Focus on Stability & Trade, Securely Built for Inclusion, Stability, Cross border Trade, Revenue Sharing and Evolution to decentralisation

Table of Content

-

Introduction

-

Problem Statement

-

Solution Overview

-

Why Create a Nordic stablecoin instead of using the Euro or USD in the crypto space?

-

Why Peg a stablecoin to a basket of currencies?

-

Comparison of metrics between Nordics & Euro

-

Technology Stack

-

$EURN Token

-

The Digital Nordic Euro Basket

-

Profit Sharing & rewards using ColorTrace Implementation & Staking

-

Chainlink Implementation

-

reForge Implementation

-

Here are some ways the Digital Nordic Euro will make money

-

Risk Assessment

-

Regulatory & Compliance

-

Conclusion

1. Introduction

The Nordic region is a group of prosperous and stable economies with a strong tradition of innovation. However, the region is currently reliant on external currencies, such as the Euro and USD, for its monetary system. This dependence on external currencies can make the region vulnerable to global economic shocks and can hinder its ability to pursue independent monetary policies. In addition, the Nordic region relies on the Euro for cross-border trade and investment. The euro is the most widely used currency in the world, and it is the currency of choice for many European businesses and investors. This can make it difficult for Nordic businesses to compete with businesses in countries that use the Euro.

To address these challenges, a new Euro Digital Euro called $EURN is introduced, a stablecoin anchored to the Euro and a basket of Nordic currencies, including the Danish krone (DKK), Swedish krona (SEK), and Norwegian krone (NOK). $EURN would offer several benefits to the Eu & the Nordic region, including:

-

Enhanced Monetary Stability: $EURN would help to more stabilize the Nordic economy by providing a stable and predictable monetary anchor.

-

Increased Financial Inclusion: $EURN would make it easier for Nordic businesses and individuals to access financial services.

-

Enhanced Trade Facilitation: $EURN would facilitate trade between Nordic countries and would make it easier for Nordic businesses to trade with businesses in other parts of Europe and the world.

-

More Effective Profit Sharing: $EURN would utilize ColorTrace from Layer Zero Protocol to enable transparent and efficient profit-sharing mechanisms among participants of the transactions.

-

**Efficient & Secure: **$EURN would leverage ARYZE’s Digital Cash and the reForge solution to instantly access any variant of Digital Cash needed for the basket i.e. eEUR, eDKK, eNOK, eSEK. This unlocks arbitrage opportunities, as market makers can take advantage of price differences between Digital Cash pairs across Web3 by reForging Digital Cash into a currency they wish to buy or sell on an exchange, ensuring the stability of the $EURN basket.

2. Problem Statement

Volatility Concerns: The traditional cryptocurrency market is characterised by significant price volatility, making it challenging for users to rely on these digital assets for stable transactions and store of value.

**Currency Diversification: **Users and businesses desire exposure to multiple fiat currencies to mitigate risks associated with the fluctuations of a single currency. A stablecoin backed by a basket of major European currencies (EUR, DKK, SEK, NOK) could offer a diversified and stable alternative.

Cross-Border Transactions: Traditional cross-border transactions often involve high fees, delays, and complexities. A digital stablecoin backed by multiple fiat currencies could streamline cross-border transactions, reducing costs and improving efficiency. The Nordic region is currently reliant on external currencies, such as the Euro, for its monetary system. This reliance on external currencies can make the region vulnerable to global economic shocks and can hinder its ability to pursue independent monetary policies. For example, if the Euro or USD experiences a devaluation, Geo-political crises, the Nordic region’s economy could be negatively affected. Additionally, the Nordic region has limited control over the monetary policy of external currencies, which can make it difficult to respond to domestic economic challenges.

Representation of Nordic Digital Currencies: Recognize the absence of Nordic digital currencies at the same level as EURC in the European digitl currencies landscape. The lack of representation impedes the diversified use of stablecoins in Nordic countries.

Liquidity and Stability: The use of a single Nordic stablecoin like eDKK/eSEK/eNOK in Europe may not provide the required liquidity and stability. This limitation hinders the broader adoption and efficiency of Nordic stablecoins in cross-border transactions.

