By Gary Pesola, Venture Fellow @NEA & IB @GS

The Evolution of the Web

Before diving into crypto / web3, we need to first understand the precursors and look at how the web has changed.

The internet was created in the 70s during the Cold War. At the time, the US had a centralized computer controlling its nukes and the government was worried a single attack could shut down the entire system. Decentralization became a priority and so a system of computers across the country emerged.

Web 1.0: READ ME

In 1990, Tim Berners-Lee created the World Wide Web. Initially, only highly technical individuals could use the tool, but this quickly changed with the emergence of web browsers like Mosaic and Internet Explorer. These browsers allowed for anyone to surf the web, ushering in the age of web 1.0. Web 1.0 was decentralized and open-source so anyone could actually build on it, but only if they had highly technical skills. Many like to call web 1.0 READ ME since that’s all most people could do.

Web 2.0: READ + WRITE ME

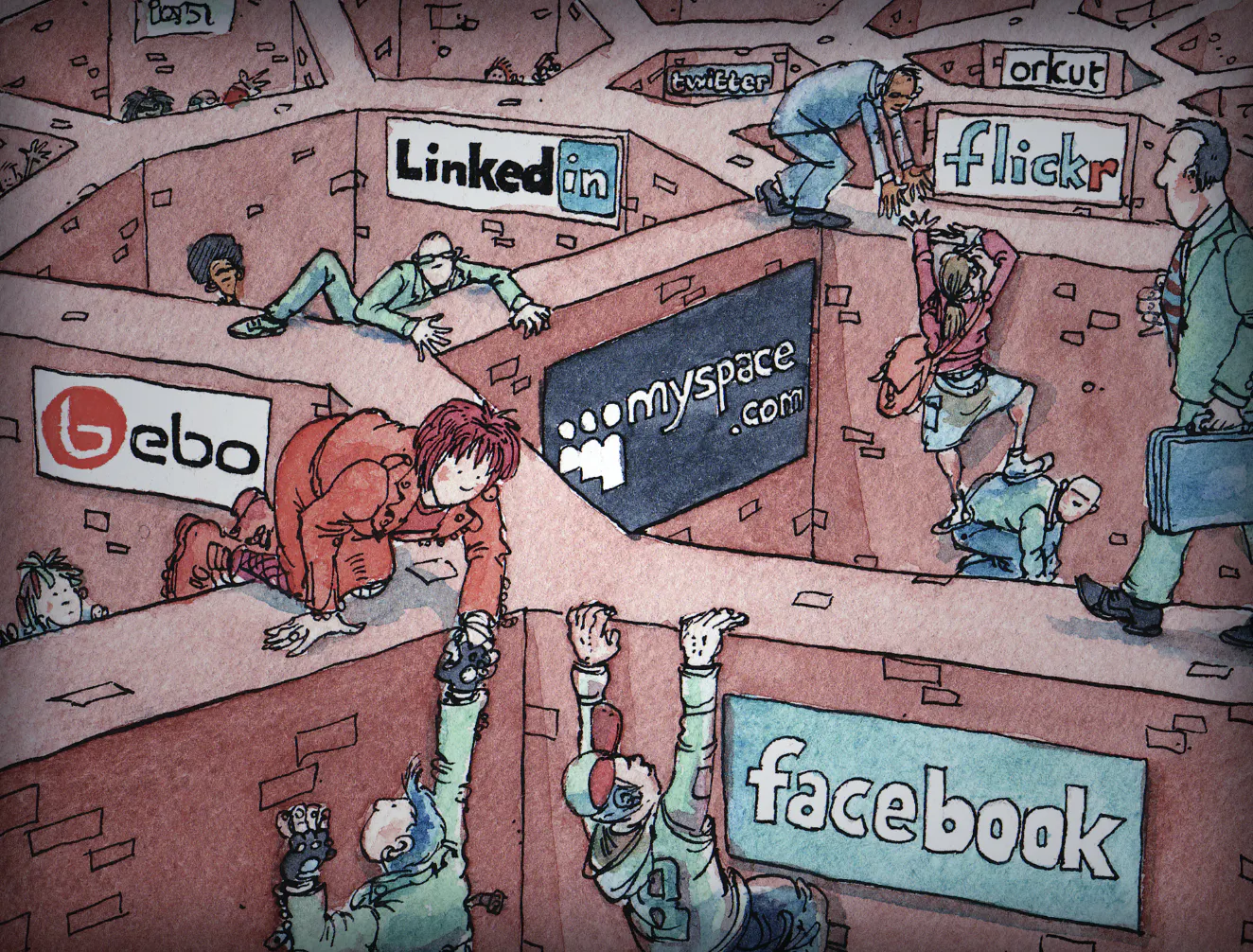

Around 2005, easy to use websites emerged allowing anyone to publish content online. MySpace, Youtube, and Twitter are just a few early examples. Our lives became infinitely easier with these new platforms, but one of the main goals of the web: decentralization; became a thing of the past. Most of the web’s data became concentrated in a few different websites (each site having their own centralized data centers powering them). Web 2.0 is characterized by convenience and centralization.

