In April, the European Investment bank, the lending arm of the European Union, issued a £100M bond on Ethereum’s blockchain. Just recently, Goldman Sachs announced plans to offer ether futures and options to its clients while the Bank of Israel is testing using Ethereum's technology in an internally launched digital shekel trial. Ethereum has been in the news a lot lately due to the NFTs craze earlier this year. If you can remember, Beeple sold his Everyday's NFT Collection for $69M worth of Ether. That’s a crazy amount of money, right?

The Ethereum white paper was published in 2013. In this paper, the author, Vitalik Buterin argued that blockchain can enable much more than just be a database for money. He envisioned Ethereum, the blockchain could be programmable thus enabling derivatives, lending and borrowing among other applications. The Ethereum project was later kick-started in 2015.

**Economics of Ethereum**

Before we go into the details of how the Ethereum network works, let’s first make sure that you have an idea of how its underlying technology works. The Bitcoin blockchain’s native currency is bitcoin as Ethereum’s is Ether. The network makes money by charging transaction fees on activities in the network.

The initial concept of bitcoin was digital currency while that of Ethereum was programmable money. Programmable money means that applications and smart contracts can be built on top of the Ethereum blockchain. While Bitcoin is restricted to being a store of value, medium of exchange and a unit of account, Ether facilitates all that and powers decentralized exchanges, derivatives and other hosts of financial applications. The composability of Ether gives it an edge over bitcoin as it able to finance much of the activities in the crypto world.

Given the recent rise in usage of decentralized applications(dApps) in the Ethereum ecosystem, the transaction fees (gas fees) have been ridiculously high as miners prioritize transactions with high gas fees. These high transaction fees have harbored a continued adoption of the ecosystem. The Ethereum network is secured by the proof of work consensus mechanism which we will explain later which is similar to that of the Bitcoin network. According to KPMG, a consensus mechanism is a method of authenticating and validating a value or transaction on a Blockchain or a distributed ledger without the need to trust or rely on a central authority.

In the proof of work consensus mechanism, workers agree on the state of the blockchain (account balances and the order of transactions) by expending computational effort(mining) and validating that said effort has indeed been used. Proof of work ensures that the network remains secure and that double spending doesn’t occur. The workers are incentivized to mine the main Ethereum blockchain by issuing new currency into the ecosystem and earning transaction fees as a reward. Ethereum's yearly network issuance at the moment is at 4% per year with 2 Ether per block and 1.75 Ether per uncle block which is rewarded to miners. This issuance policy is enforced in the network by developers, miners, community members and ecosystem projects.

The current proof of work consensus mechanism has faced a few challenges that have slowed down the Ethereum ecosystem’s adoption rate. Some of the caveats include:

- Currently, the Ethereum blockchain can process 19 transactions per second while Visa processes 1700 per second.

- The rise in gas fees has made it expensive to conduct transactions on the network.

- Environmental concerns arise since the proof of work mechanism consumes a lot of electricity.

- The ecosystem faces volatility concerns since gas fees tend to drastically change due to supply-demand forces. For example, while registering my ens domain I found it cheaper to do so early in the morning as gas prices were lower.

- Ethereum doesn’t have a supply cap, unlike Bitcoin’s network which is at 21M bitcoins. This means that Ethereum is inflationary thus diluting the efforts of the miners.

Two proposals have been made to solve the problems of the current system. These proposals can be classified as layer-1 or layer-2 solutions. Layer-1 solutions are those that make improvements on the base protocol with the intention of enhancing the scalability of the system. The Bitcoin and Ethereum blockchains are considered layer-1 as they settle all transactions in their own network. Layer-2 refers to the overlaying infrastructure built on top of the layer-1 chain.