Inefficiency in Trade Conversion: Trade often occurs across borders and involves transactions in Euros or local currencies. The need for conversion during trade is inefficient and poses challenges in achieving optimal liquidity and stability.

3. Solution Overview

A countries monetary authority, such as its central bank, may use a basket of currencies as a reference with which to set its own currency exchange rate, such as in the case of a pegged currency. By using a basket of foreign currencies, rather than pegging to just a single currency, the monetary authority can lower exchange-rate fluctuations. The same principal can be applied to stablecoins.

Equity investors who have exposure to different countries will use a currency basket to smooth risk. Their core investment strategies are in the equity markets, but they do not want to incur substantial losses when investing in foreign equity markets due to currency fluctuations. The same can be said for bondholders. The same principal can be applied to stablecoins.

$EURN is a stablecoin that is anchored to EURO and a basket of Nordic currencies. This means that the value of $EURN is pegged to the average weighted value of the eEUR, eDKK, eSEK, and eNOK. This peg is maintained by a participants of European and Nordic banks and financial institutions to ensure that its value remains stable.

$EURN is designed to provide the European & Nordic region with several benefits, including:

-

Enhanced Monetary Stability: The peg to the Nordic currency basket will help to stabilize the value of $EURN, making it a more attractive currency for businesses and individuals.

-

Increased Financial Inclusion: $EURN will be more accessible to Nordic businesses and individuals than external currencies, which will help to improve financial inclusion in the region.

-

Enhanced Trade Facilitation: $EURN will be a common currency that can be used for cross-border payments between Nordic countries and across Europe. This will make it easier for businesses to trade with each other and will also make it easier for tourists and businesses to travel within the region.

-

More Effective Profit Sharing: ColorTrace from Layer Zero will enable transparent and efficient profit-sharing mechanisms among network participants. This will ensure that all participants in the $EURN network are fairly compensated for their contributions.

-

Enhanced Efficiency & Security: reforge will enhance the security and accuracy of price feeds, ensuring the stability of the $EURN basket.

4. Why Create a new Nordic based Euro stablecoin instead of using the Euro or USD in the crypto space?

It can offer several advantages tailored to the specific economic and financial characteristics of the Nordic region. Here are some reasons why Nordic stablecoins might be beneficial:

-

**Focus on Trade & cross border transactions: **Most of the major stable coins today are not centred for trade and cross border, but just as a temporary mechanism to hold stable value that deteriorates over time due to factors like inflation. They have to constantly serve yields, otherwise lose value.

-

**Regional Focus: **Nordic stablecoins can cater specifically to the Nordic market, addressing the unique needs and preferences of users in Sweden, Denmark, Norway, Finland, and Iceland.

-

**Currency Pegging Flexibility: **A Nordic stablecoin allows for greater flexibility in choosing the pegging mechanism. It can be pegged to a basket of Nordic currencies, providing stability and reducing reliance on a single fiat currency.

-

**Economic Resilience: **The Nordic region is known for its economic stability and resilience. A stablecoin pegged to Nordic currencies may be perceived as a reliable and secure digital asset within the local context.

-

**Local Regulatory Alignment: **A Nordic stablecoin can be designed with a clear understanding of local regulatory requirements, ensuring compliance with Nordic financial regulations and potentially facilitating quicker regulatory approvals.

-

**Reduced Exchange Rate Risk: **For businesses and individuals operating within the Nordic region, a stablecoin pegged to Nordic currencies can reduce exchange rate risk compared to using stablecoins pegged to global reserve currencies.

-

**Cultural and Linguistic Alignment: **Nordic stablecoins can leverage cultural and linguistic alignment within the region, creating a stronger sense of community and trust among users.

-

**Innovation and Technological Sovereignty: **Issuing Nordic stablecoins provides an opportunity for the region to lead in financial innovation, fostering technological sovereignty and reducing dependency on external financial systems.

