Welcome to the sixth edition of Fluff and Air, a recurring publication by 0xcarnation and ct_zpy. Today we’re thinking through what the flow of value might look like in the multi-chain future, and whether it’s possible to capture the value of these flows.

Just a heads up: This article is for educational purposes only, and does not constitute financial or dam construction advice. We probably hold some of the tokens mentioned here.

From our previous article, we suggested that looking at liquidity profiles across various chains and how they change over time. We’ve found that some ETH L2s have improving liquidity conditions even through the bear market.

Using an analogy, chains are like lakes and bridges are like rivers that enable assets to flow back and forth. Yield opportunities act like gravity that pulls asset flow in one direction or another. In essence, we aim to find the rivers where the flow is strong and we can build a dam to capture a portion of the flow.

Now, how do we capitalize on this flow of value? Do we just spray and pray at bridging projects?

Let’s first take a step back. We could look for the assets with the largest flows and see if there are any dams on top that’s harvesting the flow.

As long as you’re not a full “ETH Mainnet” maxi, you’ll probably find it reasonable to expect a lot of volume trying to bridge across various chains as crypto users speculate or access their favorite dapps.

Assumption #1 - we won’t live in a mono-chain world.

If this one is wrong, there won’t be a need for dams, and you may skip this article.

Stablecoins

USDC

Circle recently announced that USDC will have its own built-in cross-chain transfer.

USDC will have trustless, near-instant, zero-fee, no slippage, etc transfers across all supported chains. And USDC is the stablecoin with the deepest dex liquidity on most chains, main exceptions being BUSD on BSC and USDT on Tron.

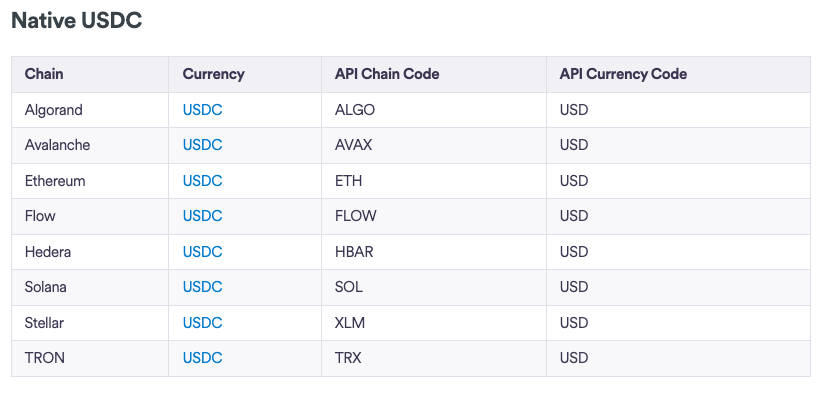

Below is a list of chains that support native mint/burn of USDC, and there are announcements to support more chains in 2023.

Source: Circle docs

Fraxferry

Fraxferry is Frax’s own cross-chain transfer solution.

The main feature is that there are no additional features besides moving FRAX back and forth, so there are fewer ways that this can be exploited by highly profitable traders. If we view FRAX as wrapped USDC, Fraxferry extends the reach of USDC liquidity to even more chains.

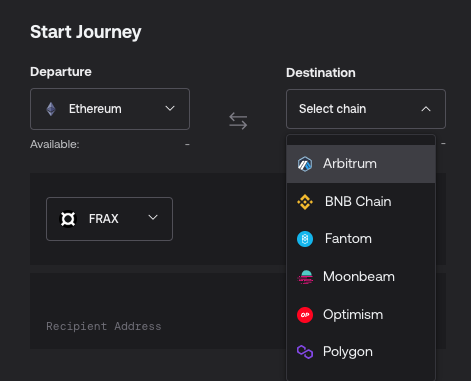

On the Fraxferry app we can see the list of currently connected chains.

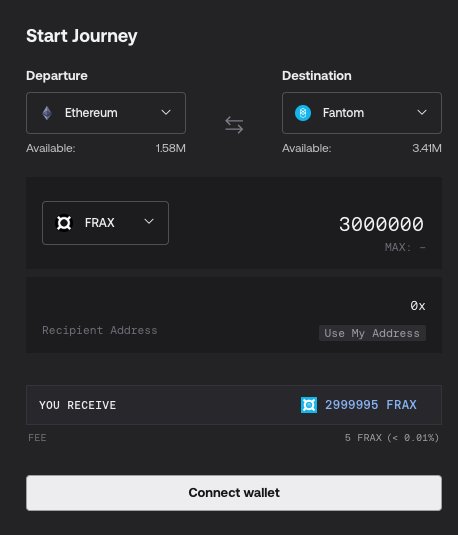

If we ask for a quote, we see that there is only a fixed 5 FRAX fee for transfers.