The two proposals are:

- EIP-1559:

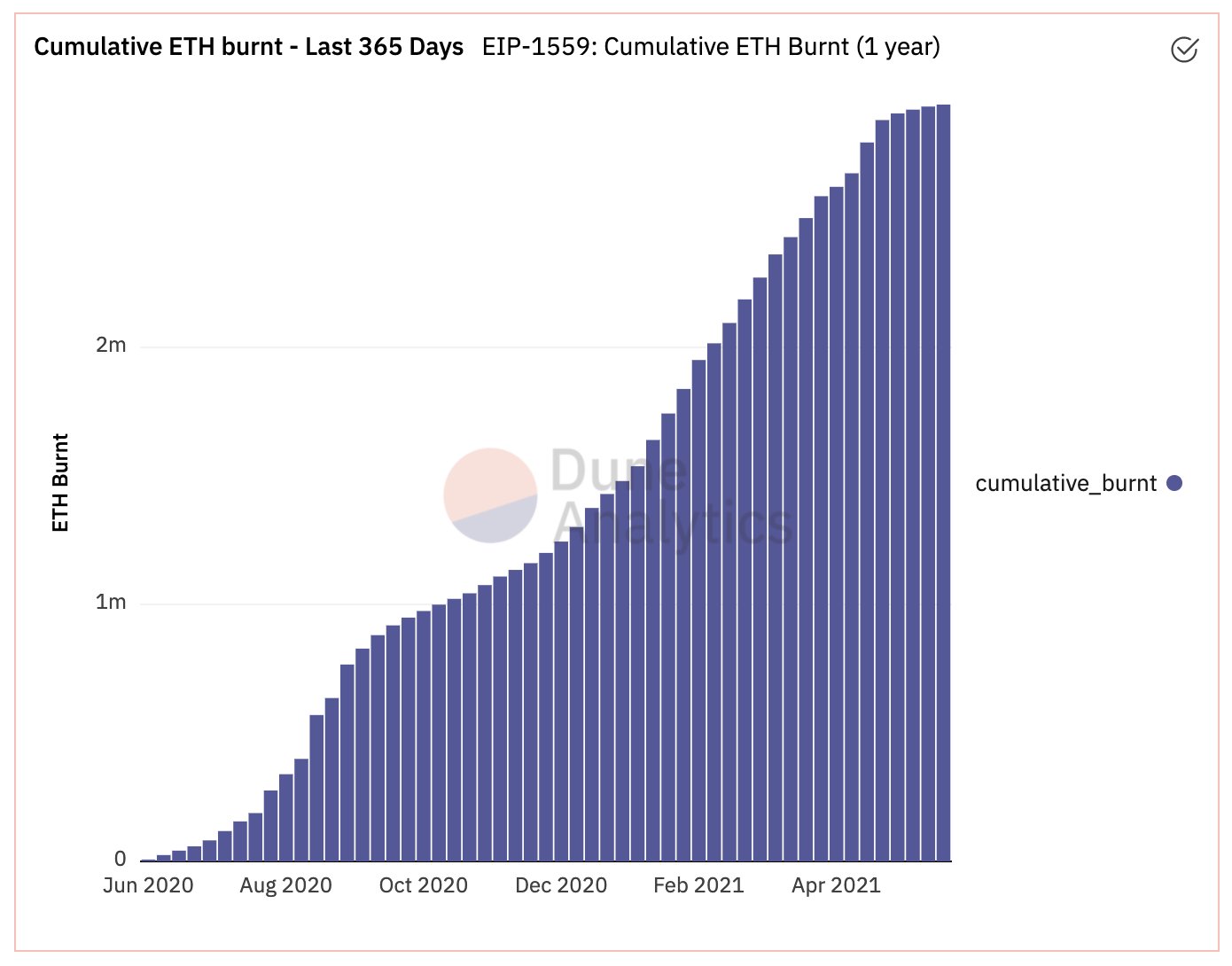

The Ethereum Improvement Proposal(EIP) 1559 aims to change how gas fees are processed by splitting them into base fees and tips. With EIP-1559, popularly known as Ethereum's Scarcity Engine or Ethereum's Burn Mechanism, Ethereum’s annual supply may reduce to less than 1% per annum since the network is migrating from proof of work to proof of stake, a concept that we will explore later.

