Bitcoin has escaped the mailing list and made it to the BlackRock spreadsheets. Who can keep it scaled and decentralised?

What am I about to read?

Goat Network is a BTC L2 with Decentralised Sequencers.

What does that mean output wise? Well, Bitcoin can be utilised to provide sustainable yield for more Bitcoin.

You can see history in the architecture. In Britain, you can see it in some churches, some have Saxon builds with an addition of Norman touches, some even have Roman bases.

A popular picture of an Istanbul house that shows 4 epochs.

Bitcoin is similar. The major question of Bitcoin once it launched was how to scale it. How do you make this currency, decentralised from central authority, based on blocks, be accessible to people?

And this read skims over the relevant history of Bitcoin and demonstrate how Goat Network is the next layer to Bitcoin’s and cryptos architecture.

Setting the Scene

Satoshi came up with Bitcoin and we have been debating if it was/is a good idea ever since.

Gold bugs say it is going to zero any day now.

The governments have tried to ban it to no avail.

My family scoff at the word “Bitcoin”.

Yet, here we are.

BlackRock are telling your nan to buy Bitcoin.

To take from Amir Taaki’s rhetoric, code is like a magic spell, governments can’t use violence on code and thus the more they try to ban it, the more incentive and use Bitcoin has.

And my family still scoff at the word “Bitcoin” but now my cousins ask me about crypto.

Bitcoin helped spearhead the world towards tokenisation. It was a eureka moment and since then the value of the token economy has gone up, for Bitcoin is number go up tech.

What are new dollars are made of? Purchasing power quietly stolen from ordinary people.

Satoshi’s whitepaper was the result of years of work, on top of the heritage of cryptography and computation. It is a protest against the central banks that had society in a vice.

Satoshi had put into motion a superior financial incentive that was only available by the digital realm.

2008 was a massive blow to the economic system. Iceland bailed out its people and was the country fastest to recover.

Most of the world bailed out the banks. Bailing out the banks was akin to an attempt of absorbing a liver shot. QE and austerity measures abound and societies across the globe nearly 20 years later are still struggling with the strains of mass wealth exchange and stultified capital pools.

The US debt is not a number, it is a loud scream. One that continues to grow.

Bitcoin is a digital mirror.

A digital mirror to gold.

A digital mirror to fiat currency.

Bitcoin competes will all stores of assets.

And due to its hard cap, due to its ability to be transferred quickly across the globe, due to its immutable ledger, Bitcoin can go from this:

To this:

Where the debt is so high, the way to get rid of it is inflation. Yet, quick hyperinflation will cause chaos. Governments need BTC as a reserve to be an anchor to inflate into.

BlackRock has been going down its tier-list of clients, advising them to allocate % of their wealth into Bitcoin.

There is a need for USD stablecoins as they require reserve assets such as bonds. Stablecoins are a stepping stone to the tokenisation of assets in the real-world.

As these RWAs come on-chain, they are fractionalised and provide more composability for products. Bitcoin and blockchain will absorb a lot of the world and open it up assets to a broader market.

Bitcoin was a way to provide an alternative system to TradFi. It is the ultimate memecoin, when it was first released there was no infrastructure, the lead dev vanished, there was a core loyal, fanatic circle that worked on it, shilled it. Wences Casares said it was ultimately a thought experiment – look into what a meme is.

Memes can adapt faster than genes, memes are to help genes. Our genes have found ourselves in a tight spot and along came Satoshi with the Bitcoin meme.

As Bitcoin has expanded, captured an awareness, despite being discouraged by actors in TradFi, now many in TradFi must accept it for their clients want it. More people want into Bitcoin with each passing cycle.

2008, the banks were too big to fail. Today, Bitcoin is too big to ignore.

Early Challenges of Bitcoin

Satoshi capped Bitcoin's block size at 1 megabyte (MB) and ever since the discourse has debated if that was a good idea. This limited the number of transactions that could be processed every 10 minutes.

Thumbs, cooking, and the philosophical concepts and technology around accounting. Three things that separate humans from the multitude of animals and aliens on Earth.

Money is a social layer, a mathematical-social ritual, a sociological phenomenon, and over a long enough timeline, humans argue, which leads to civil strife.

Originally, the blocksize was not given a cap but was limited to 32mb, Vitalik Buterin said this was because it was the limit of peer-to-peer messages, this was an artifact of the code.

