L2 Giants: Polygon vs Arbitrum

Layer 2 blockchains have seen rapid growth since Ethereum gas costs have priced many users out of the market. With so much value up for grabs, the scaling solutions are battling it out for both users and builders.

Why Are L2s Needed?

One of the biggest misconceptions about the upcoming Ethereum merge from Proof of Work (PoW) to Proof of Stake (PoS) is that gas fees will be reduced (Ethereum Foundation, 2022). As great as this would be for avid DeFi users and daily NFT minters, the merge will simply transition the consensus mechanism of the blockchain. Therefore, the gas fees will remain dependent on the demand for blockspace and likely within historical price ranges of $5 to $50 for transactions (Messari, 2022).

Ethereum has significantly higher gas costs than competing alternative Layer 1s, like Solana or Avalanche, due to both its popularity and low technological barrier for running a validator node. Anyone with 32 ETH can run a validator node on Ethereum with an “average consumer-grade computer,” while a Solana validator node can cost upwards of $5,000 to build, considering the more powerful hardware requirements (Ethereum Foundation, 2022; Solana Documentation, 2022). Solana’s more advanced hardware allows the network to process 3,000x more transactions per second than Ethereum while keeping the transaction cost under a cent.

However, this hardware requirement comes at the cost of decentralization. Ethereum has over 400,000 validators compared to Solana’s ~1,900 (Ethereum Foundation, 2022; Solana, 2022). The larger validator base makes Ethereum significantly more secure than Solana, since it would cost magnitudes more to gain control of 51% of 400,000 validators compared to just 1,900. Yet, along with the increased security, Ethereum’s higher gas fees make microtransactions prohibitively expensive and prevent mass adoption in developing markets where users simply cannot afford to interact with Ethereum.

Layer 2 blockchains offer a solution that retains the security of Ethereum while making the gas fees comparable to more centralized Layer 1 solutions. Blockchains are responsible for the execution of transactions, availability of past data, and consensus that the data is accurate and in the correct order. Since data availability and consensus are the most important segments handled by the most secure layer, Layer 2 solutions are best suited for the execution of transactions. This allows the Layer 1 to process higher volumes of transactions at quicker speeds while ensuring the historical evidence of the transactions are secured by the most decentralized base layer possible.

Competing for Second

Given Ethereum’s dominance as the go-to blockchain for any builder, the race to become the premier Layer 2 for Ethereum is hotly contested. The two most popular Layer 2 scaling solutions for Ethereum are Arbitrum and Polygon.

Arbitrum is an optimistic rollup. Check out our previous article: Arbitrum, Optimistically Steamrollin’ the Competition. To review, optimistic rollups execute transactions off-chain, then batch these transactions to post the batch as a single transaction on Ethereum (Streckenbach, 2021). What makes Arbitrum optimistic is the way that all transactions on the rollup are assumed correct by default. If a transaction is suspected to be illegitimate, users can submit fraud proofs to challenge the validity of that transaction (Offchain Labs, 2021).

Arbitrum’s largest competitor, Polygon, is a suite of scaling solutions for Ethereum. While the only solution currently live is the PoS sidechain, Polygon is developing both optimistic and ZK-rollups. One of the biggest debates within the blockchain community is whether or not the Polygon PoS chain is truly a Layer 2 scaling solution. Polygon’s PoS chain is technically a sidechain, not a rollup; rather than batching all the transactions and posting them to Ethereum, the transactions are all individually posted on the PoS chain. Since the PoS chain is an independent chain connected to Ethereum mainnet by a two-way bridge, the transactions are cheaper than posting to Ethereum itself. This presents a trade-off because sidechains do not inherit the security of the main chain they are connected to. Instead, the PoS chain relies on 100 validators that post the transactions onto the Polygon chain, a large drop-off compared to the 400,000 validators on Ethereum (Polygon, 2022).

So How Do These Layer 2 Solutions Compare?

To fairly compare the top Layer 2 solutions, the judgment needs to go beyond the underlying tech. Multiple parameters must be taken into account, such as covering security, transaction fees, user adoption, and the ecosystem built on the chain.

