TL;DR

-

Car prices are seams of gold that dealerships give away for free

-

Dealerships are consolidating, further compounding data value

-

Stronger sales, branding, and customer satisfaction are at stake

-

Tech taken from crypto enables new, nationwide car price tickers

Introduction

As car dealerships and auction houses explore ways to use data for improving margins and unlocking opportunities, they should also look at business practices that leak valuable information every day, and use technology to squeeze out of it more value.

For traditional industries, technology is like a rising tide raising the level of all boats. Rarely does a new feature create a sustainable competitive advantage. For the most part this is fine and these industries compete on operational excellence, marketing, economies of scale, and so forth. The history of car dealerships reflects this reality, with most sharing data freely and relying on third parties to aggregate and distill.

But as dealerships consolidate, one area of data sharing may be “costing them” a fortune: prices established from used and pre-owned car transactions*.

Today, improved management, modern shopping experiences hyper-focused on the consumer, and new technology for coordinating competitors (i.e. blockchains), are creating an interesting new opportunity for forward-thinking companies.

This article proposes a new financial and business opportunity for auto markets, based on car price data, which requires coordination between large car markets like dealerships and auction houses but might unlock considerable opportunities.

*new car prices are tightly controlled by car manufacturers rather than dealerships. This articles focuses on the used market.

Dealership Networks Consolidate Car Markets

"Price discovery" happens all around us at stores, in restaurants, and with Internet eCommerce. In short, prices are set at markets. For used cars, the markets are primarily dealerships and auction houses, but also elsewhere in smaller volumes.

Dealerships are fragmented across the country, and because cars are more complicated than books or stock tickers (cars vary in quality, age, etc.) data aggregation and analysis companies like Kelly Blue Book rose up to provide a national view of prices across all sales in the country. Because no dealerships control enough of the market to have a nationwide view, these trusted third-parties remain a mutually beneficial arrangement. Data aggregators are more than happy to mine the data and sell golden insights back to dealerships, create economic indexes from it, and so on.

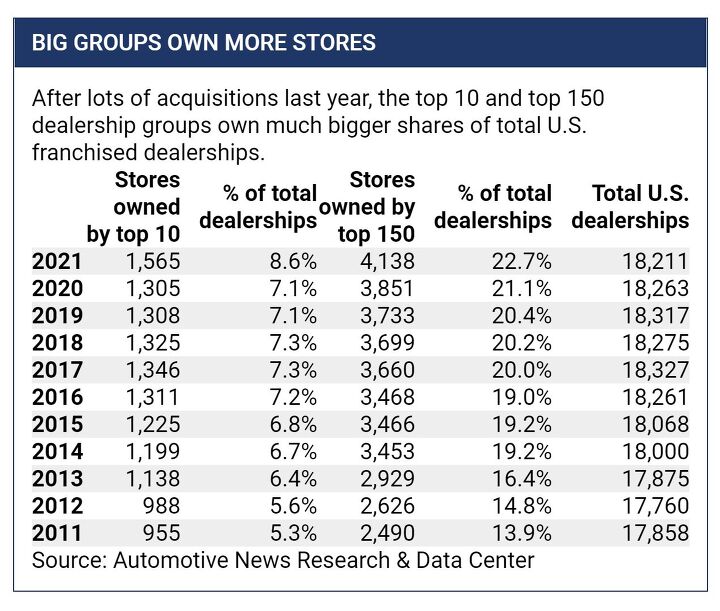

However dealerships are getting less fragmented.

With this consolidation companies are looking for new opportunities, to improve margins and develop brands themselves rather than rely on manufacturer badges.

One such opportunity: a nationwide car price feed. A car-ticker. Similar to a stock ticker but for cars. A nationwide, credible, fast price feed built by a network of dealership networks and auction houses. A public utility with shared ownership that can potentially lift the entire industry.

To succeed this car-ticker has to be neutral, specific to the make, model and year for each car, and composed of data representing at least 10% of annual sales (to start, growing from there). How to build it? Surprisingly the first step is to share the data, just differently from how it’s done today. More on this shortly. In the next two sections we nail down the business case as it's more important than the technology. Skim to the "Nationwide Car Price Partnership Network" section below if you know what’s coming.