This was a security concern as an attacker could overwhelm the network by potentially creating enormous blocks. Furthermore, Satoshi not only wanted to aid the security of the early network, he wanted to preserve the decentralised aspect as larger blocks require more bandwidth, storage, and processing power, which could make the network less accessible to smaller participants.

It was 2010 when Satoshi snuck in the 1MB limit.

Contention and challenges to this could be seen a couple months later with Jeff Garzik, who on October 3, 2010 published a patch that immediately increased the block size to 7MB. However, it had no users yet it showed what was going to happen over the next few years in Bitcoin – a debate, tussle and fight for the blocksize of the network.

What this develops into is the Blocksize War.

Yet before the war goes into full declaration, a key event happens.

Satoshi goes silent.

It is 2011 and it not directly from the blocksize situation, rather the increasing attention that was coming towards Bitcoin from the sources Satoshi seemingly did not want.

The first case being…

On the December 10th 2010, an article was published in PC World, titled “Could the WikiLeaks Scandal Lead to New Virtual Currency?”. - www.pcworld.com/article/499375/could_wikileaks_scandal_lead_to_new_virtual_currency.html

The article is rather neutral towards Bitcoin.

The article highlights as Wikileaks was gaining heat, a way around the donation sanction imposed was using Bitcoin. However, Satoshi sees this as bringing the strong authoritarian forces attention to a young network that is still trying to develop in peace.

He begins to pull back from open involvement, his last Bitcoin forum post in on December of 2010 but he still communicates with Gavin Andresen and Mike Hearn via email.

2011, February time is when the infamous Silk Road begins, another moment happens in April 2011, this time from Gavin Andresen.

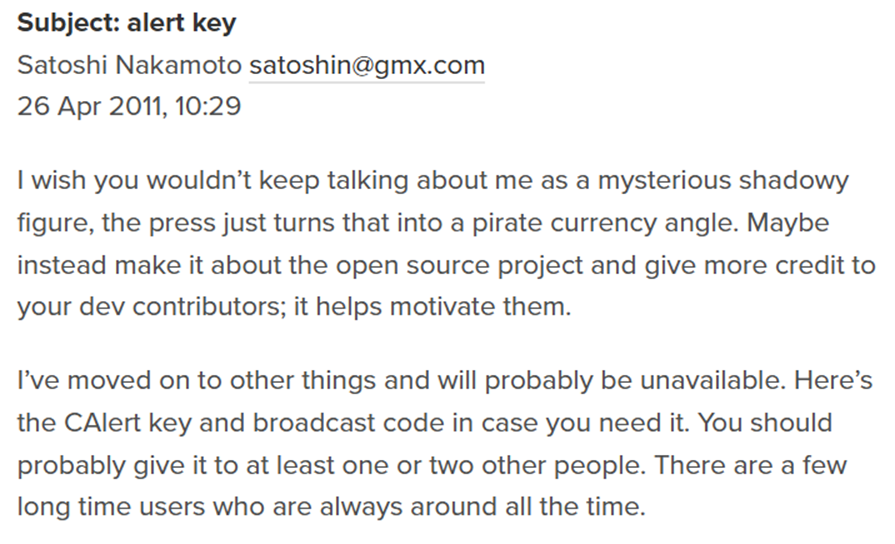

Gavin talking to the CIA ruffles many feathers in Bitcoin circles and notably Satoshi does not want Bitcoin to be seen as a pirate currency, as seen in Satoshi’s last email to Gavin.

Gavin has his reasons for being public about going to a CIA event, as evident in his response to the above Satoshi email.

Satoshi is conflicted, if he stays onboard with Bitcoin, how does he maintain his anonymity, even more so as Bitcoin raises in dollar value and is utilised by anyone and everyone?

In June 2011, an article on Gawker titled "The Underground Website Where You Can Buy Any Drug Imaginable" brings attention to Silk Road, which is a website that utilised Bitcoin.

As seen later in 2013, Ross Ulbricht, the founder of Silk Road, was arrested and put on trial for selling illicit goods and illegal drugs. In 2015, he was sentenced to a life in prison.

If that is what they did to Ulbricht, what would happen to Satoshi if he was discovered by, say, the FBI? What would the establishment do to a person who stimulated the creation of a decentralised currency undermining the central banking system?

Perish the thought.

Or perhaps Satoshi was someone such as Hal Finney or Len Sassaman who passed away.

Or maybe Satoshi is a Paul Le Roux-type and went to prison, therefore had to abandon the project.