Security

As a rollup, Arbitrum inherits the entire security of Ethereum, since each batch of transactions is permanently stored on Ethereum once the challenge period expires. The fraud proof system, which has worked flawlessly since inception, requires a single honest actor to challenge any fraudulent transactions. As long as there is one interested party who acts honestly, Arbitrum can claim to be as secure as Ethereum.

Due to its smaller number of validators, Polygon’s security is often deemed a weaker alternative. However, the extent to which people look down on its security is too harsh. Polygon relies on only 100 validators, but the validators are decentralized and not controlled by Polygon itself. There is a diverse pool of institutions, companies, and crypto-native individuals who stake their MATIC tokens on Ethereum as a form of collateral that can be slashed if they act dishonestly. Thus, it takes a majority of these diverse validators to compromise their reputation and staked collateral in order for the PoS chain to be “hacked.” Regardless of opinions about Polygon’s security, Arbitrum’s security reigns supreme, since it directly relies on Ethereum’s larger validator base.

Winner: Arbitrum

Builders and users who refuse to compromise on security but want the cheaper fees available on Layer 2s have greatly favored Arbitrum, given its reliance on Ethereum’s validator base.

Fees

Since Polygon is a sidechain and the transactions themselves are not posted to Ethereum, the average transaction cost has been historically between 1-2 cents. In Polygon’s most recent update, the average transaction cost for Q2 2022 was $0.018 (Polygon, 2022).

Comparatively, Arbitrum divides the cost of posting batched transactions to Ethereum across each individual transaction within the batch. As the rollup scales to handle more transactions in each batch, the cost of each individual transaction becomes cheaper. As of writing, the average cost of sending ETH on Arbitrum is $0.25, while a more complex transaction, such as a token swap, is $0.41 (L2Fees, 2022).

(One important caveat is that transactions on Polygon are paid in its native MATIC token, while Arbitrum fees are in Ethereum since there is no Arbitrum token.)

While both Polygon and Arbitrum are significantly cheaper options than Ethereum, the gas fees on Arbitrum are still high enough to price users out of using the chain. The negligible gas fees on Polygon not only allow for a larger active user base, but also enable more use cases. For example, micropayments on Arbitrum become senseless when users need to pay $0.25 to send a payment of $1. On Polygon, however, paying one cent for the same transaction is cheaper than existing Web2 solutions such as PayPal.

Winner: Polygon

Polygon has positioned itself as a blockchain that is accessible to any type of user, seeing strong adoption in emerging markets where optimistic rollup gas fees are still too high.

Adoption

Looking at adoption, Polygon trumps Arbitrum. Over the past 30 days (6/26-7/26/22), Polygon has had an average of over 2.7m daily transactions, while Arbitrum has seen just over 100,000 (PolyScan, 2022; ArbiScan, 2022).

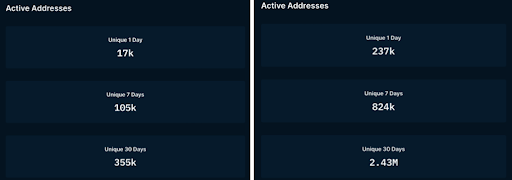

Moreover, Polygon has a cumulative total of more than 150 million unique addresses compared to Arbitrum, which has just over 1 million. Though this can be a misleading stat, the more accurate distinction comes from the active unique addresses. The gap shrinks slightly when observing the past 30-day active unique addresses, with Polygon at 2.43m and Arbitrum at 355k (Nansen, 2022).

Interestingly, this shows that only 1.62% of Polygon addresses are active, compared to 35.5% of Arbitrum addresses. Users who bridge funds to Arbitrum often remain users. Polygon’s lower percentage is partly because of its cheaper gas fees, which makes it easier to spin up bots that bloat Polygon’s total unique addresses. Even with lower user retention rates, Polygon has a much larger and more diverse ecosystem with almost 7x the active users.

Winner: Polygon

Polygon has more dApps and cheaper fees, making it far more attractive for everyday users who wish to have a cheap, seamless experience interacting on a blockchain. Due to its affordability, Polygon has a much larger addressable market.

Ecosystem

Along with more users, Polygon also has more value on its chain. Looking at the total value bridged to each chain from Ethereum, Polygon hosts over $3.7b while Arbitrum sits at just under $2b (L2Beat, 2022; Dune Analytics, 2022).