Hidden Value of Car Price Data

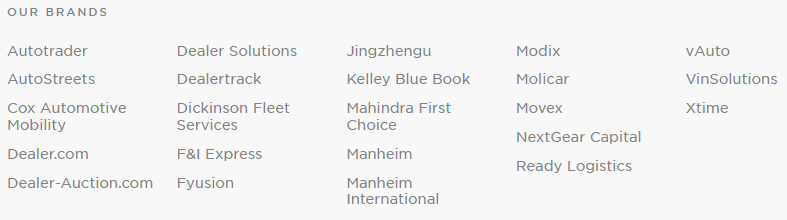

As a study, let's unbundle Cox Automotive. It’s the largest single data management and dealership operations software company. Most Americans can easily name one or two of their subsidiaries based on interactions with the auto or car insurance industry.

Cox Enterprises fully understand what they have, as they've been steadily expanding their data monopoly with numerous domestic and European acquisitions over the years. Dealerships are the primary buyers of these software and data services.

See the problem? Dealerships are sharing, and then paying to regain access, to the second most valuable data feed in the car market: prices. (#1 being customer data.)

-

Where can I buy a 2018 Toyota Sienna cost? Cars.com or Car Gurus, via Google

-

What will insurance reimburse for a wrecked 2012 F-150? Kelley Blue Book

-

How are used car prices trending in the US? Manheim Used Car Index

Helping third-parties (Cox is not alone) develop data monopolies was logical and productive historically, but times are changing. Not only is the process slow, with prices updating at best weekly and often monthly, but also expensive. Here are some very rough numbers on the opportunity, just to get an order of magnitude.

The US used car market generates revenues of roughly $100 billion per year. If just 0.5%, half-a-percent, of this can be retained by not leaking price data out of dealerships and then buying it back, reclaiming it would add $500 million to dealership bottom lines, per year.

What about ad-spend? Currently dealerships give away comparison shopping data to advisory websites and search engines. Consumers typically filter by price, which creates a race to the bottom competition for click-throughs. So not only are dealerships giving up customer website engagement and the associated ad revenue, they are paying for lower quality sales leads as well.

Outsourcing inventory and pricing engines cedes key customer touchpoints to third-parties. Internet ad spend for dealerships in 2021 was about $5.6 billion (new and used) in the US. Add non-car ad revenue of advisory sites for a more accurate sum.

Aligning with Customers and Branding

What!? Dealerships should focus on market share not risky initiatives, and the current model mints money. True, most are doing well. But stagnation is death, and let’s also remember why consolidation is working: small dealerships are not earning as much as they used to. Consolidation allows economies of scale. Also, in down-markets having strength in multiple areas will help. Two examples: customer service and branding.

Customers today expect a wonderful buying experience. But customer experience will never be great if listed prices are immediately renegotiated after walking into the store. The car-ticker allows conversations to focus on more important things like vehicle availability and condition, added services, financing, and insurance, where the bulk of the profits are made.

This consumer-centric sales flow also opens the door to build national brands, in a market where manufacturers have all the brand name recognition. Credible prices enable sales associates to be trusted advisers, which in turn unlocks dealership branding. Trusted brands allow dealerships to unlock loyalty value and higher spend. If conversations begin with more trust, it typically translates into higher lifetime value.

Placing an addressable market value on higher customer loyalty and brand recognition takes only a little imagination. For inspiration look to Best Buy, Sephora, and Home Depot with their gold-aprons as examples that avoided death by Amazon.

Nationwide Car Price Partnership Network

Finally. This section gets a bit complicated because it both describes a new technology and a new method of coordinating competitors. First the technology. A nationwide, trusted car-ticker utilizes smart contracts, which are enabled by blockchain technology. Ethereum is the most well known, but Solana will be more practical as described below.

Fundamentally, blockchains are databases running on distributed computer networks. What makes them special is that everyone has read/write access to the database and, once transactions are confirmed, nobody can delete or update the records. The blockchain is append only. The downside is that blockchains have availability risks, are harder to use, and are slow compared with in-house or cloud databases.

Why would we need a slower, global read/write, open database, even if they are distributed? Sounds terrible! Because smart contracts running on blockchains mean no single entity owns and controls the data. Instead they agree on the rules around writing to the blockchain running the contracts. This means Enterprise, Manheim, CarMax, Lithia Motors, Asbury Auto, and John Elway Dealerships can operate a shared database without wondering if the other parties will betray them.

They can publish sales data, creating a national car-ticker with equal access, and each can verify that none of the others are faking the data or abusing the network.

Yes, it does also mean anyone can read the feed, including those who don't contribute data. But that doesn't matter. First, the more people that read the price feed the more trusted and valuable it becomes. Second, it just needs to be more valuable to contribute than to free-ride. The previous two sections focused on business value for this reason.