Whoever/whatever Satoshi Nakamoto was/were that is not a discussion for this piece.

It was April 2011, Satoshi fades into history and Bitcoin sails on without the actor.

Blocksize Wars: the attack of the clones

Bitcoin is agnostic, it is simply a decentralised peer-to-peer cash system, a decentralised ledger. I say simply in a manner to not take that fact for granted, it is remarkable, I say simply because it is a tool that people project their world onto it. And we’ve been debating if that is a good idea ever since.

Regardless if Satoshi wanted to increase the blocksize or not, without Satoshi present to ordain the philosophy, it is exceptionally hard to make big changes to Bitcoin and the blocksize was a significant debate that raged on after Satoshi left.

Gavin Andresen was the Chief Scientist of the Bitcoin Foundation, his voice held weight in any discourse regarding Bitcoin and Gavin supported Mike Hearn’s Bitcoin XT.

In short, it was big blockers proposing a big blocksize as the small blocks bottlenecked the network versus the small blockers wanting to keep the small blocksize to ensure security and decentralisation – and mid-blockers largely being ignored.

Everyone in this episode of Bitcoin were acting on what they thought was for the best for Bitcoin, people wanted to scale Bitcoin so that it is accessible to everyone.

According to Adam Back, Gavin Andresen and Mike Hearn were quite aggressive in implementing their idea of a hard fork for Bitcoin, which was anti-thetical to how Bitcoin had developed in the years prior. It came across as “we are having a coup, join in or else”.

Bitcoin XT was announced in August 15, 2015, was to increase this limit to 8 MB and then double it every two years until 2036, when the limit would be around 8,000 MB.

This increase that would end up at 8,000MB was a massive shock to many in the Bitcoin community. The community did want to expand the 1MB but this push was too much too soon.

There were loyalists on either side and thus, as you can imagine, groups and chats were splitting, a bifurcation was taking place, people were setting up their clubs.

However, Bitcoin XT was not a success and is a neglected project now but it was a significant move that has left scars in the Bitcoin community that continue today.

There were mad moments. May 2, 2016, Gavin announced he believed Craig Wright was Satoshi and reiterated this on stage, a platform he shared with Vitalik Buterin. Vitalik, like most people, were convinced Wright wasn’t because he never provided the simple proof that he was Satoshi.

This is a mad moment because anyone that listens to Craig and looks at his track record, he’s a con. Gavin would later weaken his support for Craig but it was a large stain on his reputation plus this was detrimental to the big blocker’s argument and credibility.

It was ruled in court that Craig was not Satoshi.

Skipping over a lot of detail, in August 2017, Bitcoin Cash (BCH) was a hard-fork and what was seen a a solution to making Bitcoin maintain its ability to be currency for micropayments. It had a blocksize of 8MB and has had successful rallies.

BCH was the last big blocker coin – Bitcoin XT, Bitcoin Classic, Bitcoin Unlimited fell away – and it can still be utilised. For the small blockers, they wanted BCH to have some momentum and success because that would draw in and harbour the big blocker community.

Roger Ver had a lot of people calling his Bitcoin Cash project, Bcash. This did lead to an amusing moment of rage from Ver when interviewed by John Carvalho -https://www.youtube.com/watch?v=oCOjCEth6xI

Every now and then you may still see a comment somewhere, such as a comment section or some farcical conference, that Bitcoin Cash is the real Bitcoin. A fundamental reality here is did the original Bitcoin Network, established by Satoshi Nakamoto, continue? Yes. What is that called? Bitcoin. Therefore, Bitcoin is Bitcoin, everything else is just another attempt at something. Anything else is a philosophical argument, a spiritual argument, without Satoshi’s bless, that is just self-anointment to claim whatever project is Bitcoin.

Roger Ver stuck by his belief that BCH was the true vision of the original Bitcoin whitepaper. Yet, here I am writing in 2024 and I ask you, which cryptocurrency is Larry Fink of BlackRock asking you to buy? Which ETF became the most successful ETF in history?

And if Bitcoin persists, how do you unlock its security and wealth?

Bitcoin ticks on

At this point, regardless of people’s opinions of Bitcoin, what the government intends to do, what some conference spouts about Bitcoin, the network every 10 minutes or so creates another block. Another 10 minutes goes by and another block is added to the chain.

It has an extraordinary legacy already.