Let’s look into why EIP-1559 is nicknamed Ethereum’s burn mechanism. Currently, gas fees are awarded to the workers to incentivize them to secure the network and validate transactions. In the new proposal, the base fees are burned and the tips are awarded to network validators. The burnt base fees ensure that the miners aren't incentivized to artificially congest the network, by prioritizing transactions with higher gas fees hence raising the transaction fees to be paid. EIP-1559 leads Ethereum to become a deflationary asset thus making it ultrasound money. You can watch a simulation on how much ETH gets burnt with this new proposal on watch the burn**. **EIP-1559 is set to go live on August 4th, 2021.

2. Ethereum 2.0:

i) Change in the consensus mechanism

Ethereum's consensus mechanism is being migrated from proof of work to proof of stake. Instead of using mining to validate the state of the blockchain to generate rewards, individuals will have to stake 32 Ether to become validators in the network. This proof of stake chain, also known as the beacon chain, was implemented in December 2020 and will be merged with the rest of the chain sometime in 2022. According to glassnode, over $5.5M in ETH has been held up in the ETH 2.0 contract. With this migration taking effect, it is projected that ETH's supply will reduce by about 90%, a phenomenon called the Cliffening by the Ethereum community. However, this proof of stake move is not new in the blockchain world as networks such as Cardano have been using it. Proof of stake was first implemented in 2012 when Peer Coin was introduced.

The proof of stake consensus mechanism has a couple of improvements from the proof of work. Proof of stake will reduce Ethereum’s overall carbon footprint as electricity consumed will drastically reduce. Consequently, the cost of being a ‘miner’ will reduce since one will only need to stake Ether and not only purchase expensive hardware but also pay for the high electricity bills. Migrating will also reduce the miner's selling pressure as before they had to sell their rewards to foot their electricity bills amongst other maintenance costs. Therefore, it lowers the entry barrier to becoming a validator. To become a validator, all you need is an internet connection, 32 Ether, raspberry pi, and an SSD.

Proof of stake offers better security as compared to proof of work. More nodes will be available in Proof of stake thus strengthening the overall security of the network. The network is less susceptible to a 51% attack unlike when it was in the previous consensus mechanism. A 51% attack is whereby a miner or mining pool is able to control 51% or more of the network's computation power or hash rate thus invalidating the other miner's work, transactions and can even double-spend the rewards. \

In proof of stake, if a validator attacks the network, it will quell the attack by seizing the validator’s staked Ether. This type of defense mechanism by the Ethereum network is called stake slashing. By seizing the staked Ether, the consensus mechanism is able to prevent the 51% attack from being carried out. The second type of network defense is called layer one ‘slashing’ and is triggered when you go against the protocol’s consensus. The corollary to this is, is that the network will slash your staked Ether by a third. For each attack, the validator will have to acquire new Ether from the market, and thanks to the law of demand and supply, purchasing Ether in every new iteration will be costlier than the previous iteration. The slashed Ether will be distributed to more honest nodes. As Vitalik states, this defense mechanism limits the attacker’s economic resources.

ii) Addressing Scaling

Ethereum 2.0 introduces sharding which will be useful in the on-chain scaling of the network. Sharding, a layer 1 solution, involves splitting the database to reduce the load on the network. This means that a validator will not have to process all the transactions on the Ethereum mainnet. The result of sharding is increased transaction speeds and reduced transaction costs as network congestions will be reduced too. All this will be carried out without compromising the security of the network.

The beacon chain, which is labeled a coordination layer does so by assigning nodes to shard chains. Communication on-chain is also coordinated by receiving and storing transaction data which will be accessible by other shards.