-

**Support for Local Businesses: **Adoption of Nordic stablecoins can support local businesses by offering a stable and efficient digital payment solution within the region, potentially innovating the legacy slow and expensive payment processors and reducing transaction costs associated with cross-border payments.

-

**Environmental Considerations: **The Nordic region is known for its focus on sustainability. A Nordic stablecoin could incorporate environmentally friendly features, aligning with the region’s commitment to green initiatives.

-

**Strengthening Nordic Fintech Ecosystem: **The creation and adoption of Nordic stablecoins can contribute to the growth of the Nordic fintech ecosystem, fostering innovation, and attracting investment in the region.

-

**Localization of Financial Services: **A Nordic stablecoin can facilitate the localization of financial services, enabling the development of decentralized applications and financial products tailored to the Nordic market.

-

Resilience to Political Interference: The euro is subject to political interference from the European Central Bank (ECB), which could make its value more volatile. Nordic stablecoins, on the other hand, would be less susceptible to political manipulation, as they would be governed by decentralized organizations.

-

Increased Access to Liquidity: Nordic stablecoins could provide increased access to liquidity for businesses and individuals in the Nordic region. This could make it easier for them to conduct transactions and invest their money.

-

Powerful Alternative to the USD & EUR Stable coins: This will serve as a powerful, stable and secure alternative to the different existing flavours of the USD & EUR stable coins which do not share profits.

While using global stablecoins like USDC or USDT may be practical for certain purposes, the introduction of Nordic stablecoins emphasizes a commitment to regional needs, regulatory alignment, and the fostering of a thriving digital economy within the Nordic context. It’s essential to carefully assess the market demand, regulatory landscape, and potential collaborations within the region to ensure the success of Nordic stablecoins.

5. Why Peg a stablecoin to a basket of currencies?

Pegging a stable coin to a basket of currencies rather than a single currency, offers several advantages, primarily related to increased stability and reduced exposure to the economic conditions of any individual currency. Here are key reasons for pegging to a basket of currencies:

-

**Diversification: **By pegging to a basket of currencies, the stablecoin is inherently diversified. This means that the stability of the stablecoin is less vulnerable to the fluctuations of any single currency. Diversification helps mitigate the impact of economic shocks in a specific country.

-

**Reduced Exchange Rate Risk: **Pegging to a basket of currencies reduces the exchange rate risk associated with pegging to a single currency. If the stablecoin were pegged to a single currency, it would be more susceptible to the economic conditions and monetary policy decisions of that particular country.

-

**Economic Stability: **A basket of currencies often includes currencies from stable and economically strong nations. This stability helps maintain the value of the stablecoin over time and provides confidence to users and investors.

-

**Broad Market Representation: **Including a variety of currencies in the basket ensures a broad representation of different economies. This is especially beneficial if the stablecoin aims to serve a global or multi-regional user base.

-

**Central Bank Diversification: **Central banks and monetary authorities often hold reserves in a basket of currencies to diversify their holdings. Pegging a stablecoin to a similar basket aligns with the principles of prudent financial management.

-

**Market-Driven Stability: **Pegging to a basket allows for a more market-driven stability mechanism. The value of the stablecoin reflects the overall stability of the combined currencies, reducing the influence of any single central bank’s policies.

-

**Adaptability to Changing Economic Conditions: **Economic conditions can change over time, impacting the value of individual currencies. A basket peg provides flexibility to adapt to these changes, allowing the stablecoin to maintain its stability even if one or more currencies in the basket experience fluctuations.

-

**Geopolitical Risk Mitigation: **Geopolitical events and uncertainties can impact individual currencies. A basket peg helps mitigate geopolitical risk, as the stablecoin’s value is influenced by a diversified set of currencies.

-

**Global Acceptance: **A stablecoin pegged to a basket of widely accepted reserve currencies may have increased global acceptance. Users and businesses around the world may find it more reliable and suitable for various international transactions.

-

**Aligning with Global Economic Trends: **As the global economy evolves, a stablecoin pegged to a basket can better align with overall economic trends, providing a stable and adaptable solution for users.

