDS users as per their shares/proportions. The 20% downside protection i.e. of $600 is also divided within the current set of dCDS users. These dCDS users also partake in some of the upside potential of these crypto assets. The ultimate objective is to act as a volatility hedge for collaterals backing our stablecoin $USDa

Since, the liquidation happens at 100% LTV i.e if the ETH price drops by $600 then the user will be liquidated while his loan-to-value ratio stands at 100%. Here, the dCDS user doesn’t face any losses because any kind of downside protection provided earlier like $600 in above is then shared back and distributed among dCDS users who have opted for liquidation gains. So, dCDS users always have unrealized losses and can always be recovered back depending on the borrower user actions.

Overtime, dCDS users can potentially deposit any type of tokens from other projects. Imagine depositing memecoin and being able to use it as utility and earn yields as high as 200%.

So, dCDS not only helps in reducing premiums for stablecoin borrowers but also act as a secondary backing mechanism for our omnichain ‘colored dollar’ $USDa by redistributing those high overcollateralization opportunity costs and liquidation losses which is one of the big issues with existing decentralised stablecoins.

As mentioned earlier, Autonomint $USDa leverages the existing trust networks of already existing projects to allow users to deposit these project tokens in our dCDS product and act as secondary backers of our stablecoin. We will be able to command incentives from these projects as well and redistribute them to protocol participants. This will help us preserve our protocol token incentives and liquidity mining costs which can be utilized to incentivize some of the critical operations and create a more sustainable tokenomics.

Peg Stabilisation of $USDa

The peg stabilization is a function of supply & demand and a good set of monetary policy tools a protocol have, the better the peg stabilization.

Autonomint Monetary policy tools are as mentioned below:

Supply side

-

Borrowing fees & debt ceilings utilized to control the supply of $USDa

-

Option fees premium charged to control the supply

-

Amount of downside protection given against any asset.

-

Since the collateral is already hedged with dCDS, it gives us flexibility to integrate with Perps to explore external hedging mechanisms by going short Perps and acquiring funding rates which can be passed to the users. The %age of yields shared to $USDa holders helps us control the supply

-

Exploring multiple markets for $USDa stablecoin

Demand side

-

Change in proportion of volatile tokens acceptance in dCDS - from 80% to 20%

-

Sharing of borrowing fees with dCDS users Sharing of %age of option premiums with dCDS users by redistributing the funds across other lending protocols or derivative protocols to either act as keepers or LPs and acquire liquidation gains.

-

Amount of downside protection given to stablecoin borrowers.

-

Changing of other projects token incentives for long term dCDS liquidity providers.

Thus, we have multiple monetary policy tools in our arsenal and we will be introducing a clever way for borrowers to recover their option premiums back which will be shared over upcoming blogs.

An omni-chain stablecoin → $USDa

$USDa is also an omni-chain product based on a LayerZero OFT standard that allows fungible tokens to be transferred across multiple blockchains without asset wrapping, middlechains, or liquidity pools. Through an omni-chain product, we want to offer users the opportunity to be part of new blockchains and acquire incentives on them without worrying about the volatility of these new chains. We also want to ensure a low-cost experience by allowing users to mint & bridge $USDa stablecoin in low gas and faster transaction based environments.