To summarize, we have one centralized and one decentralized stablecoin, both with deep liquidity that have their own bridging solutions. This will likely mean that for anyone trying to bridge any other stables, they might have lower total fees if they simply swap into USDC or FRAX first, bridge, and then swap into their desired stable on the destination chain

Assumption #2 - stablecoins will not require 3rd party bridges.

Stablecoin flow is like a river running in a separate underground tunnel that we have no access to, so no, we cannot build dams here.

An “ideal” stablecoin is also one that flows freely with no resistance, compared to “non-ideal” stables that users pay fees to bridge around. Stablecoins that rely on fee-extracting third-party bridges are less competitive than stablecoins that have negligible bridging fees.

So besides stablecoins, that leads us to the coins and tokens native to each chain. And of course the largest coin to consider is BTC ETH.

ETH

One of the things that makes ETH stand out among its L1 peers is that not only is it the gas token on its own chain, it is also the gas token on numerous Layer 2 (L2) solutions. You might’ve heard of Arbitrum and Optimism.

Side note, even for L2s that have their own gas token, if they settle back to Mainnet, they still need ETH at some point. For example, Metis L2 users pay gas in METIS tokens but the Metis chain still needs to pay ETH to settle back to Mainnet.

To understand ETH bridging flows, we have to understand bridging solutions. We won’t cover all the bridges for their technical and security details here. Rather, let’s take a look at what types of flow happens on them.

Native ETH bridges

All L2s come with a “canonical bridge”, usually constructed by the L2 team. Canonical bridges usually have no fees nor slippage in either direction. With optimistic rollups, there is a 7-day delay for fraud challenges to occur. However, the 7-day window is kind of an arbitrary and heuristic number where we’d be highly confident that even in poor environments (chain halting/reverting), we’d still have time for honest actors to report any fraudulent L2 transactions.

As optimistic rollups mature and other fraud challenge mechanisms come online, the challenge window might shorten to mere hours or even minutes. The curious reader can read about why the challenge period is set to “7 days” and what the minimum period could be: Polynya on optimistic rollups and Ed Felten on Optimizing Challenge Periods.

ZK-rollups typically have zero fee or slippage on canonical bridges with minimal delay time (ETH Foundation on ZK rollups).

Assumption #3 - Transfers between L1s and L2s will be free and fast for optimistic rollups and instant for ZK-rollups.

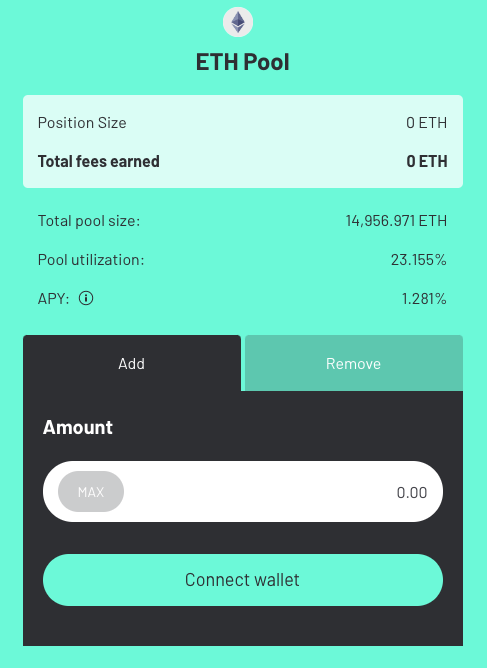

Across

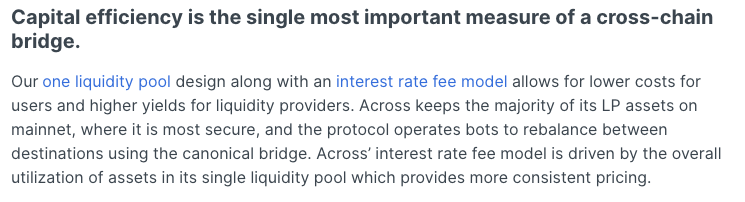

Across has an interesting method for charging fees. It is based on a global utilization rate of ETH (how much ETH is being locked up in the 7-day bridging from L2s compared to total ETH in the LP pool).

Source: Across docs

Side note, one of the cool features of Across’s utilization rate means that at any time, bridging between any supported L2s will have the same fees.

As we can see, the LPers are earning dirt poor yield. On the flip side, this means that bridgeooors are paying very little costs to bridge.

We may ask ourselves why LPers are willing to take such low returns. We speculate it’d likely be parties who benefit from associated positive externalities, e.g. who benefits from cheap+fast bridging? L2 foundations, the bridge team, large whale holding L2 token, rollup maxi, etc. These entities are effectively altruists (not to be confused with effective altruists), and will drive down the costs and profit margins of bridges.