While there are advantages to pegging to a basket of currencies, it’s essential to carefully manage the composition of the basket, considering factors like economic size, stability, and liquidity of the included currencies. Additionally, regular monitoring and adjustments may be necessary to ensure the stability of the stablecoin over time.

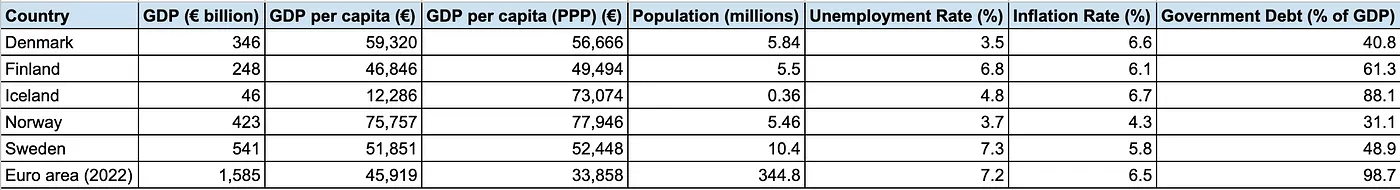

6. Comparison of metrics between Nordics & Euro

Here is a comparison of the supply, GDP, and other key economic indicators for the Nordic countries and the Euro area:

The data for the table comparing the GDP numbers for the Nordic countries and the euro area is from the International Monetary Fund’s World Economic Outlook database. This database provides data on a wide range of economic indicators for countries around the world. The data is updated quarterly, so the figures in the table are for the fourth quarter of 2022.

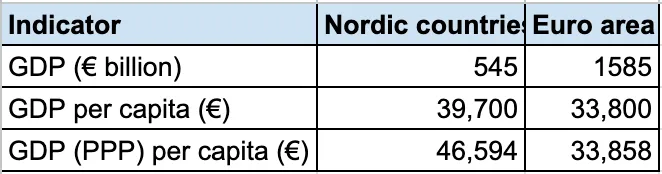

GDP: The Nordic countries have a combined GDP of €545 billion, which is about 34% of the euro area’s GDP of €1585 billion.

-

GDP per capita: The Nordic countries have an average GDP per capita of €39,700, which is about 12% higher than the euro area’s average GDP per capita of €33,800.

-

GDP (PPP) per capita: The Nordic countries have an average GDP (PPP) per capita of €46,594, which is about 42% higher than the euro area’s average GDP (PPP) per capita of €33,858.

As you can see, the Nordic countries have a strong economy with a high GDP and GDP per capita. They also have a high standard of living, as indicated by their high GDP (PPP) per capita.

Denmark is strong and reliant on services such as finance, shipping, and tourism.

Finland has an economy based on manufacturing, forestry, and telecommunications.

Norway also has a strong economy, based on oil and gas production.

Sweden’s economy is based on manufacturing, engineering, and forestry.

Overall, the Nordic countries are some of the wealthiest countries in the world. They have strong economies, high levels of education, and well-developed social safety nets. This makes them attractive places to live and work.

Here is a table summarising the key economic indicators for the Nordic countries and the euro area:

Summary GDP 2022

**Supply. **The Nordic countries have a relatively small population and a large supply of natural resources, such as oil, gas, and timber. This has helped to support their economies and has made them relatively wealthy. The euro area, on the other hand, has a much larger population and a smaller supply of natural resources. This has put pressure on the euro area’s economy and has led to higher levels of unemployment and inflation.

**Unemployment: **is the rate of people who are actively seeking work but cannot find a job. It is a measure of the health of the labor market. A low unemployment rate is generally considered to be a sign of a healthy economy, while a high unemployment rate can indicate a weak economy. The Nordic countries have an unemployment rate of 5.2%, which is lower than the euro area’s unemployment rate of 7.2%. This is due to the fact that the Nordic countries have a strong social safety net and a well-functioning labor market.

**Inflation: **The Nordic countries have an inflation rate of 5.9%, which is lower than the euro area’s inflation rate of 6.5%. This is due to the fact that the Nordic countries have a relatively closed economy and are less exposed to the global economy.