Vitalik Buterin got into Bitcoin around 2011, went on a pilgrimage across three continents, met all sorts of people involved in and around Bitcoin. He had wanted to build out the smart contract functions on top of Bitcoin but due to restrictions and security concerns this wasn’t possible. Therefore, Buterin came up with Ethereum.

.: Tick follows tock, Bitcoin makes another block. :.

Mike Hearn, an early core dev of Bitcoin, would leave Bitcoin after XT waned. He went on to work with R3 and a key developer for Corda – the internet of agreements for the traditional finance elite. R3 went on to incubate Obscuro, later renamed TEN – The Encrypted Network – this is a confidential-rollup for Ethereum, putting TEEs to work and making Ethereum Encrypted.

.: Tock follows tick, securing it with cryptic tricks. :.

Amir Taaki was the radical opposite to Gavin Andresen, Taaki was an advocate of Bitcoin being used to help WikiLeaks and those sorts of projects. He has gone on to Dark Fi and continue work towards private finance.

.: From the genesis block to the latest hash, freedom rides on its digital cash. :.

Litecoin was launched in 2011, a fork of Bitcoin Core codebase, it was seen as the silver to Bitcoin gold. 2024, Litecoin has submitted and become a memecoin.

.: With every turn, the ledger grows, immutable truth, the network knows. :.

Luckycoin was a fork of Litecoin. Dogecoin launched on December 6, 2013 with a grassroots community that wanted to take the serious edge off crypto. It has proven to be a solid store of value and can be argued a symbol of the American it – it has come from humble grassroots, now Elon Musk is taking Doge to the Whitehouse.

.: From the genesis block to the latest hash, freedom rides on its digital cash. :.

The Blocksize Wars may have eased out the big blockers for now but the question remains, how to deal with congestion? How does Bitcoin become more than a horded asset?

The small blockers want to increase Bitcoin's transaction capacity to millions of transactions per second whilst maintaining Bitcoin’s decentralization and security. One of the outcomes of this want is the Lightning Network.

I am interested in the trajectory of a certain character relating to David Marcus, follow me a second.

David Marcus claims he knew of Bitcoin in 2009 from Wences “BTC Patient Zero” Casares, I can believe that as he founded Zong a year earlier thus would have swum in similar circles. It was a mobile payments company that allowed users to pay for digital goods via their phone bills. Later acquired by PayPal in 2011. Marcus became PayPal president a year later.

Facebook had ambitions to seize the means of financial transactions, they hired Marcus and put him in charge of the messenger app. If you can layer the most popular social media app messenger with a payment service, the world is yours!

[ Here in “Diem Diaspora” I look into Facebook’s attempt to seize the world https://mirror.xyz/pcybe.eth/bGNT8lEfaKtBKQ5TLJBezSPt0DR8XDKaNVuDIglbVx8 ]

Meanwhile, in February 2015, Joseph Poon and Thaddeus Dryja published the Lightning Network whitepaper titled “The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments.”

2018, Lightning Labs, founded by Elizabeth Stark and Olaoluwa Osuntokun, released the first mainnet beta of the Lightning Network.

That year Libra Association begins its trek to world domination. Marcus began saying the now often said line that, “For me, now, it’s clearer that Bitcoin serves a purpose of being digital gold, not a good medium of exchange.” Funny that.

People like Marcus will say it is not a medium of exchange yet their cronies like PayPal Peter Thiel accepts Bitcoin as a payment for his products and services at Palantir. Obviously, it suited Marcus’s agenda to make Facebook’s Libra coin the go-to stablecoin.

[ Here is a tweet from Marcus that gives his POV on this chapter https://x.com/davidmarcus/status/1862654506774810641 ]

Libra limped to Diem, Diem dipped into an early grave. Marcus left Facebook in 2021. 2022 called and Marcus co-founded Lightspark along with Christian Catalini, who also worked at Libra/Diem. Lightspark is a company focused on developing infrastructure for Bitcoin’s Lightning Network, emphasizing scalability and practical applications of Bitcoin.

David Marcus becomes a board member of Brazil’s NuBank in 2023 – a digital bank with over 75 million users.

El Salvador has made Bitcoin legal tender and utilises the Lightning Network.

Marcus said a variety of well-known financial brands—including Stripe, Coinbase and NuBank—are trying out Lightspark’s tools. For example, NuBank have a partnership with Lightspark, through Lightspark Coinbase have integrated into Lightning Network.