DeFi

Polygon also has a bigger DeFi ecosystem, with $2.22b in TVL versus Arbitrum’s $1.29b (DeFiLlama, 2022). Polygon has more than 2x as many DeFi dApps, with 277 versus Arbitrum’s 106 (DeFiLlama, 2022). However, bigger does not mean better. Arbitrum has seen more original dApp innovations, with native projects such as Dopex, Radiant, and Umami Finance launching recently. Conversely, Polygon has emerged as one of the leading chains in undercollateralized lending, with protocols such as Clearpool and Teller. To declare a DeFi winner would be foolish, as both have flourishing ecosystems with new dApps being developed every day.

Other

While Arbitrum is mostly centered around DeFi, Polygon is expanding more quickly into gaming and social media. The recent launch of AAVE’s Lens Protocol was a massive win for Polygon. Additionally, Polygon has the Polygon Studios arm, led by Ryan Wyatt, the former head of gaming at YouTube. The Studios team is an absolute business development powerhouse, securing partnerships with the largest brands across the globe, as seen below.

Winner: Tie

The Builder’s Dilemma

Builders have limited bandwidth when it comes to developing new dApps and expanding to Layer 2s. Therefore, the challenge in deciding which Layer 2 to build on can be difficult. For users, the decision is simple, depending on how much they are willing to pay in gas fees and what level of security they deem necessary. If desired, they can use both Polygon and Arbitrum for different use cases. Builders, on the other hand, need to determine where their specific project is most likely to succeed.

When deciding between Polygon and Arbitrum, builders need to consider the target user base, composability within each ecosystem, security needs of the protocol, and the expected volume of transactions. Some builders are “ETH maxis” and refuse to build on Polygon until it becomes a “true Layer 2” rollup like Arbitrum. However, holding onto this ethos of decentralization can be like shooting oneself in the foot. What Polygon lacks in security, it makes up for in business development and ease of accessibility.

NFT projects, games, and social media dApps are all best suited to launch on Polygon. The larger user base and bootstrapped NFT ecosystem with Opensea support has made Polygon the go-to chain for NFTs after Ethereum and Solana. Similarly, Polygon’s cheap gas fees make gaming and social media feasible, while the same applications are realistically too cost-intensive for constant transactions on Arbitrum.

While Polygon is a clear winner in almost all other categories, the competition is more evenly matched when evaluating both chains for DeFi protocols. Security becomes a far more important issue when dealing with hundreds of millions of dollars in financial products compared to gaming. However, it seems that users are comfortable enough with Polygon’s security, as it has nearly $1b more in DeFi TVL. The ethos of the builders often becomes the deciding factor in whether or not Polygon is secure enough to build on. An Ethereum maxi is never going to choose to build on Polygon over Arbitrum with the existing solutions, however, the team may be sacrificing potential profits to appease their strict assumptions. Alas, the “builders' dilemma” will become increasingly important, as the future of each chain depends on the builders within its ecosystem.

Resources:

- L2Beat. 2022. Overview. https://l2beat.com/

- L2Fees. 2022. Fee Info. https://l2fees.info/

- DeFiLlama. 2022. TVL All Chains. https://defillama.com/chains

- Polygon. 2022. PoS Info. https://polygon.technology/solutions/polygon-pos/

- Lucas Streckenbach. 2022. State of Ethereum Layer 2’s. https://www.bcblockchain.org/posts/ethl2/

- Offchain Labs. 2021. Fraud Proofs: How Validators Keep Arbitrum Honest. https://medium.com/offchainlabs/fraud-proofs-and-validators-how-you-or-anyone-can-keep-arbitrum-honest-d68add3f6c5d

- Elias Simos. 2022. Dune Dashboard: Bridge Away (L1 Ethereum). https://dune.com/eliasimos/Bridge-Away-(from-Ethereum)

- Polyscan. 2022. Blockchain Data. https://polygonscan.com/charts#blockchainData

- Arbiscan. 2022. Blockchain Data. https://arbiscan.io/charts#blockchainData

- Solana Docs. 20222. Running a Validator. https://docs.solana.com/running-validator/validator-reqs

- Ethereum Foundation. 2022. Run A Node. https://ethereum.org/en/run-a-node/

- Ethereum Foundation. 2022. Merge. https://ethereum.org/en/upgrades/merge/