**Government Debt: **The Nordic countries have a government debt-to-GDP ratio of 54.04%, which is lower than the euro area’s government debt-to-GDP ratio of 98.7%. This is due to the fact that the Nordic countries have a long history of fiscal prudence and have a strong public sector.

Overall, the Nordic countries are a group of prosperous and stable economies. They have a strong social safety net, a well-educated workforce, and a healthy economy. The Nordic countries are also relatively well-positioned to weather the current economic downturn.

7. $EURN Token

The $EURN token is a digital asset that is used to represent ownership of the Digital Nordic Euro. The token maybe based on the Ethereum blockchain, Zk Layer2 & Layer Zero and is compatible with the ERC-20 standard.

$EURN tokens can be bought and sold on cryptocurrency exchanges. They can also be used to make payments, provide DeFi, AI based arbitrgate opportunities and to store value as an alternative to the monopoly of USDC, USDT, EURC etc

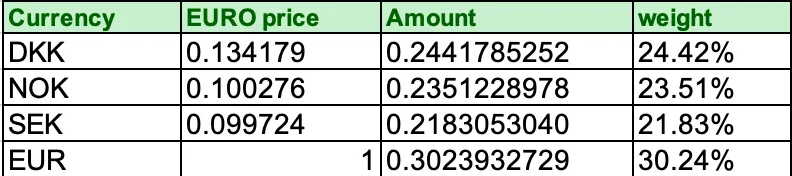

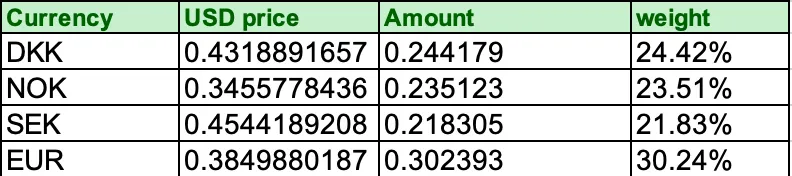

These weights were chosen to reflect the relative size and importance of the currencies in the European and Nordic economy. The DKK is the largest currency in the Nordic region, followed by the SEK and the NOK. The weights of the currencies in the basket may also be adjusted periodically to reflect changes in economic conditions.

Please note that the revenue collected on a percentage ratio maybe invested in prominent cryptocurrencies like BTC, ETH etc over a period of time, mainly when inflation comes into the picture. This will serve as a hedge over a period to time to evolve into a more decentralized currency. More about that later.

Ratios for the basket are mentioned in the below section.

8. The Digital Nordic Euro Basket

The Digital Nordic Euro basket is the set of currencies that is used to peg the value of $EURN. The current basket consists of the eEUR, eDKK, eSEK, and eNOK from ARIZE . The weight of each currency in the basket is determined by the Digital Nordic Euro DAO. More about that later.

The $EURN basket is designed to be diversified across a number of stable Nordic & EU currencies. This diversification helps to mitigate the risk of sharp fluctuations in the value of $EURN as the supply of these Nordic coins is not as large as the EUR or USD.

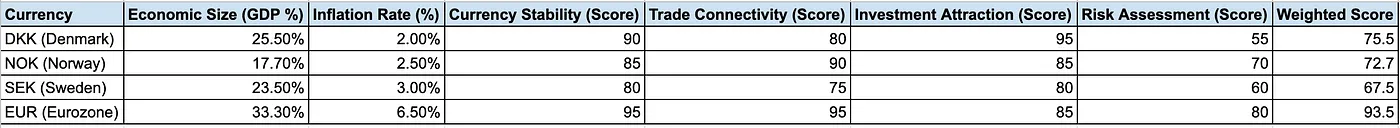

Ratios for the basket:

Sources: The International Monetary Fund’s (IMF), World Economic Outlook database, The Economist Intelligence Unit’s Country Reports, The European Central Bank’s data portal. We used the most recent data available from each source as of January 11, 2024.