Problems in web 2.0:

- Advertising: Everywhere you click there are ads. Ads became rampant because people were worried about putting their credit card information on the web, so platforms needed to offer their content for free, and instead, monetize it with ads. Free content is also an easy to way to grow a platform’s userbase.

- Data Collection & Breaches: Corporations quickly realized that collecting a user’s data could lead to better ads, and better ads could lead to more sales. User data is stored in enormous centralized servers, making them easy prey for hackers.

- Surveillance: Governments collect data just like companies do. Check out PRISM, a USA surveillance program that allegedly (reported by the Washington Post and The Guardian) has direct access to the servers of Google, Facebook, and many others.

- Censorship: Centralized servers make it incredibly easy for governments or corporations to block access to them. Some governments ban media platforms that support political dissent. China has banned most western media platforms including Facebook, Youtube, and Wikipedia.

Web3: READ + WRITE + OWN ME

Web3 is about returning to decentralization. By building applications (like Facebook or Youtube) on decentralized networks, networks like Bitcoin, this can be achieved. A Blockchain is an immutable digital ledger that connects a decentralized network. Applications on the blockchain have no single entity enforcing rules, rather rules are enforced through cryptography, allowing for transactions to be verified and added to the blockchain in a transparent and secure way.

What is Blockchain Technology?

Put simply, the blockchain is a tamper-proof shared database that records transactions. Transactions can be tangible (buying a sofa) or intangible (selling intellectual property), and the blockchain can record both. Blockchains can also be programmed via smart contracts, or programs that will run once predetermined rules are met. Smart contracts allow the blockchain to be fully programmable.

In order for transactions to be verified and recorded, they must be approved by the blockchain network. Once a transaction is initiated, it’s sent to members of the network and subject to approval (via consensus mechanisms). If approved, the transaction is added to the blockchain and distributed across the network. Members of the network are financially incentivized to verify transactions because money is paid out to them when they verify a transaction. In the case of Bitcoin, this verification process is known as Bitcoin mining. The money paid out to miners is supplied by the person initiating the transaction and is known as the gas fee (AKA transaction fee).

Contrary to popular belief, Bitcoin mining is NOT actually taking a pickaxe and hitting the dirt hoping for gold.

How do I “own” web3?

Tokens give users property rights, or in other words, users can own a piece of the internet by owning tokens. Ethereum (a blockchain) has a native coin called Ether, which is responsible for powering transactions and running the network. Ether is also a cryptocurrency that can be used for the transactions. Coins and tokens, like Ether, can be purchased via exchanges, or earned through projects like play-to-earn and build-to-earn.

Here’s an example of owning part of the internet:

If you want to buy an NFT (which is a token), you can’t use fiat currency (like US Dollars), instead you’d use coins and tokens. Most NFTs are sold for Ether, and so you’d have to go through an exchange, like Coinbase, to turn your fiat currency into Ether. Once you have Ether, you can purchase the NFT. By owning Ether, you also own part of the Ethereum blockchain as Ether powers the blockchain.

Tokens

Tokens can be broken into two broad categories: Fungible and Non-Fungible. Fungible tokens are indistinguishable between each other, the US Dollar is a great example of fungibility. 1 US dollar is identical to another and so they can always be exchanged between each other. On the other hand, non-fungible tokens (NFTs) are unique and are distinguishable between each other. A great example of a non-fungible item would be your passport. You cannot exchange your passport with someone else’s because it has unique information and is only compatible with you.

Tokens can be used to govern projects, similarly to how shares of a company govern corporations; however tokens are not considered financial securities (at least not yet). By engaging in future social media platforms on the blockchain (check out BitClout, an Instagram like blockchain platform), you could gain ownership of the native tokens of the platform and have a financial incentive for the success of the platform (aligning user + platform interests is a very good thing).

Here’s a great article on governance tokens if you’re interested in learning more!

Where do Cryptocurrencies come in?

A cryptocurrency is simply the native digital asset of a blockchain. Tokens are digital assets that are built on existing blockchains. For example, Ether ($ETH) is the native cryptocurrency on the Ethereum blockchain, while Uniswap ($UNI) is an Ethereum token that governs the Uniswap Protocol, which is built on Ethereum. Coins and tokens have prices like stocks that constantly change.

There can be dozens of tokens existing on a blockchain (which Ethereum already has) but there can only be one coin (AKA cryptocurrency) on a blockchain.

TL;DR

- Web 1.0 & 2.0 had many problems, including data collection and data breaches as a result of centralized authorities

- Blockchain technology is tamper-proof and decentralized, allowing for the creation of cryptocurrencies (coins + tokens) and is ushering in Web3

- Tokens (on the blockchain) allow for people to own parts of the internet by contributing to projects, posting content, or simply using the platforms themselves

- Cryptocurrencies are the medium for content, projects, and applications to be easily owned by anyone… Not just large corporations