Now, for L2 to L2 bridging, you can always use the canonical bridges if you are shuffling around funds with size. But for smaller transfers, going directly between L2s is better UX because you bypass having to wait for funds to arrive on Mainnet first as well as paying the mainnet gas fees.

Assumption #4 - Bridging across (ha!) L2s will be cheap and fast and it’s a race to the bottom on fees

This is like having rivers in parallel between two lakes. If a dam is built on one river and has too much resistance, the other rivers with smaller/no dams will get more flow.

Across is essentially a public good with minimal value extraction, and that’s the reason we list it here. Bridges that extract fees will find it an up-hill battle against projects setup like a public good.

Alt-L1

For most alt-L1 tokens, you’re probably only going to hold them on that L1. e.g. if we’re holding SOL tokens, the place with the best yield/liquidity/utility/security for this asset is gonna be on Solana.

It’s possible that users would have demand to gain exposure to these assets on a different chain, which would mean some bridging volume, but users who are doing this for long term exposure would not bridge often, and synthetic assets offer an attractive alternative vehicle which depends on oracles as opposed to bridges.

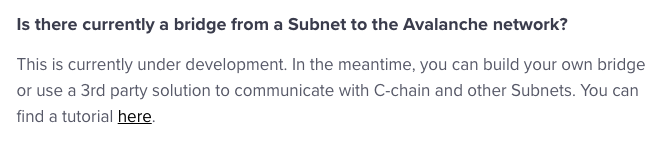

Avalanche is an interesting case because of their focus on the Subnet architecture. In a future with many subnets, users would probably have to bridge assets around regularly.

Source: Avalanche docs

For now, there is no universal/canonical Subnet bridge, but we imajin that if Ava Labs builds one, they wouldn’t be charging any fees on it either.

IBC

Asset transfers between IBC-enabled chains rely on “relayers”. The important bit to note here is that anyone could run a relayer, and that relayers do not charge any fees on the assets transferred (and even pay out of pocket sometimes to cover the gas costs on both ends). You can read more about IBC relayers in this post and follow the discussions on incentivizing relayers here and here.

IBC pioneered the idea of interchain accounts, where you don’t need to actually bridge assets around for interoperability. For example, if we were to do cross-chain lending/borrowing, we could keep collateral on Chain A and borrow debt on Chain B. Chain A can query the amount of debt on Chain B, and if I fall below the liquidation threshold Chain then A can liquidate my collateral.

Ideas similar to interchain accounts are also seen on EVM DeFi like Aave V3 and Tapioca. Coincidentally or not, both of these lending protocols have plans for a native stablecoin that can be bridged/minted freely across their respective supported chains.

Assumption #5 - Cosmos dappchains (and cross-chain DeFi in general), they will have native bridging to minimize dependencies and costs imposed by 3rd party bridges.

CEXes

CEXes remain the best bridges to date. You transfer an asset on one network, you pay a fixed cost to withdraw the asset to a different network. If transferring large sums, the fixed costs are negligible. Sometimes you get hit with a delay or the exchange has to rebalance the assets across the chains. Whether you are personally willing to use CEXes or not, lots of big money bags will use CEXes as bridges.

Assumption #6 - If you accept some KYC and centralization, you get the biggest portal gun known to humanity and you are a god compared to pleb bridgeooors.

Conclusion and Predictions

Now this piece may read like it’s a bearish view on bridges, but it actually isn’t. We’re extremely bullish on the flow of value between chains going up and to the right. We’re just even more bullish that competition among smart teams will lead to very little barrier to the flow of value.

Bridging solutions will likely seek ways other than asset transfer fees to create and capture value. Some examples might be facilitating message passing for cross-chain dapps, cross-chain MEV, or even monetizing on the fact that the bridges get first access to observe large asset flows in real time.

Now for some fun ideas and predictions. For ETH bridges, the opportunity cost of being an LPer is the ETH staking rate. One way to overcome that cost would be using liquid staked ETH as the bridging asset. This concept works fine as long as there are liquid pools for liquid staked ETH on the destination chains. Liquid staked ETH holders would gain access to additional yield above vanilla staking by being a bridge LPer.

Not only can we use bridges to import and export assets, we can also import and export yield by having the token be a yield-bearing token. For example, we can have a yvDAI token representing 1 DAI deposited into Yearn’s DAI vault on Mainnet and the yvDAI accrues yield over time. If we bridge 1 yvDAI to another chain, we’ve exported yield in DAI to this other chain. The holder of yvDAI on the destination chain can access the yield either by bridging back to mainnet to withdraw for DAI, or if a liquidity pool exists on the destination chain, then just swap yvDAI for DAI directly.

Even though we dived into bridging concepts a bit here, we avoided all mentions of bridging tokenomics and investability. Mebbe that means a new article soon™?