Basket Composition with EURO peg for a $EURN

Example Basket Composition with USD peg for a currency $USDN

A sophisticated approach to determining the weights of the currencies in the basket for a $EURN currency would involve considering various factors related to the economic strength and stability of each currency. Here’s a potential methodology for calculating the weights:

-

Economic Size: Assign weights based on the relative economic size of each Nordic country, measured by their GDP or GDP per capita. This would ensure that the basket reflects the economic importance of each country.

-

Inflation Rates: Consider each currency’s inflation rate, with lower-inflation currencies receiving higher weights. This would help to mitigate the risk of inflation fluctuations.

-

Currency Stability: Assess the historical stability of each currency’s exchange rate against the euro. Stable currencies would receive higher weights, as they would contribute to overall stability.

-

Trade Connectivity: Evaluate the trade linkages between each Nordic country and the other countries in the basket. Currencies with stronger trade links would receive higher weights.

-

Investment Attraction: Consider the attractiveness of each Nordic country as an investment destination. Currencies from more appealing investment markets would receive higher weights.

-

Risk Assessment: Evaluate the overall risk profile of each currency, taking into account factors such as political stability, external debt, and fiscal sustainability. Lower-risk currencies would receive higher weights.

Using this multi-faceted approach, the weights for the EURN currency could be dynamically adjusted based on changes in the underlying economic and financial conditions of each Nordic country. This would provide a more refined and responsive mechanism for managing the currency basket.

Moreover, here are some of the factors that can affect exchange rates:

-

Economic growth: A country with strong economic growth is likely to have a strong currency, as investors are more likely to invest in that country.

-

Interest rates: Higher interest rates make a country’s currency more attractive to investors, which can lead to an increase in demand for that currency and a stronger exchange rate.

-

Inflation: Inflation can weaken a currency, as it makes it more expensive to buy imported goods and services.

-

Political stability: Political instability can lead to uncertainty and volatility in the currency market.

-

Speculation: Speculation by investors can also affect exchange rates. If investors believe that a currency is going to appreciate, they will buy that currency, which can lead to an increase in demand and a stronger exchange rate.

Exchange rates can be a complex and unpredictable, but they are an important factor for businesses and investors to understand.

Example calcualtion : 1 $EURN = 75.5/309.2 DKK+ 72.7/309.2 NOK + 67.5/309.2 SEK + 93.5/309.2 EUR

9. Profit Sharing & Rewards using ColorTrace & Staking

ColorTrace from Layer Zero is a decentralized protocol that allows stakeholders to share profits and rewards in a transparent and auditable manner. $EURN will utilize ColorTrace to enable transparent and efficient profit-sharing mechanisms among network participants. This will ensure that all participants in the Digital Nordic Euro network are fairly compensated for their contributions.

$EURN will use ColorTrace to track and distribute revenue generated from various sources, including:

-

Transaction fees

-

Staking rewards

-

Fee generation from decentralized applications (dApps)

ColorTrace will provide a tamper-proof record of all transactions and rewards, ensuring that all participants are treated fairly and that the $EURN network remains sustainable.

Moreover, Staking will be enabled and staked representations will be provided to the users to make sure profits are shared.

10. Chainlink Implementation

Chainlink is a decentralized oracle network that provides real-time price feeds for a variety of assets. $EURN will utilize chainlink to enhance the security and accuracy of price feeds, ensuring the stability of the $EURN basket.

Chainlink decentralized nature makes it more resistant to manipulation than centralized oracle networks. This is because multiple nodes must agree on the price of an asset before it is considered valid. This makes it much more difficult for any single entity to manipulate the price of $EURN.

Chainlink will provide NordicCoin with real-time price feeds for the eDKK, eSEK, and eNOK. This will allow the stakeholders to maintain the peg to the Nordic currency basket more effectively.

11. reFORGE Implementation

reForge from ARYZE offers new financial opportunities to leverage such as market makers, exchanges, brokers, and Dapps. With reForge, $EURN can instantly access any variant of Digital Cash needed, instead of being limited to a single currency.

This unlocks seamlessly managing the basket of nordic currecncies and also provides arbitrage opportunities, as market makers can take advantage of price differences between Digital Cash pairs across Web3 by reForging Digital Cash into a currency they wish to sell on an exchange, or use to make the markets.