Catalini speaks about how everyone is wrong about stablecoins - https://www.forbes.com/sites/christiancatalini/2024/11/01/why-everyone-is-wrong-about-stablecoins/ - it is an insightful read.

He brings up Stripe and speaks favourably of them, saying they have an advantage in the stablecoin market. Stripe is a company Marcus says work with Lightspark. In the article, Catalini says:

“Tech companies with banking licenses, like Revolut, Monzo, and Nubank, are well-positioned to lead in their markets, and other players are likely to accelerate their licensing efforts to gain similar advantages. However, many players in the stablecoin market will struggle to compete with established banks and may face acquisition or failure. Banks and credit card companies will resist a market dominated by one or two stablecoins. Instead, they’ll advocate for a landscape with multiple interoperable and interchangeable issuers. When that happens, liquidity and availability will be driven by existing distribution channels to consumers and merchants—an advantage already held by neobanks and payment companies like Stripe or Adyen.”

I have little doubt, all those positively mentioned in the article by Catalini are partnered with Lightspark. Here are some of the publicly shown partnerships:

Wences Casares, who encouraged Marcus interest in Bitcoin, set up Xapo Bank, which is integral to Bitcoin storage for the elite and Coinbase custody set-up, has integrated into Lightning Network via Lightspark.

David Marcus wanted to make a global digital currency that ran on Facebook but the tech was not fully ready and the regulators impeded this dream.

There is a whole rabbit hole with PayPal, Facebook, et al, which journalists such as Whitney Webb and Mark Goodwin provide thorough detail on.

Now, I present this with two implications.

One, this determination from David Marcus, this depth of infrastructure going back to start-up of PayPal and Xapo, it provides insight into the future of Bitcoin, that Bitcoin will have a huge significance in the future of currency and finance.

Two, Bitcoin has a danger of having a strong centralised cabal dominating it.

David Marcus spoke this year and declared “the only network that has achieved the level of decentralisation and neutrality that is actually good enough to become the internet of money is Bitcoin.”

Lightspark are releasing Spark, a Bitcoin L2 for payments.

Where the USD and other currencies have a central bank authority, Bitcoin doesn’t, meaning where Libra failed, Spark cannot.

For Marcus, Spark will become a Unified Money Grid with Bitcoin strong in the centre.

He was right about Bitcoin, I am highly skeptical Marcus and his cronies are the ones that should lead the way. I am just glad he isn’t declaring himself as Satoshi.

Block by block, brick by brick

The world is a big place, the schemers are gonna scheme.

Meaning in a jumper that we must knit ourselves.

China was calling for a neutral internation currency in 2008.

The graphic below is how much electricity is needed to mine a Bitcoin, the deep blue is cheap (woo, great) the purple is expensive (boo, bad).

As Bitcoin is not backed by a central authority, it is backed by energy and time. You need a rig and an energy source to harvest Bitcoin. Bitcoin helps store the value over time.

We are seeing the rise of the BRICS bloc and China has an objective to maintain Hong Kong as a financial centre of this network. Where Singapore will be a hub for family offices entry into crypto, Hong Kong wants to be the trading centre, real products will be traded with the use of Bitcoin and crypto, all outside of the Western financial system.

HK’s Cyberport's Web3 network is backed financially by the Chinese government, it features over 270 blockchain firms. China also has the benefit of being the centre of Bitcoin rig manufacturing, therefore, China and their energy-rich BRICS allies have an advantage in the Bitcoin economy compared to the West.

US sanctions increased 933% from 2000 to 2021. With USD printing and inflating, this causes the debts in smaller nations to be too vast, they struggle to stimulate their own economies as well as pay off the debts. On top of that, the high interest rates back home make USD so expensive abroad, therefore, the BRICS are massively incentivised to seek an alternative system. Putin hinted at a potential BRICS currency during the 2024 Kazan conference but there is an immediate system that is open, neutral, decentralised and has the deep liquidity: Bitcoin.

Let’s review the state of Bitcoin.

It has come a long way from a mailing list to now the asset governments, family offices, and investment firms are scrambling towards.

The West has charged up the Lightning Network via Lightspark to provide a Unified Money Grid with Bitcoin at the heart. Using the words from Fortune, people will send money across borders using a Venmo-style interface. In the background, the transaction will occur by converting one currency—say the Brazilian real—into Bitcoin and then converting it again into the transfer recipient’s local currency such as the U.S. dollar

The BRICS are building an alternative system to the western league, with Bitcoin playing a pivotal part.