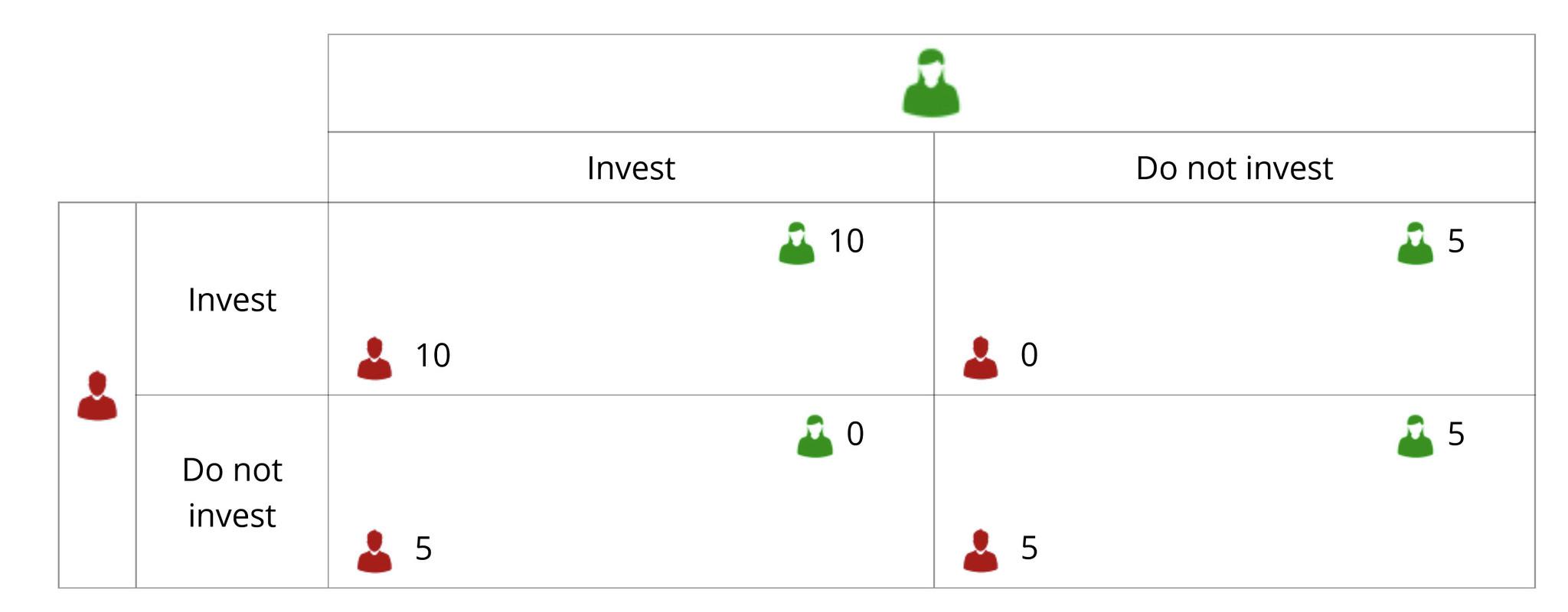

Visually, here’s how economists describe why competitors should value cooperating:

We’ve arrived at the other piece of the solution, the new method of coordination. First a quick review as we've come a long way!

-

Car price discovery is happening under fewer roofs because of consolidation

-

A neutral, nationally available car price feed, a car-ticker, has significant value

-

No one company controls enough market share to generate such a car-ticker

-

Blockchains allow competitors to collaborate, by changing economic incentives

Now let's unpack that last point: what are these economic incentives that allow competitors to collaborate? What are the incentives to contribute price data, rather than free load on the publicly available car-ticker?

Hopefully the above paragraphs have spelled out the first benefit: dealerships and others get value, potentially incredible value, from data they already share. But second, participants get tokens which provide utility, confer reputation, and economic value.

Everyone knows crypto tokens are a scam these days, right? This is different.

Car-Ticker Tokens

Crypto tokens are a "greater fool" asset when their sole value is speculative. In this case tokens have utility and therefore intrinsic value: they govern usage of the car-ticker network, insure its economic value, and eventually pay for its maintenance.

The token incentives work as follows: allocated tokens are destroyed when submitted data is inaccurate or halted, and are minted for contributions to the network or software. This mint and burn mechanism is the carrot-and-stick for helping or harming the price network, and thus the flow of tokens reflects the value of the network. Car-ticker tokens only have value if the network is utilized. Converting tokens to dollars is irrelevant, though inevitable.