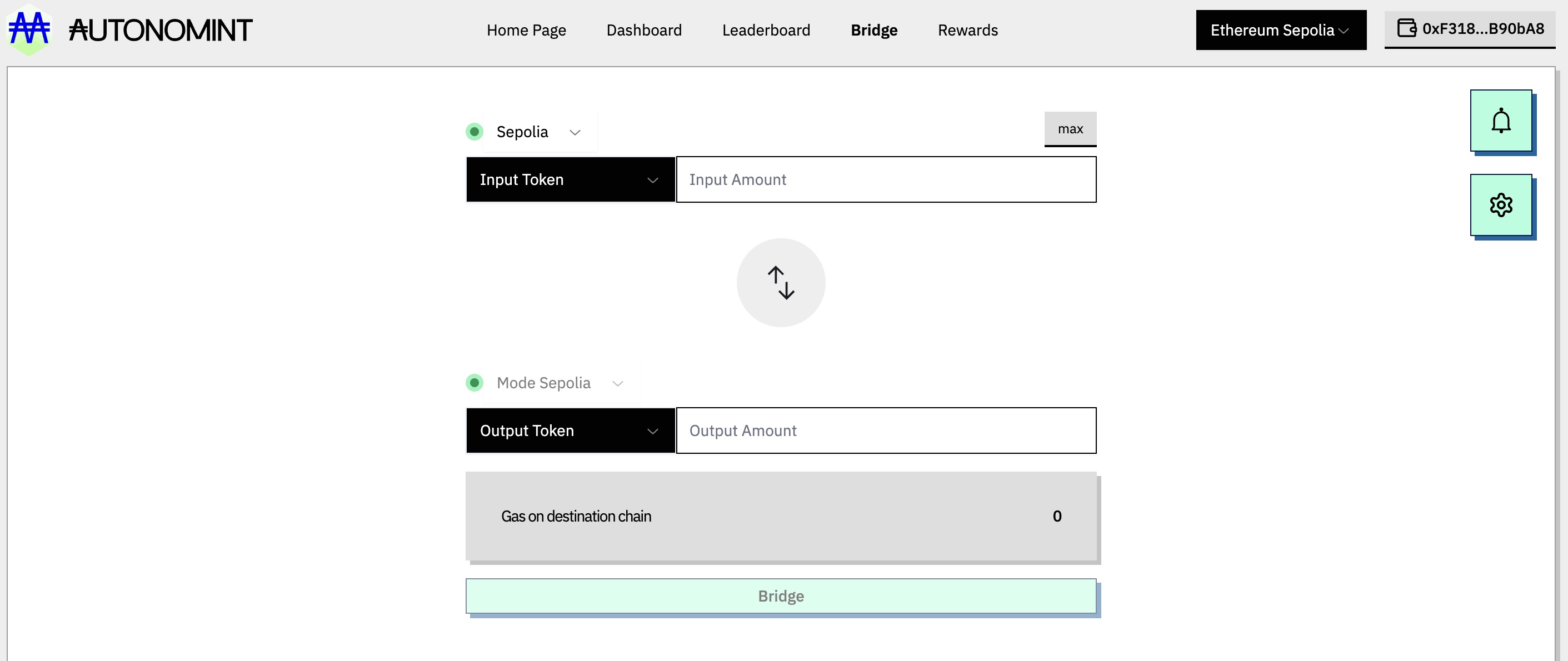

Currently, Autonomint is live on testnet where users can mint stablecoin at Mode L2 chain, Base chain and Ethereum and bridge them across through integration with LayerZero interoperability solution. LayerZero is a highly secure bridging solution and most importantly an omnichain messaging protocol, a transport layer that allows applications to send messages containing bytes of information from one chain to another. Here, each blockchain will be like a node in one larger, more performant network.

The biggest benefit of LayerZero is that it’s not just a token bridging solution and instead any code level messaging or information can be sent across through LayerZero OApp. This really helps us in creating a multi chain dCDS product where liquidity in one-chain can be used to protect borrower positions in another chain.

**What’s Colored Dollar?

**

So, in order to build robust primary markets of $USDa, we have utilised LayerZero color-tracing algorithm to colour the metadata of $USDa minted or other tokens minted at Autonomint. We are basically changing the metadata of an ERC20 token to allow us to trace the stablecoin issuance of specific mint by minters for specific areas to accordingly build & incentivise primary markets in those areas by allocating a share of yields. This color tracing involves O(1) computational complexity and thus makes it feasible to trace yields while stablecoins are transferred across wallets, DEXes, across blockchains etc.

This color tracing of stablecoins minted allows to keep on utilising the fungible nature of ERC20 tokens while allowing us to build customizable solutions on it for specific usecases.

Conclusion

$USDa will be stablecoin that will continue on the degen experience of crypto products with new Defi primitives like dCDS that will solve some of the deeper issues of over-collateralization, cascading liquidations, derivatives liquidity fragmentation and many more. It will finally offer a high-yielding product to the market in stablecoin $USDa that is not influenced by careless token farming which is highly unsustainable. The protocol utilises derivatives to hedge the volatility of collateral backing $USDa with the counterparty being dCDS users who accrue option fee gains & delta price change gains leading to accruing multiple X yields. This ofcourse comes with risks of collateral price delta variation.

The omnichain tech stack of Autonomint helps us and users tap into incentives and low-cost experience of new L2s and ultimately leverage the true composability of Defi products across chains.

Participate in our NFT collection

If you would like to be part of Autonomint’s degen experience where we capture this degen spirit then participate in our official NFT collection - “Quacks Club” with 100 Quack Shelby NFTs mints available currently with future omnichain utilities to be unlocked inlcuding official entry as a beta participant. Through this we celebrate the degen spirits of Great sailors, like the Polynesians across the Pacific, the ancient Phoenicians who sailed around Africa as Herodotus describes, The ancient Greek Pytheas from Massalia (Marseilles, France) who sailed around the British islands and up to the North to the frozen arctic sea, the Vikings and so many others.

We will be covering our tokenomics design in next blogs which will be quite different from what exists currently across protocols. Till then, participate in our testnet and accrue top positions in Leaderboard.