In the private sphere, BlackRock is advising clients to stock up on Bitcoin, add to portfolios. In UK, pension funds have started to allocate a % towards Bitcoin.

That is a lot of activity coming to a network that keeps ticking on, ten minutes at a time. Bitcoin is imposing a new reality on us.

Aforementioned, Bitcoin captures energy and time, as the price in dollars rises, fewer millionaires and billionaires will be able to get a whole bitcoin. In Bitcoin, you have more time. In the current fiat system, there is a lot of debt and inflation, which robs people of their time – pay attention to your younger relatives, notice how much harder they have to work for the rewards to be a lot less.

And still my relatives won’t hear me out when I say buy Bitcoin. NGMI.

DSEQ

This new reality we owe a lot to a cypherpunk mailing listing. It was these people who brought to the public the push for cryptographic money. The attempts were the breakthroughs that led to Bitcoin.

$BTC will most likely be around for 100 years more as it has reached escape velocity. If a school of thought to scaling Bitcoin is providing a layer-2 over the network, how can we maintain a decentralised future?

Goat Network is providing that and opening up BTC-FI.

Goat was incubated by the Metis Foundation. I have done a big read on Metis, which can be read here - https://mirror.xyz/pcybe.eth/4IJTMcvAULH3kO-tvpQ3tqHbeRBugwKlGveYqOYmseo. Metis comes out of Natalia Ameline, mother of Vitalik Buterin, and Elena Sinelnikova meeting Kevin Liu, Yuan Su and Ming Guo. They worked together to build a layer-2 for Ethereum and wanted to progress the DAC economy.

Metis was the first Ethereum Layer 2 to decentralise the sequencer.

A sequencer determines the order of transactions, it batches the transactions and send them to Ethereum.

A sequencer is profitable business, which is why chains are so reluctant to decentralise it

The drawback of having a centralised sequencer is if the sequencer goes down, the network is down, and this has happened to other layer 2s. On top of that, those that run the sequence can front-run and abuse information from the sequence.

Decentralised sequencers (DSEQ) makes the network more secure, where one may fail, there are other sequencers, plus it protects for participants of the chain from front-running. The decentralised sequencer model design allows participants to run their own sequencer nodes, earning a direct share of the network's revenues.

Metis DSEQ nodes can earn up to 5,000 METIS every month on a successful application, while nodes that have LST protocols, which provide DeFi opportunities to users and boost network utilisation, stand to earn as much as 10,000 METIS monthly.

Projects such as Enki and Artemis have utilised this to reward their communities.

Notably, Metis have incubated ZKM and then Goat Network.

The objective of ZKM is to scale blockchain with ZK-tech. The team cooked up something good, something called zkMIPS. Don’t worry, this is all relevant to Goat.

zkMIPS

People started swapping things and ever since they’ve been making more complicated system based around the simple idea of person A and person B exchange an item or two. What if I am Dutch and want to sell nutmeg in Europe? Well, that is a massive endeavour but lucrative if accomplished.

We used to call up a fella to sell our stocks on a gold mine in a country with dubious legal structures.

We have these vast financial networks centred around banks and fractional reserve ideas. Then some Japanese sounding name on the internet said, “How about these apples?” as he posted a whitepaper on Bitcoin.

And from there we have all these blockchains popping up, which is great but there is a lot of faff to connect them. There are bridges, hacks, vulnerabilities. It can be a nightmare even for the hardened crypto-vet. All this so I can sell magic internet money.

MIPS indeed stands for Microprocessor without Interlocked Pipelined Stages. The MIPS architecture uses a reduced instruction set computer (RISC) instruction set, which provides a simple and efficient way to execute instructions.

To quote the ZKM whitepaper on zkMIPS, “One of the advantages of MIPS is its fixed set of instructions, which simplifies the design of stable zero-knowledge products for the market… In the realm of blockchain Layer 2 solutions, applying MIPS architecture results in less complicated circuits in ZK proof generation system. This makes MIPS an ideal fit for practical blockchain L2 solutions built upon it.”

Ming Guo, chief scientist at Metis and ZKM, began working in aerospace, doing research on re-entry objects.

Then he ventured into MIPS architecture before going into blockchain. A rather bright and interesting man to say the least.

Ming and Kevin Liu were perhaps thinking one, how do you solve the issue with bridges as they tend to be rugged or exploited.