Another scaling technique is called off-chain scaling. By off-chain scaling, executed transactions are handled off the mainnet and on layer 2. The technique is called rollups where transactions are not executed on the mainnet but the transactions data are posted on the mainnet to reach consensus. There are currently two kinds of rollups, zero-knowledge rollups and optimistic rollups. Rollups are useful for ensuring that the network is open for participation, reduced transaction costs and faster transaction speeds.

**Triple point money**

In David Hoffman’s Ether: A New Model for Money piece, he introduced the concept of Ether being triple-point money in the following ways:

1. Store of value: Assets that are scarce and value continues to persist across time and space. Ether that is locked up in DeFi applications.

2. Consumable asset: This is Ether used as gas fees with the implementation of EIP 1559.

3. Capital asset: Ether is that is staked for validation in the new proof-of-stake consensus mechanism is considered a capital asset

The thermodynamic concept where an element can exist in both gas, liquid and solid-state can also be used to explain Ether as triple point money. In solid-state, Ether is staked by validators. In the liquid state, Ether is available in the markets to be consumed while in the gas state, it is burned as base fees.

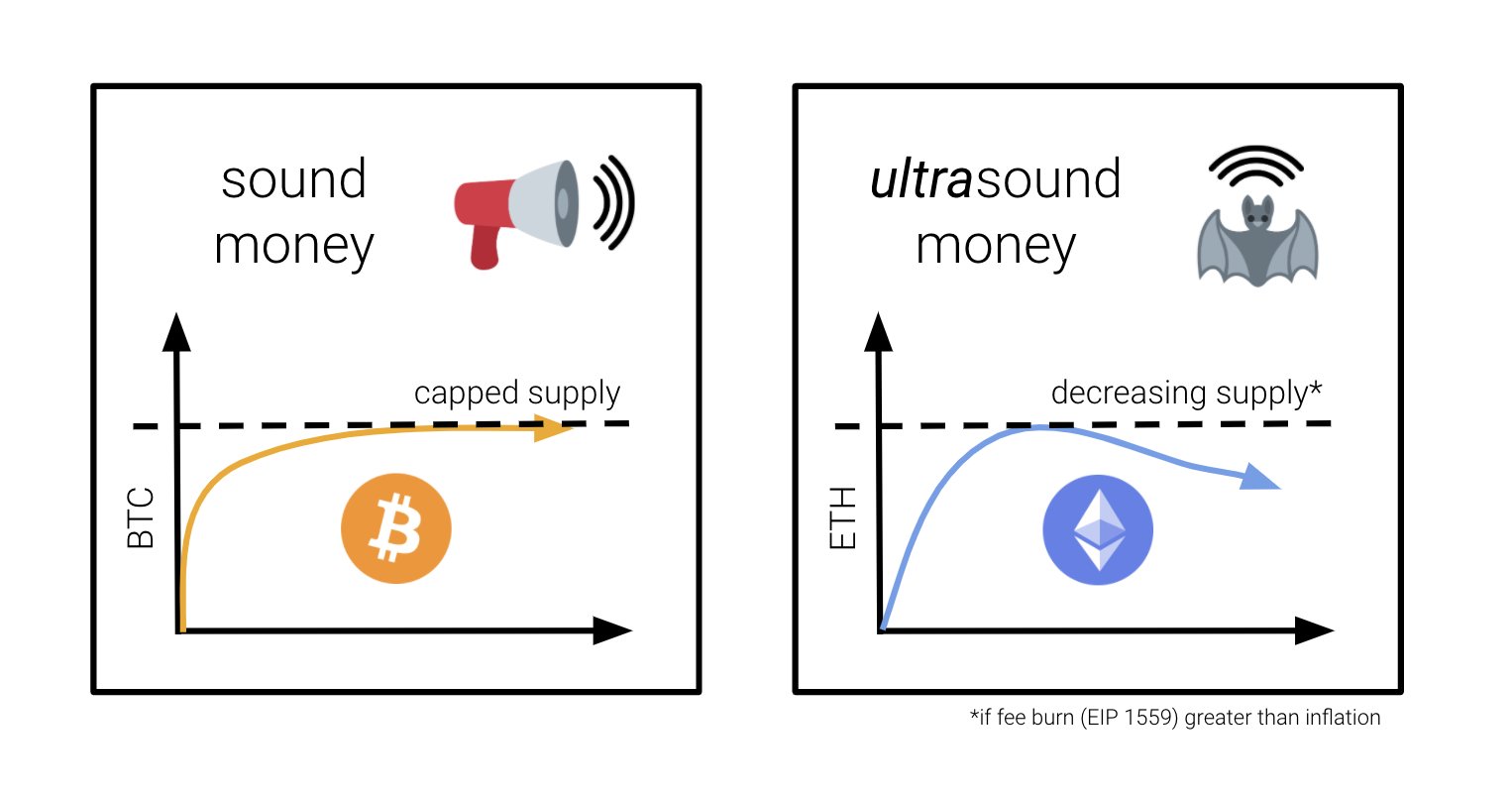

**Ultrasound money**

Earlier we mentioned, Ether is becoming ultrasound money due to its deflationary nature in the upcoming upgrade. Let's now explain what Ether being ultrasound money entails. Justin Drake coined the term ultrasound money in regards to the migration to Ethereum 2.0 which as we explained earlier entailed the implementation of EIP 1559, sharding and proof-of-stake consensus engine. Bitcoin has a capped supply of 21M BTC hence considered sound money while Ethereum is considered ultrasound money since it will eventually have a decreasing supply.

Justin modeled the road to 100M Ether to emphasize this point.

If this projected model is correct and Ether is still financing most DeFi activities, the price of Ether will eventually rise as supply cannot meet the demand for the asset.

Why should you care about Ethereum?

Now that we’ve learned about the past, present and future of Ethereum, let’s look at why you should pay attention to it. Ethereum experiences platform network effects like no other crypto ecosystem, from apps, tokens, liquidity and developer community. The more legitimate and useful products are built on top of it, the higher the price of Ether rises as there’s an organic demand for it.

