Obchakevich Research

Obchakevich Research

Obchakevich Research is a on-chain data company founded in 2023 by Alex Obchakevich. We provide high quality analytical data and research.

Subscribe to Obchakevich Research

Receive the latest updates directly to your inbox.

Top-5 Crypto cards according to Obchakevich Research®

Introducing five innovative crypto, each offering unique opportunities to utilize digital assets in everyday life.

Lisk as an important player in the Superchain

Lisk is not just a blockchain platform but a key player in shaping the Superchain ecosystem—a network that unites various blockchains into a single, scalable, and interoperable infrastructure. Superchain aims to solve one of Web3’s biggest challenges: the isolation of blockchains, creating a space where data and applications can flow seamlessly between networks.

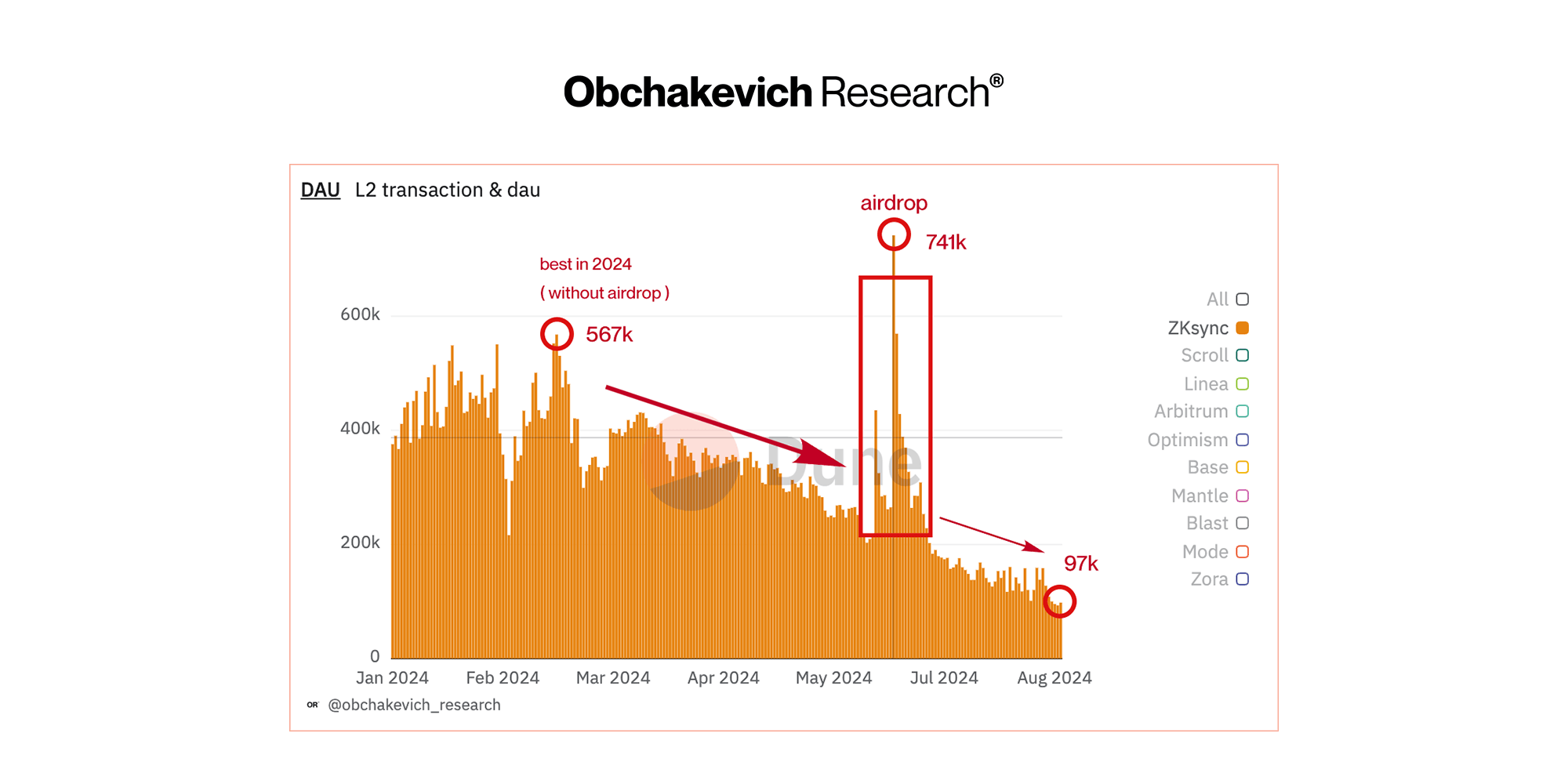

ZKsync post-airdrop user research & analytics

ZKsync is a Layer 2 solution for the Ethereum blockchain that utilizes zk-Rollups technology to increase scalability and reduce transaction fees. ZKsync enables fast and low-cost transactions while maintaining the security provided by the underlying Ethereum blockchain.

How the BUSD was dying

Binance USD (BUSD) is a stablecoin released by the Binance exchange in collaboration with Paxos. BUSD was intended to provide users with a stable digital asset pegged to the US dollar. However, despite its initial popularity, over time BUSD faced a number of problems and challenges that led to its gradual decline.

Scroll Bridge TVL review

Scroll seamlessly extends Ethereum’s capabilities through zero knowledge tech and EVM compatibility. The L2 network built by Ethereum devs for Ethereum devs.

VanEck Crypto ETF (Jul.2024)

An exchange-traded fund (ETF) is a type of investment fund whose shares are traded on exchanges, similar to regular stocks. An ETF holds assets such as stocks, commodities or bonds, and usually operates with an arbitrage mechanism designed to keep its trading value close to the net asset value.