Then there was some eureka moment that went something like this:

“Kev, mate, you know zero-knowledge proofs, right?” Ming is leaning back in his office chair, looking at the ceiling.

“Verified,” Kevin continues to bounce his ball against the wall, a mug with ‘METIS’ on it sits on his desk with half-cold coffee.

“Well, my old pal, how about we just zk the MIPS?” Ming merges his hands together.

And Kevin nods, pulling this gesture…

ZKM was established and can boast having Jeroen van de Graaf, and Lucas Fraga among others helping with the project.

With Stephen Duan from Eigen Network, ZKM has imported a lot of knowledge and experience as Eigen Network was building a general-purpose zkVM with native privacy.

The intention was to help Metis become a hybrid rollup, which is the best of Optimistic and ZK rollups. but eventually their eyes widened one day – I presume – because they realised the scale this can go.

ZK techniques allow states to be verified without revealing the information, ZK shields the data. MIPS is a stable instruction set. One of the issues with ZK is EVM can have changes to it that make it unstable for ZK. However, as EVM is a VM, therefore a tech stack, MIPS are a CPU instruction set, which is lower than the tech stack.

With MIPS is low-power, scalable processor design, ZK can make it private. PERFECT. And here is the great thing.

Let’s say an ecosystem equals a base layer and multiple rollups.

If one rollup in an ecosystem becomes ZKVM compatible then it can be interoperable with all the other rollups

Now, Bitcoin is one ecosystem, Ethereum is another. If there is one rollup on both ecosystems ZKVM compatible, then those ecosystems are interoperable. They call this the ENTANGLED ROLLUP.

ZKM’s tech stack is designed to facilitate universal settlement across previously incompatible blockchain networks, enabling trust-minimized compatibility and unified liquidity.

Metis is on Ethereum and will become a hybrid rollup, meanwhile on Bitcoin…

Year of the Goat

Once ZKM had its breakthrough, the Metis foundation incubated another beast.

THE GOAT.

In the Bitcoin game, people want as much Bitcoin as they can accumulate. However, as the dollar cost goes up for Bitcoin it gets harder to purchase $BTC therefore the alternative is to mine Bitcoin. Yet, this is capital intensive and costly in energy terms unless you own a volcano, a dam, or live in Iceland.

By applying decentralised sequencers and ZKM-tech on the back-end, Goat Network can provide secure, sustainable yield for Bitcoin. This can be witnessed in the Metis ecosystem, Enki and Artemis were providing 100%+ APY for Metis tokens as Metis was applying its eco-fund and those two projects help sequencer nodes and could apply the rewards to stakers. Added to that, tokens could be liquid staked through Shoebill Finance.

Therefore, in Goat, the revenue from these sequencer nodes can be shared, people can get Bitcoin as rewards. If you own a node, you can lock in BTC for BTC rewards but rewards can be enhanced if the Goat token is locked in also.

Goat Network can open up borrowing, lending, NFTs, defi, with Bitcoin at the core. Goat will start with 7 nodes in the decentralised node network, the first to do so and Goat will scale, it will go on to have hundreds of nodes then thousands.

Projects can launch through Goat Launcher, the launchpad for projects wanting to build on Goat Network. With incentivized governance to empower community-driven moderation, Goat Launcher can reflect the community values.

Goat Network can off-load the computation on Bitcoin, help provide the speed and efficiency wanted and needed for a BTC-FI economy, all the while maintaining decentralisation.

This is an exciting prospect for Bitcoin. I will give a real quick history of the evolution of Bitcoin, how it has gone from went from addresses to Goat as this will help appreciate how a currency can now have dapps built on it.

Bitcoin’s evolution reflects its journey from a simple digital currency to a sophisticated platform enabling advanced computations and smart contracts. It began with legacy addresses, the original Bitcoin address format. These were functional but lacked optimisations for scalability and fee reduction, paving the way for innovations.

Native SegWit was a significant step forward, introducing improved scalability, lower fees, and advanced signature schemes to enhance transaction efficiency. This was followed by Taproot, which transformed Bitcoin by enabling complex smart contracts, bolstering privacy, and improving fungibility through advanced scripting mechanisms and signature aggregation.

In the network's early days, certain scripting functions like OP_CAT were disabled by Satoshi to prevent vulnerabilities such as Denial-of-Service (DoS) attacks. However, recent advancements have revisited computation possibilities in more secure ways.