12. Technology Stack

The technology stack used in a stablecoin project, especially one involving banks and custody services, is critical to ensuring the security, stability, and efficiency of the ecosystem. Below, I’ll elaborate on the key components of the technology stack for a stablecoin project with bank custody services:

-

Blockchain Technology: Blockchain is the foundational technology for most stablecoins. It provides transparency, security, and immutability to the transactions. Depending on the stablecoin project, it may run on various blockchain platforms, such as Ethereum.

-

Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They play a pivotal role in stablecoin operations, handling functions like issuance, redemption, and collateral management. Smart contracts ensure transparency and automate processes.

-

Wallet Infrastructure: Wallets are crucial for users to store, send, and receive stablecoins. There are various types of wallets, including web wallets, mobile wallets, and hardware wallets. Secure and user-friendly wallet solutions are essential for mass adoption.

-

Cryptography: Cryptographic techniques are used for securing private keys, transaction data, and wallet addresses. These ensure that transactions and custody services remain secure and resistant to hacking.

-

Consensus Mechanisms: Depending on the blockchain platform, stablecoins may use different consensus mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS). The choice of consensus mechanism impacts network security and scalability.

-

Oracles: Oracles are external data sources that provide information to smart contracts. In the case of stablecoins, oracles can supply real-world price data, such as the exchange rate of the stablecoin to its pegged asset (e.g., the Euro, Kroner).

-

Reserve Management: Banks involved in stablecoin custody need robust systems for managing the reserves that back the stablecoin. This includes real-time tracking of reserve assets, automated monitoring, and compliance with regulatory requirements.

-

Security Measures: A comprehensive security stack is critical. This includes features like multi-signature wallets, cold storage solutions, hardware security modules (HSMs), and continuous security audits to protect against hacks and fraud.

-

Regulatory Compliance Tools: Given the regulatory scrutiny of stablecoins, tools for Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance are essential. Banks must have these measures in place for stablecoin issuers and users.

-

Monitoring and Reporting: Real-time monitoring of transactions, reserves, and system health is vital. Banks and stablecoin projects need tools to generate reports for auditing and compliance purposes.

-

Integration APIs: Application Programming Interfaces (APIs) allow for seamless integration with other financial systems, payment gateways, and exchanges, enabling users to interact with the stablecoin ecosystem more easily.

-

Scalability Solutions: As stablecoin usage grows, scalability solutions like Layer 2 scaling or sidechains may be necessary to handle a higher volume of transactions efficiently.

-

Testing and Development Tools: Robust testing environments and development tools are crucial for building, testing, and deploying smart contracts and other components of the stablecoin ecosystem.

-

User Interfaces: User-friendly interfaces, whether web-based or mobile apps, are essential for enabling easy access and usability of stablecoins by the broader public.

-

Analytics and Data Services: Data analytics tools help stablecoin issuers and banks gain insights into user behavior, transaction patterns, and network health.

-

Documentation and Support: Comprehensive documentation and customer support are necessary to assist users, developers, and businesses in understanding and using the stablecoin ecosystem effectively.

The technology stack for a stablecoin project with bank custody services must be carefully designed and implemented to ensure both security and regulatory compliance while delivering a seamless user experience. Collaboration between technology experts, regulatory specialists, and banking professionals is essential for success in this space.

13. Here are some ways the Digital Nordic Euro will make money

-

Transaction Fees: Stablecoin issuers can charge fees on transactions made using their stablecoins. These fees can be a fixed amount per transaction or a percentage of the transaction value. These fees are collected from users whenever they make payments or transfers using the stablecoin.

-

Income on Reserves: Some stablecoin projects invest the reserves backing the stablecoin in interest-bearing assets. They can earn interest on these reserves and use that income to cover operational costs and generate profits. The income earned may come from lending the reserves to borrowers or investing in low-risk assets.

-

Licensing and Partnerships: Stablecoin projects may license their technology to other businesses, allowing them to use the stablecoin for their own purposes. They can charge licensing fees and enter into partnerships with payment processors, financial institutions, or e-commerce platforms to promote the use of their stablecoin.