Because of these economic incentives, as more participants contribute price data the value of the network goes up because the token utilization grows. As tokens are utilized the value of the "Hidden" network from section two gets quantified and thus revealed. Tokens also provide another funding avenue for the car-ticker project.

Car-ticker tokens can be allocated to contributors based on a variety of factors, with early and large contributors receiving more, and vest over time. In addition they are earned by contributing work to the network, and unlock governance power over the system. The founding members of the network must be chosen carefully for both commitment and volume of sales, but would also gain the most reputation for pioneering the initial consortium of participants.

By the way, the above token plan borrows trading firm Jump Crypto's work heavily. They built crypto price oracle Pyth Network https://docs.pyth.network/, built on Solana. The car price ticker essentially forks that project, which is why Solana is recommended, but it could be built on another chain. Or as just another set of Pyth price assets with less effort and risk (but also without its own token). In the Pyth documents you will find a graphic describing how information and tokens flow to support the network.

Conclusion

At this unique point in time, dealership consolidation and tech advancements allow for the creation of a consortium of participants to create a new, unique and incredibly valuable utility for the car industry. The car-ticker for prices.

The data is already shared and other companies are making large sums of money aggregating and selling the insights back to the dealerships, and building consumer-friendly websites that siphon customer loyalty opportunities away from dealerships.

A consortium of car market makers representing approximately 10% of national sales, a relatively modest investment of resources, and some detailed thinking about token incentives, could build a truly unique and valuable resource that lifts the entire industry.

Please get in touch to discuss this idea, or to educate me on this will never work!

Like this idea or the subject? Here are two related pieces: Data Mining for Car Revenue and new financial tools that help dealerships manage risk and innovate.

Appendix

Technical Detail

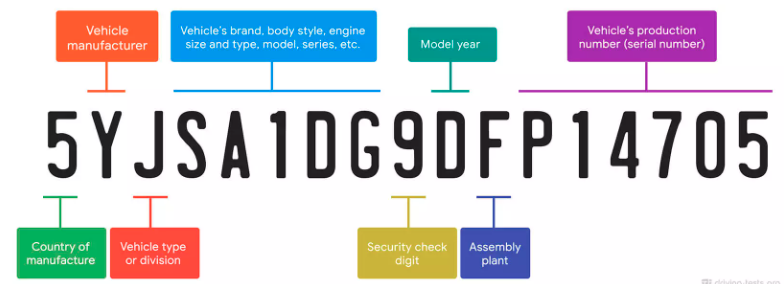

A vehicle is defined as a 10 digit VIN -- i.e. all the important data, up to and including Model year (see image below. The contributors to the price data consortium would be a small number of forward-looking companies with enough cumulative volume to represent >5% of total used car sales (though ideally >10%), and would grow over time.

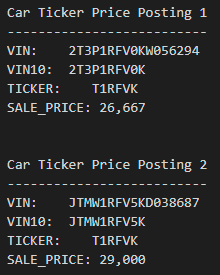

And here is an abstraction of the VIN that we might use for tracking car-ticker prices:

For the price consortium to function politically, the sales location and vendor would have to be anonymous. Also, the availability of a national average price does not stop local dealerships from advertising discounted prices. In fact might make such ads more powerful because customers are more likely to trust that they're actually getting a discount! Store managers could advertise a percentage discount reliably.

Note on Innovation

The author agrees that most technical innovation should not begin with dealerships. However the creation of the car-ticker can only happen if the large operators take the initiative, and none of them will jump in without a critical-mass of first movers.

The rest of the innovation should come as a result of open-sourcing the data, because a new platform like this creates an environment for startup companies. These companies will develop new financial instruments, and compete with data monopolies like Cox Automotive.

Finally, the car-ticker network also creates novel business metrics for even the most sophisticated dealership operators. Metrics such as monthly sales performance against the national average sales prices, as one example.

Branding

Final note on branding, which was too much detail to include above. In addition to saving ad spend and having more opportunity to engage customers at the top of the sales funnel, more attractive advertising narratives are also possible:

-

Low price leader: "prices consistently 5% less than the national average"

-

Re-localized matching: "we'll beat prices of any competitor in our zip code"

-

Pricing peace of mind, begets loyalty: "never worry about service again"

I’ve spent very little time writing tag lines, and these are no exception, but perhaps they get the point across: shift the narrative.