One breakthrough is BitVM, which allows computations to be represented on Bitcoin without executing them on-chain. Instead, it stores proofs of these computations for verification, sidestepping the limitations of earlier scripts like OP_CAT. Its successor, BitVM2, introduced permissionless verification, enabling anyone to validate computational proofs without centralised trust.

Building on this, the GOAT Network’s Optimistic Challenge Process (OCP) leverages BitVM2’s protocol to enable off-chain computation verified on-chain. Inspired by ZKM’s proof network, it splits complex verification into smaller tasks managed through Merkelized Abstract Syntax Trees (MAST) and Taproot.

From basic transactions to permissionless computation, Bitcoin now embodies a robust framework for decentralised innovation, blending privacy, efficiency, and scalability. $BTC went from $0 to $100,000 in less than twenty years.

Bitcoin will be around for another hundred years, governments are mining and stacking, and Goat Network is opening up Bitcoin to be an active asset. Goat respects the fundamentals and enhances them.

And the really exciting long-term of all this is the Unified Settlement Layer and Entangled Rollup.

Aforementioned, if one rollup on one base layer has ZKM-tech and there is another rollup on another base layer with ZKM-tech, then they are compatible. This ZKM-tech is easy to implement.

We have Metis on Ethereum and Goat Network on Bitcoin. Metis will bring in ZKM-tech and therefore, we have the two biggest cryptocurrencies able to bridge. If someone wishes to, they will be able to enter the Ethereum ecosystem and utilise Bitcoin as collateral.

And if you think further out, there is the Move side of crypto, there is Solana and so on. If these have ZKM-tech, the fluidity of liquidity will be huge and range dapp composition will be broad.

Let me get help put across the how significant ZKM-tech with a decentralised network is for crypto.

Connecting blockchains like Ethereum, Metis, and Arbitrum is crucial for seamless communication and transferring assets.

Traditionally, this requires relayers to send transactions between chains and oracles to verify them. For two blockchains, you’d need 2 relayers (one for each direction) and 2 oracles (one for each chain). But as you add more blockchains, the infrastructure balloons: 3 blockchains need 6 relayers and 3 oracles, 4 blockchains need 12 relayers and 4 oracles, and so on.

This setup quickly becomes expensive, complex, and hard to manage. Enter DSEQ network, a game-changing solution. These components handle the roles of both oracles and relayers for multiple chains, drastically simplifying the system. Instead of setting up separate relayers and oracles for every chain pair, a single sequencer can support the entire network.

DSEQ networks scale beautifully. Need more capacity? Just add another sequencer, and it serves all chains without creating redundant infrastructure. This not only cuts costs but also makes the system more efficient and easier to maintain.

The result? Blockchain interoperability that’s simpler, cheaper, and scalable. There is less infrastructure, therefore, less vulnerabilities to capital. Then, the infrastructure that is used – the DSEQs – help maximise revenue and community rewards.

DSEQ networks have the potential to revolutionise the way blockchains interact, making the ecosystem more connected and fostering greater innovation. It’s a step toward a future where blockchains work seamlessly together—without all the technical headaches.

Goat is launching at the start of 2025 and as it has the security of Bitcoin whilst scaling it. Bitcoin isn’t going anywhere; Goat can accelerate the growth of Bitcoin.

Leap across the chasm

This used to be a way to purchase Bitcoin.

Wences Casares established Xapo Bank with high security for Bitcoin to high-value clients.

This infrastructure was bought by Coinbase, who then became the custodian for BlackRock.

BlackRock are pushing Bitcoin to be a % of people’s portfolios.

David Marcus and Lightspark are hellbent on unifying money with Bitcoin at the centre.

BRICS are opening up crypto channels, nations are mining Bitcoin, stacking it.

Soon Bitcoin will be too costly to mine and too costly for people to get a whole Bitcoin in their wallets.

If there is any doubt, I wish to erase it. Bitcoin will continue to grow as there is this strong, deep liquidity that is decentralised.

Meanwhile, Goat Network provides a secure, decentralised Layer 2 for Bitcoin to turn idle Sats into a yield-bearing asset. As Goat progresses, it can leap across the chasms between ecosystems and provide a trust-minimised bridge protocol as its Entangled Rollup unifies liquidity.

I will reiterate the point.

Goat Network can unify liquidity in crypto.

Goat Network can embolden the Bitcoin economy.

Tick Tock, Next Block.