Leveraged farming allows you to potentially enhance your earnings by using borrowed funds to invest in liquidity pools. This guide will walk you through the process of opening a leveraged farming position on Extra Finance.

What you will find in this article:

Opportunities:

-

Increased exposure.

-

Access to Premium leverages.

-

Enhanced yield potential.

-

Diverse investment options.

-

Strategic flexibility and Risk management: effective management of leverages positions is crucial. For guidance on adjusting leverage, you can read the articles “Extra Finance farming: Elevating leverage” and “Extra Finance farming: Managing Leverage Downward”.

How to open position:

1)From the Extra Finance menu at the top of the page, click on “Farm”.

2)Choose the blockchain where you will engage in leveraged farming. Extra Finance currently supports:

-

Optimism: engage with liquidity pools from Velodrome.

-

Base: participate in liquidity pools from Aerodrome.

3)Upon selecting the blockchain, a list of available liquidity pools will appear, displaying crucial details such as:

-

Assets in the pool.

-

Total Value Locked (TVL).

-

APY and APR: information about potential earnings, including auto-compounded yields and various APR metrics.

-

Leverage options: indicates the maximum leverage available, which can increase depending on conditions such as holding a certain amount of EXTRA tokens through the veEXTRA Boost. Learn more about veEXTRA Boost in the “Obtaining the veEXTRA Boost” article.

4)Click on the “Farm” button to open the depositing menu, which updates dynamically as you adjust your inputs.

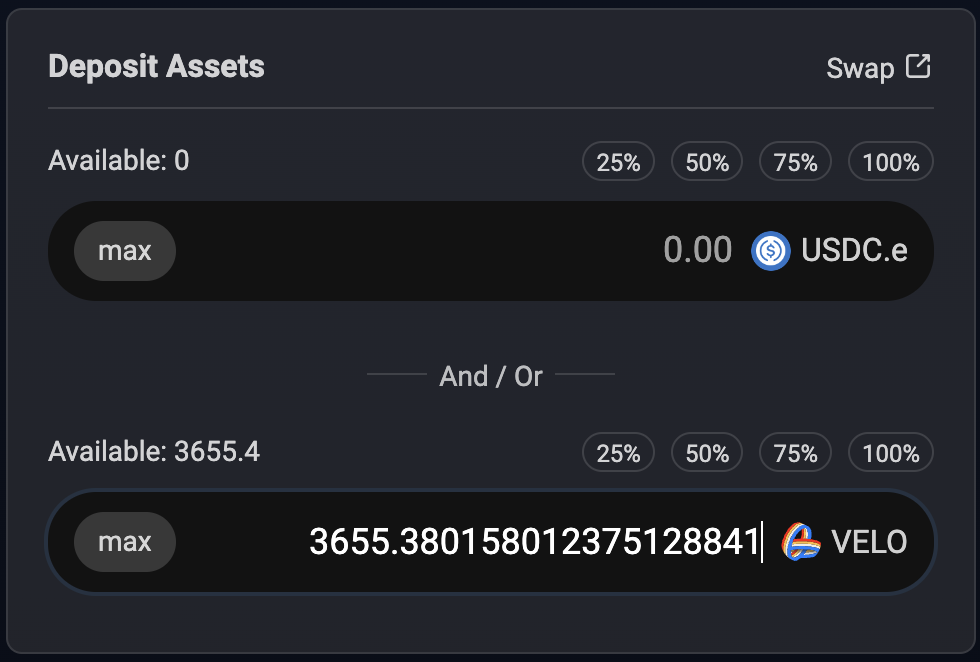

5)Enter the amount you wish to deposit.

You can:

-

Type the specific amount manually.

-

Use percentage buttons to select a portion of the asset available in your wallet.

-

Use the “Max” button to commit the total available amount.

6)Adjust the leverage setting for your position.

7)The right side of the screen will display detailed information about the position, including the adjusted features based on your leverage setting.

8)Once you are satisfied with the setup, click “Confirm” to finalize your deposit and begin leveraging your farming strategy.

By following these steps, you can effectively open a position with leverage farming on Extra Finance, potentially increasing your investment returns. Remember, leveraged farming involves higher risks, including the possibility of greater losses, so it’s crucial to manage your investments wisely.

Lynn Brooke

This article serves educational purposes and is not financial advice. We encourage you to do your own research and be responsible for your actions in the financial space.