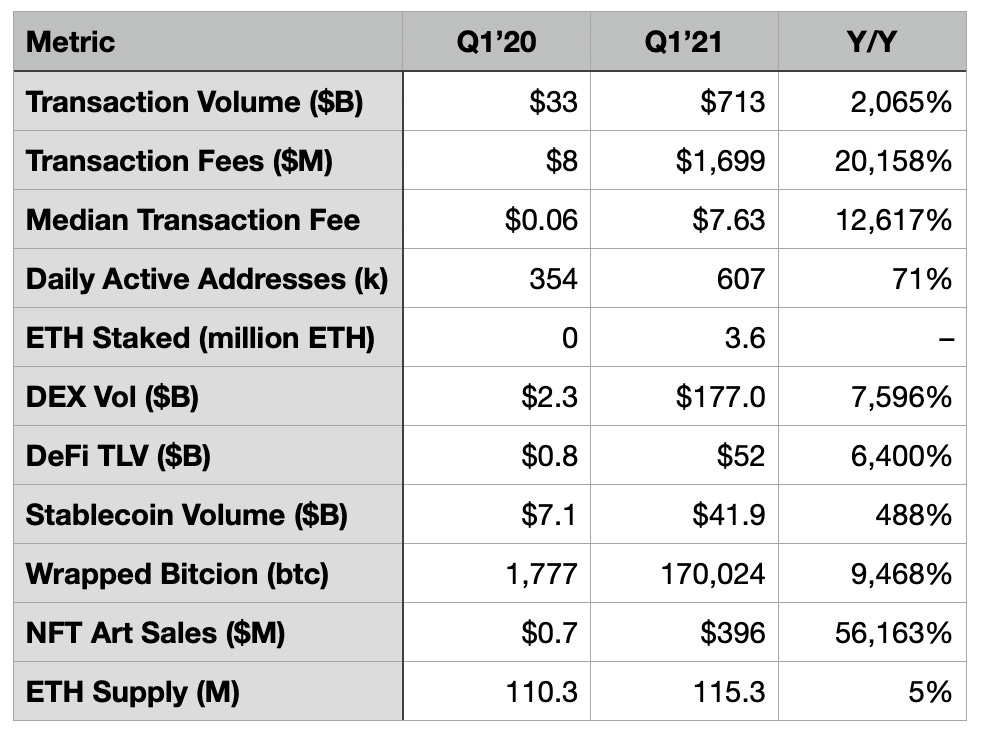

Ethereum has had a stellar Q1 this year with the ecosystem reporting a few key results :

- Total value locked in DeFi increased by 64x to $52B in Q1 2020 as compared with $0.8B in Q1 2020

- NFT art sales increased by 560x to $360M as compared with $0.7M in Q1 2020

- Volume in Decentralized exchanges increased by 76x to $177B in Q1 2021 as compared with $2.3B in Q1 2020.

These numbers are thanks to the increased adoption in use cases on the Ethereum ecosystem such as buying real estate in the metaverse, buying art , lending and borrowing, buying domain and issuing bonds. As of April 2021, there were 146M unique Ethereum wallet addresses as compared to 130M addresses at the beginning of the year. Ethereum has settled $2.5 trillion in transactions in Q2 2021. According to data from Dune Analytics, the total number of unique addresses interacting with Ethereum's DeFi ecosystems has reached 3M. There are over 252,428 BTC on Ethereum, which represents slightly over 1% of its total supply. Ethereum is currently settling over $45B in transaction volume per day as compared to Bitcoin's $12B.

Ethereum powers much of the web3 platforms currently in existence. Mirror.xyz, a decentralized writing platform, uses $WRITE tokens to fund the creator’s work. The token is based on Ethereum’s ERC-20 protocol. Mirror allows writers to explore modern funding mechanisms such as crowdfunding, NFTs and even Decentralised Autonomous Organizations(DAOs). The readers are incentivized to support the writer’s work by purchasing a portion of it to receive rewards for ownership of the published work.

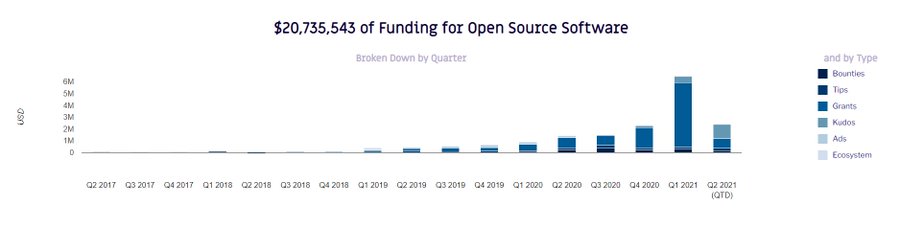

In Q1 2021, Gitcoin funding has allocated over $6M to Ethereum developers in grants, tips and other forms. Since January 2020, $20M has been donated in funding through the same platform to the developers. Since the field is still nascent, there has been a steady increase in demand for web3 developers. In 2020, blockchain was on the top 10 hard skills in demand according to LinkedIn. With the growth of Defi and NFTs, this demand is only set to continue rising.

Further reading resources:

1. Ether: A New Model for Money

2. UltraSound money by Justin Drake

3. Why Proof of Stake by Vitalik Buterin

4. Consensus' Q1 2021 DeFi Report

5. Ethereum Announces First Quarter 2021 Results

Disclaimer: This blog is strictly for education and is not investment advice or a solicitation to buy or sell any asset to make any financial decisions. Do your own research*.*