-

Staking and Governance Tokens: Some stablecoin projects have associated governance tokens that can be staked or used in the network’s governance processes. Users may need to acquire and hold these tokens, which can create demand and value for them. The project may benefit from token price appreciation.

-

Asset Management Services & automatic arbitrage : Stablecoin issuers can offer asset management services where users can invest their stablecoin holdings to earn interest or rewards. The project can generate fees from managing these investment pools.

-

Collateral Liquidation: In the case of collateralized stablecoins, if the value of the collateral falls below a certain threshold, the stablecoin project may liquidate the collateral to cover potential losses. Any excess funds generated from liquidations can contribute to the project’s revenue.

-

Lending and Borrowing Services: Some stablecoin projects offer lending and borrowing services where users can borrow stablecoins by providing collateral or lend stablecoins to earn interest. The project can earn fees from facilitating these lending and borrowing activities.

-

Exchange Listing Fees: Stablecoin projects may charge fees to cryptocurrency exchanges for listing their stablecoin on the platform. This can increase the liquidity and accessibility of the stablecoin.

-

Custody and Wallet Services: Projects can offer custody and wallet services to users, charging fees for the storage and management of digital assets, including stablecoins.

-

Native wallet with yields: A native wallet to be created into a payment scheme across EU, by connecting private and business together.

-

Premium Services: Projects can offer premium services or features to users for a subscription fee. These premium services may include faster transaction processing, enhanced security features, or access to exclusive features.P2P Payments

-

E-commerce Transactions: Integration with e-commerce platforms allows for seamless payments, reducing friction in online shopping experiences.

-

Integration with Payment Gateways: $EURN is compatible with various payment gateways, ensuring broad acceptance by merchants.

14. Risk Assessment

$EURN is a new and innovative project, and there are inherent risks associated with its development and operation. These risks include:

-

Technical risks: $EURN is a complex project, and there is a risk of technical glitches or bugs that could affect its stability or security.

-

Regulatory risks: The regulatory environment for stablecoins is still evolving, and there is a risk that $EURN could be subject to new regulations that could hinder its development or operation.

-

Economic risks: The $EURN basket is exposed to the economic risks of the eDKK, eSEK, and eNOK. If one of these currencies experiences a sudden devaluation, the value of $EURN could be affected.

-

Political risks: The Nordic region is a stable and peaceful region, but there is a risk of political instability that could affect the value of $EURN.

The stakeholders responsible for maintaining the peg to the Nordic currency basket will take steps to mitigate these risks. These steps may include:

-

Thorough testing: NordicCoin will be subjected to rigorous testing to identify and address any potential technical issues.

-

Compliance with regulations: NordicCoin will comply with all applicable regulations, and the stakeholders will monitor the regulatory landscape closely.

-

Diversification of the Digital Nordic Euro basket: The $EURN basket will be diversified across a number of stable Nordic currencies.

-

Diversification of funding sources: The takeholders will seek funding from a variety of sources to mitigate the risk of relying on any single source of funding.

15. Regulatory and Compliance Framework

Legal Status: $EURN operates within the legal framework of the European Union, complying with all relevant regulations.

KYC and AML Measures: Stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) measures are in place to prevent illicit activities.

Consumer Protection: $EURN transactions are subject to consumer protection laws, ensuring the rights and interests of users.

16. Conclusion

The Digital Nordic Euro is a novel and promising project that has the potential to revolutionise the way the Nordic region interacts with the global economy. The project is well-designed and addresses the challenges faced by the Nordic region with regards to monetary stability, financial inclusion, trade facilitation, and profit-sharing. However, there are inherent risks associated with the project, and the consortium of Nordic banks and financial institutions will need to take steps to mitigate these risks.

The potential benefits of $EURN are significant, and the project has the potential to make a positive impact in the European and the Nordic region. If the participants are able to successfully address the risks and implement the project effectively, $EURN could become a widely adopted stablecoin that helps to strengthen the trade across the Nordic & European economy.