Subscribe to Hedgey

Receive the latest updates directly to your inbox.

The Current Scene in DAO Compensation

A sustainable compensation model can be a make-or-break for DAOs trying to retain and onboard contributors, especially in a bear market.

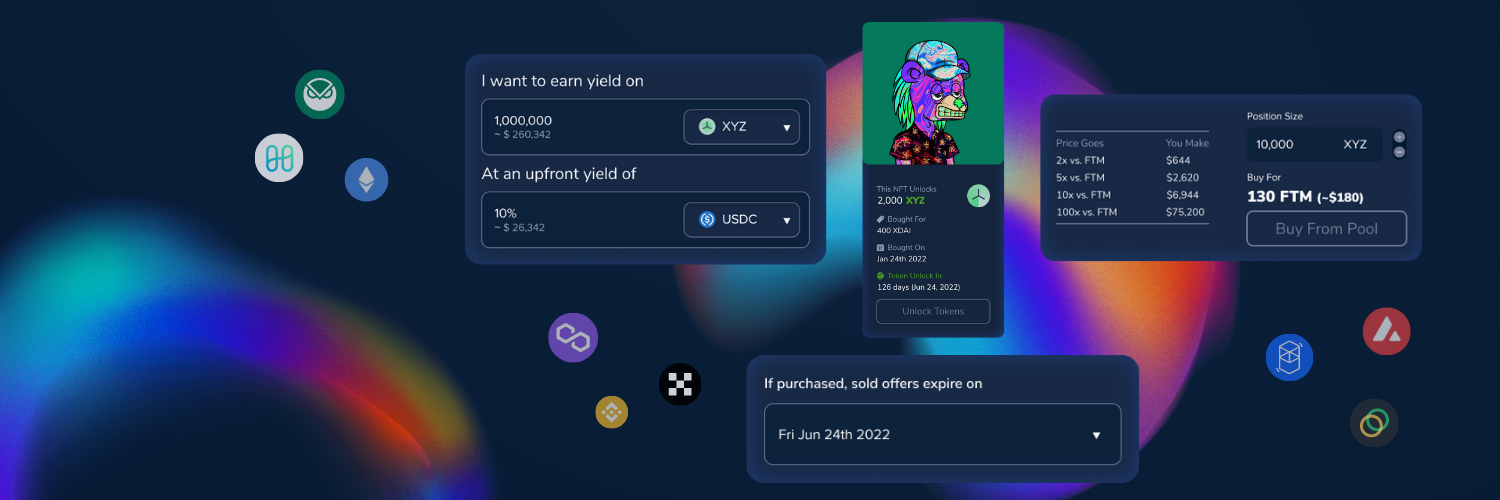

Using Hedgey to distribute locked tokens inside NFT wrappers

See how Gnosis Chain DAOs are using Hedgey to distribute locked tokens through NFTs, and how they create a visual identity for their digital communities.

Using Covered Calls to build runway in a bear market

Web3 and DAO treasuries have taken a substantial hit in recent weeks. Asset prices globally are down and inflation is up. Some DAOs, such as 1Hive, were able to utilize diversification strategies during the peak of last cycle to convert their native tokens to stable coins, to build up that emergency runway, but most did not. It has never been more apparent of how important diversification is. It may seem like there is nothing left to do, because selling tokens at these prices may only further exacerbate the problems and put additional sell pressure on token prices, especially when buyers are becoming more scarce until things settle down. However, I believe there is still one great option to deploy native DAO tokens to earn yield and responsibly convert them to stable coins: long dated covered calls.

NFT-gated Token Sales

For the first time, NFT, POAP, & token communities can give supporters exclusive access to discounted token offerings, and create a new way to whitelist.

DAO-to-DAO Token Swaps

Introducing another pillar of the Hedgey protocol, DAO-to-DAO (D2D) token swaps — a huge step toward DAO-DAO interoperability.

Using public, time-locked OTC offerings to raise funds without market selling tokens.

For DAOs/Treasuries, token teams, and web 3 startups

Giving contributors time-locked tokens using Hedgey NFTs.

Introducing a new approach to token rewards that allows DAOs and token teams to give tokens to core members while having better control on when tokens enter liquid markets. Learn more on our DISCORD.